Norwegian Cruise Line (NCLH): A Hedge Fund Perspective On Investment

Table of Contents

NCLH's Financial Performance and Valuation

Analyzing NCLH's investment viability requires a thorough understanding of its financial health and current valuation. Key metrics provide insights into its performance and potential for future returns.

-

NCLH Stock Price and Financial Statements: Examining NCLH's recent financial statements reveals its revenue growth, profitability margins (operating income, net income), and debt levels (debt-to-equity ratio). Fluctuations in the NCLH stock price directly reflect investor sentiment and market perception of its financial performance. Analyzing these trends helps predict future price movements.

-

Key Valuation Metrics: Hedge funds use several valuation metrics to assess NCLH's worth. These include the Price-to-Earnings ratio (P/E), Price-to-Book ratio (P/B), and Enterprise Value/EBITDA (EV/EBITDA). Comparing these ratios to industry averages and historical data provides a benchmark for understanding if NCLH is undervalued or overvalued. A low P/E ratio, for instance, might suggest an attractive entry point.

-

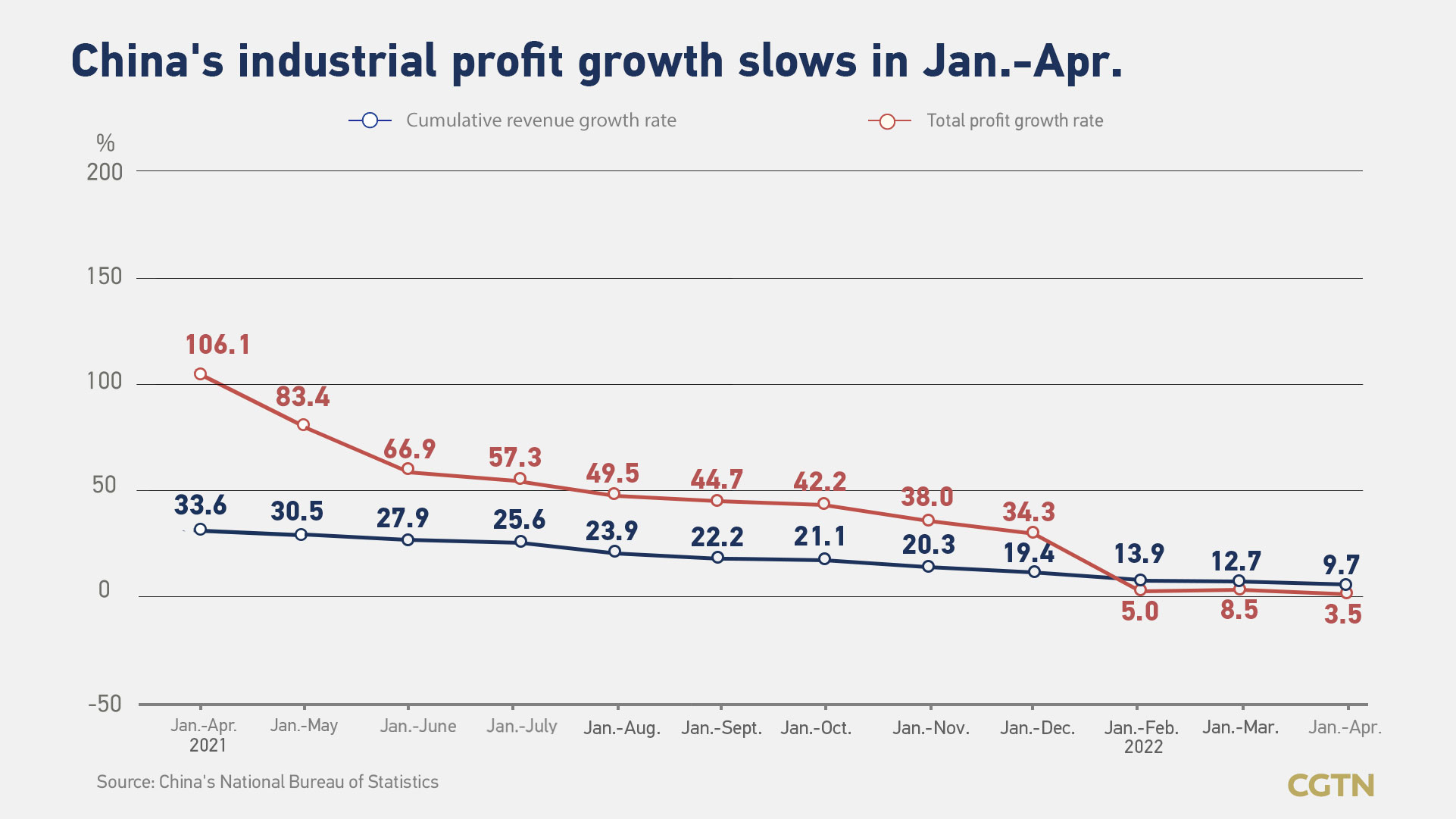

Macroeconomic Factors: Macroeconomic factors such as inflation, recessionary pressures, and interest rate hikes significantly impact the cruise industry. A weakening economy can lead to decreased consumer spending on discretionary items like cruises, affecting NCLH's revenue and profitability. This is crucial for assessing the overall risk and potential for return on investment.

-

Market Capitalization: NCLH's market capitalization reflects the total market value of its outstanding shares. Tracking this metric helps gauge the size and overall valuation of the company within the broader cruise market.

Risks Associated with Investing in NCLH

Investing in NCLH carries inherent risks associated with the cruise industry and broader macroeconomic conditions. A thorough risk assessment is vital for any hedge fund considering this investment.

-

Cruise Industry Risks: The cruise industry is susceptible to unforeseen events. Health outbreaks (like pandemics), geopolitical instability affecting travel routes and destinations, and economic downturns can significantly impact demand and profitability. NCLH's historical performance during past crises provides insights into its resilience.

-

Fuel Price Fluctuations: Fuel costs constitute a substantial operational expense for cruise lines. Significant increases in fuel prices directly impact profitability, making NCLH vulnerable to fuel price volatility. Hedging strategies against fuel price risk are a consideration for mitigating this exposure.

-

