Sensex Today: 700+ Point Surge, Nifty Reclaims 18800 - LIVE Market Updates

Table of Contents

Sensex's 700+ Point Surge: A Detailed Look

The Sensex's 700+ point gain represents a significant percentage increase, marking one of the strongest single-day rallies in recent times. This surge reflects a positive shift in investor sentiment and is fueled by several key factors. To put this into perspective, let's consider the historical context: [Insert data comparing this surge to previous significant daily movements – e.g., percentage change compared to average daily fluctuations in the last 6 months/year].

Contributing factors to this impressive surge include:

- Positive Global Market Trends: Global markets showed robust growth, largely driven by [mention specific global events impacting market sentiment, e.g., positive economic data from the US, easing geopolitical tensions]. This positive global sentiment spilled over into the Indian markets.

- Strong Foreign Institutional Investor (FII) Buying: Significant FII inflows injected substantial liquidity into the market, bolstering investor confidence and driving up prices. [Insert data on FII investment figures if available].

- Positive Domestic Economic Indicators: Recent positive economic indicators, such as [mention specific positive economic data, e.g., strong manufacturing PMI, improved consumer confidence], have boosted investor optimism about India's economic growth prospects.

- Sector-Specific Performance Drivers: Several sectors contributed significantly to the rally. The IT sector witnessed strong gains driven by [mention specific reasons, e.g., positive earnings reports, increased outsourcing demand], while the banking and FMCG sectors also performed exceptionally well due to [mention reasons].

[Insert chart/graph visualizing Sensex movement throughout the day. Clearly label axes and key data points.] Key benchmark levels like [mention specific levels] were decisively broken during this impressive rally.

Nifty Reclaims 18800: Significance and Implications

The Nifty reclaiming the 18800 mark holds significant psychological importance. This level had acted as a resistance point in recent weeks. Breaking through this barrier signifies increased investor confidence and a potential shift towards a more bullish market sentiment.

The implications of this milestone include:

- Increased Investor Confidence: The successful breach of 18800 reinforces positive sentiment and encourages further investment.

- Potential for Further Upward Movement: This breakthrough could signal a sustained upward trend, although short-term corrections are always possible.

- Impact on Different Investment Strategies: This rally significantly impacts various investment strategies, potentially altering portfolio allocations and trading decisions for many investors.

Comparing the current Nifty performance with recent trends and forecasts shows [Insert comparative data/analysis, e.g., percentage change compared to last month/quarter, correlation with forecast predictions].

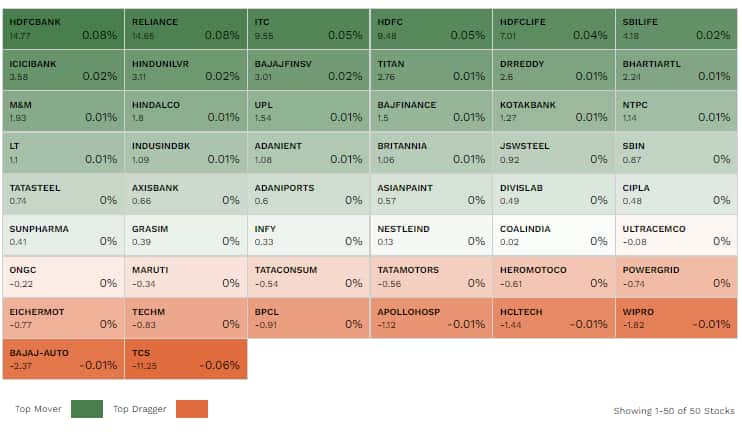

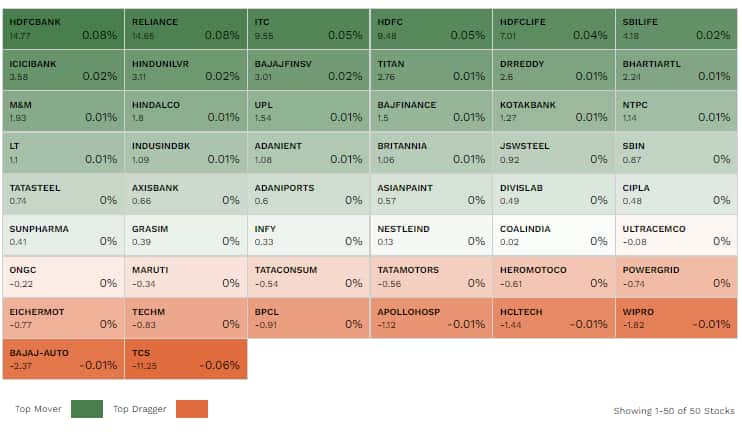

Top Gainers and Losers: Sector-Wise Performance

Analyzing the top gainers and losers provides further insights into today's market dynamics. [Mention the best-performing sectors and their percentage gains, and the worst-performing sectors and their percentage losses. Include specific company examples if relevant and impactful]. The reasons behind this performance variation can be attributed to factors like [mention reasons for the sector's performance; e.g., company-specific news, industry trends, global demand changes].

