New HMRC Letters: What UK Households Need To Know

Table of Contents

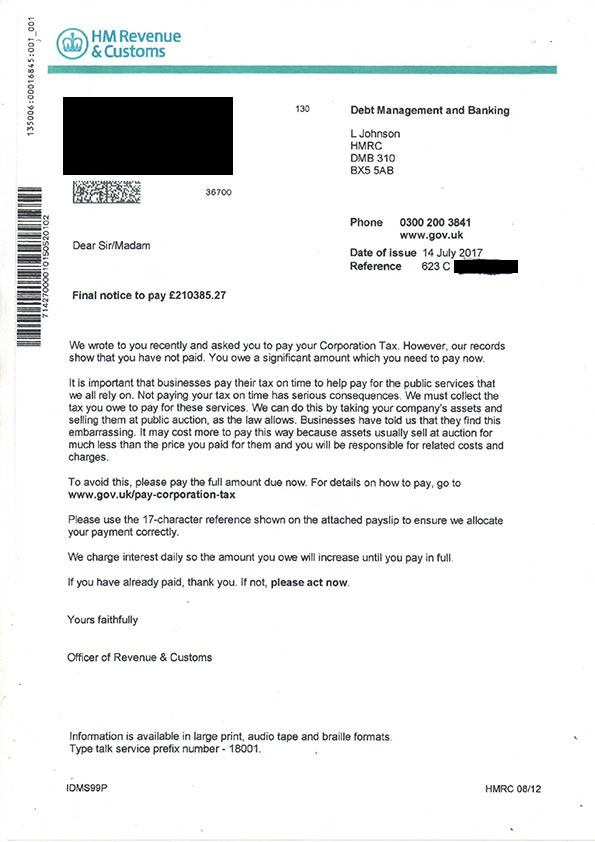

Identifying Genuine HMRC Letters

Many scams attempt to mimic official HMRC letters to steal personal and financial information. It's crucial to be vigilant and know how to spot a fake. Learning to verify HMRC letter authenticity is the first step in protecting yourself from phishing and other fraudulent activities related to your UK tax affairs. Knowing how to identify official HMRC correspondence helps safeguard your financial well-being.

- Check for official HMRC letterhead and logo: Genuine HMRC letters will feature the official HMRC logo and letterhead, often with specific security features.

- Verify the sender's address and contact details using the HMRC website: Don't rely solely on the information in the letter. Cross-reference the address and contact details with the official HMRC website to ensure legitimacy.

- Look for security features like unique reference numbers: HMRC letters often include unique reference numbers and other security features to verify authenticity.

- Never click on links in suspicious emails or letters claiming to be from HMRC: HMRC will never ask for personal or financial information via email or untrusted links.

- Report suspected scams to Action Fraud: If you suspect a letter is fraudulent, report it immediately to Action Fraud, the UK's national reporting centre for fraud and cybercrime.

Common Reasons for Receiving an HMRC Letter

Understanding why you've received an HMRC letter is crucial for responding correctly. Several common reasons necessitate communication from HMRC regarding your UK tax obligations. These range from routine updates to urgent requests for information.

- Tax assessment: This letter details your tax liability for the tax year. It shows the total amount of tax you owe and payment deadlines.

- Payment reminder: You'll receive this if a tax payment is overdue. It will remind you of the outstanding amount and potential penalties for late payment.

- Tax refund: This is good news! This letter confirms that you're due a tax refund and outlines the payment process.

- Enquiry: HMRC might request further information regarding your tax return if there are inconsistencies or missing details. Responding promptly and accurately is vital.

- Changes to your tax code: This letter informs you of any changes to your tax code, which affects the amount of tax deducted from your salary or pension. Understanding your tax code is important for accurate tax management.

How to Respond to HMRC Letters

Responding promptly and accurately to HMRC letters is essential to avoid penalties. Knowing the appropriate channels for communication and payment ensures compliance with your UK tax obligations. Understanding how to interact with HMRC efficiently can save you time and potential financial repercussions.

- Check the letter's instructions carefully: Each letter will contain specific instructions on how to respond and any deadlines you need to meet.

- Respond within the specified timeframe: Ignoring deadlines can lead to penalties. Make sure you respond within the stipulated time frame.

- Use the provided methods for payment and communication: HMRC will usually specify preferred methods for payment (e.g., online banking, cheque) and communication (e.g., online portal, phone).

- Keep copies of all correspondence and payment confirmations: This documentation is important for your records, especially if you have any disputes or require proof of payment.

- Contact HMRC directly if you have any questions or require clarification: Don't hesitate to reach out if you're unsure about anything. HMRC's website provides contact details and support resources.

Understanding Penalties for Non-Compliance

Ignoring HMRC letters can have serious financial consequences. Late payments, inaccurate returns, or simply not responding can lead to significant penalties. Understanding these penalties will incentivize prompt and accurate responses to all HMRC correspondence.

- Late payment interest: You'll be charged interest on any outstanding tax payments that are not made by the deadline.

- Penalties for inaccurate tax returns: Submitting an incorrect tax return can result in substantial penalties.

- Potential legal action: In severe cases of non-compliance, HMRC might take legal action, resulting in further penalties and potential legal fees.

