Private Credit Hiring: 5 Do's And Don'ts To Get Hired

Table of Contents

Do's for Private Credit Hiring Success

1. Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. Generic applications won't cut it in the competitive landscape of private credit jobs. To stand out, you need to highlight your relevant skills and experience using keywords specific to the industry.

- Highlight relevant skills and experience: Use keywords like leveraged loans, distressed debt, credit analysis, underwriting, portfolio management, financial modeling, and valuation.

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, instead of "Managed a portfolio," write "Managed a $50 million portfolio, increasing returns by 15% within two years."

- Customize for each job: Don't use a generic template. Carefully read each job description and tailor your application materials to reflect the specific requirements and responsibilities.

- Showcase your market understanding: Demonstrate your knowledge of current trends and challenges within the private credit market. Mention relevant news, regulations, or market shifts to show your engagement with the industry.

2. Network Strategically

Networking is crucial in private credit hiring. Building relationships can open doors that online applications can't.

- Attend industry events: Conferences and seminars are excellent opportunities to meet professionals and learn about new opportunities.

- Leverage LinkedIn: Connect with professionals in private credit, engage in relevant discussions, and join industry groups.

- Informational interviews: Reach out to people working in private debt or alternative credit for informational interviews. This allows you to learn about their career paths and potentially gain valuable referrals.

- Build relationships with recruiters: Connect with recruiters specializing in financial services and private credit. They often have exclusive job listings and insider knowledge.

3. Master the Interview Process

The interview is your chance to shine. Preparation is key to succeeding in private credit interviews.

- Practice common questions: Prepare for questions about your experience with credit analysis, risk assessment, financial modeling, and your understanding of various private credit instruments.

- Demonstrate financial acumen: Show your proficiency in financial modeling (Excel, DCF analysis), credit metrics (leverage ratios, interest coverage), and financial statement analysis.

- Prepare insightful questions: Asking thoughtful questions demonstrates your genuine interest and engagement.

- Research the firm: Thoroughly research the firm's investment strategy, portfolio, and recent activities.

4. Showcase Your Financial Acumen

Private credit requires strong financial skills. Highlight your expertise throughout the application and interview process.

- Proficiency in financial modeling: Demonstrate expertise in Excel, discounted cash flow (DCF) analysis, and other relevant modeling techniques.

- Understanding of credit metrics: Showcase your knowledge of key credit metrics like leverage ratios, interest coverage ratios, and default probabilities.

- Financial statement analysis: Demonstrate your ability to analyze financial statements to assess the creditworthiness of borrowers.

- Familiarity with private credit instruments: Display understanding of various private credit instruments, including leveraged loans, mezzanine debt, and distressed debt.

5. Follow Up Professionally

Following up demonstrates professionalism and keeps you top-of-mind.

- Send thank-you notes: Send personalized thank-you notes after each interview, reiterating your interest and highlighting key discussion points.

- Follow up appropriately: If you haven't heard back within a reasonable timeframe, a polite follow-up email is acceptable.

- Maintain professionalism: Maintain a professional and enthusiastic demeanor throughout the entire process.

Don'ts for Private Credit Hiring

1. Don't Neglect Your Online Presence

Your online presence matters. Recruiters often check social media and LinkedIn profiles.

- Update your LinkedIn: Ensure your LinkedIn profile is current, professional, and reflects your skills and experience relevant to private credit hiring.

- Be mindful of social media: Be aware of your online presence and ensure it reflects a positive professional image.

- Maintain consistency: Your online presence should be consistent with the image you portray in your resume and cover letter.

2. Don't Underestimate the Importance of Networking

Don't rely solely on online job applications. Active networking significantly increases your chances of success.

- Don't rely solely on online applications: Networking expands your reach beyond posted job openings.

- Actively seek networking opportunities: Attend industry events, join professional organizations, and connect with people on LinkedIn.

- Don't be afraid to reach out: Don't hesitate to connect with people in your network and ask for informational interviews or advice.

