Monday Morning Surge: Live Music Stocks Recover Following A Week Of Uncertainty

Table of Contents

Analysis of Monday's Market Surge in Live Music Stocks

Increased Investor Confidence

The renewed confidence in live music stocks can be attributed to several converging factors. The market responded positively to a combination of improved economic indicators and positive news within the industry itself.

- Positive Economic Indicators: While concerns about a recession persist, some positive economic data released last week, such as a slight decrease in inflation, eased investor anxieties. This reduction in uncertainty emboldened investors to reinvest in riskier assets, including live music stocks.

- Successful Weekend Concerts: A series of hugely successful concerts across the country over the weekend showcased the continued strong demand for live music experiences. High attendance figures and positive reviews boosted investor sentiment.

- Analyst Upgrades: Several leading financial analysts upgraded their ratings for key live music stocks, citing improved forecasts and the sector's inherent resilience. These upgrades influenced investor decisions and contributed to the buying pressure.

- New Strategic Partnerships: The announcement of new strategic partnerships between live music companies and technology firms further fueled the market surge. These partnerships promise new revenue streams and increased operational efficiency. For instance, LIVE (Live Nation Entertainment) saw a 3% increase in share price, while LYV (Super Group) experienced a 2% jump, showcasing the overall market positivity. Trading volume for both also increased significantly.

Impact of Recent Positive News

Beyond the broader macroeconomic factors, positive news within the live music industry itself directly influenced investor sentiment.

- Successful Festival Attendance: Major music festivals across the globe reported record-breaking attendance figures, demonstrating the unwavering public appetite for live music experiences.

- Strong Ticket Sales for Upcoming Events: Robust ticket sales for upcoming concerts and festivals further reinforced the strength of the market. This demonstrated strong future revenue streams for live music companies.

- Positive Artist Announcements: The announcement of highly anticipated tours by major artists injected considerable optimism into the market. These tours are expected to generate significant ticket revenue and drive further growth.

- Government Support Measures: In some regions, government support measures aimed at promoting the arts and culture sector provided an additional boost to investor confidence.

Factors Contributing to the Previous Week's Uncertainty

The preceding week's dip in live music stocks was a consequence of a combination of macroeconomic concerns and industry-specific challenges.

Macroeconomic Concerns

The initial decline in live music stock prices was partly attributable to broader economic anxieties.

- Inflation Rates: High inflation rates raised concerns about consumer spending and the potential impact on ticket sales. Investors worried about reduced disposable income impacting demand for live music events.

- Interest Rate Hikes: Interest rate hikes by central banks increased borrowing costs for businesses, potentially affecting the profitability of live music companies.

- Recession Fears: Growing fears of a potential recession led to investors moving away from riskier investments, like live music stocks, towards safer options.

- Geopolitical Instability: Ongoing geopolitical instability further contributed to the overall market uncertainty, causing investors to adopt a more cautious approach.

Industry-Specific Challenges

Beyond macroeconomic factors, the live music industry faces its own set of challenges that influenced investor perception.

- Rising Operational Costs: Increased costs for venues, artists' fees, and logistics put pressure on profit margins for live music companies.

- Supply Chain Disruptions: Supply chain disruptions impacting equipment and infrastructure continued to affect the industry's operational efficiency.

- Competition from Streaming Services: The continued rise of streaming services presents a challenge for live music companies seeking to attract audiences.

- Ticket Price Sensitivity: Concerns about ticket price sensitivity, especially among budget-conscious consumers, also influenced investor sentiment.

Long-Term Outlook for Live Music Stocks

Despite the short-term volatility, the long-term outlook for live music stocks remains positive.

Resilience of the Live Music Experience

The inherent strength of the live music experience continues to provide a foundation for long-term growth.

- Irreplaceable Nature of the Live Experience: The unique atmosphere and social connection offered by live music events remain irreplaceable, creating enduring demand.

- Growing Demand for Concerts and Festivals: The global demand for concerts and festivals continues to expand, particularly among younger demographics.

- Continued Expansion of the Global Live Music Market: The live music market is expanding globally, presenting opportunities for growth and investment.

Investment Strategies for Live Music Stocks

For investors considering exposure to this sector, a strategic approach is essential.

- Diversification: Diversifying your portfolio across various sectors and asset classes is recommended to mitigate risk.

- Long-Term Investment Strategy: Investing in live music stocks is best suited for a long-term investment strategy, allowing for weathering short-term market fluctuations.

- Fundamental Analysis: Conducting thorough fundamental analysis of individual companies is crucial before making any investment decisions.

- Consideration of Risk Tolerance: Assessing your individual risk tolerance is essential before investing in this potentially volatile sector. Consider consulting with a financial advisor. For further research, consider reputable financial news websites such as the Financial Times or Bloomberg.