Competitive Landscape: The cruise industry is competitive, with several established players vying for market share. NCLH's competitive positioning, its ability to differentiate its offerings, and its market share growth are crucial factors to assess.

-

Regulatory Risks: The cruise industry is subject to strict regulations concerning safety, environmental protection, and labor practices. Changes in regulatory environments can impact operational costs and profitability.

Growth Potential and Future Outlook for NCLH

Despite the inherent risks, NCLH offers potential for growth. Analyzing its strategies and the industry outlook is key to evaluating long-term prospects.

-

Growth Strategies: NCLH's growth strategies include fleet expansion (introducing new ships), developing new itineraries to cater to evolving travel preferences, and incorporating technological advancements to enhance the passenger experience. These initiatives are crucial for driving future revenue growth.

-

Emerging Markets: Expanding into emerging markets with growing middle classes presents significant growth opportunities for NCLH. However, this also necessitates careful consideration of local market dynamics and potential challenges.

-

Adaptability to Change: The ability of NCLH to adapt to evolving consumer demand and technological disruptions, such as incorporating sustainable practices and leveraging digital technologies, will be critical for its long-term success.

-

Long-Term Growth Projections: Analyzing long-term growth projections, considering factors like market demand, economic conditions, and NCLH's strategic initiatives, is vital for assessing the potential return on investment.

Dividend Policy and Shareholder Returns

NCLH's dividend policy and its approach to shareholder returns are significant considerations for investors.

-

Dividend Yield and Potential for Increases/Decreases: Examining NCLH's historical dividend yield and assessing the potential for future dividend increases or decreases based on profitability and financial health provides insights into potential income generation for investors.

-

Capital Allocation: Understanding how NCLH allocates its capital, whether through reinvestment in growth initiatives, share buybacks, or dividend payments, provides insight into its commitment to shareholder value.

Hedge Fund Strategies for Investing in NCLH

Hedge funds employ various strategies to capitalize on investment opportunities in NCLH while managing risk.

-

Long-Term vs. Short-Term Investments: Some hedge funds may adopt a long-term investment strategy, holding NCLH shares for an extended period, while others might employ short-term trading strategies based on market fluctuations.