3. Don't Go Unprepared for Interviews

Thorough preparation is essential for a successful interview.

- Research the firm and interviewer: Understand the firm's investment strategy, portfolio, and the interviewer's background.

- Practice your responses: Practice answering common interview questions, focusing on your experience and technical skills.

- Don't underestimate technical skills: Demonstrate proficiency in financial modeling and credit analysis.

4. Don't Overlook the Details

Attention to detail shows professionalism and care.

- Error-free applications: Proofread your resume, cover letter, and any other application materials carefully.

- Professional attire: Dress professionally for interviews to make a positive first impression.

- Punctuality and communication: Be punctual for interviews and respond promptly to communication.

5. Don't Be Discouraged by Rejection

The private credit hiring process is competitive. Rejection is a part of the process.

- Learn from each experience: Analyze your application and interview performance to identify areas for improvement.

- Keep applying: Don't let rejection discourage you. Persistence and a positive attitude are crucial.

- Seek feedback: If possible, request feedback from interviewers to learn from your experiences.

Conclusion

Securing a position in private credit hiring requires dedication, preparation, and a strategic approach. By following these do's and don'ts, you can significantly improve your chances of success. Remember to tailor your application materials, network effectively, master the interview process, and showcase your financial expertise. Don't be discouraged by setbacks; persistence and a proactive approach will help you land your dream job in private credit. Start your journey towards a successful private credit career today!

