Rigetti (RGTI) And IonQ: A Deep Dive Into Quantum Stock Performance In 2025

Table of Contents

Rigetti Computing (RGTI) Stock Performance Outlook for 2025

Analysis of RGTI's Current Market Position:

Rigetti Computing utilizes superconducting qubits, a leading technology in the race towards building fault-tolerant quantum computers. Their current financial standing is a key factor to consider, alongside recent developments in their technology roadmap. Partnerships and collaborations with major players in the industry will also heavily influence their future success. For example, successful collaborations could accelerate the development of their quantum computers and expand their market reach.

- Strengths: Advanced qubit technology, experienced team, growing patent portfolio.

- Weaknesses: Relatively smaller market capitalization compared to some competitors, potential for delays in achieving key milestones.

- Opportunities: Growing demand for quantum computing solutions across various industries, potential for strategic acquisitions.

- Threats: Intense competition from other quantum computing companies, technological hurdles in scaling up qubit systems.

Predicting RGTI Stock Price Movement in 2025:

Several factors will influence RGTI's stock price in 2025. Significant technological breakthroughs, increased market demand for their quantum computing services, and successful partnerships could lead to a bullish scenario. Conversely, delays in technological progress, increased competition, and a slower-than-expected adoption rate of quantum computing could result in a bearish outlook. A neutral scenario would see modest growth, aligning with the overall market trend.

- Key factors driving RGTI stock price: Technological advancements, successful partnerships, market adoption of quantum computing solutions.

- Potential risks and rewards: High risk associated with investing in an emerging technology, but potentially high rewards if the company achieves its technological goals and gains market share.

IonQ Stock Performance Outlook for 2025

Analysis of IonQ's Current Market Position:

IonQ employs trapped ion qubits, another promising technology with its own advantages and disadvantages compared to superconducting qubits. Their financial health, along with recent advancements and strategic collaborations will greatly affect their stock's trajectory. A strong partnership network can bolster their technology development and market penetration.

- Strengths: High-fidelity qubits, strong partnerships, established presence in the quantum computing ecosystem.

- Weaknesses: Potential scaling challenges associated with trapped ion technology, dependence on partnerships for certain aspects of their development.

- Opportunities: Expanding applications of quantum computing across diverse sectors, potential for government funding and grants.

- Threats: Competition from other quantum computing companies, the need for continuous technological innovation to stay ahead.

Predicting IonQ Stock Price Movement in 2025:

IonQ's stock price in 2025 will depend on factors similar to those influencing RGTI's performance. Rapid technological advancements, strong market demand, and successful commercialization of their quantum computing systems could lead to significant stock price appreciation. On the other hand, slower-than-expected progress, increased competition, and unforeseen technical challenges could result in a pessimistic outcome. A neutral scenario would involve moderate growth.

- Key factors driving IonQ stock price: Technological breakthroughs, strategic alliances, successful commercial deployment of quantum computers.

- Potential risks and rewards: Similar high-risk, high-reward profile as RGTI, with potential for substantial returns if the company successfully delivers on its promises.

Comparative Analysis: RGTI vs. IonQ in 2025

Both RGTI and IonQ are significant players in the quantum computing industry, each with its own technological approach. While both face intense competition, their different qubit technologies present distinct advantages and disadvantages. RGTI's superconducting qubits potentially offer greater scalability, while IonQ's trapped ion qubits may offer higher qubit fidelity in the near term. The ultimate success of each company depends on factors such as technological breakthroughs, securing significant contracts, and strategic partnerships.

- Key comparative factors: Qubit technology, scalability, market penetration, financial strength, partnerships.

- Advantages and disadvantages of investing: Both offer high-risk, high-reward potential. Investors should carefully evaluate their risk tolerance and diversification strategies.

Investing in Quantum Computing Stocks: Risks and Opportunities

Investing in quantum computing stocks like RGTI and IonQ is inherently high-risk, high-reward. The technology is still in its early stages, and significant challenges remain before widespread commercial adoption is achieved. However, the potential rewards are substantial, given the transformative potential of quantum computing across various industries. Investors should carefully consider the following:

- Risk factors: Technological uncertainty, intense competition, long-term investment horizon required, potential for significant losses.

- Potential returns: High potential for long-term capital appreciation if the industry grows as expected.

- Investment strategies: Diversification is crucial to mitigate risk, combining investments in quantum computing stocks with other assets.

