Record Suncor Production Counterbalanced By Declining Sales And Inventory Build-up

Table of Contents

Record Suncor Production Levels

Suncor's recent production figures represent a milestone in its operational history. The company achieved record-high output, exceeding previous years' performance significantly. This success is largely attributed to increased efficiency in its oil sands operations and the successful commissioning of new projects. The improved extraction techniques and technological advancements have contributed to this substantial increase in Suncor production.

- Oil Sands Production: Suncor reported an increase of X% in oil sands production compared to the same period last year, reaching Y barrels per day. (Replace X and Y with actual figures).

- Other Energy Sources: Production of [mention other energy sources, e.g., natural gas] also saw a notable increase of Z%, reaching W units. (Replace Z and W with actual figures).

- Operational Improvements: Key operational improvements included [mention specific examples, e.g., enhanced steam assisted gravity drainage (SAGD) techniques, upgraded infrastructure].

Declining Sales and Market Demand

Despite record Suncor production, sales figures have been disappointing. This discrepancy is primarily due to a combination of factors impacting global energy markets. Reduced global demand, primarily driven by economic slowdowns in key regions, has put downward pressure on energy prices. Geopolitical instability has also played a significant role, creating uncertainty and impacting market confidence.

- Sales Figures: Compared to the previous quarter/year, sales decreased by A%. (Replace A with actual figures).

- Market Factors: The slowdown in the global economy, particularly in [mention specific regions], has significantly dampened energy consumption.

- Price Fluctuations: The price of oil has remained volatile, averaging $B per barrel, impacting Suncor's revenue. (Replace B with actual figures). This price volatility directly influences the profitability of Suncor production.

Growing Inventory and Storage Challenges

The combination of record Suncor production and declining sales has led to a significant build-up of inventory. This presents several challenges for the company, including increased storage costs and the risk of potential losses due to price fluctuations or product degradation. Managing this surplus effectively is crucial for Suncor's financial health.

- Inventory Growth: Inventory levels have increased by C% compared to the previous quarter/year. (Replace C with actual figures).

- Storage Costs: The costs associated with storing excess oil and gas are substantial and are likely impacting profitability.

- Potential Solutions: Suncor may need to explore strategies such as strategic price adjustments, increased marketing efforts to stimulate demand, or even temporary production cutbacks to manage inventory levels.

Financial Implications and Future Outlook for Suncor Production

The combination of increased Suncor production, declining sales, and rising inventory levels has a direct impact on the company's profitability. Net income may suffer, requiring Suncor to implement cost-cutting measures and adjust its strategic plans to navigate this challenging environment.

- Financial Impact: The company's Q[Quarter] earnings report is expected to reflect the strain of the current situation. (Reference specific financial data if available).

- Strategic Responses: Suncor's management has indicated [mention specific actions taken or planned, e.g., cost-cutting initiatives, exploration of new markets].

- Future Projections: Experts predict [mention expert opinions on future Suncor production levels and market outlook]. The future of Suncor production hinges on several interconnected factors.

Analyzing Suncor Production and its Challenges

In summary, Suncor's impressive record production stands in stark contrast to the current reality of declining sales and a growing inventory surplus. This situation highlights the complexities of the energy market and the challenges faced by even the largest producers. Monitoring Suncor production levels and market trends is crucial for investors to make informed decisions. To stay updated on Suncor's performance and the evolving energy landscape, we encourage you to seek out further information and analysis focusing on Suncor production updates, Suncor energy market analysis, and Suncor stock performance. Continue your research into the interplay of factors influencing Suncor production and its future prospects for a more comprehensive understanding.

