Orix Stake Sale: India's Greenko Founders In Pursuit Of New Deal

Table of Contents

The Orix Stake Sale: Key Details and Significance

The Orix stake sale involves the divestment of a substantial portion of Orix Corporation's holdings in Greenko Energy. While the exact percentage hasn't been publicly disclosed, reports suggest a significant stake, potentially impacting the overall ownership structure. Orix's investment in Greenko spans several years, marking a considerable period of involvement in the Indian renewable energy market.

Several factors likely contributed to Orix's decision to divest:

- Market Conditions: Fluctuations in global financial markets and the evolving landscape of renewable energy investments could have influenced Orix's strategic decision-making.

- Strategic Realignment: Orix might be realigning its portfolio to focus on other investment opportunities or sectors.

- Unlocking Value: The sale allows Orix to realize the value of its investment in Greenko, potentially generating substantial returns.

Potential buyers include a mix of:

- Private Equity Firms: Several large private equity firms with expertise in the energy sector are reportedly interested in acquiring Orix's stake. Their interest stems from Greenko's strong portfolio and growth potential in the burgeoning Indian renewable energy market.

- Strategic Investors: Strategic investors, including other players in the energy sector, might be keen to acquire Greenko's assets for strategic expansion and market consolidation.

The valuation of Greenko and the final deal size remain undisclosed, but industry analysts anticipate a significant transaction, reflecting the company's strong market position and future prospects. The deal's outcome will directly influence Greenko's existing projects, including its extensive solar, wind, and hydro power assets, and potentially shape its future expansion plans.

Greenko Founders' Strategy and Future Ambitions

Anil Chalamalasetty and Mahesh Kolli, the founders of Greenko, have been instrumental in driving the Orix stake sale. Their active involvement suggests a proactive approach to shaping Greenko's future. Their long-term vision for Greenko involves:

- Consolidation and Growth: The founders likely aim to consolidate Greenko's position as a market leader in the Indian renewable energy sector.

- Strategic Expansion: Funds from the stake sale could be used to fuel expansion into new markets and technologies within the renewable energy sector.

- Debt Reduction: A portion of the proceeds might be used to reduce Greenko's existing debt burden, improving its financial flexibility.

The founders' extensive experience and proven track record in the renewable energy sector bolster their ambitious plans. They understand the intricacies of the Indian energy market, governmental regulations, and the evolving investor landscape. Their vision, coupled with the influx of capital, positions Greenko for significant growth. Greenko's strong portfolio and strategic positioning place it favorably against its competitors in India's increasingly competitive renewable energy market.

Implications for India's Renewable Energy Sector

The Orix stake sale carries substantial implications for India's renewable energy sector:

- Increased Investment: The transaction signals the continued attractiveness of the Indian renewable energy market to both domestic and international investors.

- Government Support: Supportive government policies, including ambitious renewable energy targets and incentives, further enhance the sector's appeal to investors.

- Private Equity's Role: Private equity firms play a crucial role in funding the growth and expansion of renewable energy companies like Greenko, providing capital for new projects and technological advancements.

The deal underscores the significant growth potential of the Indian renewable energy sector. However, challenges remain, including grid infrastructure limitations and land acquisition issues. Despite these challenges, the long-term outlook remains positive, driven by India's commitment to sustainable energy and the increasing demand for clean energy solutions.

Conclusion

The Orix stake sale in Greenko marks a significant turning point for India's renewable energy sector. The strategic actions taken by Greenko's founders signal a renewed focus on growth and expansion, fuelled by potential capital influx and a strengthened strategic position. The outcome of this transaction will not only influence Greenko's future but will also impact the broader landscape of renewable energy investments in India.

Call to Action: Stay updated on the finalization of the Orix stake sale and its impact on Greenko's future. Follow our coverage to stay informed about the dynamic developments in India's renewable energy market and the strategic moves of key players like Greenko Energy. Learn more about the Greenko Orix deal and its implications for sustainable energy in India.

Featured Posts

-

Liverpool And Angelo Stiller A German Media Perspective And Its Impact On Arne Slot

May 17, 2025

Liverpool And Angelo Stiller A German Media Perspective And Its Impact On Arne Slot

May 17, 2025 -

Knicks Playoff Hopes Dented By Jalen Brunson Injury

May 17, 2025

Knicks Playoff Hopes Dented By Jalen Brunson Injury

May 17, 2025 -

Angel Reeses Post Game Interview Key Takeaways From Chicago Sky Game

May 17, 2025

Angel Reeses Post Game Interview Key Takeaways From Chicago Sky Game

May 17, 2025 -

Canadas Housing Crisis Can Modular Homes Provide A Faster More Affordable Alternative

May 17, 2025

Canadas Housing Crisis Can Modular Homes Provide A Faster More Affordable Alternative

May 17, 2025 -

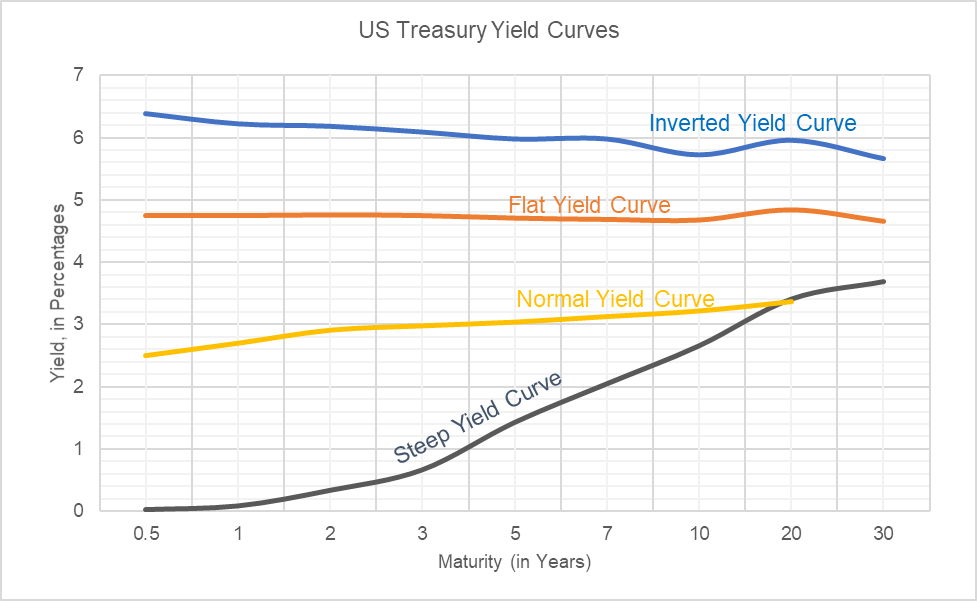

Japans Steep Bond Curve A Deep Dive Into Investor Sentiment And Economic Outlook

May 17, 2025

Japans Steep Bond Curve A Deep Dive Into Investor Sentiment And Economic Outlook

May 17, 2025