MicroStrategy Stock And Bitcoin: Predicting Investment Returns In 2025

Table of Contents

MicroStrategy's Bitcoin Strategy and its Impact on Stock Performance

Understanding MicroStrategy's Bitcoin Holdings

MicroStrategy's journey into Bitcoin began in August 2020, when it made its first significant investment. Since then, the company has consistently added to its Bitcoin holdings, becoming one of the largest corporate holders of the cryptocurrency. Their rationale centers on Bitcoin's potential as a long-term store of value and a hedge against inflation. This strategy, while audacious, has dramatically altered MicroStrategy's balance sheet, transforming it from a traditional business intelligence company to a significant player in the cryptocurrency market.

- History: A series of strategic purchases since 2020, steadily increasing holdings.

- Rationale: Store of value, inflation hedge, long-term investment thesis.

- Impact: Significant increase in asset value (correlated with Bitcoin's price), but also increased volatility and exposure to crypto market risks. MicroStrategy Bitcoin holdings represent a substantial portion of its overall assets. The MicroStrategy investment strategy has clearly prioritized Bitcoin. The impact on the Bitcoin balance sheet is a crucial factor for investors to understand.

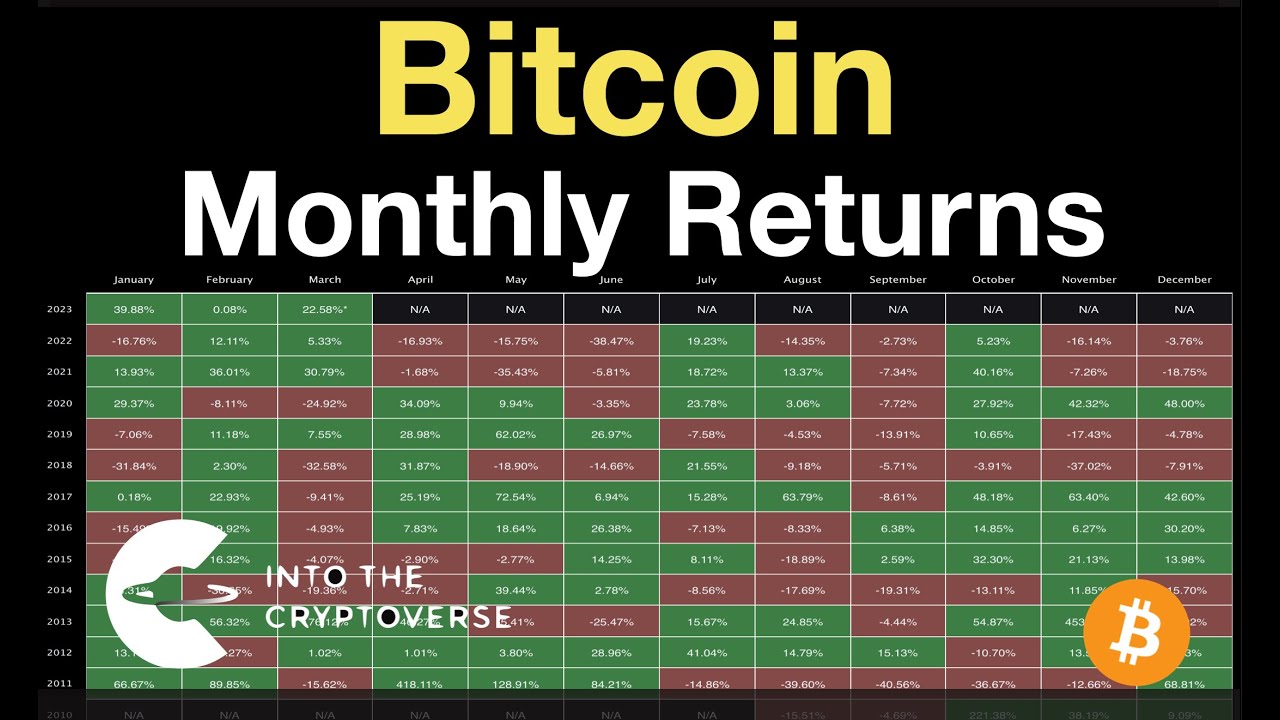

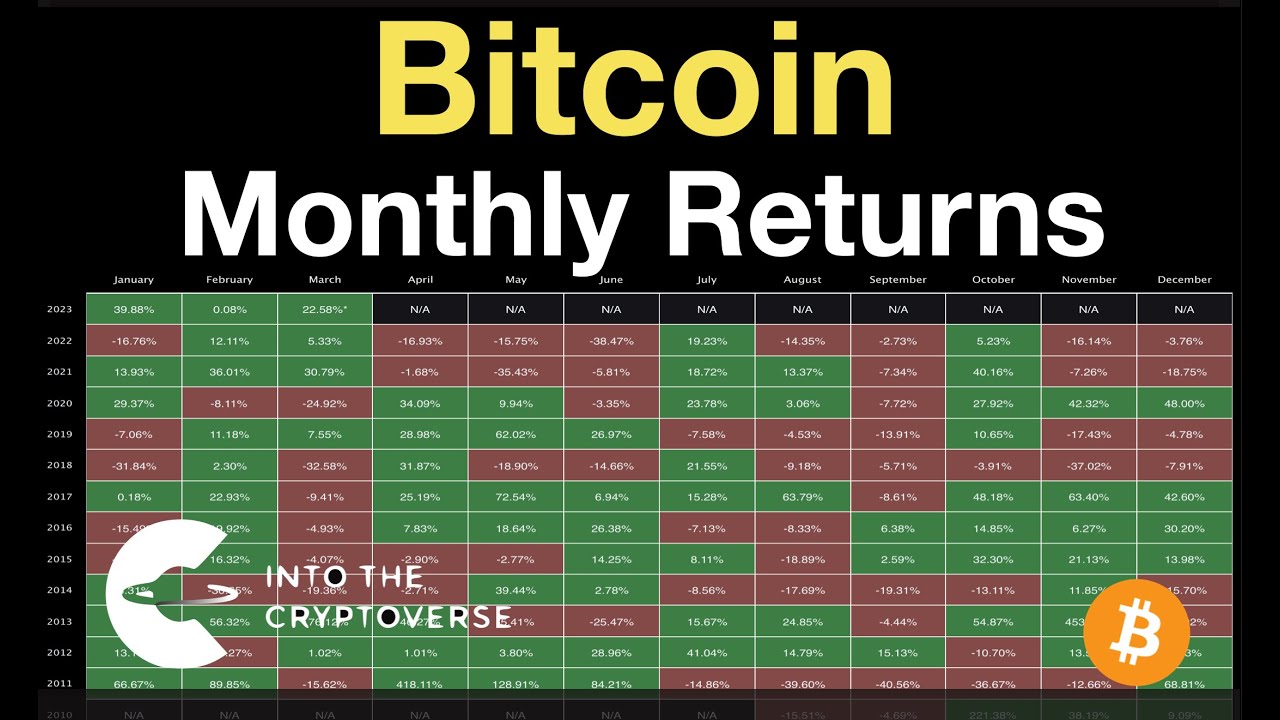

Correlation between Bitcoin Price and MicroStrategy Stock Price

A strong correlation exists between Bitcoin's price fluctuations and MicroStrategy's stock price. When Bitcoin's price rises, investor sentiment towards MicroStrategy improves, leading to a surge in its stock price. Conversely, a dip in Bitcoin's price often results in a decline in MicroStrategy's stock value. This correlation is influenced by various factors:

- Market Sentiment: Positive Bitcoin news generally translates to positive sentiment for MicroStrategy.

- Investor Confidence: Investor confidence in both Bitcoin and MicroStrategy are closely intertwined.

- Media Coverage: Significant media attention given to either Bitcoin or MicroStrategy tends to amplify price movements.

[Insert chart/graph illustrating the correlation between Bitcoin price and MicroStrategy stock price]

Risks Associated with MicroStrategy's Bitcoin Investment

MicroStrategy's Bitcoin investment is not without significant risks. The inherent volatility of Bitcoin poses a substantial threat to the company's valuation.