-

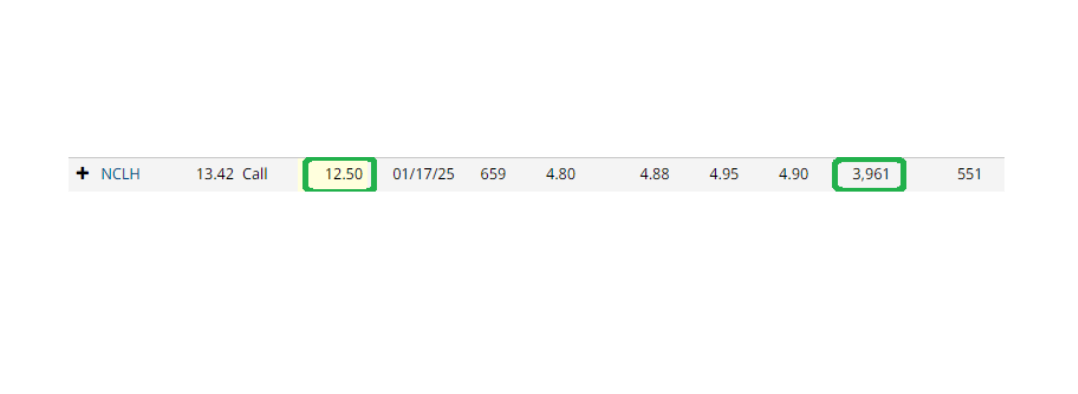

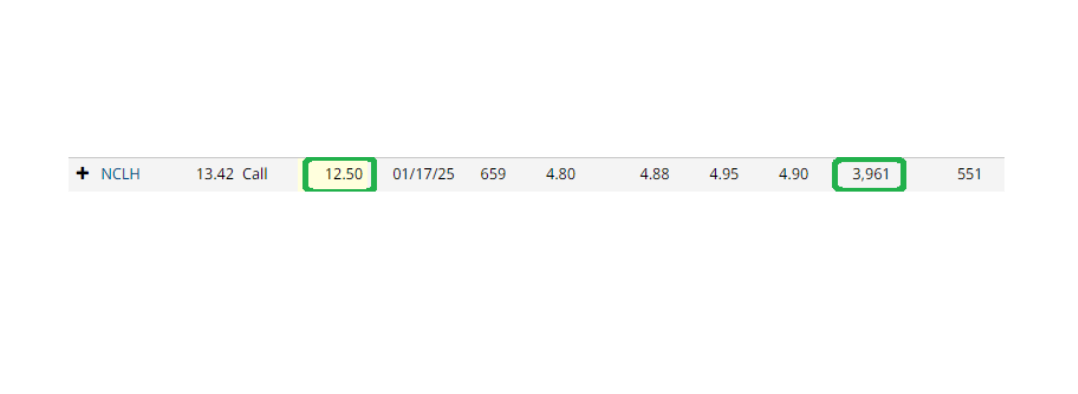

Options Trading and Arbitrage: Options trading and arbitrage strategies can be utilized to capitalize on specific market conditions and price discrepancies.

-

Risk Management Techniques: Effective risk management is crucial. Techniques like hedging, diversification, and stop-loss orders help mitigate potential losses.

-

Portfolio Diversification: Diversifying within a broader portfolio is vital to reduce overall risk. Investing in NCLH should be part of a well-diversified investment strategy, not a singular focus.

Conclusion

This analysis of Norwegian Cruise Line (NCLH) from a hedge fund perspective reveals a company with significant growth potential but also facing inherent industry risks. Careful consideration of financial performance, valuation, risks, and future outlook is crucial before making an investment decision. Before making any investment in NCLH or any other cruise line stock, conduct thorough due diligence and consider seeking professional financial advice. Understanding the nuances of the Norwegian Cruise Line (NCLH) investment requires a deep dive into the financial statements and an assessment of the market conditions. Therefore, thorough research is key to a successful Norwegian Cruise Line (NCLH) investment strategy.

Featured Posts

-

How Robust Investments Led To Higher Profits For China Life

Apr 30, 2025

How Robust Investments Led To Higher Profits For China Life

Apr 30, 2025 -

Beyonces Daughters Blue Ivy And Rumi A Striking Resemblance At The 2025 Super Bowl

Apr 30, 2025

Beyonces Daughters Blue Ivy And Rumi A Striking Resemblance At The 2025 Super Bowl

Apr 30, 2025 -

Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Thong Tin Lich Thi Dau 10 Tran Hay Nhat

Apr 30, 2025

Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Thong Tin Lich Thi Dau 10 Tran Hay Nhat

Apr 30, 2025 -

Nothing Phone 2 Redefining Modular Smartphone Design

Apr 30, 2025

Nothing Phone 2 Redefining Modular Smartphone Design

Apr 30, 2025 -

China Life Financial Results Investment Performance Highlights

Apr 30, 2025

China Life Financial Results Investment Performance Highlights

Apr 30, 2025