SPAC Stock Outperforming MicroStrategy? A Deep Dive For Investors

Table of Contents

Understanding SPAC Performance

SPAC Returns vs. Market Benchmarks

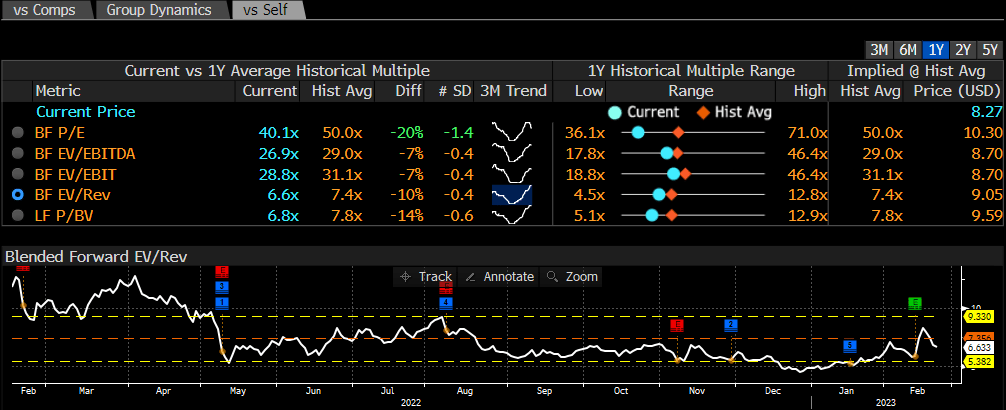

Comparing average SPAC returns to broader market indices like the S&P 500 and Nasdaq over various timeframes reveals interesting insights into SPAC investment performance. While pre-merger SPAC returns are often modest, reflecting the speculative nature of the investment, post-merger performance is crucial. Analyzing this data requires careful consideration of several factors.

- Post-merger performance: This is the critical metric. A successful merger with a strong target company can significantly boost returns, while a poorly executed merger can lead to substantial losses.

- Pre-merger returns (if applicable): Some SPACs trade actively before a merger target is announced. Analyzing these pre-merger movements can highlight market sentiment and investor expectations.

- Factors influencing returns: Market conditions, the quality of the target company's business, the experience of the SPAC management team, and the integration process all play a vital role in determining post-merger returns. Data visualizations, such as charts comparing SPAC returns to market benchmarks over different time periods, provide a clearer picture of overall SPAC investment performance. Tracking key metrics like average annualized return and standard deviation is crucial for evaluating the overall success rate of SPAC investments.

Factors Influencing SPAC Success

The success of a SPAC hinges on several interconnected factors. Understanding these elements is crucial for investors seeking to identify high-potential SPAC investments.

- Experienced management teams: SPAC sponsors with a proven track record of successful mergers and acquisitions are more likely to deliver superior returns. Their expertise in identifying promising target companies and executing efficient integration processes is invaluable.

- Strong target company selection: The fundamental strength and growth potential of the target company are paramount. A high-quality target with a robust business model and strong management is more likely to succeed post-merger.

- Favorable market conditions: Broad market trends and economic conditions influence SPAC performance. A bullish market generally provides a more favorable environment for SPAC mergers and acquisitions.

- Successful mergers and acquisitions: The seamless integration of the target company into the SPAC's structure is vital. A well-executed merger, minimizing disruption and maximizing synergy, is essential for achieving positive post-merger returns. Diligence in assessing the synergies and the potential for operational efficiency improvements is crucial for potential investors.

MicroStrategy's Bitcoin Strategy

MicroStrategy's Bitcoin Holdings and Performance

MicroStrategy's significant and highly publicized Bitcoin investment strategy has dramatically shaped its performance. The company's decision to allocate a substantial portion of its assets to Bitcoin has made it a focal point for discussions on the intersection of traditional finance and cryptocurrency.

- Investment size: MicroStrategy has made substantial investments in Bitcoin, making it one of the largest corporate holders of the cryptocurrency.

- Purchase timing: The timing of MicroStrategy's Bitcoin purchases has significantly influenced its returns.

- Bitcoin price fluctuations: The highly volatile nature of Bitcoin has directly impacted MicroStrategy's stock price, leading to significant swings in valuation.

- Impact on stock price: The correlation between Bitcoin's price and MicroStrategy's stock price is strong, highlighting the inherent risk associated with this strategy.

Risks Associated with MicroStrategy's Bitcoin Strategy

MicroStrategy's heavy reliance on Bitcoin exposes it to several substantial risks. Investors should carefully consider these before investing in the company.

- Volatility of Bitcoin: Bitcoin's price is notoriously volatile, making MicroStrategy's investment highly susceptible to market swings.

- Regulatory uncertainty: The regulatory landscape surrounding cryptocurrencies is constantly evolving, presenting potential risks to MicroStrategy's Bitcoin holdings.

- Potential for significant losses: The value of Bitcoin could plummet, resulting in substantial losses for MicroStrategy.

- Concentration risk: MicroStrategy's heavy concentration in Bitcoin creates a significant concentration risk. A sharp decline in Bitcoin's price could severely damage the company's financial health.

Direct Comparison: SPACs vs. MicroStrategy

Performance Metrics Comparison

A direct comparison of SPACs and MicroStrategy requires analyzing various key performance indicators (KPIs) over a relevant period. This comparison helps assess which investment approach might offer better returns and manage risks effectively.

- Annualized returns: Comparing average annualized returns for both investment classes reveals which has generated better overall returns.

- