Forecasting Apple Stock (AAPL) Price: Key Levels To Consider

Table of Contents

Technical Analysis of AAPL Stock

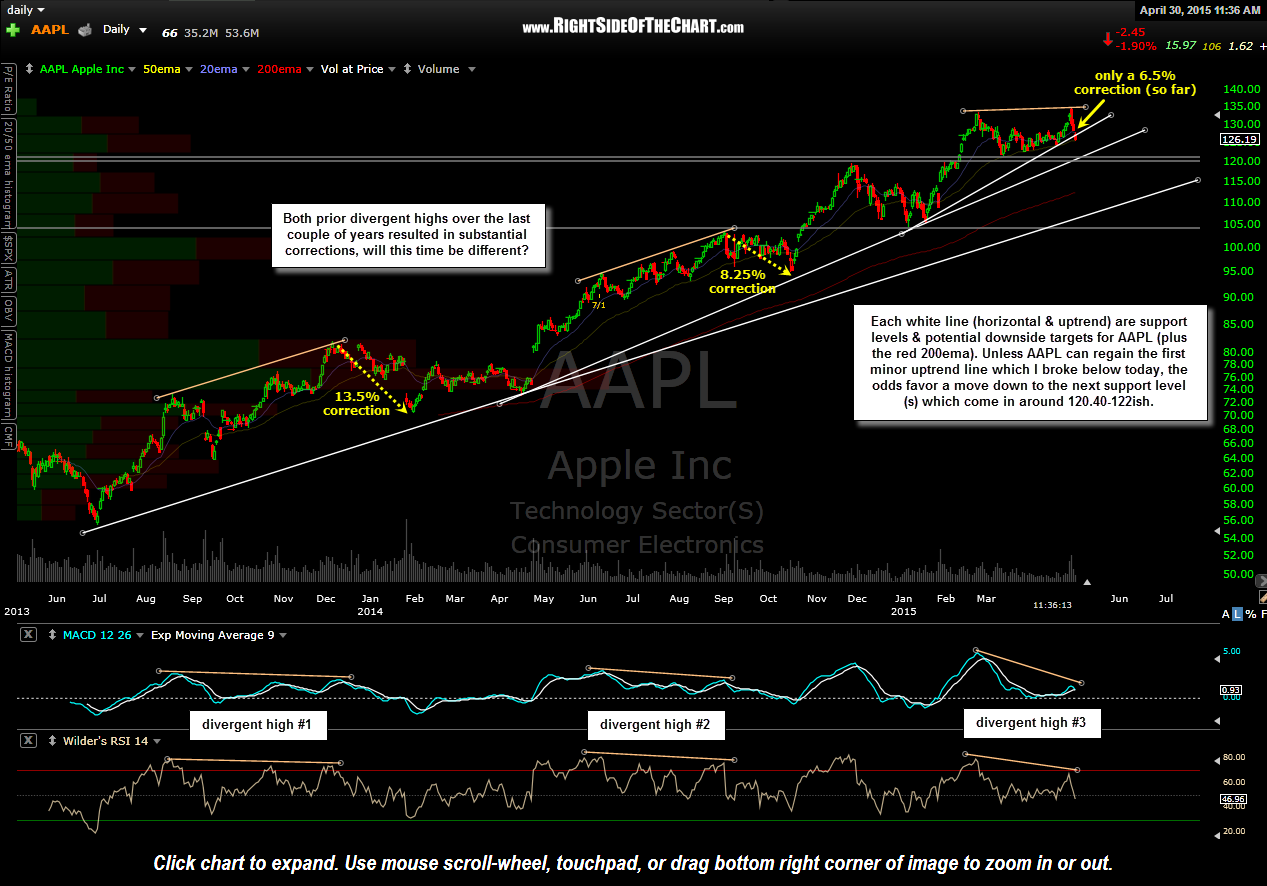

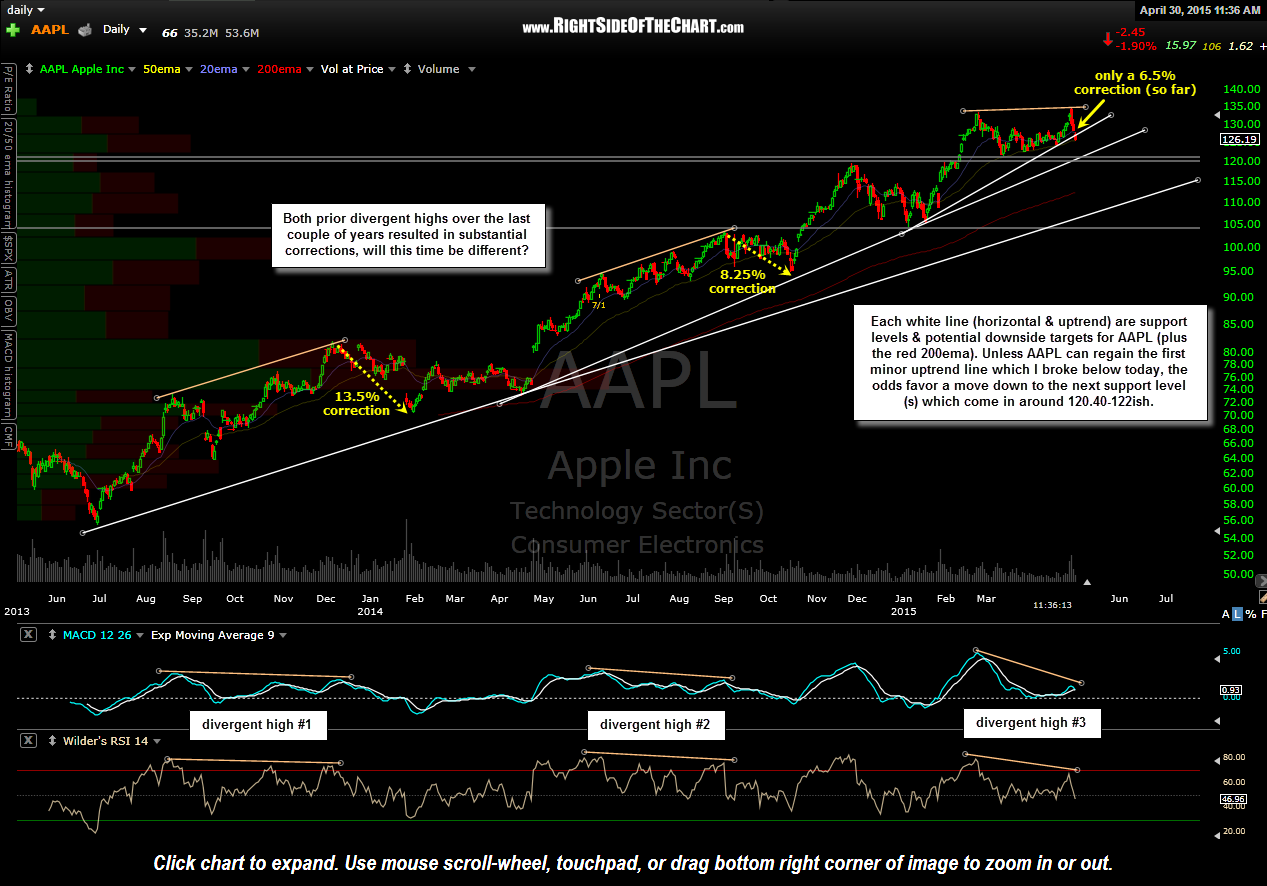

Technical analysis involves studying past market data, like price and volume, to predict future price trends. Identifying support and resistance levels, trendlines, and chart patterns is crucial for forecasting AAPL's price.

Support and Resistance Levels

Support levels represent price points where buying pressure is strong enough to prevent further price declines. Resistance levels are the opposite – price points where selling pressure outweighs buying pressure, halting upward momentum. Identifying these levels on an AAPL chart is vital.

- Examples of past support and resistance levels: Historically, the 150-day and 200-day moving averages have often acted as significant support or resistance for AAPL. Breaks above or below these levels can signal significant price movements.

- Moving averages: The 50-day moving average is also a commonly used indicator, providing a shorter-term view of the trend. Crossovers between moving averages (e.g., a 50-day moving average crossing above the 200-day moving average, a bullish signal) can be powerful indicators of future price direction.

Trendline Analysis

Trendlines connect a series of higher lows (uptrend) or lower highs (downtrend) on a chart. These lines help visualize the overall direction of the price.

- Uptrend, downtrend, and sideways trading: An uptrend indicates sustained buying pressure, while a downtrend signals persistent selling. Sideways trading suggests a period of consolidation before a potential breakout.

- Identifying breakouts and breakdowns: A breakout occurs when the price decisively breaks above a resistance level, confirming an uptrend. A breakdown happens when the price moves below a support level, indicating a downtrend.

- Examples of past trendlines: Examining past AAPL charts and identifying successful trendlines can help refine your ability to spot potential future trends.

Chart Patterns

Recognizing chart patterns can provide valuable insights into potential price movements. Common patterns include head and shoulders, double tops/bottoms, triangles, and flags.

- Examples of past occurrences: Studying past instances of these patterns in AAPL's chart can demonstrate their predictive power.

- Bullish and bearish implications: A head and shoulders pattern, for example, is typically considered bearish, signaling a potential price reversal. Conversely, a double bottom often suggests a bullish reversal.

