Responding To HMRC: Important Child Benefit Messages Explained

Table of Contents

Understanding Your Child Benefit Letter from HMRC

Navigating HMRC correspondence can feel overwhelming, but understanding the common reasons for contact and the language used will help simplify the process.

Common Reasons for HMRC Contact Regarding Child Benefit

HMRC may contact you for several reasons, including:

- Changes to your circumstances: This includes changes of address, changes in income (yours or your partner's), the birth of a new child, or a child reaching a certain age. Failing to notify HMRC of these changes can lead to overpayments or ineligibility.

- Verification of information: HMRC may request further information to verify the details you've provided in your application or subsequent updates. This is a standard procedure to ensure accuracy and prevent fraud.

- Potential overpayment of Child Benefit: If HMRC identifies a potential overpayment, they will contact you to explain the situation and outline the repayment options.

- Queries regarding your eligibility: They may contact you if they have questions about your ongoing eligibility for Child Benefit, based on your circumstances.

- Request for further information: HMRC may require additional documentation or clarification on certain aspects of your claim.

Deciphering the Language in HMRC Child Benefit Letters

HMRC letters often use specific terminology. Understanding these phrases is key to a prompt and accurate response. Common phrases include:

- "We need further information": This indicates that HMRC requires additional documentation or clarification to process your claim or update your details.

- "Overpayment": This signifies that you have received more Child Benefit than you were entitled to. You'll need to respond promptly and address the overpayment.

- "Review of your claim": This usually means HMRC is reassessing your eligibility for Child Benefit, potentially due to a change in your circumstances.

- "Tax Credits": While distinct from Child Benefit, your Tax Credits may be impacted by changes affecting your Child Benefit entitlement.

It's essential to read your HMRC letter carefully, noting all deadlines and specific requests. Underline or highlight key information to ensure you address all points.

Responding to HMRC's Queries Effectively

Promptness is key when replying to HMRC. Aim to respond within the given deadline to avoid further complications.

- Provide accurate information: Double-check all details before submitting your response to ensure accuracy. Incorrect information can delay processing and potentially lead to further investigation.

- Complete information: Address all points raised in the letter, providing all requested documentation.

- Keep copies: Maintain copies of all correspondence, including the original letter and your response, along with any supporting documents.

- Use official channels: Use the contact details provided in the HMRC letter to respond. Avoid informal methods of communication.

Dealing with Child Benefit Overpayments

An overpayment occurs when you receive more Child Benefit than you are legally entitled to. This often happens due to a change in circumstances that wasn't reported to HMRC or an error in their records.

Understanding Overpayment Notices from HMRC

Overpayment notices from HMRC clearly state the amount of the overpayment and the proposed repayment method. Common methods include:

- Deduction from future Child Benefit payments: HMRC may deduct the overpayment from your subsequent payments.

- Direct debit: You may be asked to set up a direct debit to repay the overpayment.

- One-off payment: In some cases, you may be asked to make a one-off payment.

If you disagree with the overpayment, you have the right to challenge it.

Challenging a Child Benefit Overpayment

If you believe the overpayment is incorrect, follow these steps:

- Gather evidence: Collect any supporting documentation that contradicts the overpayment notice, such as payslips, bank statements, or previous correspondence.

- Contact HMRC: Contact HMRC through the designated channels to explain your situation and present your evidence. Be prepared to discuss your circumstances thoroughly.

- Appeal the decision: If your initial challenge is unsuccessful, you may have the right to appeal the decision through the formal appeals process outlined by HMRC.

Maintaining Accurate Child Benefit Information

Proactive communication with HMRC is crucial for maintaining your eligibility and avoiding potential problems.

Regular Updates to Your Child Benefit Information

It's vital to inform HMRC immediately of any changes affecting your eligibility for Child Benefit, such as:

- Change of address: Failure to update your address may result in delays or missed payments.

- Changes in income: Significant changes in your or your partner's income could affect your entitlement.

- Changes in marital status: Marriage, separation, or divorce can impact your Child Benefit payments.

- Child turning 16: Child Benefit payments typically stop when a child turns 16, unless they continue full-time education.

Update your details online through the HMRC website for the quickest and most efficient method.

Keeping Comprehensive Records of Child Benefit Payments and Correspondence

Maintaining accurate records simplifies the process of responding to HMRC and helps prevent future issues. Keep records of:

- All Child Benefit payment details: Note the payment amounts and dates.

- All correspondence with HMRC: Save copies of letters, emails, and any other communication.

- Supporting documentation: Keep copies of payslips, bank statements, and any other relevant documents that could support your claims.

You can store these documents digitally or use a physical filing system, but ensuring their accessibility and safety is crucial.

Seeking Further Assistance with HMRC Child Benefit Correspondence

If you need additional support, several resources are available:

HMRC Helpline and Online Resources

The HMRC website provides comprehensive information on Child Benefit and other tax credits. You can find contact numbers and online forms for various inquiries.

