Recent Semiconductor Market Surge: What Drove The ETF Sell-Off?

Table of Contents

The Semiconductor Market Surge: A Supply and Demand Imbalance

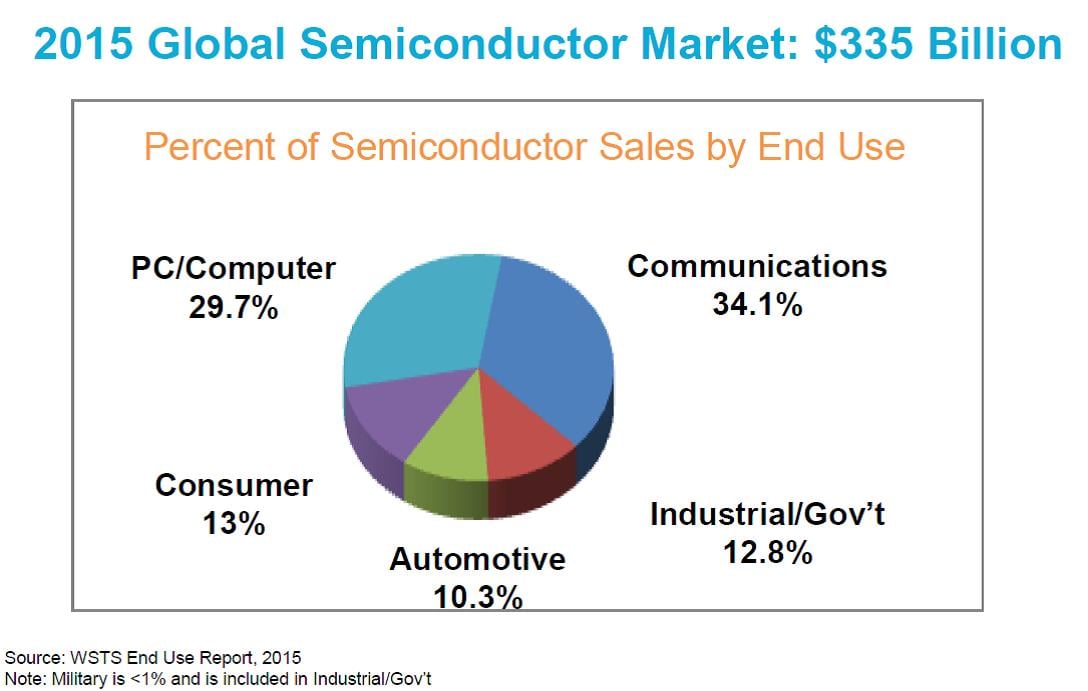

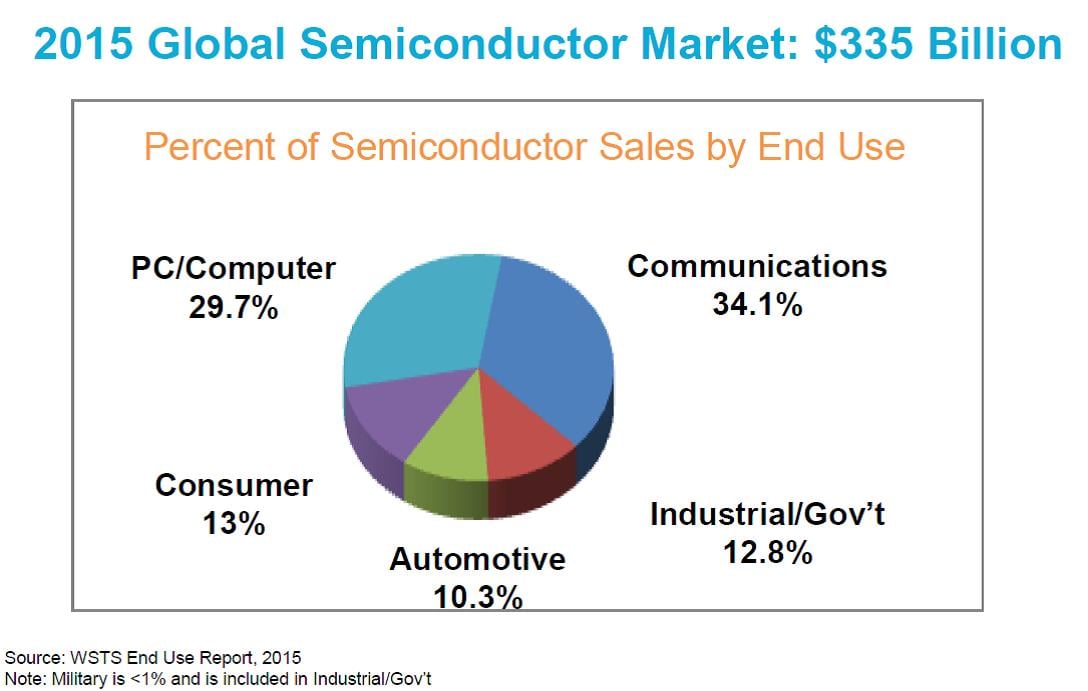

The dramatic rise in semiconductor stock prices wasn't arbitrary; it stemmed from a fundamental imbalance between supply and demand.

Persistent Chip Shortage

The global chip shortage, which began in 2020 and continues to impact the industry, is a primary driver of the surge. This shortage has led to:

- Increased demand from automotive, consumer electronics, and data center sectors: The pandemic accelerated digital transformation, boosting demand for chips across various sectors. The automotive industry, in particular, faced severe production bottlenecks due to the lack of crucial semiconductors.

- Geopolitical tensions and trade restrictions impacting supply chains: Trade wars and geopolitical instability further complicated the situation, disrupting established supply chains and creating delays. This made it harder for companies to source the components they needed.