Fundamental Analysis of AAPL Stock

Fundamental analysis involves evaluating the intrinsic value of AAPL stock by analyzing the company's financial health and growth prospects. This provides a long-term perspective on potential price movements.

Earnings Reports and Revenue Growth

Apple's quarterly earnings reports are crucial for understanding the company's financial performance. Revenue growth is a key indicator of the company's success and directly impacts stock price.

- Key metrics to watch: Earnings Per Share (EPS), revenue growth rate, profit margins, and debt-to-equity ratio are among the most important metrics to follow.

- Impact of positive and negative surprises: When AAPL beats or misses earnings expectations, it can significantly impact the stock price, often leading to short-term volatility.

Product Innovation and Market Share

Apple's continuous product innovation is a vital driver of its growth and stock price. Maintaining a strong market share is also crucial.

- Impact of iPhone sales: The iPhone remains a core revenue generator for Apple, and fluctuations in sales directly affect the stock price.

- Services revenue growth: Apple's services segment (App Store, Apple Music, iCloud, etc.) shows strong growth potential and adds stability to its revenue stream.

- Competition: Competition from other tech giants plays a significant role in Apple's market share and, consequently, its stock price.

Macroeconomic Factors

Broader economic trends heavily influence investor sentiment and AAPL's stock price.

- Impact of recessionary fears: During periods of economic uncertainty, investors may become risk-averse, leading to a decline in AAPL's stock price.

- Inflation rates: High inflation can negatively impact consumer spending and reduce demand for Apple products.

- Global economic growth: Strong global economic growth generally supports higher stock prices, while slower growth can lead to declines.

Other Factors Influencing AAPL Stock Price

Beyond technical and fundamental analysis, other factors significantly influence AAPL's price.

Investor Sentiment and News

News events, both positive and negative, and overall market sentiment play a crucial role in AAPL's volatility.

- Examples of impactful news: Product launch announcements, regulatory changes, supply chain disruptions, or negative publicity can all significantly impact the stock price.

- Role of social media sentiment: Social media sentiment can also influence short-term price fluctuations, as it reflects the collective opinion of a large group of investors.

Analyst Ratings and Price Targets

Analyst ratings and price targets from financial institutions can influence investor behavior and potentially impact the stock price.

- Interpreting buy, sell, and hold recommendations: Analyst ratings provide insights into professional opinions about the stock's future performance, but it's crucial to consider multiple opinions.

- Importance of considering multiple analyst opinions: Don't rely on a single analyst's opinion. Compare ratings from several reputable sources to get a more balanced perspective.

Conclusion

Forecasting Apple stock (AAPL) price accurately requires a comprehensive approach combining technical and fundamental analysis, along with an understanding of broader market forces and investor sentiment. By carefully considering support and resistance levels, trendlines, earnings reports, product innovation, and macroeconomic factors, investors can make more informed decisions regarding their AAPL investments. Remember, consistent monitoring and adaptability are key to successful forecasting. Start your own AAPL stock price forecast today by utilizing the insights shared in this article!

Featured Posts

-

How To Get Bbc Radio 1s Big Weekend 2025 Tickets Full Lineup And Purchase Guide

May 24, 2025

How To Get Bbc Radio 1s Big Weekend 2025 Tickets Full Lineup And Purchase Guide

May 24, 2025 -

Major Gun Trafficking Bust In Massachusetts 100 Firearms Seized 18 Arrested

May 24, 2025

Major Gun Trafficking Bust In Massachusetts 100 Firearms Seized 18 Arrested

May 24, 2025 -

Kerings Q1 Performance A 6 Share Price Slump

May 24, 2025

Kerings Q1 Performance A 6 Share Price Slump

May 24, 2025 -

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav And Its Importance

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav And Its Importance

May 24, 2025

Latest Posts

-

Navigating High Stock Market Valuations Advice From Bof A

May 24, 2025

Navigating High Stock Market Valuations Advice From Bof A

May 24, 2025 -

Bof A On Stock Market Valuations A Reasoned Perspective For Investors

May 24, 2025

Bof A On Stock Market Valuations A Reasoned Perspective For Investors

May 24, 2025 -

Thames Water Executive Bonuses A Look At The Figures And Public Reaction

May 24, 2025

Thames Water Executive Bonuses A Look At The Figures And Public Reaction

May 24, 2025 -

Are Thames Water Executive Bonuses Fair A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Fair A Critical Analysis

May 24, 2025 -

Bof As View Why Current Stock Market Valuations Shouldnt Scare Investors

May 24, 2025

Bof As View Why Current Stock Market Valuations Shouldnt Scare Investors

May 24, 2025