Apple Stock Forecast: Analyzing Key Levels Before Q2 Results

Table of Contents

Current Market Sentiment and Technical Analysis

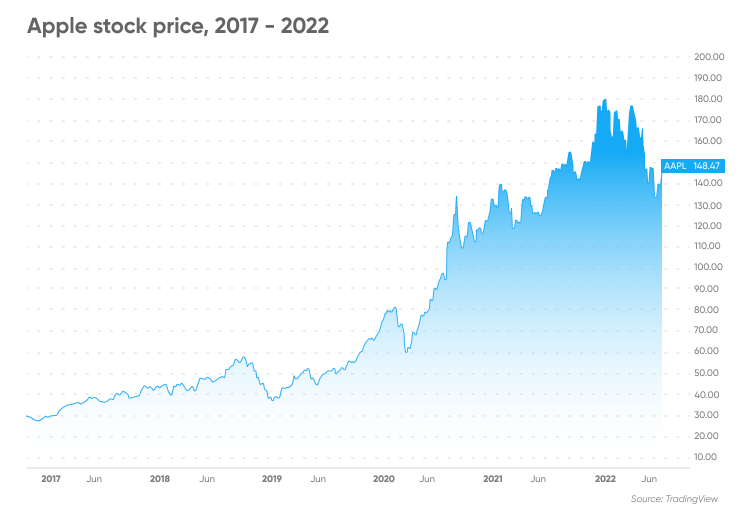

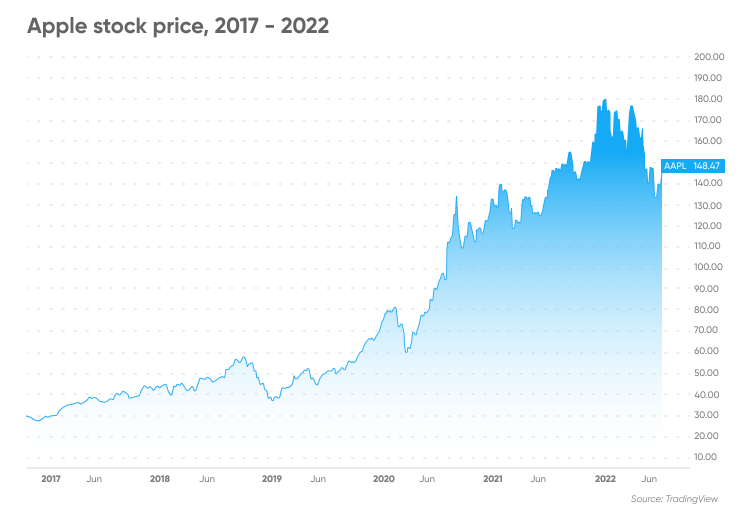

Current investor sentiment towards Apple is cautiously optimistic, reflecting both the company's strong brand reputation and concerns about macroeconomic headwinds. Analyzing the Apple stock chart reveals a period of consolidation, with the Apple stock price fluctuating within a defined range. This Apple stock technical analysis involves examining key support and resistance levels, chart patterns, and trading volume to anticipate potential future price movements. Understanding the market sentiment AAPL is crucial for any Apple stock price prediction.

- Analysis of recent trading volume and volatility: Trading volume has shown increased activity around key support and resistance levels, suggesting potential shifts in investor sentiment. Volatility has been relatively moderate compared to previous periods of uncertainty.

- Identification of significant support and resistance levels on the Apple stock chart: Technical analysis suggests key support levels around $150-$160 and resistance levels near $175-$185. A break above the resistance level could signal a bullish trend, while a drop below support could indicate bearish pressure.

- Discussion of potential breakout scenarios based on technical analysis: A bullish breakout above the resistance level could propel the Apple stock price towards $200 or higher, depending on the strength of the momentum. Conversely, a bearish breakout below support might lead to further declines.

- Overview of prevailing market sentiment (bullish, bearish, neutral): Currently, the market sentiment leans towards neutral, with cautious optimism tempered by global economic uncertainties.

Factors Influencing Q2 Earnings and Apple Stock Price

Several factors will significantly influence Apple's Q2 earnings and, consequently, its stock price. The performance of major product lines – iPhone sales, Mac sales, iPad sales, and the growth of Apple services revenue – will be closely scrutinized. Supply chain issues, while less prominent than in previous quarters, could still exert some influence. The overall market demand for Apple products will be a crucial determinant of the company's financial results. Understanding these details is crucial for any realistic Apple stock forecast.

- Projected iPhone sales and their impact on overall revenue: iPhone sales typically represent a substantial portion of Apple's revenue. Any significant deviation from anticipated sales figures could substantially impact the overall Q2 earnings and subsequently the AAPL stock.

- Analysis of the growth trajectory of Apple's services segment: Apple's services segment continues to demonstrate robust growth, contributing significantly to the company's overall profitability. Sustained growth in this area is crucial for maintaining investor confidence.

- Assessment of potential risks, including macroeconomic factors and competition: Macroeconomic factors such as inflation and interest rate hikes pose challenges to consumer spending, potentially affecting demand for Apple products. Competition from other tech companies remains a factor influencing the Apple stock price.

- Discussion of the expected impact of new product launches (if any): Any new product launches during the quarter could significantly influence Q2 results and market sentiment. The success of these new products will directly impact Apple stock performance.

Analyzing the Impact of Macroeconomic Factors

Macroeconomic factors play a significant role in influencing investor sentiment and, ultimately, the Apple stock price. Inflation, interest rates, and the potential for an economic recession are among the key concerns. These factors affect consumer spending, impacting the demand for Apple's products. Analyzing the correlation between these variables is crucial for accurate Apple stock analysis.

