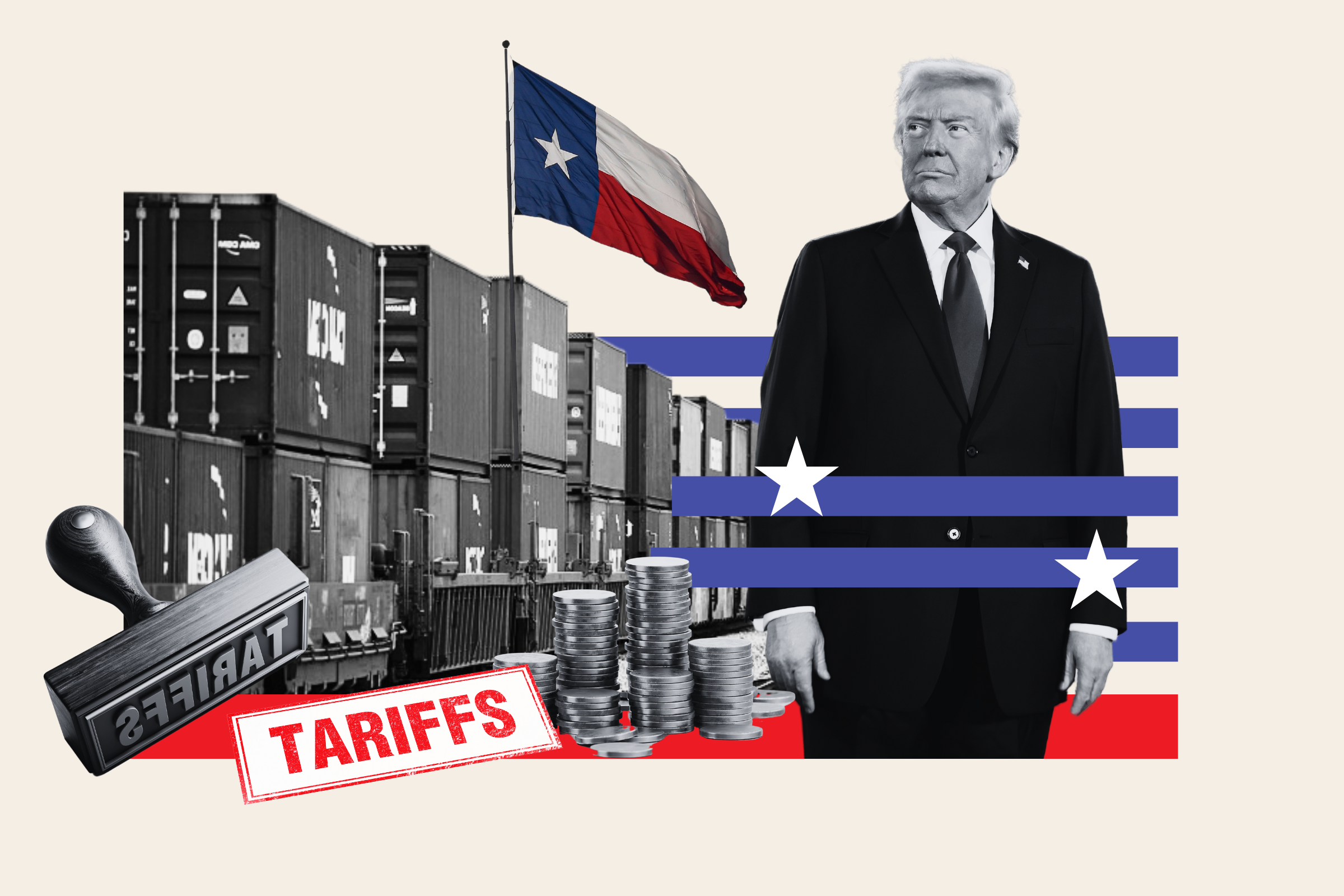

Posthaste: Understanding The Implications Of The New Tariff Ruling For Canada

Table of Contents

Impact on Specific Industries

The new Canadian import tariffs will disproportionately affect certain sectors. Understanding the intricacies of these Canadian Import Tariffs is paramount for businesses to strategize effectively. This will lead to a ripple effect across the Canadian economy.

-

Automotive Sector: The automotive industry, a significant contributor to the Canadian economy, faces potential job losses and reduced production due to increased costs of imported parts and materials. This could lead to price increases for new and used vehicles.

-

Agricultural Industry: Farmers, particularly in the dairy and lumber sectors, will feel the brunt of the new tariffs. Increased import costs for fertilizers, machinery, and other inputs will reduce profitability, potentially leading to farm closures and job losses. The impact on exports will also be significant.

-

Manufacturing Sector: Many Canadian manufacturers rely on imported components and raw materials. The new tariffs will increase production costs, leading to reduced competitiveness and potentially impacting export markets. This could lead to factory closures and job displacement.

-

Increased Import Costs from Key Trading Partners: The tariffs will increase the cost of goods imported from key trading partners, affecting a wide range of industries and potentially leading to trade disputes. This necessitates careful consideration of alternative sourcing options.

The impact of these Canadian Import Tariffs is already being felt by several businesses. For example, [Insert example of a business impacted by the tariff, including quantifiable data if available]. This underscores the urgency of understanding and adapting to the new economic realities.

