Palantir Stock: Examining The High P/E Ratio And Future Growth Potential

Table of Contents

Understanding Palantir's High P/E Ratio

What is a P/E Ratio and Why is Palantir's High?

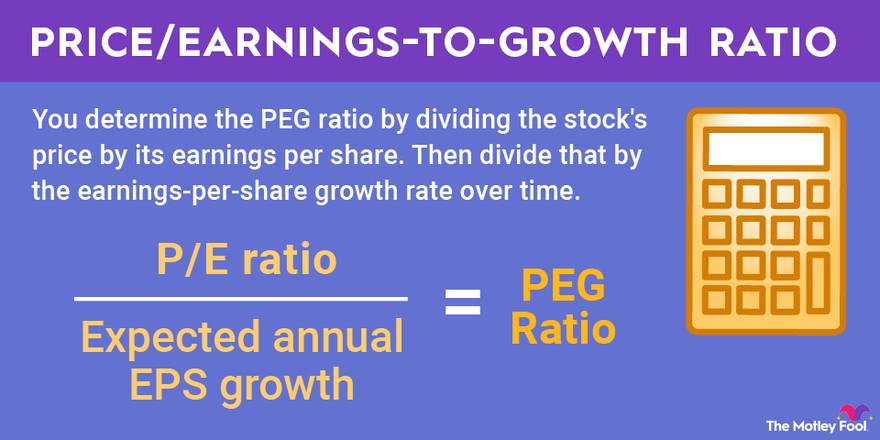

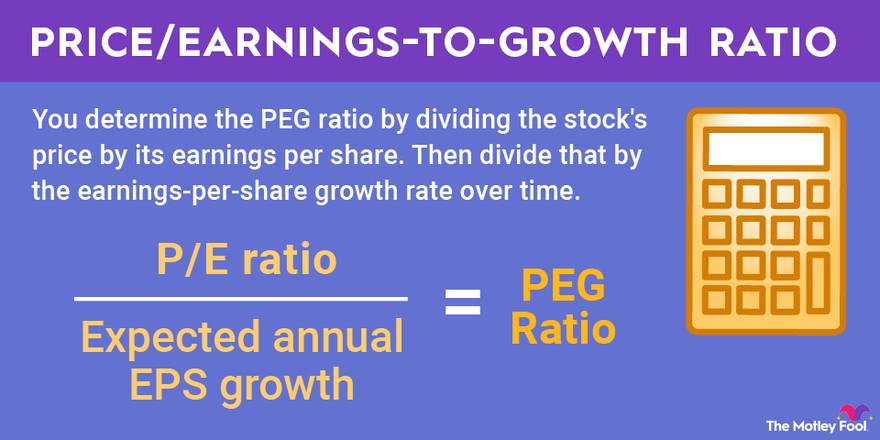

The price-to-earnings ratio (P/E ratio) is a valuation metric that compares a company's stock price to its earnings per share (EPS). A high P/E ratio generally indicates that investors are willing to pay a premium for each dollar of earnings, often reflecting expectations of strong future growth. Palantir's high P/E ratio, significantly above many of its peers in the data analytics sector, reflects this market sentiment.

Several factors contribute to Palantir's elevated P/E ratio:

-

High Growth Expectations: Investors anticipate substantial revenue growth driven by expanding government and commercial contracts. The company's cutting-edge data analytics capabilities are seen as key to this growth trajectory.

-

Innovative Technology: Palantir's proprietary platforms, Gotham and Foundry, offer unique capabilities in data integration, analysis, and visualization, giving it a competitive edge. This technological advantage is a significant driver of its high valuation.

-

Potential for Disruption: Palantir is positioned to disrupt traditional data analytics markets with its advanced AI and machine learning features. Its potential to transform how organizations manage and leverage data fuels investor optimism.

-

Comparison to Peers: Palantir's P/E ratio often exceeds that of competitors like Splunk or Tableau, reflecting the market's higher growth expectations for Palantir. A detailed comparison of key financial metrics is crucial when assessing its valuation relative to its peers.

-

Impact of Revenue and Profitability: While Palantir’s revenue is growing, its profitability remains a key factor influencing the P/E ratio. As profitability increases, the P/E ratio may adjust accordingly, reflecting a more mature and stable business model.

Assessing the Justification for the High P/E Ratio

Justifying Palantir's high P/E ratio requires a careful examination of its financial performance and future prospects.

-

Revenue Growth Trajectory: Palantir has demonstrated consistent revenue growth, but the sustainability of this growth needs to be evaluated. Maintaining a high growth rate in the face of increasing competition is a crucial factor.

-

Profitability Margins: Analyzing Palantir's profitability margins—both gross and operating—is essential. Improving margins will be key to justifying the current valuation and attracting further investment.

