Pre-May 5th Palantir Stock Investment: Risks And Rewards

Table of Contents

Understanding Palantir's Current Market Position

Palantir's current market position is a complex interplay of strong growth potential and significant challenges. To make an informed pre-May 5th Palantir stock investment, a thorough understanding of its financial health and market strategy is essential.

Recent Financial Performance and Growth Projections

Analyzing Palantir's recent financial performance reveals a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key focus. Examining key performance indicators (KPIs) such as revenue growth rate, profitability margins, and contract wins provides a clearer picture.

- Revenue growth rate comparison to previous quarters/years: Investors should compare year-over-year and quarter-over-quarter revenue growth to assess the trajectory of Palantir's top line. A sustained, high growth rate is a positive sign.

- Profitability margins and trends: Tracking gross and operating margins reveals Palantir's efficiency in converting revenue into profit. Improving margins indicate increased operational efficiency.

- Key contract wins and their impact on future revenue: Large contract wins, especially in the commercial sector, significantly impact future revenue projections and provide a strong indication of market confidence.

- Comparison to competitor performance in the data analytics market: Benchmarking Palantir's performance against its competitors (e.g., Snowflake, Databricks) provides valuable context and helps assess its competitive position. Consider factors like market share growth and technological innovation.

Analyst predictions vary considerably, so it's important to review multiple sources before forming your own opinion on future earnings and growth. Consulting reputable financial news sources and analyst reports can provide a more comprehensive outlook.

Government Contracts and Commercial Expansion

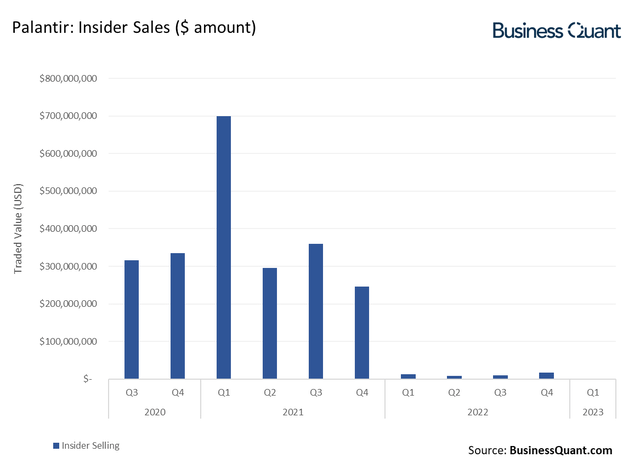

Palantir's revenue stream historically relied heavily on government contracts, particularly in the US defense and intelligence sectors. However, the company is actively pursuing commercial expansion to diversify its revenue streams and reduce reliance on government spending.

- Breakdown of revenue from government vs. commercial clients: A clear breakdown of revenue sources highlights the dependence on government contracts and the progress made in commercial sales. A shift towards a greater proportion of commercial revenue is a positive sign of diversification.

- Analysis of key government contracts and their renewal prospects: The longevity and renewal prospects of existing government contracts are critical for revenue predictability. Understanding the terms and conditions of these contracts is essential.

- Evaluation of Palantir's success in penetrating commercial markets: Assessing Palantir's ability to secure and retain commercial clients is crucial for long-term sustainability. Analyzing the growth rate of commercial revenue provides valuable insights.

- Discussion of potential risks associated with government budget cuts or policy changes: Changes in government budgets or policy shifts could negatively impact Palantir's revenue stream if the company remains overly reliant on government contracts.

Assessing the Risks of a Pre-May 5th Palantir Stock Investment

While Palantir offers exciting possibilities, several significant risks should be considered before making a pre-May 5th Palantir stock investment.

Market Volatility and Geopolitical Uncertainty

The broader macroeconomic environment significantly influences Palantir's stock price. Factors such as inflation, interest rate hikes, and geopolitical instability create market volatility and can impact investor sentiment towards technology stocks.

- Analysis of macroeconomic factors affecting the tech sector: Interest rate increases, for example, can negatively impact valuations of growth stocks like Palantir.

- Assessment of geopolitical risks and their potential impact on Palantir: Geopolitical events can create uncertainty and affect investor confidence in the market, leading to price fluctuations.

- Discussion of potential market corrections and their impact on PLTR stock: Market corrections can lead to significant drops in stock prices, posing a substantial risk for investors.

Competition and Technological Disruption

The data analytics market is highly competitive, with numerous established players and emerging startups vying for market share. Technological advancements can quickly render existing technologies obsolete.

- List of key competitors and their strengths and weaknesses: Identifying key competitors, analyzing their strengths and weaknesses, and understanding Palantir's competitive advantages are essential for assessing its long-term viability.

- Assessment of technological advancements that could disrupt Palantir's business model: The rapid pace of technological innovation poses a constant threat to existing business models. Staying ahead of the curve is crucial for Palantir.

- Analysis of Palantir's competitive advantages and strategies for maintaining market share: Understanding Palantir's competitive advantages and strategies for staying ahead of the competition is vital for evaluating its future prospects.

Exploring the Potential Rewards of a Pre-May 5th Palantir Stock Investment

Despite the risks, Palantir presents significant potential rewards for long-term investors.

Long-Term Growth Potential and Technological Innovation

Palantir's long-term growth potential stems from its leading position in the rapidly expanding data analytics market and its commitment to technological innovation.

- Discussion of Palantir's long-term growth strategy and market opportunities: Palantir's strategic roadmap and its ability to capture market share in key growth areas are vital for assessing long-term prospects.

- Analysis of Palantir's innovative technologies and their potential impact on the market: Palantir's ability to innovate and introduce new technologies that disrupt the market is crucial for maintaining a competitive edge.

- Evaluation of the company's potential for future market leadership: Assessing Palantir's potential to become a dominant player in the data analytics market is a key consideration for long-term investors.

