Sensex & Nifty Rally: 5 Reasons For Today's Significant Market Rise

Table of Contents

Positive Global Cues

Positive sentiment in global markets significantly influences the Indian stock market. The performance of international markets, particularly the US and European markets, acts as a strong indicator. Strong economic indicators and positive corporate earnings announcements overseas boost investor confidence, leading to increased buying in Indian equities. Foreign Institutional Investors (FII) and Foreign Portfolio Investors (FPI) play a crucial role in this dynamic.

- Strong performance in US tech stocks: A robust performance in the US tech sector often translates to positive sentiment globally, impacting the Indian stock market.

- Positive economic data releases from major economies: Positive GDP growth, employment figures, and consumer confidence indices from major economies create a ripple effect, influencing investor confidence in emerging markets like India.

- Increased optimism regarding global economic growth: A positive global outlook encourages foreign investment into emerging markets, leading to increased capital inflows into the Indian stock market.

- Influx of foreign investment into emerging markets: FIIs and FPIs actively seek opportunities in emerging markets, and positive global cues often trigger significant investments in India, contributing to the Sensex and Nifty rally.

Robust Domestic Economic Data

Strong domestic economic indicators are pivotal in driving market sentiment. Better-than-expected GDP growth, controlled inflation, and positive industrial production numbers reassure investors about the health of the Indian economy. These macroeconomic indicators significantly influence investor decisions and contribute to market stability. The Reserve Bank of India's (RBI) policies also play a key role.

- Improved GDP growth figures exceeding forecasts: Higher-than-anticipated GDP growth signifies a robust and expanding economy, attracting more investment.

- Lower-than-expected inflation rate: Controlled inflation demonstrates macroeconomic stability, reducing risks for investors and promoting a positive market outlook.

- Strong performance in key industrial sectors: Growth in key sectors such as manufacturing and services indicates a healthy economy, strengthening investor confidence.

- Rising consumer confidence index: Increased consumer spending indicates a healthy economy and fuels further economic growth, contributing to a positive market outlook.

Positive Corporate Earnings

Strong corporate earnings from leading Indian companies across various sectors are a major driver of market rallies. When companies report better-than-expected profits and positive future outlooks, it boosts investor confidence and attracts further investment. This increased investment directly impacts stock prices and market capitalization.

- Exceeding profit expectations by major companies: When blue-chip companies consistently exceed profit expectations, it signals strong fundamentals and attracts significant investments.

- Positive outlook for future earnings growth: Forward-looking guidance from companies offering positive projections fuels investor optimism and contributes to higher stock valuations.

- Strong revenue generation across multiple sectors: Broad-based growth across multiple sectors indicates a healthy and diversified economy, improving investor sentiment.

- Improved margins and operational efficiency: Higher profit margins and increased operational efficiency suggest strong company management and attract further investment.

Easing Inflation Concerns

Easing inflation concerns significantly contribute to market stability and growth. A controlled inflation rate allows the RBI to maintain a more accommodative monetary policy, boosting investor confidence and driving market performance. Lower inflation expectations often translate into lower interest rates, making borrowing cheaper and fueling economic activity.

- Lower-than-projected inflation figures: When inflation figures fall below projections, it signals macroeconomic stability and reduces investor anxieties.

- Expectations of stable interest rates: Stable interest rates reduce uncertainty and provide a predictable environment for businesses and investors.

- Reduced pressure on RBI to increase interest rates aggressively: A controlled inflation rate allows the RBI to avoid drastic interest rate hikes, which can negatively impact economic growth and market sentiment.

Sector-Specific Growth Drivers

Strong performance in specific sectors can disproportionately impact market indices like the Sensex and Nifty. A surge in a dominant sector, like technology, infrastructure, or financials, can pull up the overall market. Identifying these growth drivers is crucial for understanding market dynamics.

- Exceptional growth in the technology sector: The technology sector's rapid growth often significantly impacts overall market performance, especially in the Indian context.

- Increased investment in infrastructure projects: Large-scale infrastructure projects create numerous investment opportunities, attracting substantial capital and boosting related sectors.

- Strong performance of banking and financial institutions: The health of the financial sector is crucial for overall market stability and growth; their positive performance is a key indicator of market health.

Conclusion

The Sensex and Nifty rally today is a result of a confluence of factors, including positive global cues, robust domestic economic data, strong corporate earnings, easing inflation concerns, and sector-specific growth drivers. Understanding these interconnected elements provides valuable insight into current market dynamics. Staying informed about these factors is crucial for making informed investment decisions in the Indian stock market. Keep track of the Sensex and Nifty movements and analyze these contributing factors to effectively navigate the market. Continue monitoring the Sensex & Nifty for further market insights and potential investment opportunities.