-

Investment Risks: Investing in high-growth, high-P/E stocks inherently carries significant risk. Factors like competition, technological disruption, and macroeconomic conditions can significantly impact Palantir's future performance.

-

Future Earnings Growth: Analyzing the potential for future earnings growth based on its existing contracts and the expected expansion into new markets is vital. A strong pipeline of new business is crucial for validating the high P/E ratio.

-

Competition and Technological Disruption: The data analytics market is highly competitive, and technological disruption is constant. Palantir needs to demonstrate its ability to innovate and maintain its competitive edge.

Analyzing Palantir's Growth Potential

Government Contracts and Their Impact

Government contracts form a substantial part of Palantir's revenue. The stability and longevity of these contracts are essential for its sustained growth.

- Stability and Long-Term Outlook: Understanding the political and budgetary factors influencing government spending on data analytics is crucial. Long-term contracts and a diverse client base within the government sector contribute to revenue predictability.

- Expansion into New Sectors: Palantir's ability to secure contracts in new government sectors, such as defense or intelligence, could significantly boost its revenue streams.

- Geopolitical Factors: Global geopolitical events can significantly influence government spending priorities, impacting Palantir's contract pipeline and future revenue growth.

- Competition for Contracts: Palantir faces competition from other technology companies vying for government contracts. Its ability to secure and retain contracts will directly influence its growth trajectory.

Growth in the Commercial Sector

Palantir's success depends heavily on penetrating the commercial market. Its strategies to attract commercial clients include offering tailored solutions for various industries.

- Commercial Market Penetration: Palantir's progress in securing and retaining commercial clients is a critical indicator of its long-term growth potential. Evidence of increasing commercial revenue is essential for validating its high P/E ratio.

- Attracting Commercial Clients: Palantir needs to demonstrate its ability to tailor its platform to the specific needs of different commercial sectors, offering compelling value propositions.

- Growth in Specific Sectors: Success in key sectors like finance, healthcare, and energy will be crucial for achieving substantial commercial market penetration.

- Successful Partnerships: Highlighting case studies of successful commercial partnerships and demonstrating the value delivered to clients will be essential to attract new customers.

- Competition in the Commercial Market: Palantir faces strong competition from established players in the commercial data analytics market. Differentiation through innovation and superior customer service will be crucial.

Technological Innovation and Future Product Development

Palantir's continued investment in research and development (R&D) is critical to its future success.

- R&D Investments: Analyzing the scale and focus of Palantir's R&D efforts is vital for assessing its ability to stay ahead of the curve in data analytics technology.

- Technological Breakthroughs: The potential for breakthroughs in AI, machine learning, and data visualization will play a significant role in its future growth and competitive advantage.

- New Product Development: Developing new products and features that meet evolving customer needs is essential for sustaining revenue growth and maintaining a strong competitive position.

- Emerging Trends: Keeping abreast of emerging trends in data analytics and integrating them into its products is crucial for its long-term success.

- Competitive Advantage: Palantir's proprietary technology and its ability to integrate disparate data sources offer a significant competitive advantage that needs to be sustained through continuous innovation.

Conclusion

Palantir's high P/E ratio reflects its substantial growth potential and the inherent risks associated with high-growth technology stocks. Its strong presence in the government sector offers a stable revenue base, but its long-term success depends on expanding into the commercial market and sustaining technological innovation. A comprehensive understanding of the factors influencing its valuation is vital for investors considering a position in Palantir stock. Careful analysis of its financial performance, competitive landscape, and long-term growth prospects is crucial before making any investment decisions. Further research into Palantir's future earnings and market positioning is advised before making any investment choices related to Palantir stock price.

Featured Posts

-

The Papal Conclave Explained A Step By Step Guide

May 07, 2025

The Papal Conclave Explained A Step By Step Guide

May 07, 2025 -

Tragedia Na Przejezdzie Kolejowym Piecioosobowa Rodzina Zginela A Sprawcy Unikaja Odpowiedzialnosci

May 07, 2025

Tragedia Na Przejezdzie Kolejowym Piecioosobowa Rodzina Zginela A Sprawcy Unikaja Odpowiedzialnosci

May 07, 2025 -

Multiple Injured In Arizona Restaurant Shooting Police Investigating

May 07, 2025

Multiple Injured In Arizona Restaurant Shooting Police Investigating

May 07, 2025 -

The Karate Kid Part Iii Comparing It To The First Two Films

May 07, 2025

The Karate Kid Part Iii Comparing It To The First Two Films

May 07, 2025 -

Parkland Acquisition Us 9 Billion Deal Heads To Shareholder Vote In June

May 07, 2025

Parkland Acquisition Us 9 Billion Deal Heads To Shareholder Vote In June

May 07, 2025