Making Informed Decisions on Quantum Computing Stocks like Rigetti (RGTI) and IonQ in 2025

Based on our analysis, the projected stock performance of both RGTI and IonQ in 2025 hinges on technological advancements, market adoption, and the overall growth of the quantum computing sector. Their stock prices will be influenced by factors like securing key partnerships, overcoming technological hurdles, and navigating the competitive landscape. Thorough research is paramount before investing in these or any other quantum computing stocks. Remember that this is a high-risk, high-reward area with significant potential for both substantial gains and losses.

Stay ahead of the curve in the exciting world of quantum computing stocks; learn more about RGTI and IonQ today! Conduct your own comprehensive research and make informed investment decisions based on your risk tolerance and financial goals. Remember that this analysis is not financial advice.

Featured Posts

-

Understanding The Love Monster Character Analysis And Story Impact

May 21, 2025

Understanding The Love Monster Character Analysis And Story Impact

May 21, 2025 -

Efimeries Iatron Patras Savvatokyriako

May 21, 2025

Efimeries Iatron Patras Savvatokyriako

May 21, 2025 -

Understanding The Friday Rally In D Wave Quantum Qbts Shares

May 21, 2025

Understanding The Friday Rally In D Wave Quantum Qbts Shares

May 21, 2025 -

Apples Llm Siri A Comeback Strategy

May 21, 2025

Apples Llm Siri A Comeback Strategy

May 21, 2025 -

Cubs Game Lady And The Tramp Hot Dog Moment Goes Viral

May 21, 2025

Cubs Game Lady And The Tramp Hot Dog Moment Goes Viral

May 21, 2025

Latest Posts

-

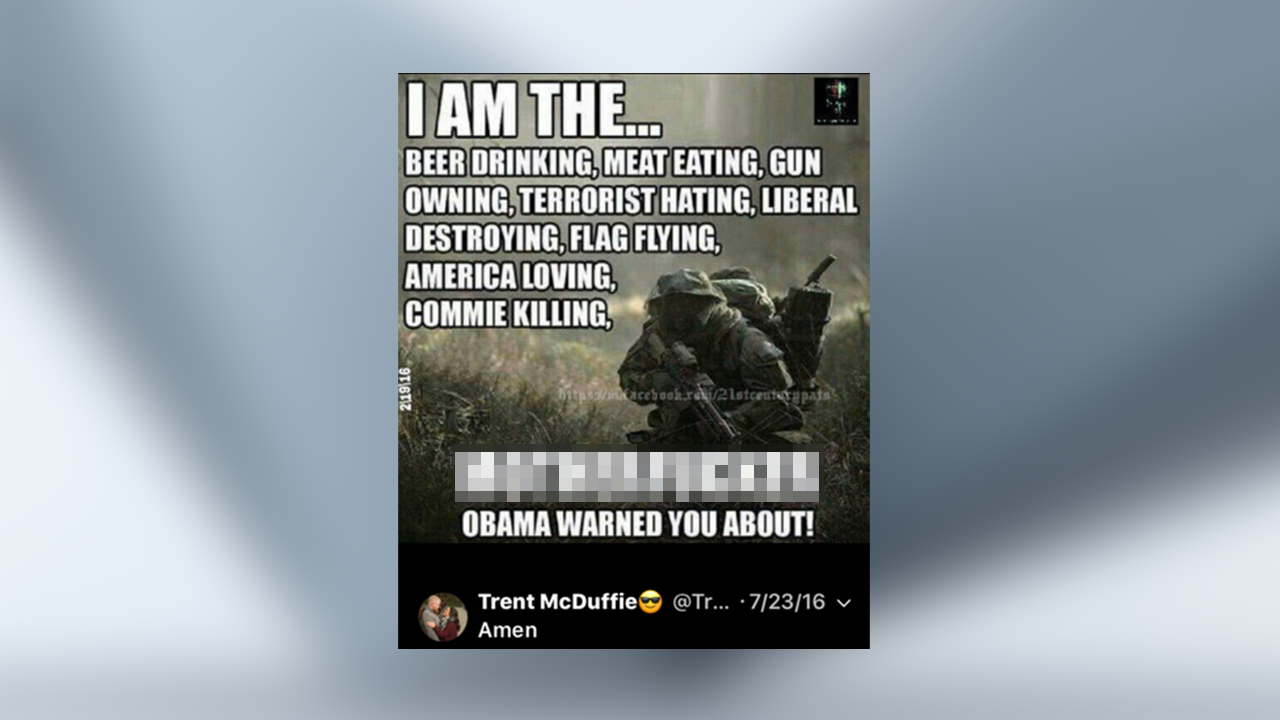

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025 -

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025 -

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025 -

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025