Navigate The Private Credit Boom: 5 Dos And Don'ts To Secure Your Next Role

Table of Contents

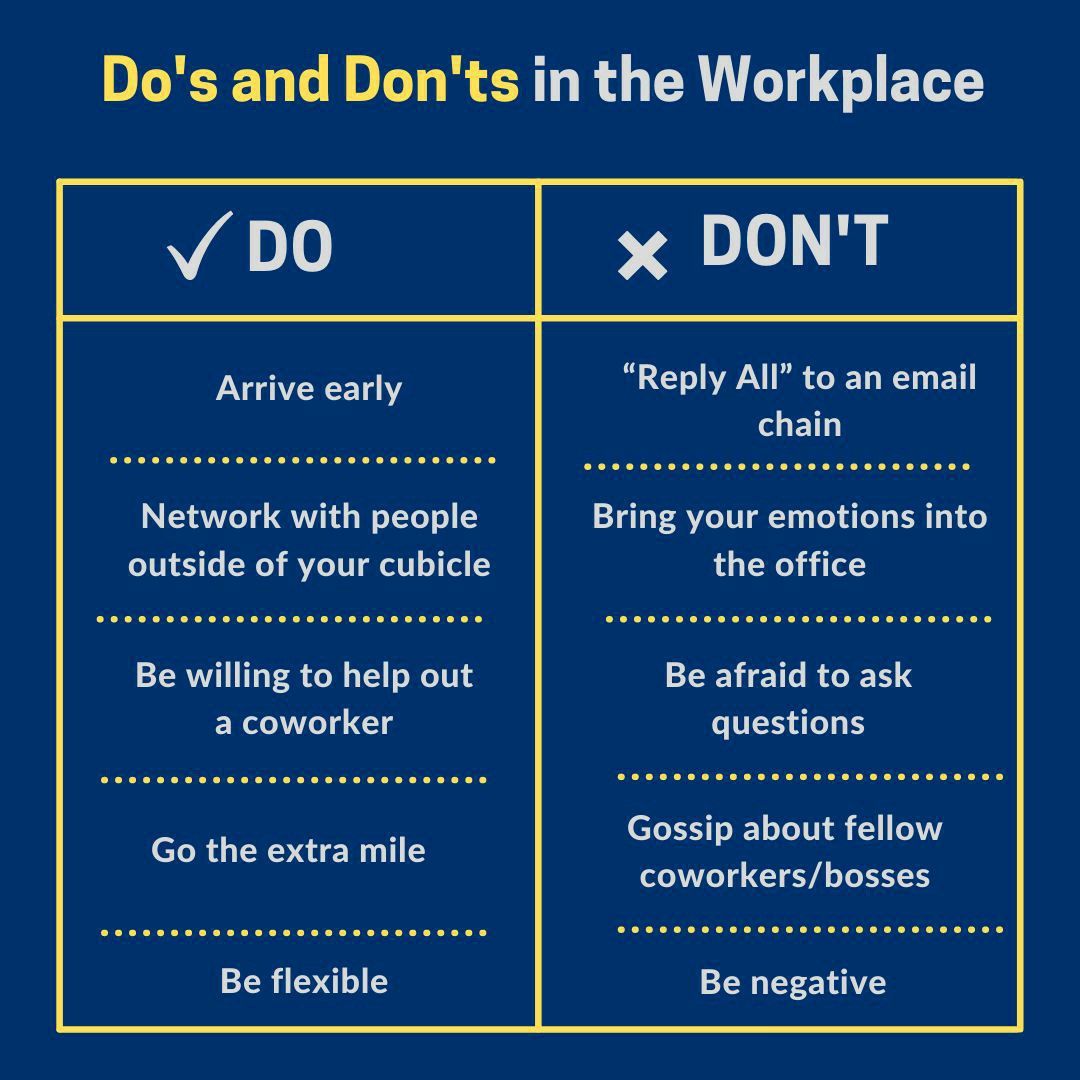

Do: Network Strategically within the Private Credit Industry

The private credit industry, like many others, thrives on relationships. Building a strong network is crucial for uncovering hidden job opportunities and gaining valuable insights.

Target Relevant Events and Conferences

Attending industry events is paramount. Don't just attend; actively participate.

- Research upcoming events: Focus on conferences, workshops, and networking events specifically focused on private credit, private debt, and alternative investments. Sites like LinkedIn Events and industry publications are excellent resources.

- Prepare talking points: Highlight your skills and experience relevant to private credit. Quantify your achievements whenever possible – for example, instead of saying "managed a portfolio," say "managed a $50 million portfolio, resulting in a 15% return."

- Actively engage: Don't just stand in the corner. Engage in conversations, exchange business cards (and follow up!), and genuinely connect with people.

Leverage LinkedIn and Online Professional Communities

LinkedIn is your digital networking hub.

