Navigating Sustainability Funding: Resources For SMEs

Table of Contents

Identifying Suitable Sustainability Funding Opportunities

Finding the right funding source is the first critical step. Fortunately, several avenues exist for SMEs seeking financial assistance for their sustainability projects.

Government Grants and Subsidies

Many government agencies at local, regional, and national levels offer SME sustainability grants and subsidies to encourage environmentally responsible business practices. These programs often prioritize projects that demonstrate a significant positive impact on the environment and the community.

- Examples: (Note: Specific programs and eligibility criteria vary by location. Replace these examples with your region's relevant programs and include links.) For example, the [insert name and link to a relevant national program] offers grants for energy efficiency upgrades, while [insert name and link to a relevant regional/local program] provides funding for waste reduction initiatives.

- Application Process: Generally, applications involve submitting a detailed proposal outlining the project's goals, budget, and anticipated environmental impact. Thorough research of each program's specific requirements is vital. Common requirements include a well-defined business plan, financial projections, and evidence of sustainability goals alignment.

Private Sector Funding

Beyond government assistance, the private sector offers various funding opportunities for sustainable businesses.

- Impact Investing: Impact investors actively seek businesses with a strong social and environmental impact alongside financial returns. They invest in companies aligning with their values, providing both capital and mentorship.

- Venture Capital: Some venture capital firms specialize in sustainable technologies and businesses, recognizing the immense growth potential in this sector. Securing this funding often requires a strong track record and a scalable business model.

- Crowdfunding: Platforms like Kickstarter and Indiegogo allow businesses to raise capital directly from the public by presenting their sustainability initiatives to a wider audience. Successful crowdfunding campaigns often leverage strong storytelling and community engagement.

Green Loans and Financing

Banks and other financial institutions increasingly offer green loans specifically designed for sustainable business projects. These loans often come with favorable interest rates and flexible repayment terms.

- Benefits: Green loans can provide access to substantial capital for large-scale sustainability initiatives, such as renewable energy installations or building retrofits.

- Eligibility Criteria: Eligibility typically involves demonstrating a clear environmental benefit of the project and adhering to specific sustainability criteria. Banks often require detailed financial statements and environmental impact assessments.

Developing a Compelling Sustainability Funding Proposal

A strong proposal is crucial for securing funding, regardless of the source. It needs to clearly articulate your vision, demonstrate the project's impact, and showcase your business's financial viability.

Defining Your Sustainability Goals

Clearly defined and measurable sustainability goals are paramount. Use the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) to set targets. For example, instead of "reduce waste," aim for "reduce waste by 25% within the next two years." This quantifiable approach helps demonstrate your commitment and allows potential funders to assess your progress.

Crafting a Strong Business Plan

A robust business plan forms the backbone of your funding application. It should include:

- Executive Summary: A concise overview of your business, its sustainability goals, and funding request.

- Market Analysis: Demonstrating market demand for your sustainable products or services.

- Financial Projections: Detailed forecasts of revenues, expenses, and profitability, showing the financial viability of your sustainability initiatives.

- Risk Assessment: Identifying potential challenges and outlining mitigation strategies.

Highlighting Environmental and Social Impact

Quantify the positive environmental and social impact of your project. Showcase how it contributes to reducing your carbon footprint, conserving resources, improving social equity, or supporting local communities. This highlights your commitment to sustainability beyond mere profit motives.

Navigating the Application Process and Beyond

Successfully securing funding goes beyond crafting a compelling proposal. Navigating the application process and managing the funds effectively are equally crucial.

Understanding Eligibility Criteria

Carefully review the eligibility criteria for each funding opportunity. Missing even a minor requirement can lead to rejection. Take the time to ensure your application aligns perfectly with the funder's expectations and priorities.

Effective Communication and Networking

Building relationships with potential funders is vital. Attend industry conferences and networking events to connect with investors and grant providers. Effective communication, both written and verbal, is essential to convey your vision and answer questions convincingly.