- Bitcoin Volatility: Sharp price swings in Bitcoin can lead to substantial gains or losses for MicroStrategy.

- Regulatory Risks: Changes in cryptocurrency regulations globally could negatively impact Bitcoin's price and MicroStrategy's holdings. Cryptocurrency regulation is a constantly evolving landscape.

- Bitcoin Price Depreciation: A prolonged decline in Bitcoin's price could significantly impact MicroStrategy's financial performance. This investment risk is considerable. MicroStrategy risk is largely determined by Bitcoin's performance.

Predicting Bitcoin's Price in 2025: Factors to Consider

Adoption and Market Demand

The future price of Bitcoin hinges largely on its adoption rate. Increasing institutional investment, a growing user base, and technological advancements all contribute to increased demand.

- Institutional Investment: Increased participation by large financial institutions will drive up demand.

- User Base Growth: Wider adoption by individuals and businesses will boost the market cap.

- Technological Advancements: Improvements in scalability and transaction speed will enhance Bitcoin's functionality. The Bitcoin adoption rate is a key driver of its price. The Bitcoin market cap is directly influenced by adoption and price. Growing institutional Bitcoin investment is a significant factor to consider.

Regulatory Landscape and Legal Frameworks

The regulatory landscape surrounding cryptocurrencies is constantly evolving. Clear and favorable regulations could boost Bitcoin's legitimacy and price. Conversely, harsh regulations could stifle growth.

- Global Regulatory Harmonization: A globally consistent regulatory framework could foster stability.

- National Regulatory Differences: Inconsistencies across countries can create uncertainty.

- Taxation and Compliance: Clear guidelines on taxation and compliance are essential for broader adoption. The impact of Bitcoin regulation and cryptocurrency regulations is uncertain. A clear legal framework for crypto is vital for stable growth.

Macroeconomic Factors and Their Influence

Macroeconomic factors, such as inflation, interest rates, and economic recessions, significantly influence Bitcoin's price.

- Inflation Hedge: Bitcoin is often seen as a hedge against inflation, increasing its demand during inflationary periods.

- Interest Rates: Changes in interest rates can affect the attractiveness of Bitcoin compared to other investments.

- Economic Recessions: During economic uncertainty, investors may flock to safe-haven assets like Bitcoin, increasing its price. Understanding how Bitcoin and inflation interact is crucial, as are other macroeconomic factors. A robust Bitcoin price prediction model incorporates these variables.

Potential Investment Returns for MicroStrategy Stock and Bitcoin in 2025: Scenarios and Analysis

Bullish Scenario

A bullish scenario sees Bitcoin's price surging significantly, driven by widespread adoption, favorable regulations, and strong macroeconomic conditions. This would lead to substantial gains for MicroStrategy's stock, potentially exceeding several hundred percent MicroStrategy return on investment. The Bitcoin ROI in this scenario could be exceptionally high.

Bearish Scenario

A bearish scenario involves a decline in Bitcoin's price due to unfavorable regulations, increased market competition, or a broader economic downturn. This could lead to significant losses for MicroStrategy, potentially impacting its investment scenario negatively.

Neutral Scenario

A neutral scenario sees moderate growth in Bitcoin's price, resulting in modest returns for MicroStrategy stock. This scenario represents a balanced approach, acknowledging both the potential for growth and the risks involved in cryptocurrency investment strategy.

Conclusion: Navigating the Future of MicroStrategy Stock and Bitcoin Investment

Predicting the future of MicroStrategy stock and Bitcoin requires careful consideration of numerous interacting factors. While the potential for high returns is undeniable, the inherent risks associated with MicroStrategy Bitcoin investment are equally significant. Before investing in MicroStrategy stock or Bitcoin, thorough research is paramount. Understanding the complexities of Bitcoin investment and cryptocurrency investing is vital. Remember to consult a financial advisor before making any investment decisions. Weigh the potential rewards against the inherent risks. Careful consideration of your MicroStrategy Bitcoin investment is essential for informed decision-making. Don't underestimate the importance of risk management in this volatile market.