Conclusion

Navigating HMRC correspondence can be challenging, but understanding how to identify genuine letters, respond appropriately, and the potential consequences of non-compliance is vital for every UK household. Remember to always verify the authenticity of any HMRC letter, respond promptly and accurately, and keep thorough records. Don't delay; understand your new HMRC letters today! Visit the official HMRC website for further information and support.

Featured Posts

-

Wwe Raw Tyler Bates Highly Anticipated Return

May 20, 2025

Wwe Raw Tyler Bates Highly Anticipated Return

May 20, 2025 -

Ignoring Hmrc Letters Could Cost Uk Households A Warning

May 20, 2025

Ignoring Hmrc Letters Could Cost Uk Households A Warning

May 20, 2025 -

Agatha Christie Une Vie D Aventures Et De Mysteres L Integrale

May 20, 2025

Agatha Christie Une Vie D Aventures Et De Mysteres L Integrale

May 20, 2025 -

Tonci Tadic O Pregovorima Putinove Karte I Ciljevi Pregovora

May 20, 2025

Tonci Tadic O Pregovorima Putinove Karte I Ciljevi Pregovora

May 20, 2025 -

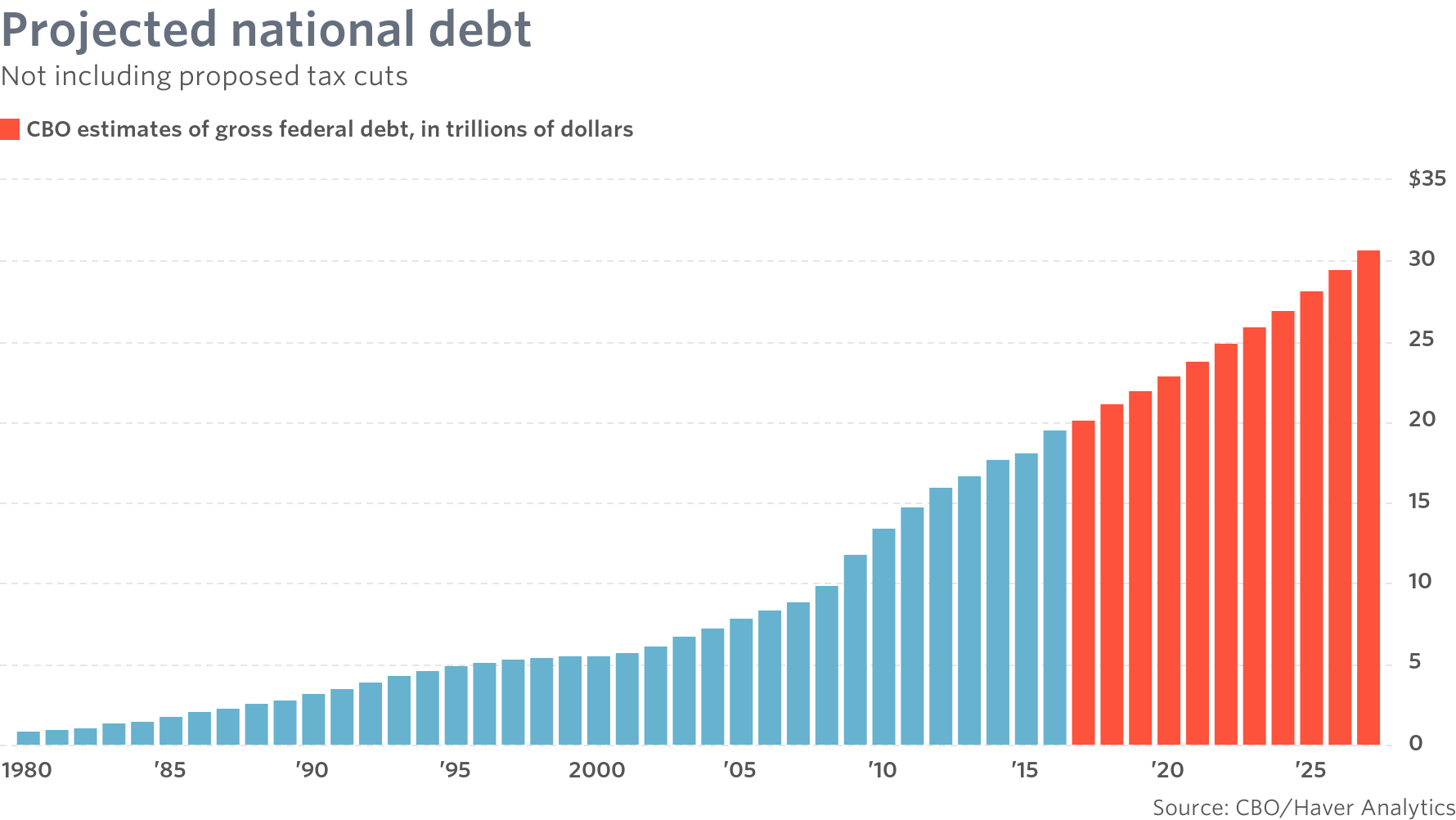

Analyzing The Gop Tax Plan The Reality Of Deficit Reduction

May 20, 2025

Analyzing The Gop Tax Plan The Reality Of Deficit Reduction

May 20, 2025