Record High Nears: Frankfurt Equities And The DAX's Strong Opening

Table of Contents

Economic Indicators Fueling the DAX's Rise

Several key economic indicators point towards the positive momentum observed in the Frankfurt equities market and the DAX's climb.

Strong German Economic Data

Recent data releases from Germany paint a picture of robust economic health, significantly bolstering investor confidence.

- Stronger-than-expected GDP growth: Germany's Q2 2024 GDP growth exceeded analyst predictions, indicating a resilient and expanding economy. [Link to official Statista data]

- Falling unemployment rates: The unemployment rate continues its downward trend, signifying a healthy labor market and increased consumer spending. [Link to official Destatis data]

- Controlled inflation: While inflation remains a concern globally, Germany has seen a moderation in inflation rates, reducing uncertainty for businesses and investors. [Link to official Bundesbank data]

This positive economic data provides a solid foundation for the DAX's strong performance, signaling a healthy and growing German economy.

Global Economic Optimism

The positive trends in the German economy are further amplified by a generally optimistic global economic climate.

- Improved global trade relations: Easing trade tensions between major global economies have created a more predictable and stable environment for international trade, benefiting export-oriented German companies.

- Positive growth in key trading partners: Strong economic performance in other major European economies and beyond is further boosting demand for German goods and services.

- Increased foreign direct investment: Global investors are increasingly confident in the German market, leading to a significant inflow of foreign direct investment.

This positive global backdrop enhances the appeal of Frankfurt equities and strengthens the upward trajectory of the DAX.

Sector-Specific Performances Driving the DAX's Gains

The DAX's rise isn't solely driven by macroeconomic factors; strong performances within specific sectors are also playing a crucial role.

Automotive Sector's Resurgence

The automotive sector, a significant component of the DAX, has shown remarkable resilience and growth.

- Volkswagen's strong sales figures: Volkswagen's increased sales, particularly of electric vehicles, have significantly contributed to the overall DAX increase.

- BMW's robust export performance: BMW's continued success in international markets reflects the strength of the German automotive industry on the global stage.

- Mercedes-Benz's innovative new models: The introduction of new models and technologies has further boosted investor confidence in the sector.

Technology and Industrial Sectors' Growth

Beyond the automotive sector, the technology and industrial sectors are also contributing significantly to the DAX's upward trend.

- Siemens' successful new product launch: Siemens' recent launch of innovative technologies has fueled investor interest and boosted the company's stock price.

- SAP's strong software sales: SAP’s continued success in the enterprise software market contributes to the overall strength of the technology sector.

- Increased demand for industrial goods: Rising global demand for industrial goods is supporting the growth of major industrial players listed on the DAX.

Other Key Performing Sectors

Other sectors, such as pharmaceuticals and consumer goods, are also exhibiting positive growth, further underpinning the overall strength of the Frankfurt equities market and the DAX's performance.

Investor Sentiment and Market Volatility

The DAX's impressive gains are also fueled by a shift in investor sentiment and expectations.

Increased Investor Confidence

Several factors have contributed to the recent surge in investor confidence in the German market.

- Strong corporate earnings: Positive corporate earnings reports from major DAX companies have boosted investor optimism.

- Low interest rates: Sustained low interest rates encourage investment in equities, further driving up demand.

- Foreign direct investment: A significant increase in foreign direct investment reflects a growing global confidence in the German economy.

Managing Market Volatility

While the outlook is positive, it’s important to acknowledge potential sources of market volatility.

- Geopolitical risks: Global geopolitical events remain a potential source of market uncertainty.

- Inflationary pressures: While currently under control, persistent inflationary pressures could impact investor sentiment.

- Supply chain disruptions: Ongoing global supply chain disruptions could still impact certain sectors.

Conclusion

The strong opening of the Frankfurt Stock Exchange and the DAX's near-record highs reflect a confluence of positive factors: robust economic indicators, strong sector-specific performances, and increasing investor confidence. While some volatility is to be expected, the overall outlook remains positive for German equities. The performance of Frankfurt equities and the DAX continues to be a compelling area for investors to watch.

Call to Action: Stay informed about the latest developments in Frankfurt equities and the DAX. Monitor key economic indicators and sector performances to make informed investment decisions related to Frankfurt equities and the DAX. Consider exploring investment opportunities in this dynamic market, but always conduct thorough due diligence before making any investment choices. Remember to diversify your portfolio and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Fujifilm X H2 Fun Refreshing And Easy To Use A Hands On Experience

May 25, 2025

Fujifilm X H2 Fun Refreshing And Easy To Use A Hands On Experience

May 25, 2025 -

Francis Sultanas Contribution To The Design Of Monacos Robuchon Restaurants

May 25, 2025

Francis Sultanas Contribution To The Design Of Monacos Robuchon Restaurants

May 25, 2025 -

Michael Schumacher And His Rivals A Look At The Tensions In F1

May 25, 2025

Michael Schumacher And His Rivals A Look At The Tensions In F1

May 25, 2025 -

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 25, 2025

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 25, 2025 -

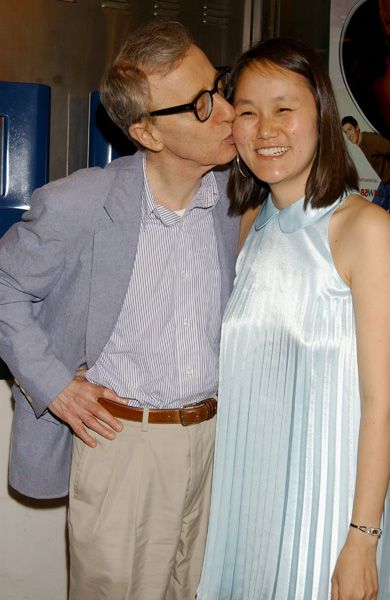

Sean Penn Questions Dylan Farrows Account Of Sexual Abuse By Woody Allen

May 25, 2025

Sean Penn Questions Dylan Farrows Account Of Sexual Abuse By Woody Allen

May 25, 2025