Navigating High Stock Market Valuations: Advice From BofA

Table of Contents

Understanding Current Market Conditions & BofA's Perspective

Currently, many market indices reflect high stock market valuations. The S&P 500 P/E ratio, a key indicator of market valuation, frequently trades above historical averages, signaling potentially inflated prices. This elevated valuation reflects a confluence of factors, including low interest rates, strong corporate earnings (in certain sectors), and sustained investor optimism. While BofA's precise stance may fluctuate with market conditions, their general assessment often reflects a cautious optimism, acknowledging the elevated valuations but also highlighting potential long-term growth opportunities. They often emphasize the need for a nuanced approach, considering both the risks and rewards presented by the current market environment.

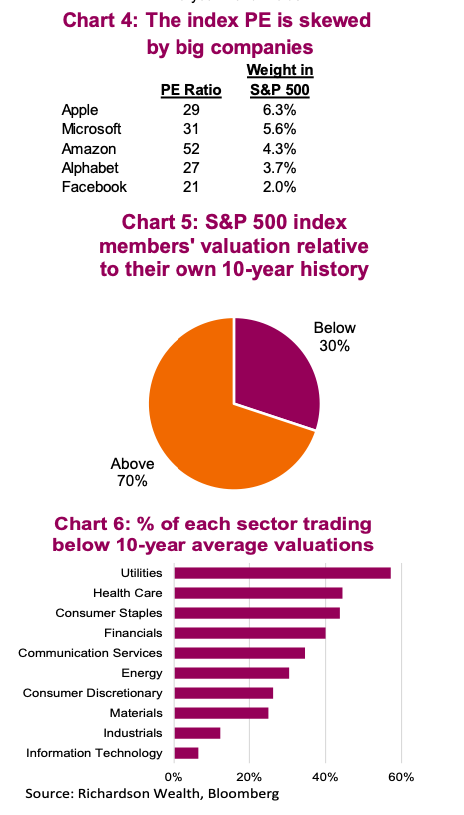

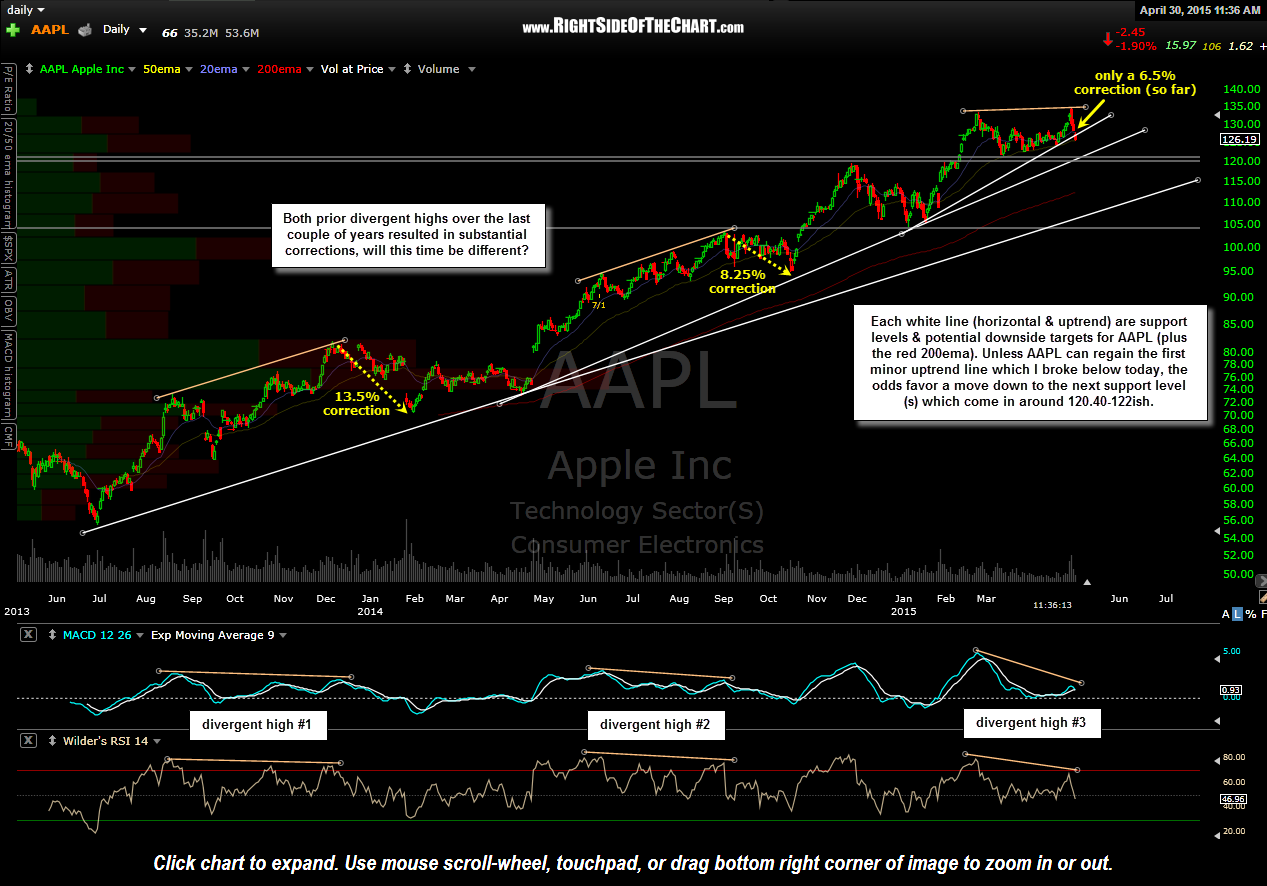

- Current P/E ratios: Currently hovering above long-term averages, suggesting potentially overvalued markets. Specific comparisons to historical averages should be regularly checked from reputable financial sources.

- Key economic indicators: BofA analysts closely monitor inflation rates, interest rate changes, GDP growth, and unemployment figures to gauge the overall economic health and its impact on stock valuations. These indicators influence their outlook on market direction and investment strategies.

- Overvalued/Undervalued sectors: BofA's research often points to specific sectors that are deemed overvalued (e.g., technology during periods of rapid growth followed by a slowdown) or undervalued (e.g., cyclical sectors during economic downturns). Investors should consult their reports for the most up-to-date information.

BofA's Strategies for High-Valuation Markets

