S&P/TSX Composite Index: Canada's Stock Market Achieves New Intraday Record

Table of Contents

Factors Contributing to the S&P/TSX Composite Index's Record High

Several interconnected factors have propelled the S&P/TSX Composite Index to its new intraday high, painting a positive picture for the Canadian stock market and the broader Canadian economy.

Strong Corporate Earnings

Robust earnings reports from major Canadian companies across diverse sectors have been a significant driver of the TSX's recent surge. Many companies have exceeded analysts' expectations, contributing substantially to the index's growth.

- Energy Sector Boom: Energy companies, fueled by elevated oil and natural gas prices, have reported record profits. For example, [insert example company name] saw a [percentage]% increase in Q[quarter] earnings, exceeding forecasts by [percentage]%.

- Technology Sector Strength: The Canadian technology sector has also shown remarkable resilience, with several companies posting significant revenue and profit growth driven by [mention specific technological advancements or market trends]. [Insert example company name] showcased impressive growth in [specific area, e.g., software sales].

- Financial Sector Stability: Canadian financial institutions have demonstrated stability and consistent performance, contributing positively to the overall market sentiment.

Rising Commodity Prices

Canada's resource-rich economy is significantly benefiting from elevated commodity prices. The increase in prices for oil, natural gas, gold, and other key commodities directly translates into higher revenues and profits for Canadian companies listed on the TSX.

- Oil and Gas Price Surge: The ongoing global energy demand has pushed oil and natural gas prices to multi-year highs, boosting the profits of Canadian energy producers and significantly impacting the S&P/TSX Composite Index. [Include a chart or graph illustrating the correlation between commodity prices and the TSX].

- Gold's Safe-Haven Appeal: Gold prices have also seen a rise, benefiting Canadian gold mining companies. This reflects a flight to safety in uncertain global economic conditions.

- Impact on Related Sectors: Rising commodity prices also positively impact related sectors like transportation and manufacturing, contributing to overall economic growth.

Global Economic Factors

While the Canadian economy is performing well, global economic factors also play a role in influencing investor confidence in the TSX.

- International Trade: Positive developments in international trade, particularly with key trading partners like the US, can boost Canadian exports and corporate earnings.

- Interest Rates: While rising interest rates can impact certain sectors negatively, the current rate environment appears to be manageable for the Canadian economy, fostering a relatively positive outlook.

- Geopolitical Events: While geopolitical instability can create uncertainty, the relative stability in certain global regions has contributed to investor confidence. [Mention specific geopolitical factors and their influence on the Canadian stock market].

Increased Investor Confidence

The surge in the S&P/TSX Composite Index also reflects a significant increase in investor confidence in the Canadian stock market. This confidence stems from several factors:

- Positive Economic Outlook: Forecasts for Canadian economic growth remain relatively positive, bolstering investor sentiment.

- Government Policies: Government initiatives aimed at stimulating economic growth and attracting foreign investment contribute positively to investor confidence.

- Strong Corporate Governance: Improvements in corporate governance and transparency in Canadian businesses enhance investor trust.

Implications for Canadian Investors

The record high of the S&P/TSX Composite Index presents both opportunities and challenges for Canadian investors.

Opportunities and Risks

The current market conditions present several opportunities for investors. However, it's crucial to acknowledge the inherent risks.

- Opportunities: Strong performing sectors like energy and technology offer significant investment potential. However, careful due diligence is essential before making investment decisions.

- Risks: Market corrections are always possible, and inflation remains a concern that could impact investment returns. A diversified investment strategy is crucial to mitigate risk.

- Diversification: Investing across multiple sectors and asset classes is vital to reduce risk and maximize potential returns in the Canadian stock market.

Sector-Specific Performance

Analyzing the performance of individual sectors within the S&P/TSX Composite Index provides a granular understanding of market dynamics.

- High-Performing Sectors: [Identify specific high-performing sectors and explain the reasons behind their success].

- Underperforming Sectors: [Identify underperforming sectors and analyze the potential factors contributing to their underperformance].

- Investment Strategies: Understanding sector-specific performance allows investors to tailor their investment strategies accordingly.

Conclusion

The S&P/TSX Composite Index's achievement of a new intraday record high underscores the strength of the Canadian economy and the positive outlook for Canadian investors. This growth is fueled by strong corporate earnings, rising commodity prices, and increasing investor confidence. However, understanding both opportunities and risks is vital for successful investment in the Canadian stock market.

Call to Action: Stay informed about the S&P/TSX Composite Index and its constituent companies to make informed investment decisions in Canada's dynamic stock market. Learn more about how to invest in the TSX and capitalize on this exciting period of growth. Monitor the S&P/TSX Composite Index regularly for future market trends. Understanding the S&P/TSX Composite Index is key to navigating the Canadian investment landscape effectively.