Featured Posts

-

Nyt Spelling Bee Strands April 12 2025 Complete Gameplay Guide

May 10, 2025

Nyt Spelling Bee Strands April 12 2025 Complete Gameplay Guide

May 10, 2025 -

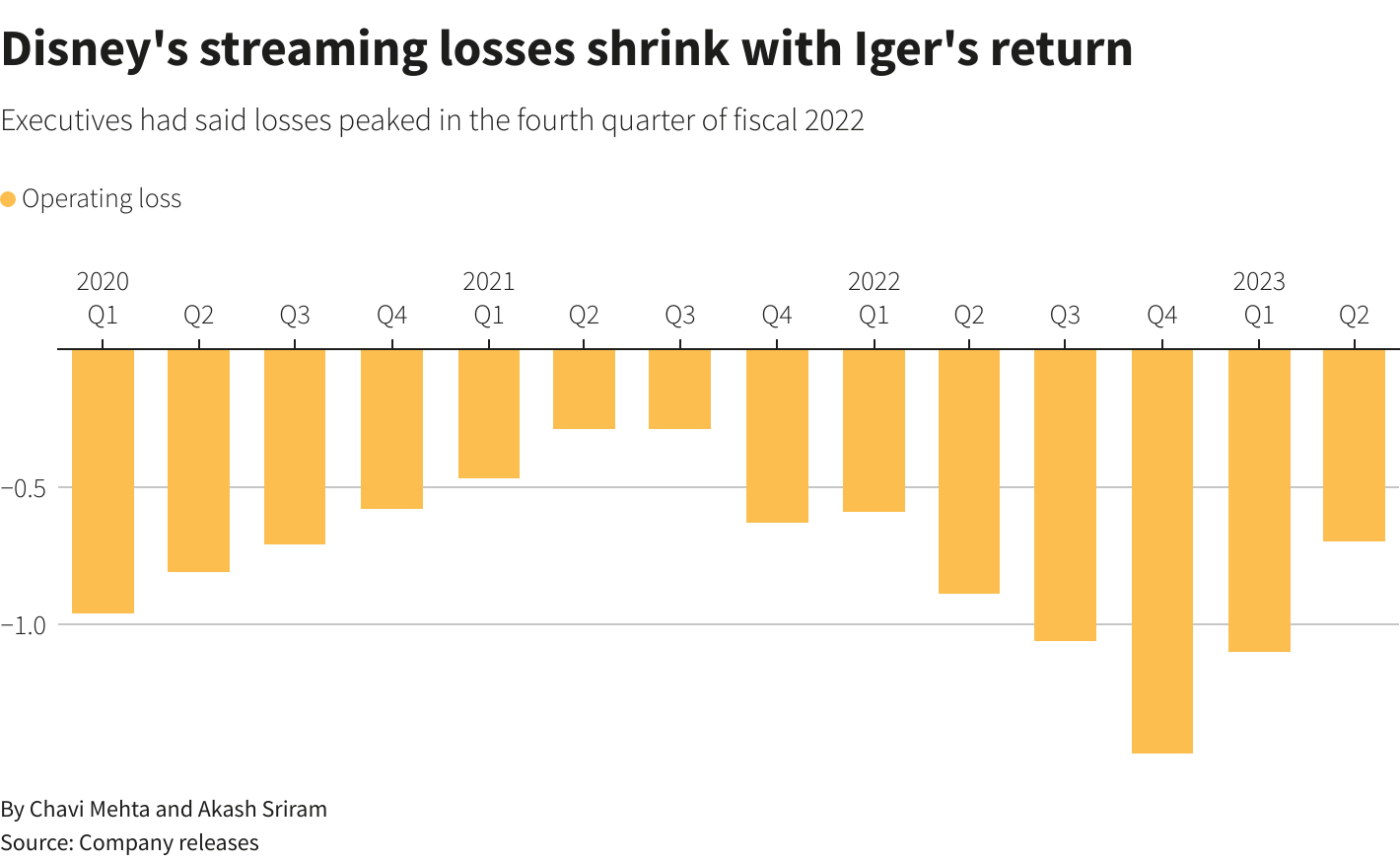

Disneys Increased Profit Strong Parks And Streaming Performance

May 10, 2025

Disneys Increased Profit Strong Parks And Streaming Performance

May 10, 2025 -

Planning Your Summer Trip Navigating Real Id Requirements

May 10, 2025

Planning Your Summer Trip Navigating Real Id Requirements

May 10, 2025 -

Snls Bad Harry Styles Impression How He Really Felt

May 10, 2025

Snls Bad Harry Styles Impression How He Really Felt

May 10, 2025 -

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025

40 Palantir Stock Growth By 2025 A Realistic Investment Opportunity

May 10, 2025