Stock Market Valuations: BofA Says Don't Panic

Table of Contents

BofA's Key Arguments Against a Market Crash

BofA's relatively optimistic stance on stock market valuations rests on several pillars. Let's examine their core arguments:

Moderate Valuation Metrics

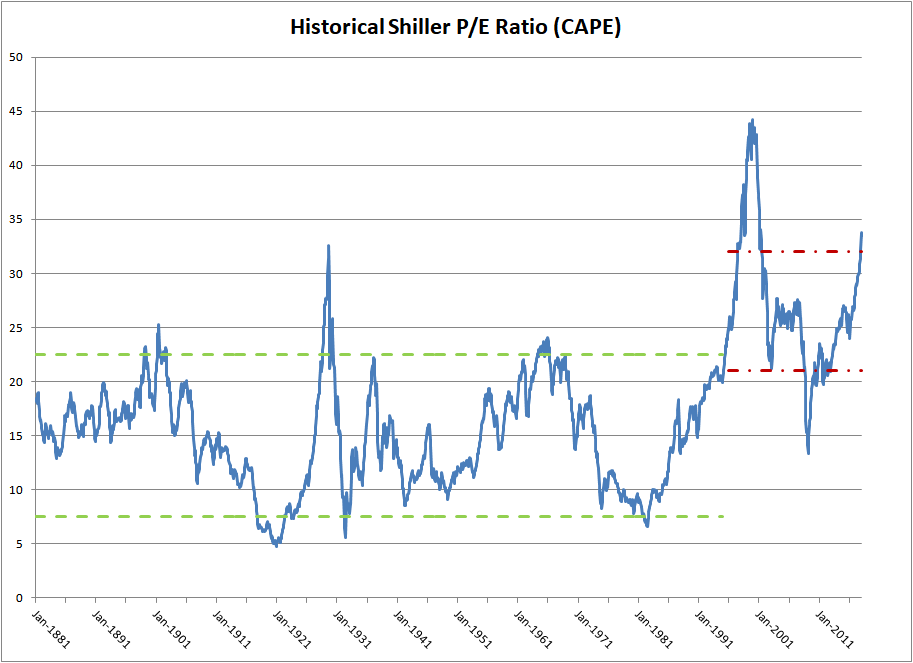

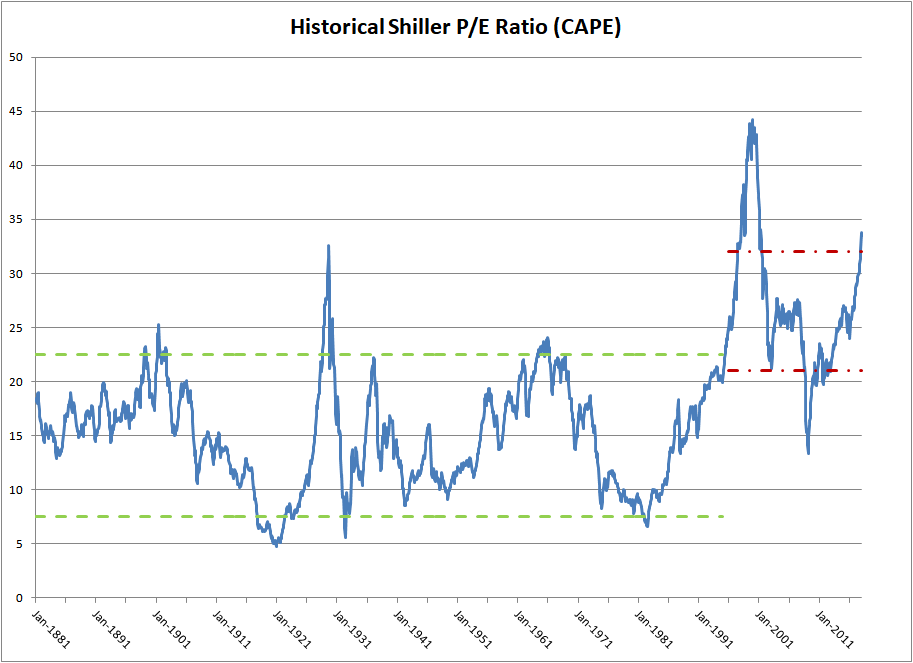

BofA's analysis suggests that current stock market valuations, while not dirt cheap, are not excessively high either. Their assessment hinges on a careful examination of Price-to-Earnings (P/E) ratios. While P/E ratios are elevated compared to their historical lows, they remain within a range considered moderate when compared to the past 10-year average.

- Specific P/E ratio comparisons: BofA's research might show a current P/E ratio of, say, 20, compared to a 10-year average of 18. While slightly above average, this isn't drastically inflated.

