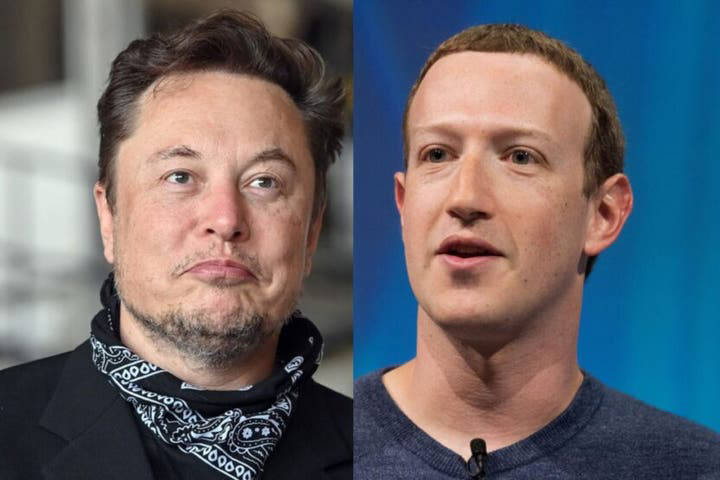

Post-Trump Presidency: Assessing The Financial Losses Of Musk, Bezos, And Zuckerberg

Table of Contents

Elon Musk's Financial Trajectory Post-Trump:

Tesla and SpaceX Performance Under Biden:

Tesla's stock performance and SpaceX's progress under the Biden administration have been a mixed bag. While Tesla continues to be a major player in the electric vehicle market, its stock has experienced volatility. Several factors have contributed to this:

- Changes in Government Subsidies: The Biden administration's focus on clean energy has, in some ways, benefited Tesla, but changes in the specifics of subsidies and tax credits have created uncertainty.

- Environmental Regulations: While supportive of electric vehicles, stricter environmental regulations could potentially increase Tesla's production costs.

- Overall Market Trends: The broader economic climate and fluctuations in the stock market have naturally influenced Tesla's share price.

- Competition: The growing competition in the EV market has also put pressure on Tesla's market share and profitability.

SpaceX, meanwhile, has continued its ambitious expansion, securing lucrative contracts and pushing forward with its Starship development program. However, the financial impact of these ventures on Musk's overall net worth remains complex and subject to ongoing evaluation.

The Impact of Social Media and Public Perception on Musk's Net Worth:

Musk's prolific and often controversial social media activity has significantly impacted investor confidence and his net worth.

- Controversies and Stock Price: Several controversies, including his acquisition of Twitter (now X), have led to negative press and short-term drops in Tesla's stock price.

- Tweets and Market Fluctuations: Musk's tweets, often unpredictable and market-moving, have been linked to significant stock price swings, both positive and negative. This volatility reflects the inherent risks associated with a company whose fate is so closely intertwined with its CEO's public persona.

- Impact on Brand Reputation: His public pronouncements and actions have also affected the overall perception of Tesla, potentially influencing consumer purchasing decisions and investor sentiment.

Analyzing the precise financial consequences of these actions requires a nuanced understanding of market dynamics and investor behavior. News sources such as the Wall Street Journal and Bloomberg offer ongoing coverage of Musk's business activities and their impact on his net worth.

Jeff Bezos's Post-Trump Financial Landscape:

Amazon's Performance and Antitrust Scrutiny:

Amazon's financial performance under the Biden administration has been characterized by continued growth, albeit with increasing regulatory scrutiny.

- Increased Antitrust Scrutiny: The Biden administration has intensified antitrust investigations into Amazon's business practices, potentially leading to higher compliance costs and regulatory hurdles.

- Shifting Consumer Spending: Changes in consumer spending patterns due to inflation and economic uncertainty have also impacted Amazon's revenue streams.

- Amazon Web Services (AWS): The continued growth of AWS has provided a significant cushion against the challenges faced by other segments of the business.

Blue Origin and Diversification Strategies:

Bezos's investments in Blue Origin represent a significant diversification strategy.

- Space Exploration Costs: The substantial financial investment in Blue Origin, while a long-term bet on space tourism and exploration, represents a drain on resources compared to Amazon's immediate profitability.

- Success and Future Prospects: The long-term financial viability of Blue Origin remains uncertain, but its potential for future revenue generation could significantly impact Bezos's overall wealth.

Mark Zuckerberg's Financial Standing After Trump:

Facebook (Meta) Navigating Regulatory Changes and Public Opinion:

Meta's financial performance has been impacted by regulatory challenges and evolving public sentiment.

- Privacy Concerns and Data Scandals: Ongoing concerns about data privacy and previous scandals have negatively impacted Meta's reputation and stock price.

- Metaverse Initiatives: The heavy investment in the metaverse has yet to yield significant returns, raising questions about its long-term viability and impact on Meta's financial performance.

- Competition: The increasingly competitive social media landscape further presents challenges for Meta's growth and profitability.

Impact of Changing Advertising Landscape:

The evolving digital advertising landscape poses considerable challenges for Meta.

- Competition from Other Tech Giants: Increased competition from other tech giants, like Google, for advertising revenue is a major factor.

- Advertising Strategy Effectiveness: The effectiveness of Meta's advertising strategies in navigating this competitive environment is crucial to its future financial success.

Conclusion: A Comparative Analysis of Post-Trump Financial Outcomes for Tech Moguls

The post-Trump presidency has presented a complex and dynamic financial landscape for Musk, Bezos, and Zuckerberg. While all three have experienced periods of both growth and volatility, the factors influencing their financial trajectories have varied significantly. Musk's social media activity and its impact on Tesla's stock price stand in stark contrast to Bezos's diversification efforts through Blue Origin and Amazon's continued dominance. Zuckerberg, meanwhile, faces ongoing challenges related to regulation and public perception of Meta. Further research into the post-Trump financial impact on tech leaders is crucial to understanding the broader implications for the tech industry and the global economy. Delve deeper into the post-Trump financial landscape affecting these tech titans to fully grasp the intricacies of this fascinating case study.

Featured Posts

-

Senate Democrats Accuse Pam Bondi Of Hiding Epstein Records

May 09, 2025

Senate Democrats Accuse Pam Bondi Of Hiding Epstein Records

May 09, 2025 -

The Fentanyl Crisis And Its Impact On Us China Trade Relations

May 09, 2025

The Fentanyl Crisis And Its Impact On Us China Trade Relations

May 09, 2025 -

Novoe Soglashenie Mezhdu Frantsiey I Polshey Makron I Tusk O Sotrudnichestve

May 09, 2025

Novoe Soglashenie Mezhdu Frantsiey I Polshey Makron I Tusk O Sotrudnichestve

May 09, 2025 -

The Reach Of Divine Mercy Religious Groups In 1889

May 09, 2025

The Reach Of Divine Mercy Religious Groups In 1889

May 09, 2025 -

Masshtabnoe Otklyuchenie Sveta V Sverdlovskoy Oblasti Posle Snegopada

May 09, 2025

Masshtabnoe Otklyuchenie Sveta V Sverdlovskoy Oblasti Posle Snegopada

May 09, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025 -

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025 -

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025 -

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025 -

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025