Featured Posts

-

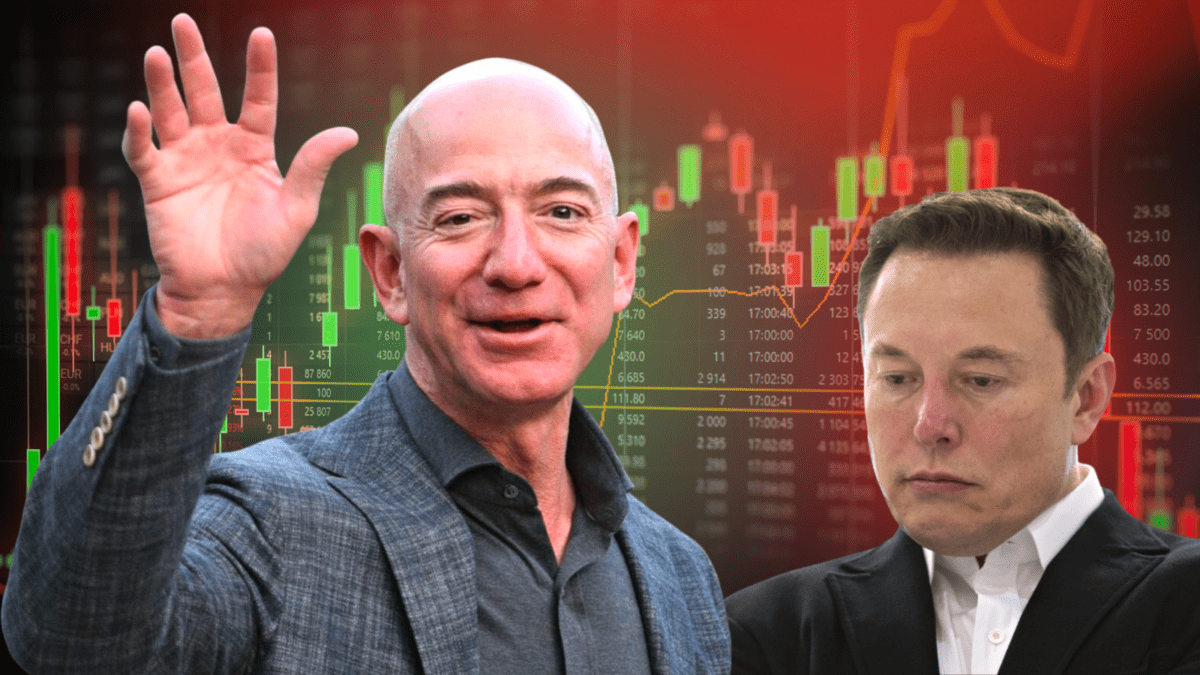

The Financial Impact On Tech Titans Musk Bezos And Zuckerbergs Losses Since January 20 2021

May 09, 2025

The Financial Impact On Tech Titans Musk Bezos And Zuckerbergs Losses Since January 20 2021

May 09, 2025 -

Chinese Goods And Trade Wars The Impact On Bubble Blasters And Beyond

May 09, 2025

Chinese Goods And Trade Wars The Impact On Bubble Blasters And Beyond

May 09, 2025 -

Palantir Stock Forecast Assessing Q1 2024 Government And Commercial Growth

May 09, 2025

Palantir Stock Forecast Assessing Q1 2024 Government And Commercial Growth

May 09, 2025 -

Jolyon Palmers Advice For Jack Doohan Focusing On F1 With Colapinto At Alpine

May 09, 2025

Jolyon Palmers Advice For Jack Doohan Focusing On F1 With Colapinto At Alpine

May 09, 2025 -

Nhl Prediction Oilers Vs Sharks Best Bets And Odds For Tonight

May 09, 2025

Nhl Prediction Oilers Vs Sharks Best Bets And Odds For Tonight

May 09, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025 -

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025 -

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025 -

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025 -

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025