- Manufacturing capacity constraints limiting production: Semiconductor fabrication plants (fabs) have struggled to keep up with the unprecedented demand, resulting in production bottlenecks and longer lead times. Building new fabs is a capital-intensive and time-consuming process.

Strong Earnings Reports and Future Outlook

Major semiconductor companies reported strong earnings, fueling investor optimism and further driving up stock prices. This positive outlook was driven by:

- Increased revenue projections based on continued high demand: Companies projected continued strong revenue growth based on sustained high demand for their products, reinforcing investor confidence.

- Successful product launches and technological advancements: Innovative new products and advancements in semiconductor technology solidified market leadership and attracted further investment.

- Strategic acquisitions and partnerships expanding market reach: Strategic acquisitions and partnerships helped companies expand their market reach and diversify their product portfolio, enhancing their competitive advantage.

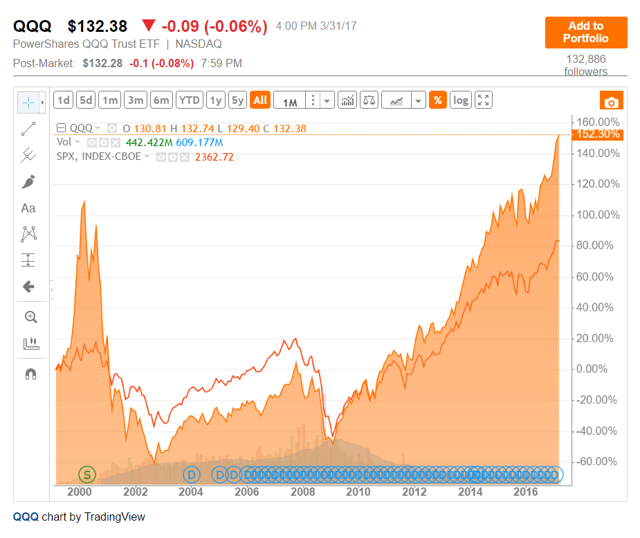

The ETF Sell-Off: Why Investors Cashed Out

Despite the strong performance of individual semiconductor stocks, a significant sell-off occurred in semiconductor ETFs. Several factors contributed to this:

Profit-Taking and Market Corrections

After a period of significant gains, investors often engage in profit-taking, leading to a sell-off. In the semiconductor market, this was exacerbated by:

- Overvalued semiconductor stocks leading to price corrections: Some analysts believed that certain semiconductor stocks became overvalued, leading to a necessary price correction to reflect a more sustainable valuation.

- Concerns about future market performance and potential slowdowns: Concerns about a potential slowdown in global economic growth and a decrease in demand for semiconductors led some investors to secure their profits.

- Rotation into other sectors deemed less risky: Investors may have rotated their portfolios into sectors perceived as less risky, such as defensive sectors like utilities or consumer staples.

Macroeconomic Factors and Inflation Concerns

Broader macroeconomic factors also played a significant role in the ETF sell-off. These include:

- Rising interest rates affecting investment strategies: Increased interest rates make borrowing more expensive and can impact investment strategies, potentially leading to a decrease in investment in the technology sector.

- Inflationary pressures and their impact on consumer spending and tech sector growth: Inflationary pressures can reduce consumer spending, impacting demand for consumer electronics and thus the semiconductor industry.

- Concerns about potential recession impacting future demand for semiconductors: Concerns about a potential recession further dampened investor sentiment, leading to a sell-off in riskier assets, including semiconductor ETFs.

ETF-Specific Factors

The ETF sell-off wasn't solely driven by macroeconomic factors; ETF-specific dynamics also contributed:

- ETF composition and weighting affecting performance: The specific composition and weighting of different semiconductor ETFs can influence their overall performance, leading to variations in investor response.

- Investor sentiment towards specific ETFs within the semiconductor space: Investor sentiment toward particular ETFs within the semiconductor space can impact their trading volume and price fluctuations.

- Liquidity issues and trading volume influencing ETF price fluctuations: Liquidity issues and lower trading volume can amplify price fluctuations in ETFs, making them more susceptible to sell-offs.

Conclusion

The recent surge in the semiconductor market and subsequent ETF sell-off highlight the complex interplay of supply and demand dynamics, company performance, macroeconomic factors, and ETF-specific considerations. While a persistent chip shortage and strong earnings fueled the initial market surge, profit-taking, macroeconomic concerns, and ETF-specific factors contributed to the subsequent sell-off. The recent surge in the semiconductor market presented both exciting opportunities and inherent risks.

Understanding the complexities of the semiconductor market and the behavior of semiconductor ETFs is crucial for making informed investment decisions. Stay informed about the latest developments in the semiconductor market to navigate the volatility and capitalize on future opportunities in this dynamic sector. Continue researching the semiconductor market and ETF performance for a complete picture.

Featured Posts

-

Donde Ver Atalanta Vs Lazio Serie A 2025 En Vivo

May 13, 2025

Donde Ver Atalanta Vs Lazio Serie A 2025 En Vivo

May 13, 2025 -

The Semiconductor Market A Recent Etf Investor Case Study

May 13, 2025

The Semiconductor Market A Recent Etf Investor Case Study

May 13, 2025 -

Pliant Secures 40 M In Series B Funding To Revolutionize B2 B Payments

May 13, 2025

Pliant Secures 40 M In Series B Funding To Revolutionize B2 B Payments

May 13, 2025 -

Analyzing The Impact And Legacy Of The Da Vinci Code

May 13, 2025

Analyzing The Impact And Legacy Of The Da Vinci Code

May 13, 2025 -

Testing Byds 5 Minute Ev Charging Technology Results And Analysis

May 13, 2025

Testing Byds 5 Minute Ev Charging Technology Results And Analysis

May 13, 2025