Profitable Dividend Investing: Keep It Simple

Table of Contents

Understanding Dividend Stocks & How They Work

Dividend stocks are shares of companies that regularly distribute a portion of their profits to shareholders. This payout, known as a dividend, represents a share of the company's earnings and provides investors with a steady stream of income. Understanding how dividend stocks work is crucial for successful profitable dividend investing.

Key terms to understand include:

- Dividend Yield: The annual dividend payment per share, expressed as a percentage of the share price. A higher yield generally means a higher income stream, but it's crucial to consider the underlying company's financial health.

- Payout Ratio: The percentage of a company's earnings that is paid out as dividends. A sustainable payout ratio is essential for long-term dividend growth. A high payout ratio may signal potential dividend cuts in the future.

- Dividend Growth Rate: The rate at which a company increases its dividend payments over time. A consistently growing dividend is a strong indicator of a healthy and financially stable company.

Here's what differentiates dividend yield and dividend growth:

- Dividend Yield: Focuses on the immediate income generated from the dividend payment relative to the stock price.

- Dividend Growth Rate: Focuses on the increase in dividend payments over time, contributing to long-term capital appreciation.

It's crucial to thoroughly research a company's financial health, including its revenue, earnings, debt levels, and future prospects, before investing. Different types of dividend payers exist, including:

- High-yield dividend stocks: Offer high dividend yields, but may carry higher risk.

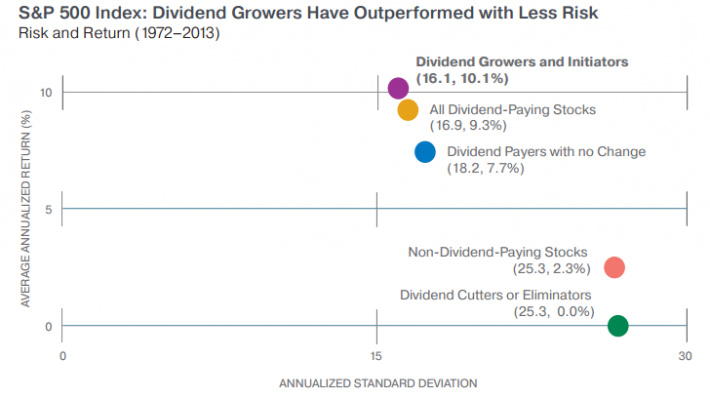

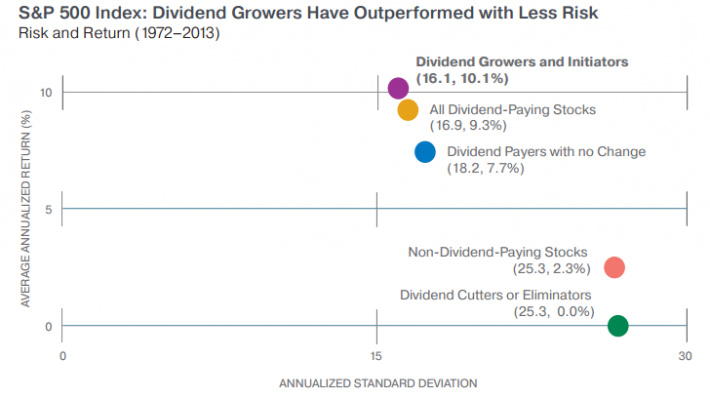

- Dividend growth stocks: Focus on increasing dividend payments over time.

- Dividend Aristocrats: Companies with a long history of consistently increasing annual dividends.

Selecting Profitable Dividend Stocks: A Simple Approach

Selecting the right dividend stocks is paramount for successful profitable dividend investing. Focus on financially strong companies with a proven track record of consistent dividend payments. A simple approach involves applying these screening criteria:

- Long history of dividend payments: Prioritize companies designated as Dividend Aristocrats, known for their commitment to consistent dividend increases.

- Moderate payout ratio: Aim for a payout ratio that allows the company to maintain and grow its dividend payments without straining its finances. A payout ratio of around 50% is often considered sustainable.

- Consistent revenue and earnings growth: Look for companies demonstrating consistent growth in their revenue and earnings, which often translates to higher future dividends.