Featured Posts

-

Edmonton Oilers Draisaitl Exits Game Due To Injury

May 10, 2025

Edmonton Oilers Draisaitl Exits Game Due To Injury

May 10, 2025 -

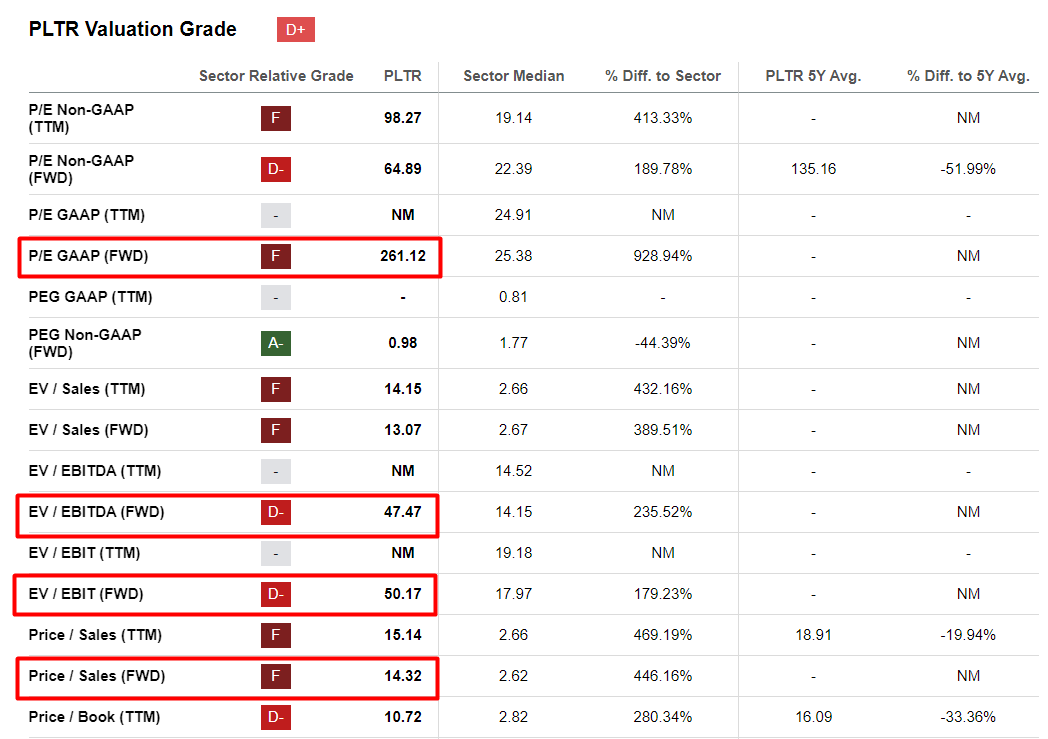

Is Palantirs 30 Drop A Good Time To Invest

May 10, 2025

Is Palantirs 30 Drop A Good Time To Invest

May 10, 2025 -

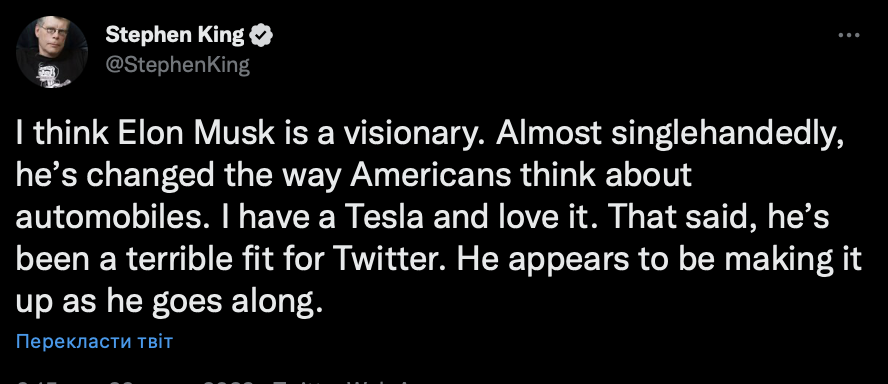

Stiven King Mask I Tramp Posibniki Putina Reaktsiya Na Zayavu Pismennika

May 10, 2025

Stiven King Mask I Tramp Posibniki Putina Reaktsiya Na Zayavu Pismennika

May 10, 2025 -

Taiwan Vp Lais Ve Day Address Concerns Over Totalitarian Trends

May 10, 2025

Taiwan Vp Lais Ve Day Address Concerns Over Totalitarian Trends

May 10, 2025 -

Solving The Nyt Crossword April 6 2025 Edition A Comprehensive Guide

May 10, 2025

Solving The Nyt Crossword April 6 2025 Edition A Comprehensive Guide

May 10, 2025