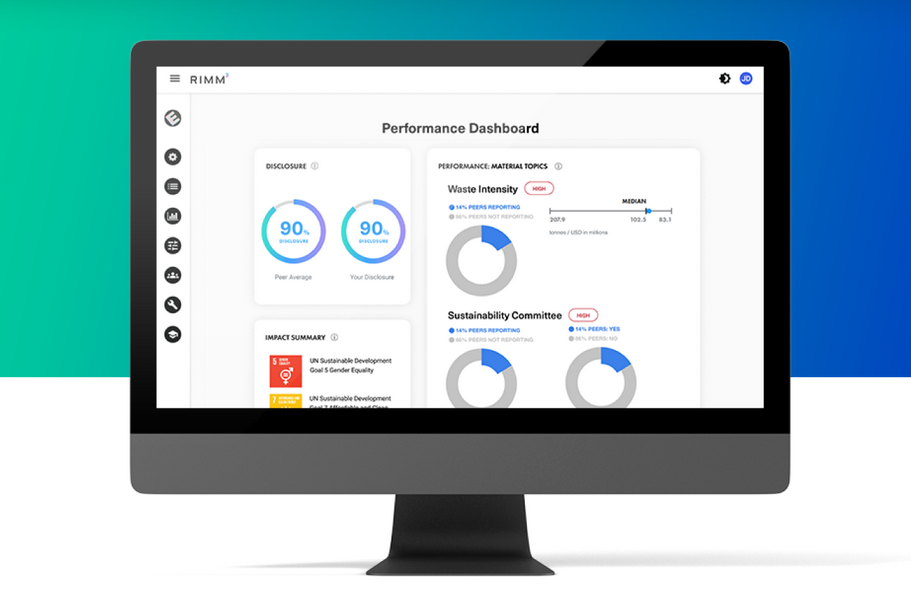

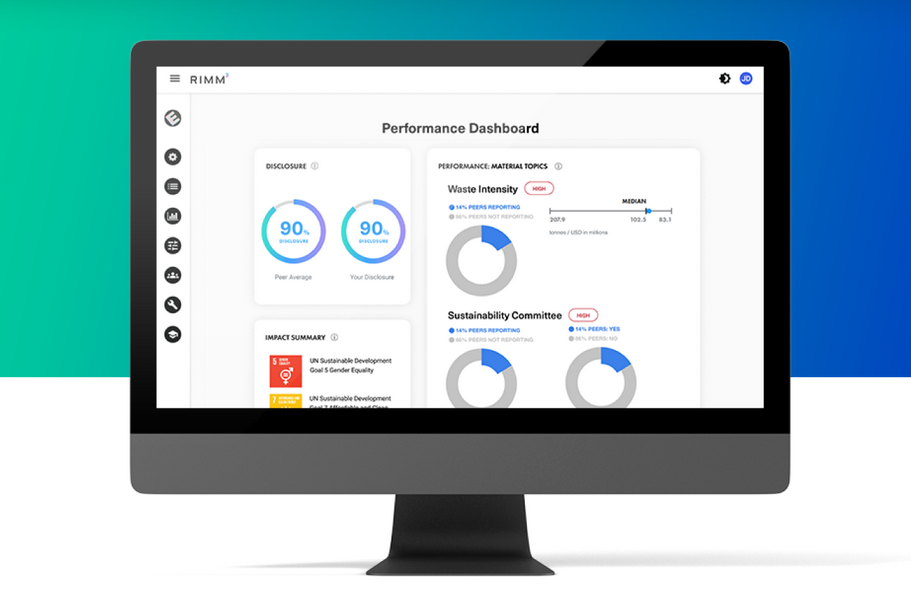

Post-Funding Reporting and Sustainability Tracking

Once you secure funding, maintaining accurate records and reporting on progress is crucial. Transparency builds trust with funders and ensures continued support. Implement tools and methods for tracking key sustainability metrics, allowing you to monitor progress against your goals and demonstrate the effectiveness of your initiatives.

Conclusion

Securing sustainability funding for SMEs requires a proactive approach and a well-structured plan. From exploring government grants and private sector investments to developing compelling proposals and managing post-funding reporting, each stage presents unique opportunities and challenges. By leveraging the resources outlined in this article and proactively addressing the key steps, your SME can successfully navigate the funding landscape and implement impactful sustainability initiatives. Start exploring the diverse funding options available to you today – research government SME sustainability grants, contact impact investors, or review your eligibility for green loans. Take the first step towards a more sustainable and prosperous future for your business! [Link to a relevant resource directory or government website].

Featured Posts

-

Participate In The 9th Eurovision 2024 Infe Poll On Esc Today

May 19, 2025

Participate In The 9th Eurovision 2024 Infe Poll On Esc Today

May 19, 2025 -

Eurovision Song Contest 2025 Uk In 19th Position

May 19, 2025

Eurovision Song Contest 2025 Uk In 19th Position

May 19, 2025 -

French Motorway Crash British Drivers Wrong Way Journey

May 19, 2025

French Motorway Crash British Drivers Wrong Way Journey

May 19, 2025 -

Leslie Cable Steps Down Michael De Lil To Lead Eurovision Belgium From 2027

May 19, 2025

Leslie Cable Steps Down Michael De Lil To Lead Eurovision Belgium From 2027

May 19, 2025 -

Erling Haaland Fails To Score In Fa Cup Final At Wembley

May 19, 2025

Erling Haaland Fails To Score In Fa Cup Final At Wembley

May 19, 2025