BofA generally recommends a multi-faceted approach to investing during periods of high stock market valuations. This involves a combination of strategic asset allocation, careful stock selection, and robust risk management. They often suggest a more selective approach to equity investments, focusing on fundamentally strong companies with sustainable competitive advantages and demonstrable growth potential.

- Diversification strategies: BofA emphasizes diversification across sectors, geographic regions, and asset classes to mitigate risk. This approach reduces the impact of any single investment performing poorly.

- Value vs. Growth Investing: Depending on market conditions, BofA may lean towards value investing (identifying undervalued companies) or growth investing (focusing on high-growth potential, even at a premium). However, they consistently stress the importance of fundamental analysis regardless of the chosen strategy.

- Long-term investment horizon: BofA consistently advises maintaining a long-term investment perspective. This allows investors to weather short-term market fluctuations and benefit from the long-term growth potential of the market.

- Defensive strategies: Strategies like hedging (using financial instruments to offset potential losses) and maintaining sufficient cash reserves are often suggested by BofA as defensive measures against potential market downturns.

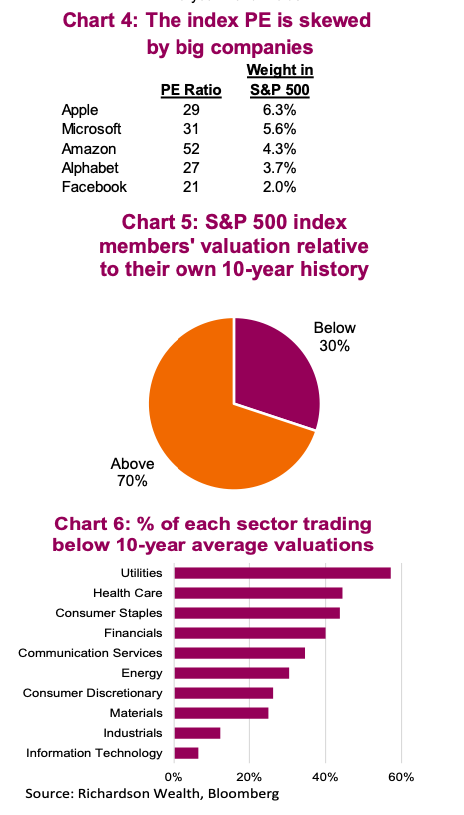

Analyzing Individual Stocks in a High-Valuation Market

Assessing individual stock valuations in a high-valuation market requires a rigorous approach. BofA often recommends employing both relative valuation (comparing a company's valuation metrics to its peers) and intrinsic valuation (assessing a company's inherent worth using discounted cash flow analysis or similar methods).

