Palantir Stock Before May 5th: Is It A Smart Investment?

Table of Contents

Analyzing Palantir's Recent Performance and Market Trends

Recent Stock Price Fluctuations

Palantir's stock price has seen a rollercoaster ride in recent months. While specific highs and lows require referencing a live stock chart (easily found via reputable financial websites), we can observe general trends. These fluctuations are often influenced by several key factors:

- Market Sentiment: Overall market conditions significantly impact Palantir's stock price, as with any publicly traded company. Positive market sentiment tends to boost the price, while negative sentiment can lead to drops.

- News Events: Announcements regarding new contracts, partnerships, technological advancements, or financial results directly influence investor confidence and consequently the Palantir stock price. The May 5th earnings report is a prime example of a news event that will likely cause significant price movement.

- Competitor Activity: The actions and performance of Palantir's competitors within the big data analytics market can also affect investor perception and subsequently the Palantir stock price. Strong competitor performance might lead to a decrease in investor confidence in Palantir.

Key Financial Indicators

Analyzing Palantir's financial health is crucial for evaluating its investment potential. Key indicators like revenue growth, profit margins, and debt levels paint a picture of the company's financial stability and future prospects. (Note: Specific numbers require referencing Palantir's official financial reports and reputable financial news sources.)

- Palantir Revenue: Examining the growth rate of Palantir's revenue provides insights into its market penetration and the effectiveness of its sales strategies. Consistent revenue growth is generally viewed favorably by investors.

- Palantir Profit Margin: Profit margins indicate the profitability of Palantir's operations. Improving profit margins suggest efficient cost management and increasing profitability.

- Palantir Debt: A high level of debt can present risks, while a low debt level is generally seen as a positive indicator of financial strength. Investors should analyze Palantir's debt-to-equity ratio to assess this aspect.

Evaluating Palantir's Growth Potential and Future Outlook

Government Contracts and Commercial Expansion

Palantir's revenue is significantly influenced by government contracts, particularly in the defense and intelligence sectors. However, the company is actively expanding its commercial client base, aiming for diversification and reduced dependence on government contracts.

- Palantir Government Contracts: While crucial for current revenue, over-reliance on government contracts carries risks associated with geopolitical instability and changing government priorities.

- Palantir Commercial Clients: Expansion into the commercial sector offers significant growth potential, broadening the customer base and reducing vulnerability to changes in government spending. This diversification is a key element in evaluating Palantir stock's long-term potential.

- Palantir Market Share: Analyzing Palantir's market share in both government and commercial sectors gives insights into its competitive position and growth opportunities.

Technological Innovation and Competitive Landscape

Palantir's technological capabilities are central to its success. Its continued investment in research and development is crucial for maintaining a competitive edge in the dynamic big data analytics industry.

- Palantir Technology: The company's proprietary platforms and algorithms are key differentiators. Continuous innovation is needed to stay ahead of competitors.

- Palantir Innovation: Analyzing Palantir's R&D spending and the introduction of new products and services is essential to understanding its long-term growth potential.

- Palantir Competitors: Key competitors in the big data analytics space include companies like Databricks, Snowflake, and others. Assessing Palantir's competitive positioning relative to these players is crucial.

Risk Factors to Consider

Investing in Palantir stock comes with inherent risks. It's essential to understand these before making any investment decisions.

- Palantir Risk: Dependence on government contracts creates vulnerability to changes in government priorities and budget allocations.

- Palantir Investment Risk: Competition in the big data analytics market is intense, requiring continuous innovation to maintain a competitive edge.

- Palantir Stock Risk: Economic downturns can affect both government and commercial spending, potentially impacting Palantir's revenue. Furthermore, regulatory changes could also pose a risk.

Expert Opinions and Analyst Predictions

Before making any investment decisions regarding Palantir stock, it's crucial to consult various financial news sources and analyst reports. These reports often provide price targets and ratings, offering a range of perspectives on the stock's potential. (Remember that analyst predictions are not guarantees of future performance.) Searching for "Palantir analyst ratings" or "Palantir stock forecast" will provide valuable information from various sources.

Conclusion: Is Palantir Stock a Smart Investment Before May 5th?

Deciding whether Palantir stock is a smart investment before May 5th requires careful consideration of its recent performance, growth potential, and inherent risks. The analysis presented here provides insights into these factors, but it's crucial to remember that stock market predictions are inherently uncertain. The May 5th earnings report will undoubtedly have a major influence on the Palantir stock price.

