Should You Buy Palantir Stock Before May 5? A Pre-Earnings Analysis

Table of Contents

Palantir's Recent Performance and Key Metrics

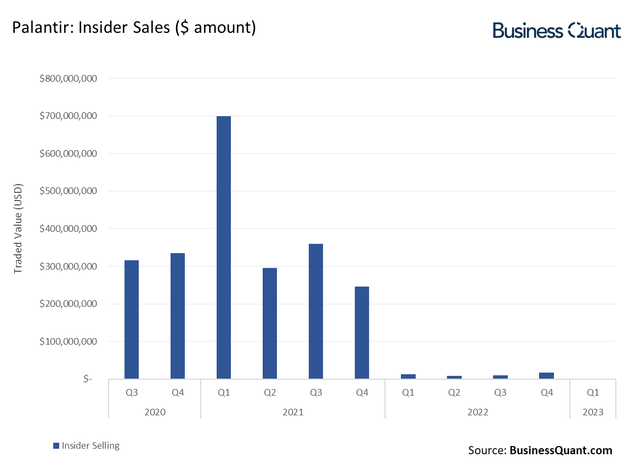

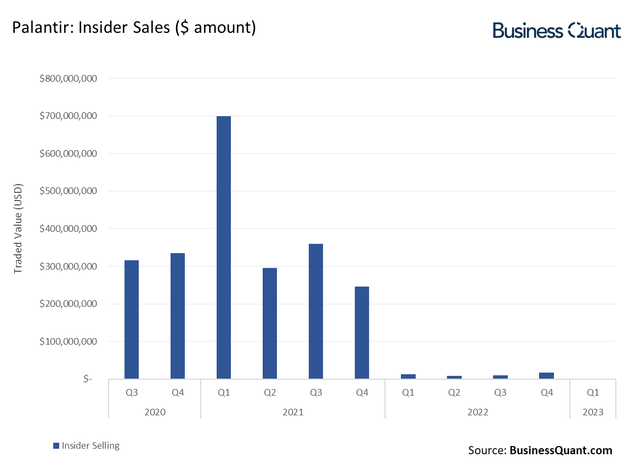

Analyzing Palantir's recent financial performance is crucial for assessing its current health and potential for future growth. We need to look beyond the headline numbers and delve into the key metrics that truly tell the story of Palantir's progress.

-

Review of Q4 2022 earnings: Palantir's Q4 2022 earnings report (replace with actual data when available) revealed [insert key findings from Q4 2022 report, e.g., revenue figures, profitability, and any surprises]. This provided [positive/negative/mixed] signals regarding the company's trajectory.

-

Analysis of year-over-year revenue growth: Examining the year-over-year revenue growth paints a picture of Palantir's ability to consistently expand its business. A sustained, high growth rate is a positive indicator for investors. (Insert data on year-over-year revenue growth).

-

Discussion of key contracts secured: Securing significant contracts, especially large government contracts, is vital for Palantir's financial stability and future growth. Recent wins in [mention specific sectors or clients] demonstrate Palantir's ability to compete effectively and secure substantial revenue streams.

-

Assessment of operating margin improvements: Tracking operating margin improvements shows Palantir's progress in managing costs and increasing profitability. Improvements in this area indicate a stronger financial foundation and increased efficiency. (Insert data on operating margin improvements).

Significant news impacting Palantir's performance, such as new partnerships or product launches, should also be considered. For example, [mention any recent significant news and its impact on Palantir stock price]. This event highlights [positive/negative/neutral] implications for future Palantir revenue and the Palantir stock price. Keywords: Palantir stock price, PLTR earnings, Palantir revenue, Palantir financial performance.

Analyzing Palantir's Growth Prospects

Palantir's long-term growth strategy hinges on several key drivers. Understanding these factors is critical for evaluating its future potential. The company’s focus on government contracts, expansion into commercial markets, and continuous product innovation are key areas to consider.

-

Potential for increased government spending on data analytics: The increasing reliance of governments worldwide on data analytics for national security and public services presents a significant growth opportunity for Palantir. Increased government budgets in this area could translate directly into higher demand for Palantir's services.

-

Expansion into new commercial markets: Palantir's move beyond government contracts into the commercial sector presents both opportunities and challenges. Success in this space will depend on its ability to adapt its offerings and attract new clients in industries such as [mention specific industries].

-

Success and adoption of Palantir's new technologies: The success of new technologies like Foundry and AIP (Artificial Intelligence Platform) will be key to driving future growth. Wider adoption of these platforms will be a significant indicator of Palantir's innovative capabilities.

-

Expected impact of investments in R&D: Palantir's continued investment in research and development is essential for maintaining its competitive edge. This commitment to innovation positions the company for growth in the long term. Keywords: Palantir growth, PLTR future, Palantir innovation, Palantir commercial market.

