Retail Sales Growth Impacts Bank Of Canada's Interest Rate Decision

Table of Contents

Retail Sales as a Leading Economic Indicator

Retail sales data serves as a leading economic indicator, offering valuable insights into consumer behavior and the broader economic landscape. Strong retail sales growth signals a healthy economy, boosting consumer confidence and indicating robust economic activity. This positive sentiment translates into increased spending, driving economic growth and contributing to a higher Gross Domestic Product (GDP). Conversely, weak retail sales can be a harbinger of an impending economic slowdown, indicating reduced consumer confidence and decreased spending.

- Retail sales data provides real-time insights into consumer demand. Analyzing trends allows economists to predict future economic activity.

- Strong retail sales contribute significantly to higher GDP growth. This is because consumer spending constitutes a substantial portion of the Canadian economy.

- The Retail Sales Index is a closely watched economic indicator. Its fluctuations are keenly observed by the Bank of Canada and financial markets.

- Changes in consumer spending patterns directly impact inflation. Increased spending can lead to increased demand, potentially pushing prices higher.

The Bank of Canada's Reaction to Retail Sales Data

The Bank of Canada utilizes retail sales data, among other economic indicators, to inform its monetary policy decisions. Its primary mandate is to maintain price stability and full employment. The Bank's reaction to retail sales data is directly linked to its inflation targeting framework.

- The Bank of Canada aims to maintain price stability (low and stable inflation) and full employment. These are the cornerstones of its monetary policy.

- High retail sales, coupled with rising inflation, may necessitate interest rate increases. This is a tool to cool down an overheated economy and prevent runaway inflation.

- Low retail sales might prompt the Bank of Canada to lower interest rates to encourage spending and stimulate economic activity. This is a form of counter-cyclical policy.

- The Bank considers various factors beyond retail sales, such as employment data, housing starts, and global economic conditions. However, retail sales remain a significant component of its analysis.

Inflationary Pressures and Retail Sales

A strong correlation exists between robust retail sales and inflationary pressures. Rapid growth in retail sales can fuel demand-pull inflation, where increased demand outstrips supply, leading to higher prices. This is especially true if the increase in demand is not met by a corresponding increase in production capacity.

- Rapid growth in retail sales can contribute to rising prices, impacting the Consumer Price Index (CPI). The CPI is a key measure of inflation.

- The Bank of Canada monitors the Consumer Price Index (CPI) closely. It is a critical factor in their interest rate decisions.

- Interest rate adjustments aim to balance economic growth with inflation control. The Bank seeks to find the sweet spot where economic growth is healthy but inflation remains within its target range.

Impact on Businesses and Consumers

Changes in the Bank of Canada's interest rate, heavily influenced by retail sales growth, have significant ramifications for both businesses and consumers.

- Higher interest rates increase borrowing costs for businesses. This can impact investment decisions, expansion plans, and overall profitability.

- Increased interest rates can lead to reduced consumer spending, as borrowing becomes more expensive. This can affect major purchases like homes and cars.

- Lower interest rates can stimulate business investment and consumer spending. This encourages economic growth but carries the risk of increased inflation.

- Uncertainty surrounding interest rate changes can impact economic planning for both businesses and consumers. This uncertainty can lead to hesitancy and reduced investment.

Conclusion

Retail sales growth is a critical factor influencing the Bank of Canada's interest rate decisions. The Bank meticulously analyzes retail sales data alongside other economic indicators to maintain price stability and foster sustainable economic growth. Understanding this complex relationship is vital for navigating the intricacies of the Canadian economy. Staying informed about retail sales data and the Bank of Canada's announcements empowers individuals and businesses to make well-informed decisions about their finances and strategies. Keep a close watch on how retail sales growth impacts the Bank of Canada's interest rate decision for a clearer understanding of the Canadian economic landscape and to better manage your financial future.

Featured Posts

-

Czy Porsche Cayenne Gts Coupe To Idealny Suv Szczegolowy Test

May 25, 2025

Czy Porsche Cayenne Gts Coupe To Idealny Suv Szczegolowy Test

May 25, 2025 -

Fallece Eddie Jordan Ultima Hora Sobre Su Muerte

May 25, 2025

Fallece Eddie Jordan Ultima Hora Sobre Su Muerte

May 25, 2025 -

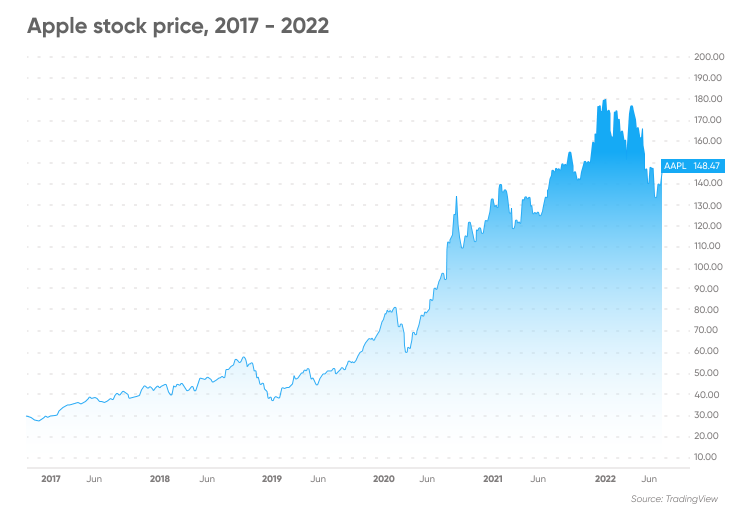

Apple Stock Forecast Analyzing Key Levels Before Q2 Results

May 25, 2025

Apple Stock Forecast Analyzing Key Levels Before Q2 Results

May 25, 2025 -

Police Charge Suspect In Fatal Myrtle Beach Hit And Run

May 25, 2025

Police Charge Suspect In Fatal Myrtle Beach Hit And Run

May 25, 2025 -

Googles I O And Open Ais Io Key Differences And Future Predictions

May 25, 2025

Googles I O And Open Ais Io Key Differences And Future Predictions

May 25, 2025