Make an informed decision about investing in Palantir stock before May 5th by conducting your own thorough research and considering the factors discussed in this article. Remember to consult with a financial advisor before making any investment decisions related to Palantir stock or any other security. Thoroughly evaluate Palantir's financial health, competitive landscape, and future prospects before committing your capital.

Featured Posts

-

La Cite De La Gastronomie De Dijon Face Aux Defis D Epicure

May 09, 2025

La Cite De La Gastronomie De Dijon Face Aux Defis D Epicure

May 09, 2025 -

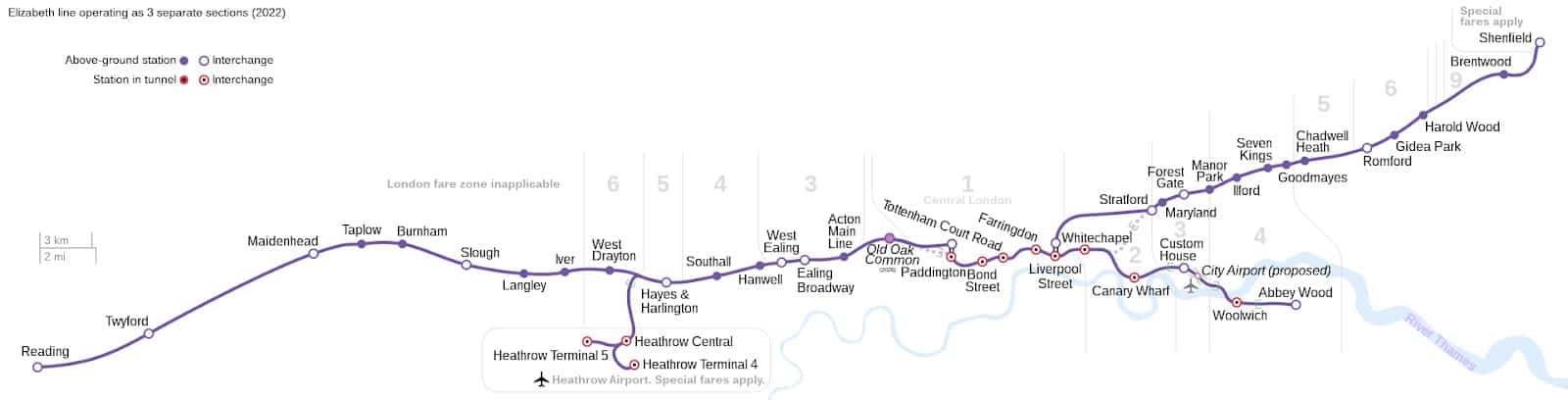

Elizabeth Line Gaps In Accessibility For Wheelchair Users And How To Improve Them

May 09, 2025

Elizabeth Line Gaps In Accessibility For Wheelchair Users And How To Improve Them

May 09, 2025 -

Mind The Gap Wheelchair Access On The Elizabeth Line

May 09, 2025

Mind The Gap Wheelchair Access On The Elizabeth Line

May 09, 2025 -

Sensex Soars 500 Points Nifty Above 18400 Adani Ports And Eternal Stock Updates

May 09, 2025

Sensex Soars 500 Points Nifty Above 18400 Adani Ports And Eternal Stock Updates

May 09, 2025 -

Joanna Page And Wynne Evans Heated Exchange On Recent Bbc Show

May 09, 2025

Joanna Page And Wynne Evans Heated Exchange On Recent Bbc Show

May 09, 2025

Latest Posts

-

Sensex 600 Nifty

May 10, 2025

Sensex 600 Nifty

May 10, 2025 -

Market Rally Sensex And Nifty Climb Ultra Tech Experiences A Decline

May 10, 2025

Market Rally Sensex And Nifty Climb Ultra Tech Experiences A Decline

May 10, 2025 -

Indian Stock Market Update Sensex Nifty Rise Ultra Tech Cement Falls

May 10, 2025

Indian Stock Market Update Sensex Nifty Rise Ultra Tech Cement Falls

May 10, 2025 -

Stock Market Today Sensex Up 200 Nifty Above 18 600 Ultra Tech Dips

May 10, 2025

Stock Market Today Sensex Up 200 Nifty Above 18 600 Ultra Tech Dips

May 10, 2025 -

Sensex Gains 200 Points Nifty Surges Past 18 600 Market Update

May 10, 2025

Sensex Gains 200 Points Nifty Surges Past 18 600 Market Update

May 10, 2025