Reps Vow To Recover $1.231 Billion More From 28 Oil Firms

Table of Contents

The Scale of the Unpaid Taxes and the Involved Oil Firms

The staggering figure of $1.231 billion in allegedly unpaid taxes represents a significant loss of government revenue. This substantial sum is owed by 28 oil firms, highlighting a systemic issue of corporate tax avoidance within the energy sector. While a complete list of the involved companies isn't publicly available at this time, it is understood that the investigation includes both large multinational corporations and smaller, independent operators. The reasons cited for the unpaid taxes vary, ranging from alleged tax evasion schemes to exploitation of legal loopholes and discrepancies in reporting financial data. The types of taxes involved encompass a range of levies, including corporate income tax, royalties on oil extraction, and various other state and federal taxes specific to the oil and gas industry. Investigations allege that these companies engaged in various forms of corporate tax avoidance, including complex financial maneuvers designed to minimize their tax liabilities. These financial irregularities are at the heart of the representatives' efforts to recover this substantial sum.

The Representatives' Action Plan and Strategies

Representatives have outlined a multi-pronged approach to recover the $1.231 billion in unpaid taxes. This action plan includes a comprehensive series of audits targeting the financial records of the 28 implicated oil companies. These audits will meticulously examine revenue streams, expenses, and tax calculations to identify any inconsistencies or potential evidence of tax evasion. In parallel, legal action will be pursued against companies found to have violated tax laws. This legal strategy may involve both civil and criminal proceedings, aiming to recover the unpaid taxes and potentially levy substantial penalties. Furthermore, legislative proposals are being drafted to strengthen existing tax laws and prevent future instances of corporate tax avoidance within the oil industry. These proposals aim to close legal loopholes, increase transparency in financial reporting, and enhance regulatory oversight of the sector. The representatives involved have publicly pledged to pursue this matter aggressively, emphasizing their commitment to transparency and ensuring that oil companies are held accountable for their financial obligations. The timeline for this recovery process is expected to span several years, given the complexity of the legal and accounting issues involved.

Potential Impacts and Implications of the Recovery Effort

The successful recovery of $1.231 billion in unpaid taxes would have significant ramifications. The recovered funds could be allocated to bolster government budgets, allowing for increased investment in crucial public services such as education, infrastructure, and healthcare. This injection of revenue has the potential to provide tangible benefits to citizens across the nation. However, the impact extends beyond budgetary considerations. The success of this recovery effort could serve as a powerful deterrent against future instances of corporate tax avoidance within the oil industry. This increased accountability could foster greater investor confidence and potentially improve the overall ethical climate within the sector. Conversely, a lack of success could embolden other corporations to engage in similar practices, undermining efforts to promote responsible corporate behavior. The outcome will undoubtedly shape future tax policy discussions and influence the design of regulatory frameworks aimed at enhancing corporate accountability.

Public Opinion and the Role of Media Coverage

Public reaction to the representatives’ efforts has been largely positive, with many expressing support for holding oil companies accountable for their tax obligations. Media coverage has played a crucial role in bringing this issue to the forefront of public awareness, fueling public pressure on both the oil companies and the government to address the matter effectively. This media scrutiny has helped to maintain the issue in the public eye, increasing the political pressure on officials to ensure swift and decisive action. The ongoing media coverage has the potential to significantly influence public perception of the oil industry, potentially harming investor confidence in companies found to be engaging in unethical tax practices. The level of public support for this initiative highlights the growing demand for greater corporate responsibility and transparency within the energy sector.

Conclusion

This initiative to recover $1.231 billion in unpaid taxes from 28 oil firms represents a significant step towards greater accountability within the energy sector. The representatives' commitment to pursuing these funds highlights the ongoing struggle for tax justice and responsible corporate behavior. The success of this effort will not only impact government revenue but could also influence future tax policies and corporate practices. The implications of this case extend far beyond the immediate financial recovery, setting a potential precedent for how future corporate tax disputes will be handled.

