Pakistan, Sri Lanka, And Bangladesh To Strengthen Capital Market Ties

Table of Contents

Enhanced Cross-Border Investment Opportunities

The potential for increased foreign direct investment (FDI) and portfolio investment flows between Pakistan, Sri Lanka, and Bangladesh is immense. This initiative aims to significantly streamline regulations and reduce barriers to cross-border investments, creating a more attractive environment for both domestic and international investors. This will involve a multi-pronged approach focusing on:

- Simplified regulatory processes for foreign investors: Streamlining bureaucratic procedures and reducing paperwork will significantly expedite the investment process, making it more efficient and attractive. This could involve the implementation of online portals and single-window clearance systems.

- Harmonization of securities laws and regulations: Aligning the legal frameworks governing securities trading across the three countries will create a more unified and predictable market, fostering greater investor confidence. This includes standardization of listing requirements, disclosure rules, and corporate governance practices.

- Improved access to information and market transparency: Enhanced data accessibility and transparency will allow investors to make better-informed decisions. This will involve improved disclosure requirements, standardized reporting practices, and the development of robust investor relations frameworks.

- Joint initiatives to attract foreign capital: Collaborative marketing campaigns and participation in international investment forums will help showcase the region's investment potential and attract capital from global investors. This will involve highlighting the unique advantages of each country's market while presenting a unified regional investment proposition.

Development of Regional Financial Instruments and Platforms

The creation of shared financial instruments and platforms is a crucial element of this collaboration. This could range from developing a regional stock exchange to facilitating the trading of standardized financial instruments across borders. This move has the potential to:

- Create a joint platform for trading regional securities: A unified platform would provide a more efficient and cost-effective way for investors to access securities markets across the three countries. This platform could also leverage technology to enhance trading speed and transparency.

- Develop standardized financial instruments: Creating common standards for financial instruments will simplify cross-border transactions and reduce operational complexity. This will also enhance liquidity and improve price discovery mechanisms.

- Facilitate the growth of Islamic finance within the region: Given the significant Muslim population in the region, promoting Islamic finance could unlock substantial investment opportunities and attract a wider pool of investors. This requires collaborative efforts to develop relevant infrastructure and expertise.

- Exploring opportunities for fintech collaboration: Leveraging fintech innovations can significantly enhance efficiency, transparency, and accessibility within the regional capital markets. This includes exploring opportunities in areas such as mobile payments, blockchain technology, and online investment platforms.

Strengthening Regulatory Cooperation and Information Sharing

Building investor confidence requires strong regulatory cooperation and efficient information sharing. This initiative necessitates a collaborative approach to market surveillance, risk management, and investor protection. This involves:

- Establishment of a joint regulatory body or forum: A formal platform for collaboration between regulatory bodies will enhance communication, coordination, and the enforcement of common standards. This body could also play a vital role in addressing cross-border regulatory challenges.

- Increased transparency and information sharing among regulators: Open communication and the sharing of best practices will contribute to a more harmonized regulatory environment and enhance market integrity. This could involve the establishment of secure data-sharing platforms.

- Joint efforts to combat market manipulation and fraud: Collaborative efforts to detect and prevent fraud will be crucial to maintaining investor confidence and protecting the integrity of the regional capital markets.

- Enhanced investor protection mechanisms: Robust investor protection mechanisms are essential to attract investment. This requires developing common standards for investor redressal and strengthening consumer protection laws.

Addressing Challenges and Risks

Despite the immense potential, several challenges and risks must be addressed to ensure the success of this initiative. These include:

- Developing robust risk management strategies: Strategies to mitigate risks related to currency fluctuations, economic volatility, and political instability are crucial. This might involve developing hedging mechanisms and contingency plans.

- Addressing political and economic uncertainties: Political stability and predictable economic policies are essential for attracting foreign investment. Collaborative efforts to promote regional stability are paramount.

- Improving cybersecurity infrastructure and protocols: Robust cybersecurity infrastructure and protocols are essential to protect the integrity of the regional financial markets from cyber threats. This requires collaborative efforts to enhance cybersecurity capabilities.

- Promoting financial literacy and investor education: Improving financial literacy among investors will enhance their ability to make informed investment decisions and participate more effectively in the capital markets.

Conclusion

Strengthening capital market ties between Pakistan, Sri Lanka, and Bangladesh offers immense potential for regional economic growth, increased investment, and enhanced regional stability. By fostering cross-border investment, developing regional financial instruments, and strengthening regulatory cooperation, these nations can unlock a new era of prosperity. However, addressing the challenges and risks associated with this initiative is crucial for its success. The collaborative efforts underway pave the way for a more integrated and robust South Asian capital market, presenting exciting investment opportunities for both domestic and international players. Learn more about how the strengthening of capital market ties between Pakistan, Sri Lanka, and Bangladesh is shaping a new era of regional economic growth and investment opportunities. This collaboration promises significant benefits for the region, leading to a more prosperous and interconnected future.

