Should You Invest In This SPAC Rivaling MicroStrategy? Risk Vs. Reward

Table of Contents

Understanding the SPAC's Business Model and Target Market

SPACs operate by raising capital through an initial public offering (IPO) to acquire a private company. The success hinges on identifying a suitable target that aligns with the SPAC's investment strategy and market analysis. This unnamed SPAC, focusing on [insert SPAC's stated sector, e.g., blockchain technology or decentralized finance], aims to capitalize on the burgeoning cryptocurrency market. Understanding its business model requires careful due diligence.

- Acquisition Strategy: The SPAC's stated strategy involves acquiring a company in the [insert specific sector] sector, leveraging [insert specific technology or market trend]. This suggests a focus on high-growth potential within the cryptocurrency ecosystem.

- Target Market Analysis: The target market size is significant, considering the rapid expansion of the cryptocurrency market. However, the competitive landscape is fiercely competitive, requiring strong differentiation and execution. A thorough analysis of the competitive landscape is crucial.

- Management Team Assessment: The SPAC's management team comprises experienced professionals with a proven track record in [insert relevant industry experience], suggesting a degree of competence in navigating the complexities of the cryptocurrency market. Further investigation into their specific experience is recommended.

Comparing the SPAC to MicroStrategy's Bitcoin Strategy

MicroStrategy's significant Bitcoin holdings have made it a prominent player in the cryptocurrency investment space. While this unnamed SPAC’s approach isn't fully disclosed, comparing potential strategies is vital. Both aim for substantial returns but differ in their risk tolerance and diversification. MicroStrategy's strategy is heavily concentrated in Bitcoin, while the SPAC may diversify across various blockchain-related assets or companies.

- Investment Strategies: MicroStrategy's is primarily a long-term bet on Bitcoin's price appreciation. The SPAC may pursue a more diversified approach, including investments in other cryptocurrencies, DeFi protocols, or blockchain infrastructure companies, potentially mitigating some risk.

- Bitcoin Price Volatility: Both strategies are exposed to the inherent volatility of the cryptocurrency market. However, diversification could potentially buffer the SPAC against Bitcoin's price fluctuations. This needs careful consideration when evaluating the risk profile.

- Diversification Strategies: MicroStrategy lacks diversification within crypto. The SPAC might diversify across various cryptocurrencies, blockchain projects or even traditional assets, potentially reducing risk, but also potentially limiting returns.

Assessing the Risks Involved in Investing in This SPAC

Investing in SPACs inherently carries risks. The lack of operational history and the uncertainty surrounding the eventual target acquisition pose significant challenges. Financial risk is high, and market volatility significantly impacts the SPAC's value before and after a merger. Regulatory uncertainty further complicates the landscape.

- Risk of Merger Failure: The SPAC might fail to identify and acquire a suitable target company, leading to the return of investor capital with minimal returns, or even losses.

- Shareholder Value Dilution: The terms of the merger could dilute the value of existing shares, potentially leading to lower returns than initially anticipated.

- Legal and Regulatory Risks: The cryptocurrency space is subject to evolving regulatory landscapes globally. Changes in regulations could negatively affect the SPAC’s investments and overall value.

Evaluating the Potential Rewards of Investing in This SPAC

Despite the risks, potential rewards are substantial. A successful acquisition of a high-growth company in the cryptocurrency sector could yield considerable returns. Early adoption in a rapidly expanding market offers a significant first-mover advantage, potentially leading to exponential growth.

- Return on Investment (ROI) Scenarios: Depending on the target acquisition and its performance, potential returns range from modest gains to substantial multiples of the initial investment.

- Target Market Growth Potential: The target market for blockchain technology and related assets is rapidly growing, presenting significant opportunities for high growth in the long term.

- Early Adoption Advantage: Investing in a SPAC entering this early-stage market could offer significant gains if the company successfully leverages its first-mover advantage and capitalizes on the market’s exponential growth.

Conclusion: Making an Informed Investment Decision

Investing in this SPAC presents a high-risk, high-reward scenario. The potential for substantial returns is evident, particularly given the growth potential of the cryptocurrency market. However, the risks associated with SPACs, the volatility of the cryptocurrency market, and the uncertainty surrounding the target acquisition should not be underestimated. A thorough comparison with MicroStrategy's established strategy helps understand the potential implications.