Risks and Challenges Facing Palantir

While Palantir presents significant growth potential, it's crucial to acknowledge the risks and challenges that could impact its future performance. A balanced assessment considers both the upside and downside.

-

Competitive landscape analysis: The data analytics market is competitive, with established players and emerging startups vying for market share. Competitors such as [mention key competitors] pose a threat to Palantir's market position.

-

Impact of a potential economic recession: A global economic slowdown could reduce spending on data analytics, particularly in the commercial sector. This could significantly impact Palantir's revenue growth and profitability.

-

Risks associated with reliance on government contracts: Palantir's significant reliance on government contracts exposes it to the risks associated with government budget cuts, changes in policy, or geopolitical instability.

-

Concerns regarding profitability and sustainability: While Palantir is working towards greater profitability, concerns remain about its ability to consistently achieve and maintain sustainable profits. Keywords: Palantir risk, PLTR competition, Palantir challenges, Palantir investment risk.

Wall Street Analyst Predictions and Sentiment

Understanding Wall Street's perspective on Palantir is crucial for making informed investment decisions. Analyst ratings, price targets, and overall market sentiment provide valuable insights.

-

Summary of analyst ratings (buy, hold, sell): A review of analyst ratings from leading financial institutions provides a snapshot of the overall sentiment towards Palantir stock. (Insert data on buy/hold/sell recommendations).

-

Average price target for Palantir stock: The average price target from analysts offers an indication of the potential future price of Palantir stock. (Insert data on average price target).

-

Analysis of recent analyst upgrades or downgrades: Any recent changes in analyst ratings provide valuable information about shifts in market perception. Upgrades suggest increasing optimism, while downgrades signal growing concerns.

-

Overview of investor sentiment (bullish, bearish, neutral): The overall investor sentiment towards Palantir can be gauged through news articles, social media, and investor forums. This sentiment helps paint a picture of the overall market expectation. Keywords: Palantir stock forecast, PLTR analyst rating, Palantir price target, Wall Street on Palantir.

Conclusion

This pre-earnings analysis of Palantir reveals a company with significant growth potential driven by its innovative technology and strong government contracts. However, the competitive landscape, potential economic downturn, and reliance on government contracts present considerable risks. The consensus among analysts is [summarize analyst consensus - bullish, bearish, neutral], with an average price target of [insert average price target]. Based on this analysis, investors should weigh the potential rewards against the inherent risks before making any investment decisions.

Before making any investment decisions regarding Palantir stock before May 5th, conduct thorough due diligence and consider consulting with a financial advisor. Stay tuned for our post-earnings analysis of Palantir!

Featured Posts

-

Post Trump Presidency Assessing The Financial Losses Of Musk Bezos And Zuckerberg

May 09, 2025

Post Trump Presidency Assessing The Financial Losses Of Musk Bezos And Zuckerberg

May 09, 2025 -

Rio Ferdinand Alters Champions League Final Prediction Psg Vs Arsenal

May 09, 2025

Rio Ferdinand Alters Champions League Final Prediction Psg Vs Arsenal

May 09, 2025 -

The Daycare Dilemma Balancing Work And Childcare

May 09, 2025

The Daycare Dilemma Balancing Work And Childcare

May 09, 2025 -

Pre May 5th Palantir Stock Investment Risks And Rewards

May 09, 2025

Pre May 5th Palantir Stock Investment Risks And Rewards

May 09, 2025 -

Bayern Munich Vs Inter Milan Who Will Win A Detailed Prediction

May 09, 2025

Bayern Munich Vs Inter Milan Who Will Win A Detailed Prediction

May 09, 2025

Latest Posts

-

Dangotes Influence On Nnpc Petrol Prices A Thisdaylive Analysis

May 09, 2025

Dangotes Influence On Nnpc Petrol Prices A Thisdaylive Analysis

May 09, 2025 -

Living Legends Of Aviation Awards Ceremony Recognizes Firefighters And Community Heroes

May 09, 2025

Living Legends Of Aviation Awards Ceremony Recognizes Firefighters And Community Heroes

May 09, 2025 -

Aviations Living Legends Celebrate Bravery Honoring Firefighters And Essential Workers

May 09, 2025

Aviations Living Legends Celebrate Bravery Honoring Firefighters And Essential Workers

May 09, 2025 -

Understanding The Candidates In Your Nl Federal Riding

May 09, 2025

Understanding The Candidates In Your Nl Federal Riding

May 09, 2025 -

Living Legends Of Aviation A Tribute To Firefighters And First Responders

May 09, 2025

Living Legends Of Aviation A Tribute To Firefighters And First Responders

May 09, 2025