| Sector | Top Gainers (%) | Top Losers (%) |

|---|---|---|

| IT | [Data] | [Data] |

| Banking | [Data] | [Data] |

| FMCG | [Data] | [Data] |

| [Other Sectors] | [Data] | [Data] |

Expert Opinion and Market Outlook: What's Next?

Market analysts are cautiously optimistic about the near-term outlook. “[Insert quote from a market analyst regarding the current market sentiment and future predictions]”, says [Analyst's Name], [Analyst's Title] at [Company Name].

The potential trajectory of the Sensex and Nifty in the short to medium term depends on several factors, including [mention factors like global economic conditions, upcoming policy announcements, and potential risks]. Potential challenges include [mention potential challenges, e.g., rising interest rates, geopolitical uncertainties]. Upcoming economic events like [mention upcoming economic events that may influence market movements] will play a crucial role in shaping the market's direction.

Live Market Updates Throughout the Day (if applicable):

[This section would be updated dynamically throughout the trading day with real-time information on market movements and significant events.]

Conclusion: Stay Updated on Sensex and Nifty Movements

Today's market witnessed a significant rally, with the Sensex surging over 700 points and the Nifty reclaiming the crucial 18800 level. This impressive performance was driven by a combination of positive global cues, strong FII buying, and positive domestic economic indicators. While the outlook remains cautiously optimistic, staying informed about daily market movements is crucial for making sound investment decisions.

To stay updated on "Sensex Today" and other vital market analyses, regularly check back for updates and subscribe to our email alerts or follow us on social media [Insert links to social media pages]. Understanding the nuances of the Sensex and Nifty is key to navigating the dynamic world of Indian stock market investment.

Featured Posts

-

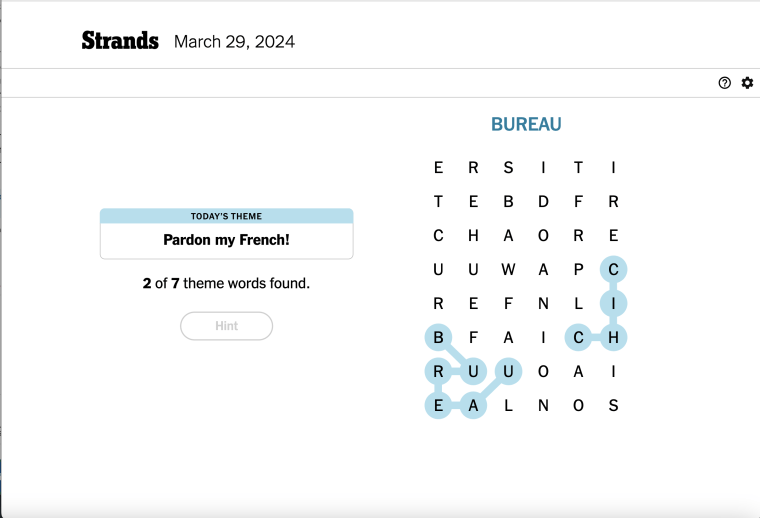

Nyt Strands Puzzle Solutions Wednesday March 12 2024 374

May 09, 2025

Nyt Strands Puzzle Solutions Wednesday March 12 2024 374

May 09, 2025 -

F1 Community United In Grief Tributes From Colapinto Perez And More

May 09, 2025

F1 Community United In Grief Tributes From Colapinto Perez And More

May 09, 2025 -

Jazz Cash K Trade Partnership Opening Doors To Stock Market Investing

May 09, 2025

Jazz Cash K Trade Partnership Opening Doors To Stock Market Investing

May 09, 2025 -

Oilers Star Leon Draisaitl Lower Body Injury And Potential Playoff Return

May 09, 2025

Oilers Star Leon Draisaitl Lower Body Injury And Potential Playoff Return

May 09, 2025 -

2025 82 000

May 09, 2025

2025 82 000

May 09, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025 -

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025 -

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025 -

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025 -

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025