Conclusion

The Monday morning surge in live music stocks highlights the industry's impressive resilience in the face of short-term economic headwinds. While macroeconomic concerns and industry-specific challenges persist, the underlying demand for live music experiences remains strong. This positive market movement suggests a potential rebound, yet careful analysis of both risks and opportunities is crucial for anyone considering investing in this sector. Stay informed about the latest developments in the live music stock market. Monitor key indicators and consider investing in live music stocks as part of a well-diversified portfolio. Learn more about smart investment strategies from reputable financial resources.

Featured Posts

-

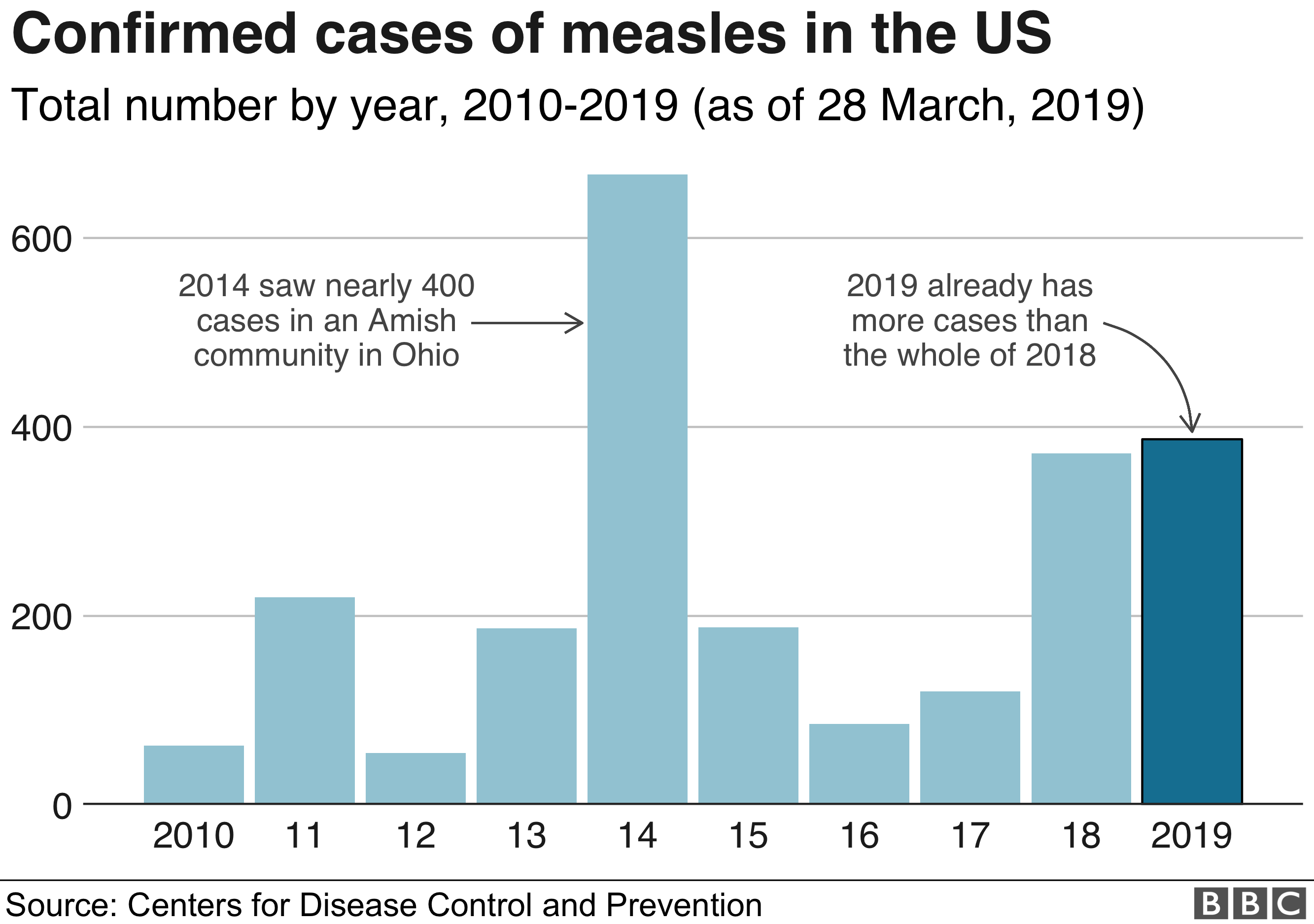