Featured Posts

-

Fortnites Cowboy Bebop Collaboration Pricing For Faye Valentine And Spike Spiegel Skins

May 17, 2025

Fortnites Cowboy Bebop Collaboration Pricing For Faye Valentine And Spike Spiegel Skins

May 17, 2025 -

Tran Dau Dang Mong Cho Djokovic Vs Alcaraz Tai Ban Ket Miami Open 2025

May 17, 2025

Tran Dau Dang Mong Cho Djokovic Vs Alcaraz Tai Ban Ket Miami Open 2025

May 17, 2025 -

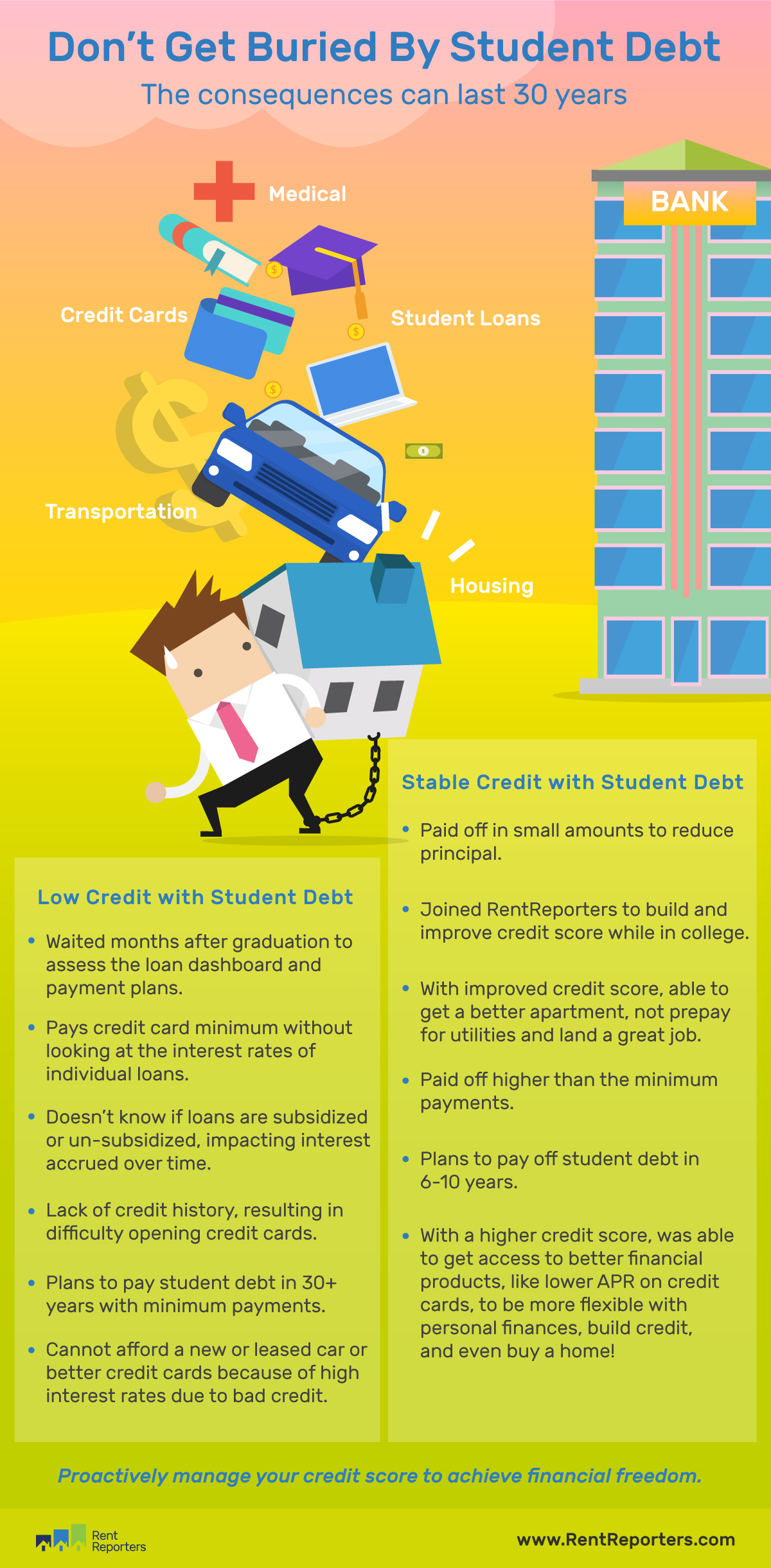

The Impact Of Student Loan Debt On Your Ability To Buy A Home

May 17, 2025

The Impact Of Student Loan Debt On Your Ability To Buy A Home

May 17, 2025 -

Top Rated No Kyc Casinos With Instant Withdrawals 7 Bit Casino

May 17, 2025

Top Rated No Kyc Casinos With Instant Withdrawals 7 Bit Casino

May 17, 2025 -

Justes Jocytes Karjeros Etapas Vilerbane Oficialus Pabaiga

May 17, 2025

Justes Jocytes Karjeros Etapas Vilerbane Oficialus Pabaiga

May 17, 2025