Consumer Price Increases and Inflationary Pressures

The increased costs associated with the new Canadian Inflation Tariffs will inevitably be passed on to consumers, leading to higher prices for a wide range of goods and services. This has significant implications for household budgets and overall economic stability.

-

Expected Price Increases: Consumers can expect to see price increases across various sectors, including automotive, food, and manufactured goods. The magnitude of these increases will vary depending on the sector and the reliance on imported goods.

-

Impact on Household Budgets: Higher prices for essential goods and services will strain household budgets, particularly for low- and middle-income families. This could lead to reduced consumer spending and a slowdown in economic growth.

-

Government Response to Inflationary Pressures: The government may implement measures to mitigate inflationary pressures, such as interest rate adjustments or targeted subsidies. The effectiveness of these measures will depend on their design and implementation.

-

Comparison with Previous Tariff Impacts: Analysis of past tariff impacts on consumer prices provides valuable insights into the potential scale and duration of the current inflationary pressures. This historical context is crucial for accurate forecasting.

Data on inflation rates and consumer spending patterns will be closely monitored to assess the true impact of the tariffs on the Canadian economy. [Insert data or reference to relevant data sources on inflation and consumer spending].

Government Response and Canada Trade Policy Tariffs

The Canadian government's response to the new tariff ruling will be critical in shaping the long-term economic consequences. Analyzing the Canada Trade Policy Tariffs and the government's response is essential to understanding future economic trends.

-

Government Aid Packages: The government may announce aid packages to support affected industries and businesses, including financial assistance, tax breaks, or retraining programs. The effectiveness of these programs will determine their long-term impact.

-

Trade Negotiations: The government is likely to engage in trade negotiations with affected countries to address concerns and potentially mitigate the negative impacts of the tariffs. The success of these negotiations will depend on diplomatic skill and international cooperation.

-

Adjustments to Trade Agreements: Existing trade agreements may require adjustments to address the challenges posed by the new tariffs. This will necessitate a review of current trade policies and their effectiveness in the current geopolitical climate.

-

Evaluation of Government Responses: The government's response will be closely scrutinized for its effectiveness in supporting affected industries and mitigating inflationary pressures. Independent analysis will be crucial to assess the success of these interventions.

Statements by government officials and details of policy announcements will be crucial for understanding the full implications of the new tariffs and the government's approach to this challenge. [Insert links to government announcements or press releases].

Opportunities and Canadian Business Tariff Adaptation

While the new tariffs present significant challenges, they also offer opportunities for Canadian businesses to adapt and innovate. Strategies for Canadian Business Tariff Adaptation are vital for survival and growth in this changing economic landscape.

-

New Market Opportunities: The tariffs may create new market opportunities for Canadian businesses by reducing competition from imported goods. This requires a strategic focus on exploiting these emerging opportunities.

-

Mitigating Negative Impacts: Businesses can mitigate the negative impacts of the tariffs through various strategies, such as sourcing alternative suppliers, investing in automation, and improving efficiency. This necessitates a comprehensive risk assessment and proactive planning.

-

Diversification Strategies: Diversifying supply chains and product offerings can help businesses reduce their reliance on imported goods and increase resilience to future tariff changes. This requires long-term strategic vision and adaptability.

-

Innovation and Technological Advancements: Investing in innovation and technological advancements can help businesses improve efficiency, reduce costs, and enhance competitiveness in the face of increased import costs. This is crucial for long-term sustainability and growth.

Case studies of businesses successfully adapting to similar tariff changes can provide valuable insights and guidance for navigating the current challenges. [Insert examples of successful adaptation strategies].

Conclusion

The new Canada tariff ruling has far-reaching implications, affecting various industries, consumer prices, and government policy. Understanding these impacts is crucial for businesses and consumers alike. This article has highlighted the potential challenges and opportunities arising from this ruling. The impact of Canadian Inflation Tariffs and their effects on Canadian Import Tariffs are substantial and require careful attention. The government's Canada Trade Policy Tariffs will play a vital role in shaping the outcome. Strategies for Canadian Business Tariff Adaptation are critical for navigating this new economic reality.

Call to Action: Stay informed on the evolving situation surrounding the Canada Tariff Ruling. Continuously monitor updates on government policy and industry response to effectively navigate this period of economic change. Further research into the specifics impacting your industry is highly recommended.

Featured Posts

-

Rosemary And Thyme Recipes Flavorful Dishes For Every Meal

May 31, 2025

Rosemary And Thyme Recipes Flavorful Dishes For Every Meal

May 31, 2025 -

Banksys Broken Heart Mural Heads To Auction

May 31, 2025

Banksys Broken Heart Mural Heads To Auction

May 31, 2025 -

Observations Sur L Ingenierie Des Castors Dans Deux Cours D Eau De La Drome

May 31, 2025

Observations Sur L Ingenierie Des Castors Dans Deux Cours D Eau De La Drome

May 31, 2025 -

Royal Bank Of Canada Reports Lower Than Expected Earnings

May 31, 2025

Royal Bank Of Canada Reports Lower Than Expected Earnings

May 31, 2025 -

Riyadh Rematch Munguia Edges Out Surace On Points

May 31, 2025

Riyadh Rematch Munguia Edges Out Surace On Points

May 31, 2025