Call to Action: Stay informed about the progress of this crucial effort to recover billions from oil companies. Follow our updates to learn more about the fight for tax justice and the ongoing battle to ensure the oil industry pays its fair share. Learn more about the ongoing efforts to recover unpaid taxes from oil companies and how you can support the push for greater corporate accountability.

Featured Posts

-

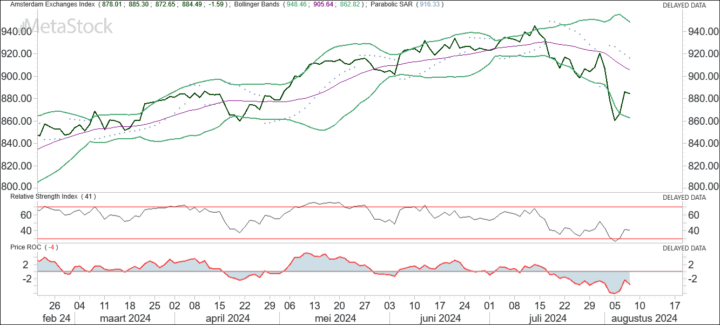

Abn Amro Aex Kwartaalresultaten Leiden Tot Koersstijging

May 21, 2025

Abn Amro Aex Kwartaalresultaten Leiden Tot Koersstijging

May 21, 2025 -

Understanding The Billionaire Boy Phenomenon Inheritance Entrepreneurship And Impact

May 21, 2025

Understanding The Billionaire Boy Phenomenon Inheritance Entrepreneurship And Impact

May 21, 2025 -

Gangsta Granny Comparing The Book And The Stage Adaptation

May 21, 2025

Gangsta Granny Comparing The Book And The Stage Adaptation

May 21, 2025 -

Real Madrid De Yeni Bir Doenem Teknik Direktoer Ve Arda Gueler In Rolue

May 21, 2025

Real Madrid De Yeni Bir Doenem Teknik Direktoer Ve Arda Gueler In Rolue

May 21, 2025 -

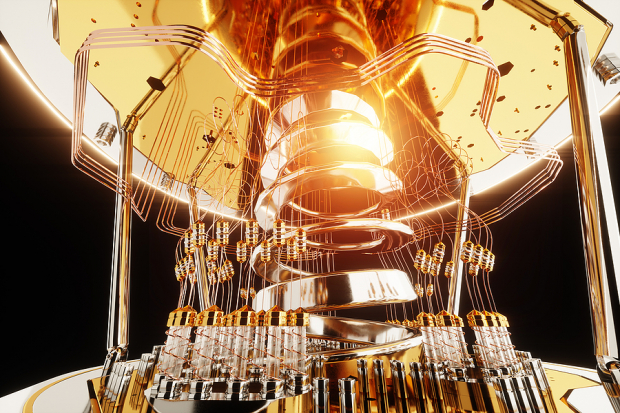

Quantum Computing Investment Exploring D Wave Qbts Stock Potential

May 21, 2025

Quantum Computing Investment Exploring D Wave Qbts Stock Potential

May 21, 2025

Latest Posts

-

Julianne Moore Stars In Siren Trailer Dark Comedy Series Promises Intrigue

May 23, 2025

Julianne Moore Stars In Siren Trailer Dark Comedy Series Promises Intrigue

May 23, 2025 -

Milly Alcock As Supergirl Netflixs Sirens Trailer Reveals Cult Connection With Julianne Moore

May 23, 2025

Milly Alcock As Supergirl Netflixs Sirens Trailer Reveals Cult Connection With Julianne Moore

May 23, 2025 -

Julianne Moore In Siren Trailer 1 Breakdown A Dark Comedy Series

May 23, 2025

Julianne Moore In Siren Trailer 1 Breakdown A Dark Comedy Series

May 23, 2025 -

Hulu Movies Leaving Soon What To Watch Before They Re Gone

May 23, 2025

Hulu Movies Leaving Soon What To Watch Before They Re Gone

May 23, 2025 -

The 10 Scariest Arthouse Horror Movies You Need To Watch

May 23, 2025

The 10 Scariest Arthouse Horror Movies You Need To Watch

May 23, 2025