Featured Posts

-

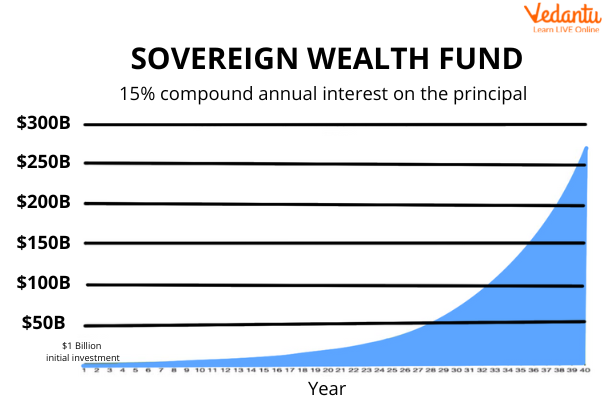

Executive Chair And Sovereign Wealth Fund Make Offer For Inter Rent Reit

May 29, 2025

Executive Chair And Sovereign Wealth Fund Make Offer For Inter Rent Reit

May 29, 2025 -

Dueling Demonstrations In Paris Le Pen Faces Backlash

May 29, 2025

Dueling Demonstrations In Paris Le Pen Faces Backlash

May 29, 2025 -

Release Date Division Street X Nike Air Max 95 97 Ducks Of A Feather

May 29, 2025

Release Date Division Street X Nike Air Max 95 97 Ducks Of A Feather

May 29, 2025 -

Saturday In The Park Festival Celebrates 35 Years With Teddy Swims

May 29, 2025

Saturday In The Park Festival Celebrates 35 Years With Teddy Swims

May 29, 2025 -

Kylian Mbappe His Desire To Conquer All With Real Madrid

May 29, 2025

Kylian Mbappe His Desire To Conquer All With Real Madrid

May 29, 2025

Latest Posts

-

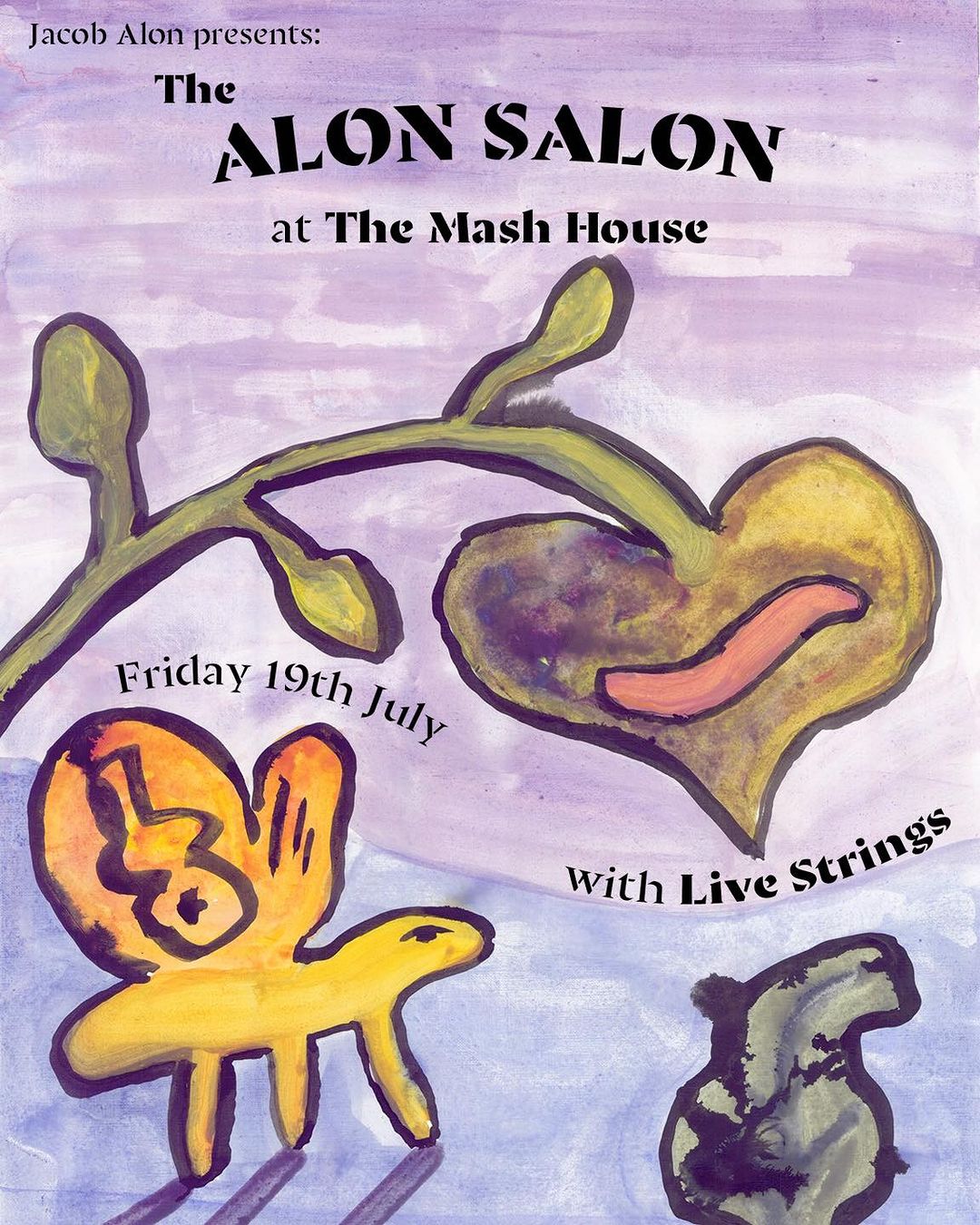

From Dental School To Jacob Alons Career Choice Explained

May 30, 2025

From Dental School To Jacob Alons Career Choice Explained

May 30, 2025 -

Listen Now Jacob Alons August Moon

May 30, 2025

Listen Now Jacob Alons August Moon

May 30, 2025 -

Why Jacob Alon Is One To Watch

May 30, 2025

Why Jacob Alon Is One To Watch

May 30, 2025 -

Jacob Alon From Dentistry To His Unexpected Career Path

May 30, 2025

Jacob Alon From Dentistry To His Unexpected Career Path

May 30, 2025 -

Meet Jacob Alon The Next Big Thing In Industry Field

May 30, 2025

Meet Jacob Alon The Next Big Thing In Industry Field

May 30, 2025