- Discussion of the impact of rising interest rates on investor sentiment: Higher interest rates tend to reduce investor appetite for riskier assets, potentially leading to a decline in the Apple stock price.

- Assessment of the potential effects of a global economic slowdown: A global economic slowdown could reduce consumer spending, negatively impacting demand for Apple products and thus its stock price.

- Analysis of the correlation between consumer spending and Apple product sales: A strong correlation exists between consumer spending and Apple product sales. A decrease in consumer spending can directly lead to a decrease in Apple's revenue and consequently, its stock price.

Potential Apple Stock Price Targets and Trading Strategies

Based on the above analysis, several potential price targets can be considered for Apple stock. However, it is important to remember that these are predictions based on current market conditions and could change. This section of the Apple stock forecast outlines potential scenarios and appropriate trading strategies.

- Short-term price target prediction based on technical analysis and Q2 earnings expectations: A short-term price target could range between $165 and $180, depending on the outcome of Q2 earnings and overall market conditions.

- Long-term price target prediction based on Apple's overall growth prospects: A long-term price target might be significantly higher, potentially reaching $220 or more, given Apple’s continuous innovation and expansion into new markets. This depends on continued growth in the services segment and sustained consumer demand.

- Discussion of risk management strategies for Apple stock investments: Risk management is crucial, especially with a volatile stock like AAPL. Diversification, stop-loss orders, and careful position sizing are essential risk mitigation strategies.

- Suggestions for potential trading strategies (e.g., buy-and-hold, swing trading, day trading): Investors may choose different trading strategies based on their risk tolerance and investment goals. Buy-and-hold is suitable for long-term investors, while swing trading and day trading are more suitable for investors comfortable with higher risk.

Conclusion

This Apple stock forecast has analyzed key factors likely to impact Apple's Q2 earnings and subsequent stock price movements, including technical indicators, macroeconomic conditions, and anticipated product sales. By considering these elements, investors can better assess their risk and formulate appropriate trading strategies. Understanding the intricacies of Apple stock price prediction requires a holistic approach.

Call to Action: Stay informed about the upcoming Q2 Apple earnings announcement and continue to monitor key levels for the AAPL stock. Conduct thorough research and consider consulting with a financial advisor before making any investment decisions related to your Apple stock forecast. Remember to always manage your risk effectively when trading in the volatile tech sector. Develop a robust Apple stock analysis strategy and keep up-to-date on all factors influencing the Apple stock forecast.

Featured Posts

-

Best Of Bangladesh Netherlands Event Attracts European Investors

May 25, 2025

Best Of Bangladesh Netherlands Event Attracts European Investors

May 25, 2025 -

Climate Change And The Threat Of Invasive Fungi

May 25, 2025

Climate Change And The Threat Of Invasive Fungi

May 25, 2025 -

Dutch Stocks Suffer Another Setback Amidst Escalating Us Trade War

May 25, 2025

Dutch Stocks Suffer Another Setback Amidst Escalating Us Trade War

May 25, 2025 -

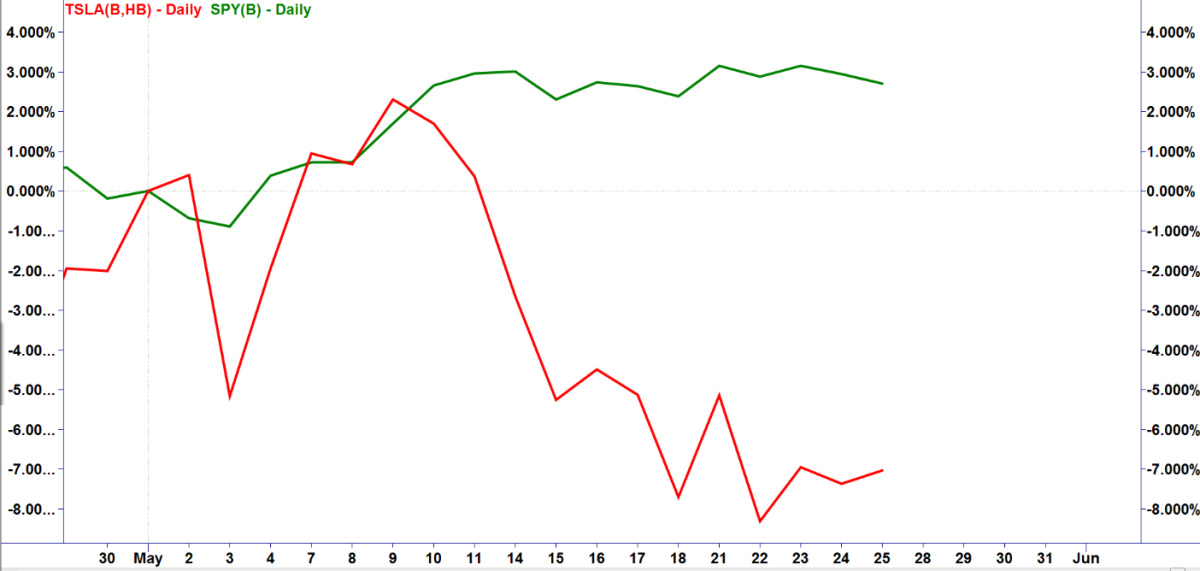

Teslas Future How Elon Musks Recent Behavior Impacts The Company

May 25, 2025

Teslas Future How Elon Musks Recent Behavior Impacts The Company

May 25, 2025 -

Bundesliga Rueckkehr Der Hsv Und Sein Triumphzug

May 25, 2025

Bundesliga Rueckkehr Der Hsv Und Sein Triumphzug

May 25, 2025