Palantir Stock: Evaluating The Investment After A 40% Rise In 2025

Table of Contents

Palantir's 2025 Growth Drivers

Several key factors contributed to Palantir's impressive 40% stock price increase in 2025. Understanding these drivers is crucial for evaluating the stock's future potential.

Increased Government Contracts

Palantir's strong relationship with government agencies, particularly in defense, intelligence, and cybersecurity, remains a significant pillar of its growth. The company benefited from increased government spending in these crucial areas.

- Significant Contract Wins: Palantir secured several multi-year contracts throughout 2025, including a substantial deal with the US Department of Defense valued at over $500 million for advanced data analytics and intelligence platforms. Another key win involved a large expansion of an existing contract with a major intelligence agency.

- Expanding Cybersecurity Solutions: Growing concerns about national security and cyber threats led to increased demand for Palantir's sophisticated cybersecurity solutions. The company leveraged its existing platform to offer enhanced threat detection, incident response, and vulnerability management capabilities.

- Long-Term Implications: These government contracts provide Palantir with a stable revenue stream and solidify its position as a leading provider of data analytics solutions to government agencies. This sustained government spending translates into predictable, long-term revenue growth.

Expansion into the Commercial Sector

While government contracts are a cornerstone of Palantir's business, its expansion into the commercial sector played a vital role in its 2025 success. The company demonstrated significant progress in attracting new clients across various industries.

- Successful Commercial Deployments: Palantir successfully implemented its platform in several Fortune 500 companies, including financial institutions, healthcare providers, and energy companies. These deployments showcase the versatility and scalability of its data analytics solutions across various sectors.

- Growth Potential in Key Sectors: The finance sector, in particular, saw significant adoption of Palantir's platform for fraud detection, risk management, and regulatory compliance. The healthcare sector also shows promising growth potential, with Palantir helping to improve operational efficiency and enhance patient care.

- Strategic Partnerships: Palantir formed strategic partnerships with leading technology providers, expanding its reach and enhancing its product offerings. These partnerships enable Palantir to integrate its platform with other popular enterprise software solutions.

Technological Advancements and Innovation

Palantir's continued investment in research and development (R&D) fuels its technological edge and competitive advantage. Several technological advancements significantly boosted its market appeal in 2025.

- Artificial Intelligence (AI) and Machine Learning (ML) Integrations: Palantir enhanced its platform with advanced AI and ML capabilities, allowing for more sophisticated data analysis and predictive modeling. This improved the platform’s ability to automate tasks, reduce errors, and deliver more actionable insights.

- New Software Features and Product Launches: The company launched several new features and modules for its platform, including improvements in data integration, visualization, and collaboration tools, further enhancing user experience and attracting new customers.

- Patent Acquisitions: Palantir acquired several key patents that broadened its intellectual property portfolio and strengthened its competitive position. This intellectual property protection provides a strong barrier to entry for competitors and ensures Palantir's long-term innovation.

Assessing Palantir's Valuation and Risk Factors

Despite its impressive growth, it's essential to assess Palantir's valuation and potential risk factors before making any investment decisions.

Price-to-Earnings Ratio (P/E) Analysis

Palantir's P/E ratio should be carefully analyzed against its competitors and historical trends. While the 40% rise indicates strong investor sentiment, a high P/E ratio might suggest the stock is currently overvalued relative to its earnings potential. Comparing the P/E ratio to industry peers and analyzing future earnings projections is crucial for determining if the current valuation is justified.

Competition and Market Share

The data analytics and software industry is highly competitive. While Palantir possesses several competitive advantages – its advanced platform, strong government relationships, and technological innovation – it faces competition from established players and emerging startups. Analyzing the competitive landscape and Palantir's market share is vital to understanding its future growth trajectory.

Financial Stability and Debt Levels

A thorough examination of Palantir's financial statements is crucial. Investors should review its cash reserves, debt-to-equity ratio, revenue growth, and profit margins to gauge its financial health and long-term sustainability. A healthy financial position is essential for sustaining growth and weathering potential economic downturns.

Future Outlook and Investment Strategies

Considering Palantir's performance and the factors discussed above, what does the future hold?

Growth Projections and Analyst Forecasts

Numerous financial analysts have published forecasts for Palantir's future growth. These projections vary, but most suggest continued growth, although at potentially a slower rate than the exceptional 40% increase seen in 2025. Staying updated on analyst ratings and consensus estimates will provide valuable insights into market sentiment and future expectations.

