Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist: Analysis And Insights

Table of Contents

2.1. Factors Influencing the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

The Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is influenced by several key factors. Understanding these factors is crucial for interpreting NAV changes and making informed investment choices.

-

Underlying Asset Performance: The ETF tracks the MSCI World Index, a broad market-cap weighted index of global equities. Therefore, the performance of this index directly impacts the ETF's NAV. Strong performance in the underlying stocks leads to NAV appreciation, while poor performance results in a decline. Keywords: MSCI World Index, ETF Performance, Global Equities.

-

Currency Fluctuations: The "USD Hedged" designation is significant. This means the ETF employs currency hedging strategies to mitigate the risk of fluctuations in the EUR/USD exchange rate. While this reduces exposure to currency risk, the effectiveness of the hedge can vary, leading to some degree of influence on the NAV. Keywords: Currency Hedging, Exchange Rate Risk, EUR/USD.

-

Expense Ratio: The ETF has an expense ratio that is deducted from the assets under management. This expense ratio, though typically small, erodes the NAV over time. Understanding the expense ratio is important for assessing the long-term growth potential of the ETF. Keywords: Expense Ratio Impact, ETF Costs.

-

Dividend Distributions: The ETF distributes dividends to its shareholders. When dividends are paid out, the NAV of the ETF decreases proportionally. However, dividend reinvestment plans can help mitigate this decrease. Keywords: Dividend Distributions, Dividend Reinvestment.

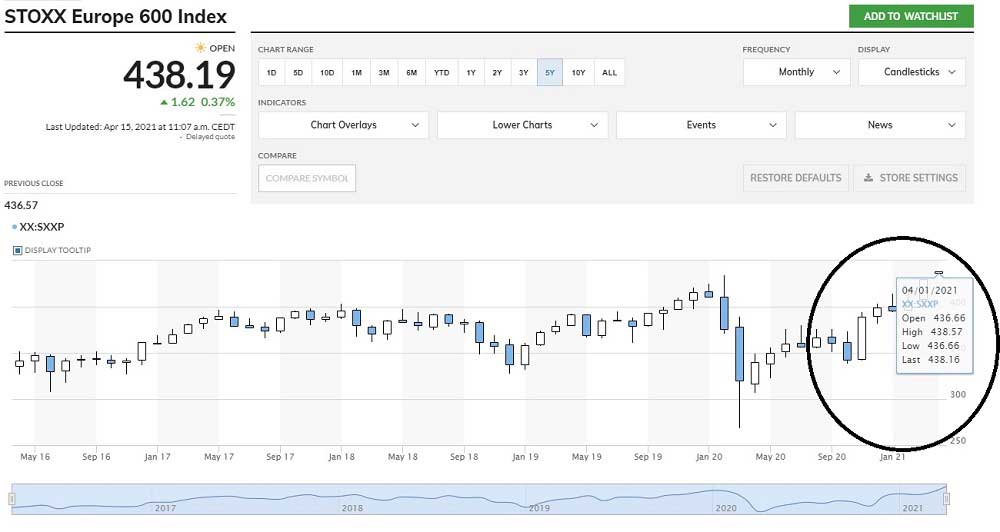

2.2. Analyzing Historical NAV Trends of Amundi MSCI World II UCITS ETF USD Hedged Dist

Analyzing the historical Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is essential for understanding its performance and volatility. You can access historical NAV data through various resources:

- Amundi Website: The official Amundi website typically provides detailed information on the ETF, including historical NAV data.

- Financial Data Providers: Major financial data providers, such as Bloomberg, Refinitiv, and Yahoo Finance, often offer historical NAV charts and graphs.

By analyzing this data, you can identify periods of significant growth or decline, correlating them with events impacting the MSCI World Index or currency fluctuations. Visualizing this data through charts and graphs allows for easier interpretation of historical trends. Keywords: NAV Chart, NAV History, ETF Performance, Historical Data Analysis.

2.3. Comparing NAV to Market Price of Amundi MSCI World II UCITS ETF USD Hedged Dist

While the NAV represents the theoretical value of the ETF's assets, the market price reflects the actual trading price. Discrepancies can arise due to supply and demand factors.

- Premium to NAV: The market price might trade at a premium to the NAV, indicating high investor demand.

- Discount to NAV: Conversely, the market price could trade at a discount to the NAV, suggesting lower investor demand.

Understanding these discrepancies is vital. Significant premiums or discounts can present arbitrage opportunities for sophisticated investors. Keywords: Market Price, Premium to NAV, Discount to NAV, Arbitrage Opportunities.

2.4. Investment Strategies Based on Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Analyzing the NAV can inform various investment strategies:

- Dollar-Cost Averaging: This strategy involves investing a fixed amount at regular intervals, regardless of the NAV. This mitigates the risk of investing a lump sum at a market peak.

- Buy-and-Hold Strategy: This long-term approach involves buying and holding the ETF for an extended period, benefiting from long-term growth potential.

- Value Investing (based on NAV discrepancies): Investors might seek to capitalize on temporary discounts to NAV, buying low and potentially selling at a higher price when the market price converges towards the NAV.

Each strategy carries its own level of risk and reward. Careful consideration of your risk tolerance is paramount. Keywords: Investment Strategy, Dollar Cost Averaging, Buy and Hold, Value Investing, Risk Management.

3. Conclusion: Key Takeaways and Call to Action

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is crucial for making informed investment decisions. Factors such as underlying asset performance, currency fluctuations, expense ratios, and dividend distributions all play significant roles. Monitoring historical NAV trends and comparing them to the market price can reveal valuable insights. While various investment strategies can leverage NAV analysis, always conduct thorough research and consider your risk profile before investing. Learn more about the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV and make informed investment decisions today! [Link to relevant resources, e.g., Amundi's website] Keywords: Amundi MSCI World II UCITS ETF USD Hedged Dist NAV, ETF Investment, Informed Investing.

Featured Posts

-

Artfae Daks Alalmany Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn

May 24, 2025

Artfae Daks Alalmany Atfaq Tjary Jdyd Byn Alwlayat Almthdt Walsyn

May 24, 2025 -

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Bbc Radio 1 Big Weekend 2024 Lineup Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025 -

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025 -

Burys Forgotten M62 Relief Road A History

May 24, 2025

Burys Forgotten M62 Relief Road A History

May 24, 2025 -

Annie Kilner Seen Without Wedding Ring After Kyle Walkers Night Out

May 24, 2025

Annie Kilner Seen Without Wedding Ring After Kyle Walkers Night Out

May 24, 2025

Latest Posts

-

Paris Facing Financial Strain Analysis Of The Luxury Sectors Decline

May 24, 2025

Paris Facing Financial Strain Analysis Of The Luxury Sectors Decline

May 24, 2025 -

Paris In The Red Luxury Goods Crisis And Its Economic Consequences

May 24, 2025

Paris In The Red Luxury Goods Crisis And Its Economic Consequences

May 24, 2025 -

French Stock Market Cac 40 Week Ending March 7 2025 Analysis

May 24, 2025

French Stock Market Cac 40 Week Ending March 7 2025 Analysis

May 24, 2025 -

Cac 40 Fridays Red Weekly Stability Market Update March 7 2025

May 24, 2025

Cac 40 Fridays Red Weekly Stability Market Update March 7 2025

May 24, 2025 -

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025

Slight Weekly Decline For Cac 40 Despite Fridays Losses March 7 2025

May 24, 2025