- Optimize your profile: Use relevant keywords like "private credit," "direct lending," "fund management," "credit underwriting," and "portfolio management." Showcase your experience and skills clearly and concisely.

- Connect strategically: Connect with professionals working in private credit firms. Don't just send generic connection requests; personalize them, referencing a shared connection or a mutual interest.

- Engage in relevant groups: Participate in discussions, share insightful articles, and contribute to the conversation. This establishes you as a thought leader in the private credit space.

Do: Highlight Relevant Skills and Experience in Your Resume and Cover Letter

Your resume and cover letter are your first impression. Make them count.

Tailor Your Application Materials

Generic applications rarely succeed.

- Customize for each role: Thoroughly review the job description and tailor your resume and cover letter to highlight the skills and experience most relevant to that specific role and company.

- Use keywords: Incorporate keywords from the job description to improve your chances of getting noticed by Applicant Tracking Systems (ATS).

- Quantify achievements: Use numbers to demonstrate your impact. For example, instead of "Improved efficiency," say "Improved efficiency by 20% through implementing a new process."

Showcase Specialized Knowledge

Highlighting niche expertise makes you stand out.

- Mention certifications: If you hold relevant certifications like CFA, CAIA, or other industry-specific qualifications, prominently feature them.

- Highlight specialized experience: Emphasize experience in distressed debt, mezzanine financing, or specific industry sectors relevant to your target firms. For example, if you have experience in real estate private credit, highlight that explicitly.

Do: Prepare for Behavioral and Technical Interviews

Interview preparation is key to success.

Practice Common Interview Questions

Practice makes perfect.

- Use the STAR method: Structure your answers using the STAR method (Situation, Task, Action, Result) to provide clear and concise responses.

- Anticipate questions: Prepare for questions about your understanding of market trends, credit risk, private debt strategies, investment strategies, and your career goals within the private credit industry.

Demonstrate Financial Acumen

Demonstrate your financial expertise.

- Showcase your skills: Highlight your proficiency in financial modeling, data analysis, and valuation methodologies. Be ready to discuss specific examples.

- Practice case studies: Prepare for case studies related to private credit investments. This shows you can apply your knowledge practically.

Don't: Neglect Due Diligence on Potential Employers

Researching potential employers is crucial.

Research the Firm's Investment Strategy

Understand their approach before applying.

- Analyze their website: Review their investment focus, target sectors, and recent investments to align your experience.

- Research their reputation: Look for reviews and news articles to understand their culture and market standing.

Underestimate the Importance of Company Culture

Company culture impacts your job satisfaction.

- Check employee reviews: Use sites like Glassdoor to gain insights into the employee experience.

- Network with current/former employees: Connect with people who have worked at the firm to gather firsthand information about the work environment.

Don't: Settle for a Role That Doesn't Align with Your Goals

Make sure the role fits your career trajectory.

Consider Long-Term Career Aspirations

Think beyond the immediate opportunity.

- Assess career growth: Evaluate the firm's track record of internal promotions and opportunities for advancement.

- Consider learning opportunities: Will the role offer opportunities to develop new skills and enhance your expertise within the private credit space?

Negotiate Your Compensation Package

Don't undervalue yourself.

- Research industry benchmarks: Use sites like Glassdoor or Salary.com to research salary ranges for similar roles.

- Prepare your negotiation strategy: Know your worth and be prepared to advocate for yourself during salary negotiations.

Conclusion

The private credit boom presents significant career opportunities, but success requires a proactive and strategic approach. By focusing on effective networking, showcasing relevant skills, preparing thoroughly for interviews, conducting due diligence on potential employers, and refusing to settle for less than you deserve, you can significantly increase your chances of securing a rewarding role in this dynamic field. Remember to leverage your network, tailor your applications, and demonstrate your understanding of private credit principles to stand out from the competition. Don't delay – start navigating the private credit boom today!

Featured Posts

-

Novace I Dokovic Prica O Uspehu I Prijateljstvu

May 17, 2025

Novace I Dokovic Prica O Uspehu I Prijateljstvu

May 17, 2025 -

Jackbit Best Crypto Casino 2025 Top Bitcoin Online Casino

May 17, 2025

Jackbit Best Crypto Casino 2025 Top Bitcoin Online Casino

May 17, 2025 -

Erdogan Al Nahyan Telefon Goeruesmesi Boelgesel Konular Ele Alindi

May 17, 2025

Erdogan Al Nahyan Telefon Goeruesmesi Boelgesel Konular Ele Alindi

May 17, 2025 -

Ftc Appeals Activision Blizzard Acquisition Whats Next For Microsoft

May 17, 2025

Ftc Appeals Activision Blizzard Acquisition Whats Next For Microsoft

May 17, 2025 -

10 Fantastic Tv Shows Cut Short Why Were They Cancelled

May 17, 2025

10 Fantastic Tv Shows Cut Short Why Were They Cancelled

May 17, 2025