Before investing in this SPAC rivaling MicroStrategy, conduct thorough due diligence and consider seeking professional financial advice to make an informed investment decision. Weigh the potential risks and rewards carefully to determine if this aligns with your overall investment strategy. Remember, the decision should be based on your individual risk tolerance and investment goals.

Featured Posts

-

Golden Knights Defeat Blue Jackets Hills 27 Saves Secure The Win

May 09, 2025

Golden Knights Defeat Blue Jackets Hills 27 Saves Secure The Win

May 09, 2025 -

Nottingham Attack Inquiry Experienced Judge Appointed To Oversee Investigation

May 09, 2025

Nottingham Attack Inquiry Experienced Judge Appointed To Oversee Investigation

May 09, 2025 -

Unprovoked Racist Attack Woman Charged With Murder After Stabbing

May 09, 2025

Unprovoked Racist Attack Woman Charged With Murder After Stabbing

May 09, 2025 -

Zolotaya Malina 2024 Dakota Dzhonson Sredi Samykh Provalnykh Filmov Goda

May 09, 2025

Zolotaya Malina 2024 Dakota Dzhonson Sredi Samykh Provalnykh Filmov Goda

May 09, 2025 -

Analiza E Formacionit Te Gjysmefinaleve Te Liges Se Kampioneve Fuqia E Psg Se

May 09, 2025

Analiza E Formacionit Te Gjysmefinaleve Te Liges Se Kampioneve Fuqia E Psg Se

May 09, 2025

Latest Posts

-

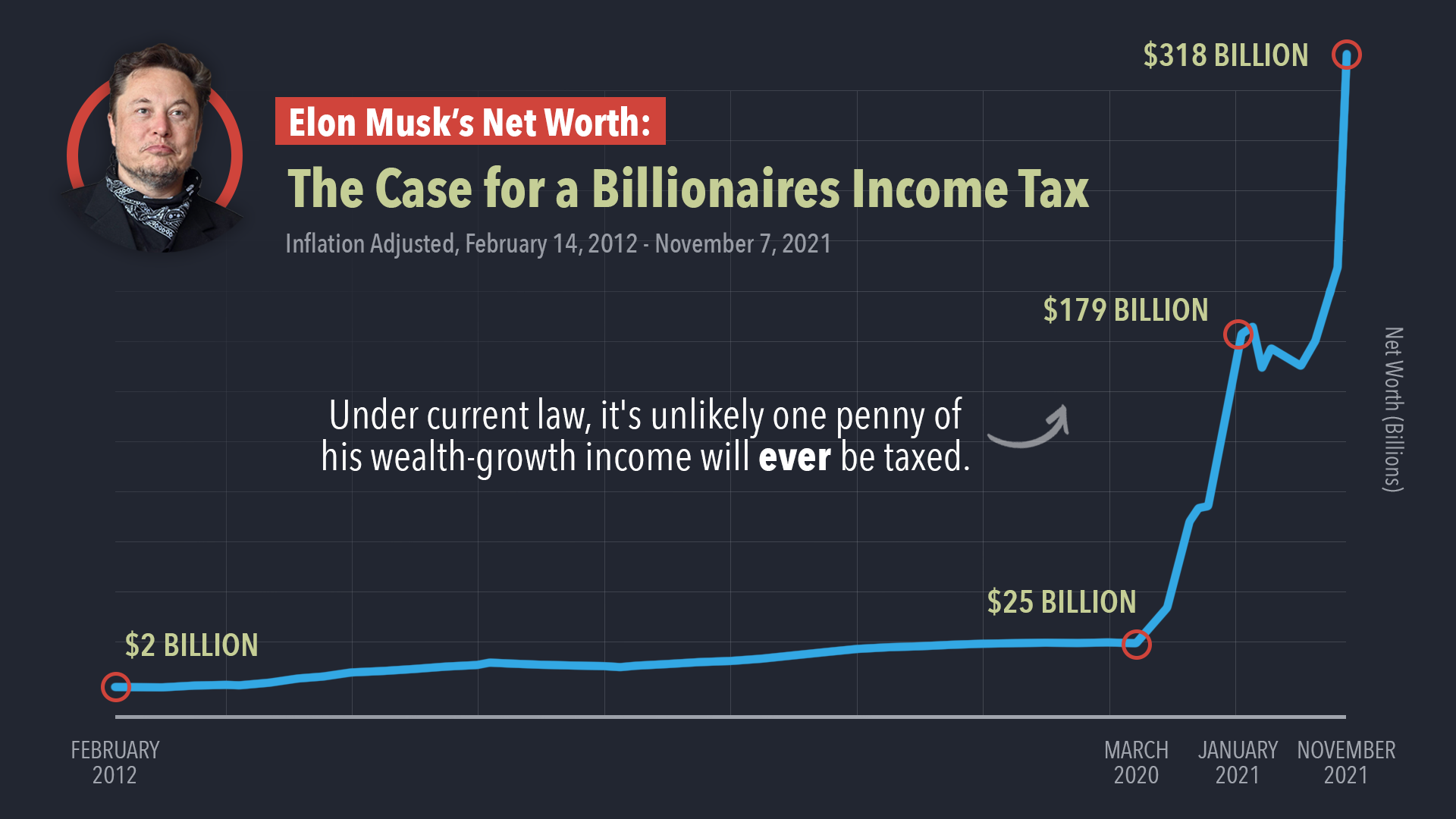

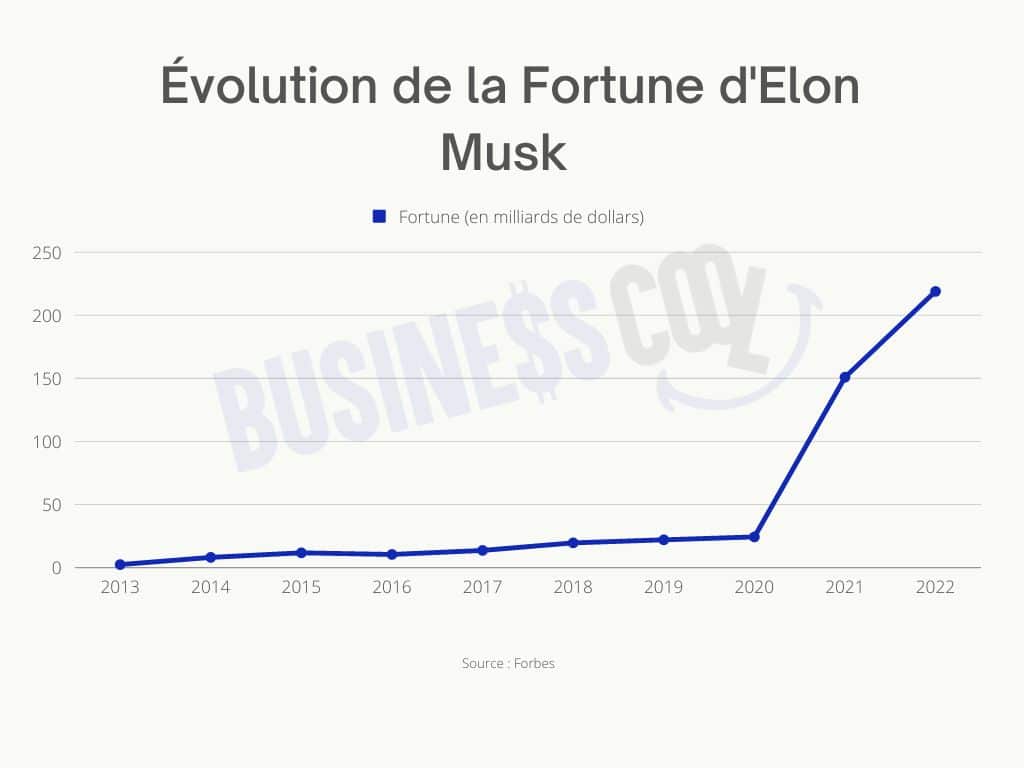

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 10, 2025

Elon Musk Remains Worlds Richest Despite 100 Billion Net Worth Loss Hurun Global Rich List 2025

May 10, 2025 -

Examining The Relationship Between Us Economic Power And Elon Musks Wealth

May 10, 2025

Examining The Relationship Between Us Economic Power And Elon Musks Wealth

May 10, 2025 -

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Trends

May 10, 2025

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Trends

May 10, 2025 -

Teslas Success And Elon Musks Fortune An Examination Of Us Economic Factors

May 10, 2025

Teslas Success And Elon Musks Fortune An Examination Of Us Economic Factors

May 10, 2025 -

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025

Analyzing Elon Musks Net Worth The Role Of Us Economic Conditions

May 10, 2025