The Drop In Us Measles Cases Factors And Analysis

May 30, 2025

The Drop In Us Measles Cases Factors And Analysis

May 30, 2025 -

Analyzing Dara O Briains Brand Of Reason And Humor

May 30, 2025

Analyzing Dara O Briains Brand Of Reason And Humor

May 30, 2025 -

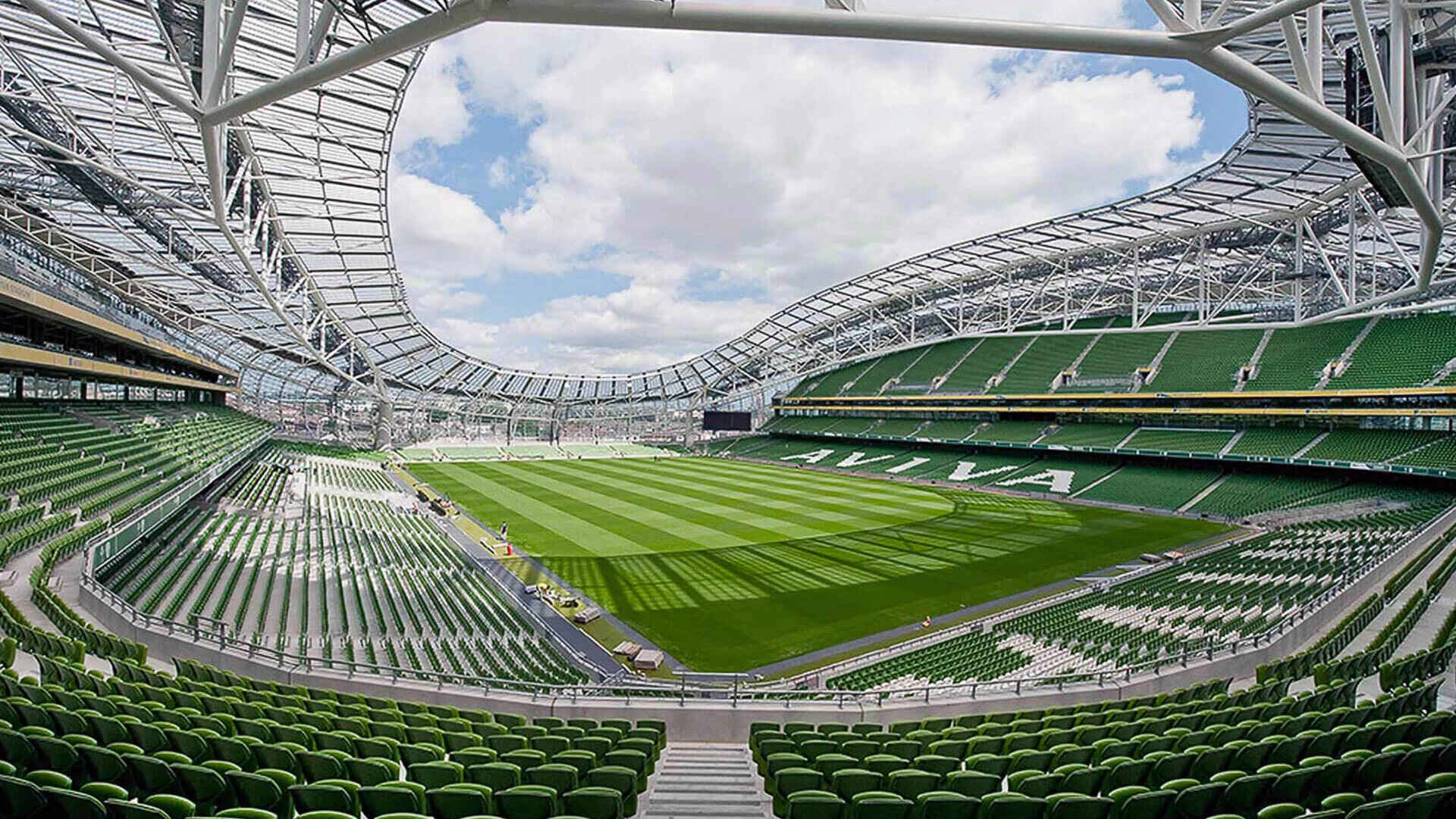

Dublin 2026 Metallicas Weekend Concert At Aviva Stadium

May 30, 2025

Dublin 2026 Metallicas Weekend Concert At Aviva Stadium

May 30, 2025 -

The Return Of A Nissan Classic Speculation And Possibilities

May 30, 2025

The Return Of A Nissan Classic Speculation And Possibilities

May 30, 2025 -

Dow Jones S And P 500 And Nasdaq Stock Market Summary For May 29

May 30, 2025

Dow Jones S And P 500 And Nasdaq Stock Market Summary For May 29

May 30, 2025