Independent Advice Services

Organizations such as Citizens Advice offer free and independent guidance on benefits and tax issues.

Tax Advisors and Accountants

Consider consulting a tax advisor or accountant if you require professional help navigating complex tax matters. They can provide expert advice and assistance with HMRC correspondence.

Conclusion

Effectively responding to HMRC communications concerning your Child Benefit is essential to prevent complications and ensure you receive the correct payments. Understanding the content of their letters, promptly providing accurate information, and maintaining detailed records are crucial steps in managing your Child Benefit successfully. By following the guidelines in this guide, you can confidently handle your HMRC Child Benefit correspondence. If you require further assistance, don't hesitate to contact HMRC directly or seek advice from one of the helpful resources mentioned above. Proactive management of your Child Benefit information will minimize stress and ensure you receive the financial support you're entitled to.

Featured Posts

-

Fenerbahce Nin Tadic Transferi Talisca Tartismasinin Ardindan Yeni Bir Doenem

May 20, 2025

Fenerbahce Nin Tadic Transferi Talisca Tartismasinin Ardindan Yeni Bir Doenem

May 20, 2025 -

Sconto Eccezionale Hercule Poirot Su Play Station 5 Meno Di 10 E

May 20, 2025

Sconto Eccezionale Hercule Poirot Su Play Station 5 Meno Di 10 E

May 20, 2025 -

Michael Schumacher De Mallorca A Suiza Para Ver A Su Familia

May 20, 2025

Michael Schumacher De Mallorca A Suiza Para Ver A Su Familia

May 20, 2025 -

Parcours Des Femmes A Biarritz Un Programme Riche D Evenements Pour Le 8 Mars

May 20, 2025

Parcours Des Femmes A Biarritz Un Programme Riche D Evenements Pour Le 8 Mars

May 20, 2025 -

Formula 1 2024 Yeni Sezon Icin Heyecan Verici Geri Sayim

May 20, 2025

Formula 1 2024 Yeni Sezon Icin Heyecan Verici Geri Sayim

May 20, 2025

Latest Posts

-

Threats To Clean Energy Understanding The Opposition And Its Impact

May 20, 2025

Threats To Clean Energy Understanding The Opposition And Its Impact

May 20, 2025 -

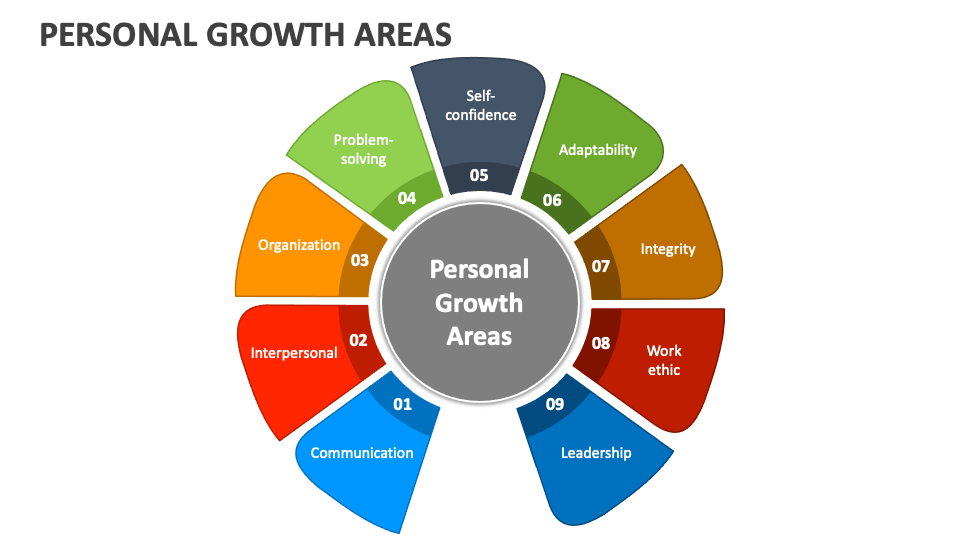

Exploring New Business Hot Spots A Detailed Map Of The Countrys Growth Areas

May 20, 2025

Exploring New Business Hot Spots A Detailed Map Of The Countrys Growth Areas

May 20, 2025 -

Clean Energys Fight For Survival Thriving In Hostile Environments

May 20, 2025

Clean Energys Fight For Survival Thriving In Hostile Environments

May 20, 2025 -

Factory Jobs In America Assessing Trumps Promise And The Challenges Ahead

May 20, 2025

Factory Jobs In America Assessing Trumps Promise And The Challenges Ahead

May 20, 2025 -

Where To Invest Mapping The Countrys Best Business Opportunities

May 20, 2025

Where To Invest Mapping The Countrys Best Business Opportunities

May 20, 2025