- Key financial metrics: Investors should carefully scrutinize key financial metrics such as the P/E ratio, PEG ratio (Price/Earnings to Growth ratio), and dividend yield to assess a company’s valuation relative to its earnings and growth prospects.

- Fundamental analysis & due diligence: Thorough fundamental analysis, including a comprehensive review of a company’s financial statements, business model, competitive landscape, and management team, is crucial. Due diligence is paramount to identifying undervalued companies or avoiding overvalued ones.

- Identifying undervalued companies: Even within overvalued sectors, it's possible to find undervalued companies that possess strong fundamentals and growth potential. Identifying these companies requires diligent research and a keen understanding of the market.

The Role of Bonds and Alternative Investments

In a market characterized by high stock market valuations, BofA often recommends incorporating bonds and alternative investments into a well-diversified portfolio. These asset classes can act as a counterbalance to the higher risk associated with equities.

- Types of bonds: Government bonds and high-quality corporate bonds can provide stability and income during periods of market uncertainty. BofA may suggest specific bond types based on prevailing interest rates and market conditions.

- Alternative investments: Alternative investments, such as real estate, commodities, or private equity, can offer diversification benefits and potentially higher returns but often come with higher risk and reduced liquidity.

- Allocation strategies: The optimal allocation to bonds and alternative investments will depend on individual risk tolerance and financial goals. BofA usually advises working with a financial advisor to determine the appropriate asset allocation strategy.

Conclusion

Successfully navigating high stock market valuations requires careful planning and a well-informed strategy. BofA's advice emphasizes the importance of diversification, thorough due diligence, and a long-term investment horizon. By incorporating a mix of equities, bonds, and alternative investments, and by focusing on fundamentally strong companies, investors can mitigate risks and potentially achieve their financial objectives. Utilize BofA's insights and consider professional financial advice to create a robust investment plan tailored to your individual risk tolerance and financial goals. Learn more about managing your investments during periods of high stock market valuations and take control of your financial future.

Featured Posts

-

Must Have Gear For Ferrari Enthusiasts

May 24, 2025

Must Have Gear For Ferrari Enthusiasts

May 24, 2025 -

The Future Of Collaboration Bangladeshs Renewed European Engagement

May 24, 2025

The Future Of Collaboration Bangladeshs Renewed European Engagement

May 24, 2025 -

Forecasting Apple Stock Aapl Price Key Levels To Consider

May 24, 2025

Forecasting Apple Stock Aapl Price Key Levels To Consider

May 24, 2025 -

Dylan Dreyer And Brian Fichera A Celebratory Family Announcement

May 24, 2025

Dylan Dreyer And Brian Fichera A Celebratory Family Announcement

May 24, 2025 -

Planning Your Memorial Day Trip Smart Flight Booking For 2025

May 24, 2025

Planning Your Memorial Day Trip Smart Flight Booking For 2025

May 24, 2025

Latest Posts

-

Sostoyanie Rybakinoy Slova Tennisistki O Forme Posle Turnira

May 24, 2025

Sostoyanie Rybakinoy Slova Tennisistki O Forme Posle Turnira

May 24, 2025 -

Rybakina Otkrovenno O Nedostatkakh V Forme

May 24, 2025

Rybakina Otkrovenno O Nedostatkakh V Forme

May 24, 2025 -

Rybakina O Svoey Forme Poka Ne Na Pike

May 24, 2025

Rybakina O Svoey Forme Poka Ne Na Pike

May 24, 2025 -

Elena Rybakina Kommentariy O Forme Posle Poslednego Matcha

May 24, 2025

Elena Rybakina Kommentariy O Forme Posle Poslednego Matcha

May 24, 2025 -

Indian Wells 2025 Swiatek And Rybakinas Fourth Round Victories

May 24, 2025

Indian Wells 2025 Swiatek And Rybakinas Fourth Round Victories

May 24, 2025