- Utilize reputable financial websites: Use resources like Yahoo Finance, Google Finance, and Seeking Alpha to screen for companies meeting your criteria.

Building a Diversified Dividend Portfolio

Diversification is key to mitigating risk in any investment portfolio, and profitable dividend investing is no exception. Diversifying your portfolio spreads your risk across various companies and sectors, reducing the impact of any single stock's underperformance. Consider these diversification strategies:

- Diversify across sectors: Invest in companies from different sectors (e.g., technology, healthcare, consumer staples) to reduce the impact of sector-specific downturns.

- Diversify across market capitalization: Include a mix of large-cap, mid-cap, and small-cap stocks to balance risk and potential returns.

- Utilize ETFs or mutual funds: Consider exchange-traded funds (ETFs) or mutual funds that invest in a diversified portfolio of dividend-paying stocks. This simplifies the investment process and reduces individual stock picking risk.

- Avoid concentrating your investments: Don't put all your eggs in one basket, even within the realm of dividend stocks. Spread your investments across multiple companies to reduce overall portfolio volatility.

Reinvesting Dividends for Accelerated Growth (DRIP)

Dividend Reinvestment Plans (DRIPs) are powerful tools for accelerating your long-term growth through the magic of compounding. DRIPs automatically reinvest your dividend payments to purchase additional shares of the same company. This allows you to buy more shares at potentially lower prices, increasing your overall holdings and future dividend income.

The power of compounding: Even small, consistent dividend reinvestments grow exponentially over time. A small investment today can grow into a significant amount over decades.

- Automatic reinvestment: DRIPs streamline the reinvestment process, eliminating the need for manual transactions.

- Compounding returns: Reinvesting dividends leads to exponential growth over time, accelerating your wealth-building journey.

- Tax implications: While DRIPs generally offer tax advantages, it's essential to consult a financial advisor to understand the tax implications related to your specific situation.

Monitoring Your Dividend Portfolio & Adapting Your Strategy

Regular monitoring is crucial for profitable dividend investing. Keep a close eye on your portfolio's performance, tracking dividend payments and overall returns.

- Utilize portfolio tracking tools: Employ online portfolio trackers or spreadsheets to monitor your investments effectively.

- Adapt your strategy: Be prepared to adjust your investment strategy based on changing market conditions and your personal financial goals.

- Rebalance your portfolio: Periodically rebalance your portfolio to maintain your desired asset allocation and risk level. This involves selling some of your higher-performing investments and buying more of those that have underperformed.

Conclusion: Profitable Dividend Investing: Your Path to Financial Freedom

Profitable dividend investing, when approached strategically and simply, offers a powerful path to long-term financial freedom. By focusing on selecting financially strong companies with a history of consistent dividend payments, diversifying your portfolio, and reinvesting dividends, you can generate a steady income stream and build wealth steadily over time. Remember to prioritize a simple, diversified approach, and consistently monitor your portfolio’s performance to adapt your strategy when necessary.

Ready to unlock the potential of profitable dividend investing? Start building your portfolio today with simple strategies that can lead to long-term financial freedom!

Featured Posts

-

Elizabeth Hurleys Hottest Cleavage Moments A Revealing Look

May 10, 2025

Elizabeth Hurleys Hottest Cleavage Moments A Revealing Look

May 10, 2025 -

Iron Ore Falls As China Curbs Steel Output Market Impact Analysis

May 10, 2025

Iron Ore Falls As China Curbs Steel Output Market Impact Analysis

May 10, 2025 -

Posthaste High Down Payments And The Canadian Housing Crisis

May 10, 2025

Posthaste High Down Payments And The Canadian Housing Crisis

May 10, 2025 -

Debut D Incendie A La Mediatheque Champollion De Dijon Degats Et Enquete

May 10, 2025

Debut D Incendie A La Mediatheque Champollion De Dijon Degats Et Enquete

May 10, 2025 -

The La Palisades Wildfires Impact On Celebrity Homes

May 10, 2025

The La Palisades Wildfires Impact On Celebrity Homes

May 10, 2025