- Mention of any discounted sectors: Certain sectors, like energy or specific technology sub-sectors, might be highlighted as exhibiting more attractive valuations, offering opportunities for selective investment.

- Reference to any specific BofA reports or analysts: Citing specific BofA reports and analysts lends credibility and authority to the analysis. (Example: "According to Savita Subramanian, Head of US Equity and Quantitative Strategy at BofA...")

[Insert Chart Here: A comparison chart showing current P/E ratios against historical averages for the S&P 500 and key sectors.]

Resilient Corporate Earnings

BofA's projection for corporate earnings growth provides further support for their relatively optimistic outlook. They cite several factors contributing to this resilience, including sustained consumer spending in certain key areas and ongoing technological advancements driving productivity in specific sectors.

- Key industries showing positive earnings momentum: Examples might include technology (AI-related businesses), healthcare, or specific manufacturing sub-sectors.

- Mention of any macroeconomic factors contributing to positive earnings outlook: This could include factors like continued strength in the labor market or specific government policies.

- Reference to BofA's forecasting models: Mentioning the sophisticated models used to arrive at these projections enhances credibility.

The Impact of Interest Rate Hikes

The Federal Reserve's interest rate hikes are a significant concern for investors. However, BofA argues that the market has largely priced in the anticipated rate increases. They believe that the current stock market valuations already reflect this impact, mitigating the potential for a dramatic downturn triggered solely by interest rate adjustments.

- BofA’s anticipated trajectory of interest rates: Mentioning BofA's prediction for future rate changes helps provide context.

- Explanation of how the market has already adjusted: This could involve citing specific market reactions to previous rate hikes or discussing how investor expectations have shifted.

- Risks and opportunities related to interest rate changes: Acknowledging potential downsides (e.g., higher borrowing costs) and upsides (e.g., potential for increased returns on fixed-income investments) balances the perspective.

Understanding the Risks and Cautions

While BofA presents a relatively optimistic view, it's crucial to acknowledge the inherent risks and uncertainties in the market.

Remaining Uncertainties

Inflation, geopolitical instability (like the war in Ukraine), and potential supply chain disruptions remain significant concerns. BofA acknowledges these risks and incorporates them into their analysis, but their assessment suggests that these factors are not necessarily indicative of an imminent market crash.

- Specific risks BofA acknowledges: Clearly state the risks, showing a balanced perspective.

- BofA's suggested strategies for mitigating these risks: Highlight any risk mitigation strategies suggested by BofA, such as diversifying investments or hedging against specific risks.

- Call outs to specific economic indicators: Referencing key economic indicators (e.g., inflation rates, unemployment figures) helps ground the discussion in concrete data.

Diversification and Prudent Investing

Regardless of BofA's analysis, diversification remains paramount. A well-diversified portfolio, spread across different asset classes and sectors, is crucial for mitigating risk in any market environment.

- Specific asset allocation suggestions (if any from BofA): Mention specific recommendations if BofA offers them.

- Advice on diversifying across sectors and asset classes: Emphasize the importance of not putting all eggs in one basket.

- Importance of a long-term investment horizon: Reinforce the need for patience and a long-term perspective when investing in the stock market.

Conclusion: A Balanced View on Stock Market Valuations

BofA's analysis offers a relatively balanced perspective on stock market valuations. While acknowledging significant risks, their assessment suggests that current valuations are not excessively inflated and that corporate earnings remain relatively resilient. However, it’s vital to remember that this is just one perspective. Investors should conduct their own thorough research, considering various viewpoints and consulting with qualified financial advisors before making any investment decisions. Stay informed on stock market valuations, understand the associated risks, and make sound investment choices based on your own risk tolerance and long-term financial goals. Analyzing equity valuations and understanding market valuations is critical for successful investing.

Featured Posts

-

Is 3 40 The Next Xrp Target A Ripple Price Forecast

May 07, 2025

Is 3 40 The Next Xrp Target A Ripple Price Forecast

May 07, 2025 -

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 07, 2025

Section 230 And The Sale Of Banned Chemicals On E Bay A Legal Ruling

May 07, 2025 -

Cleveland Cavaliers First Round Playoffs A Look At Their Opponent And Chances

May 07, 2025

Cleveland Cavaliers First Round Playoffs A Look At Their Opponent And Chances

May 07, 2025 -

Legenda N Kh L Po Silovym Priemam Ukhodit Iz Khokkeya

May 07, 2025

Legenda N Kh L Po Silovym Priemam Ukhodit Iz Khokkeya

May 07, 2025 -

Canadian Housing Market Slowdown Recession Fears Weigh On Buyers Bmo

May 07, 2025

Canadian Housing Market Slowdown Recession Fears Weigh On Buyers Bmo

May 07, 2025