Featured Posts

-

Agression Au Lac Kir De Dijon Trois Victimes

May 10, 2025

Agression Au Lac Kir De Dijon Trois Victimes

May 10, 2025 -

Changes To Uk Visa Regulations Addressing Work And Student Visa Misuse

May 10, 2025

Changes To Uk Visa Regulations Addressing Work And Student Visa Misuse

May 10, 2025 -

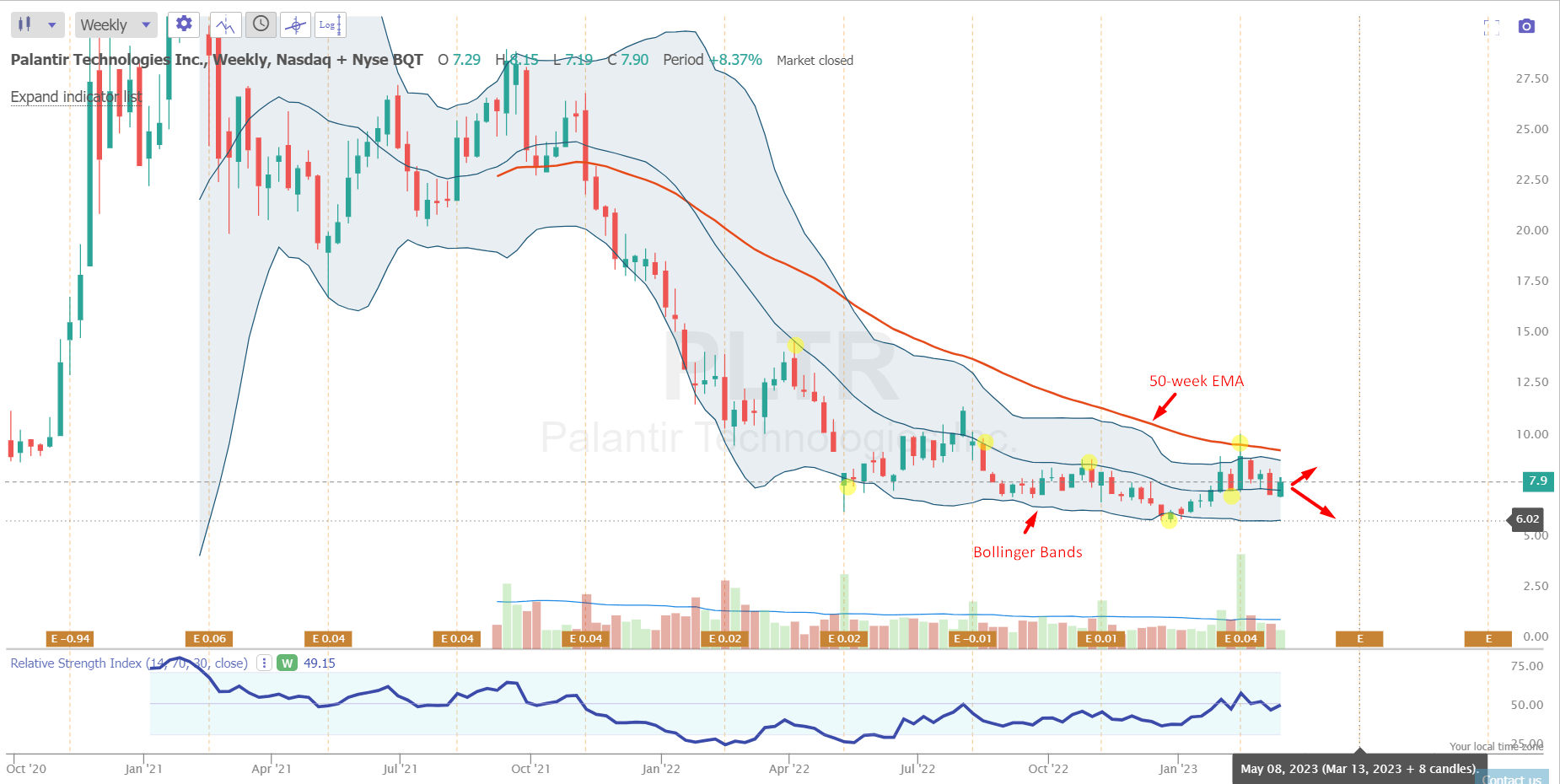

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 10, 2025

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 10, 2025 -

Dijon Et La Cite De La Gastronomie Le Role De La Ville Face Aux Defis D Epicure

May 10, 2025

Dijon Et La Cite De La Gastronomie Le Role De La Ville Face Aux Defis D Epicure

May 10, 2025 -

Pam Bondis Assertion Details On The Alleged Epstein Client List

May 10, 2025

Pam Bondis Assertion Details On The Alleged Epstein Client List

May 10, 2025