Potential Investment Strategies

Several investment strategies can be employed when considering Palantir stock. A long-term buy-and-hold strategy might be suitable for investors with a high risk tolerance and a long-term investment horizon. Short-term trading could also be an option for more active investors, though it carries higher risk. Diversification across multiple asset classes remains a crucial risk management technique for any investor.

Conclusion

Palantir's 40% stock price increase in 2025 reflects significant progress, driven by increased government contracts, commercial expansion, and technological innovation. However, investors need to carefully analyze its valuation, competitive landscape, and financial stability before making any investment decisions. While the future outlook for Palantir appears promising, inherent risks remain. By considering the points discussed in this article, investors can make informed decisions regarding the inclusion of Palantir stock in their portfolio. Ultimately, thorough due diligence is crucial when considering a Palantir stock investment, even after a significant price surge. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Snegopad V Permi Aeroport Vremenno Priostanovil Rabotu

May 09, 2025

Snegopad V Permi Aeroport Vremenno Priostanovil Rabotu

May 09, 2025 -

Tien Giang Phan Hoi Cong Dong Ve Vu Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025

Tien Giang Phan Hoi Cong Dong Ve Vu Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025 -

Metas 168 Million Payment In Whats App Spyware Case Implications And Future Outlook

May 09, 2025

Metas 168 Million Payment In Whats App Spyware Case Implications And Future Outlook

May 09, 2025 -

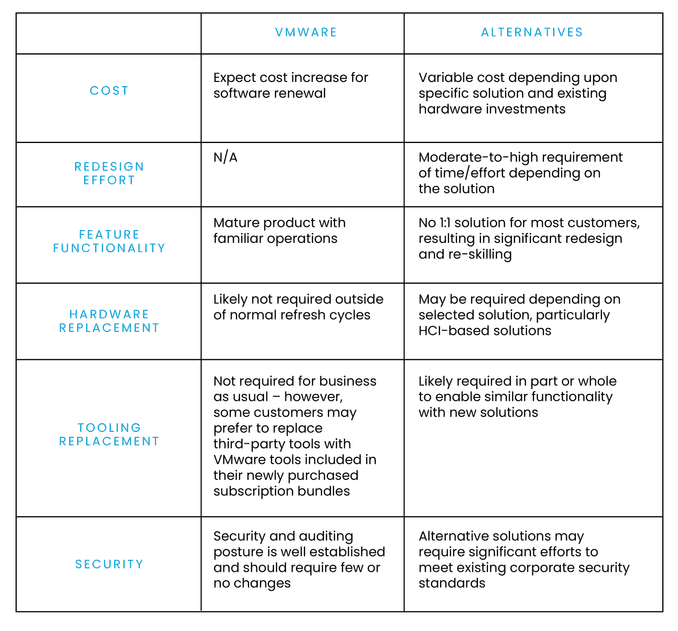

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike Concerns

May 09, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Hike Concerns

May 09, 2025 -

Strengthening Europes Nuclear Security A French Ministers Plan

May 09, 2025

Strengthening Europes Nuclear Security A French Ministers Plan

May 09, 2025

Latest Posts

-

Almdkhnwn Fy Ealm Krt Alqdm Tathyr Altdkhyn Ela Aladae Alryady

May 09, 2025

Almdkhnwn Fy Ealm Krt Alqdm Tathyr Altdkhyn Ela Aladae Alryady

May 09, 2025 -

Overlooked By Wolves Now Defining European Football

May 09, 2025

Overlooked By Wolves Now Defining European Football

May 09, 2025 -

Ashhr Mdkhny Krt Alqdm Fy Altarykh Hqayq Warqam

May 09, 2025

Ashhr Mdkhny Krt Alqdm Fy Altarykh Hqayq Warqam

May 09, 2025 -

The Player Wolves Let Go Now A European Football Star

May 09, 2025

The Player Wolves Let Go Now A European Football Star

May 09, 2025 -

Hkayat Mdkhnyn Krt Alqdm Mn Alnjwm Ila Almshakl Alshyt

May 09, 2025

Hkayat Mdkhnyn Krt Alqdm Mn Alnjwm Ila Almshakl Alshyt

May 09, 2025