Undervalued Asset Potential and Investment Strategy

Some investors believe Palantir's current stock price may not fully reflect its intrinsic value, presenting a potential opportunity for those willing to take on the associated risk.

- Comparison of Palantir's current valuation to its competitors: Comparing Palantir's valuation metrics to those of its competitors provides valuable insights into whether it's currently undervalued or overvalued.

- Discussion of various investment strategies (e.g., buy-and-hold, dollar-cost averaging): Different investment strategies carry varying levels of risk and potential rewards. Understanding these strategies is important for risk management.

- Recommendations for diversifying investments to reduce overall risk: Diversification is key to mitigating risk and protecting your investment portfolio.

Conclusion

Investing in Palantir stock before May 5th requires careful consideration of both the potential risks and rewards. While the company possesses strong long-term growth potential fueled by technological innovation and increasing demand for data analytics, investors must also account for market volatility, competition, and geopolitical uncertainty. Thoroughly analyzing Palantir's financial performance, competitive landscape, and strategic direction is crucial before making a pre-May 5th Palantir stock investment. Remember to conduct your own due diligence and consider seeking advice from a qualified financial advisor before making any investment decisions regarding a pre-May 5th Palantir stock investment.

Featured Posts

-

Increased Danish Involvement In Greenland Analyzing Trumps Impact

May 09, 2025

Increased Danish Involvement In Greenland Analyzing Trumps Impact

May 09, 2025 -

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 09, 2025

Should You Buy Palantir Stock Before May 5 A Pre Earnings Analysis

May 09, 2025 -

Stephen Kings 2025 Will The Monkey Adaptation Define The Year

May 09, 2025

Stephen Kings 2025 Will The Monkey Adaptation Define The Year

May 09, 2025 -

Vozmuschenie Kinga Oskorbleniya Trampa I Maska V Kh

May 09, 2025

Vozmuschenie Kinga Oskorbleniya Trampa I Maska V Kh

May 09, 2025 -

Fur Rondys Condensed Race A Test Of Endurance For Mushers And Teams

May 09, 2025

Fur Rondys Condensed Race A Test Of Endurance For Mushers And Teams

May 09, 2025

Latest Posts

-

Man Dies In Racist Stabbing Woman Arrested For Unprovoked Attack

May 09, 2025

Man Dies In Racist Stabbing Woman Arrested For Unprovoked Attack

May 09, 2025 -

Fatal Stabbing Unprovoked Racist Assault Leads To Mans Death

May 09, 2025

Fatal Stabbing Unprovoked Racist Assault Leads To Mans Death

May 09, 2025 -

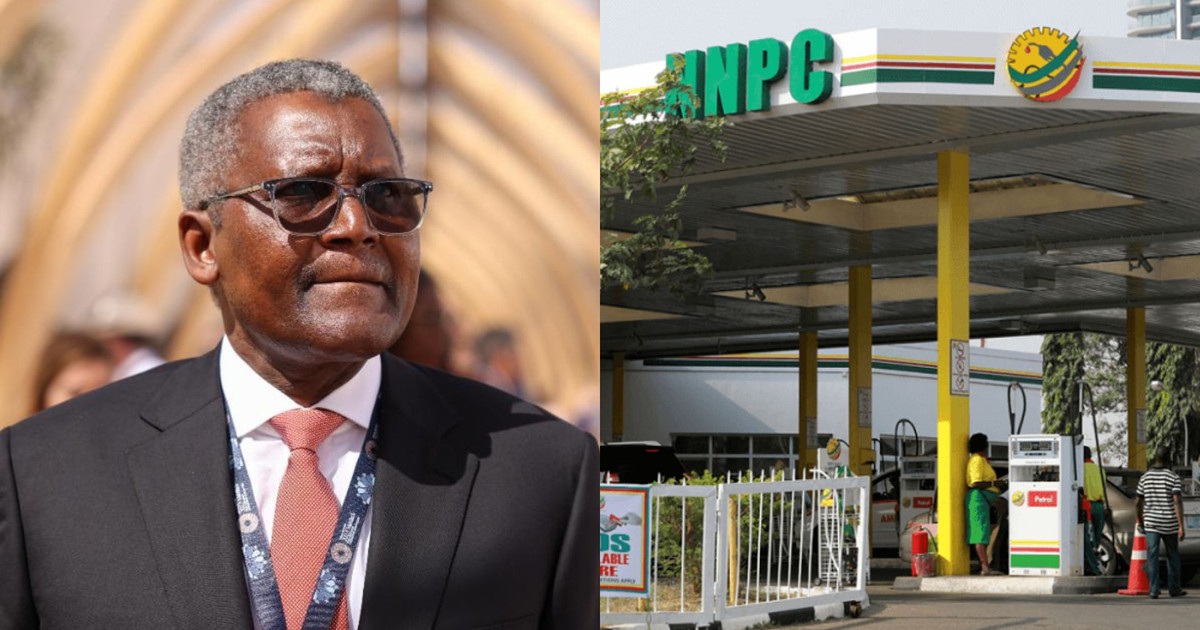

Analyzing The Correlation Between Dangote And Nnpc Petrol Prices

May 09, 2025

Analyzing The Correlation Between Dangote And Nnpc Petrol Prices

May 09, 2025 -

Unprovoked Racist Attack Woman Charged With Murder After Stabbing

May 09, 2025

Unprovoked Racist Attack Woman Charged With Murder After Stabbing

May 09, 2025 -

The Role Of Dangote Refinery In Shaping Nnpc Petrol Prices Thisdaylive Perspective

May 09, 2025

The Role Of Dangote Refinery In Shaping Nnpc Petrol Prices Thisdaylive Perspective

May 09, 2025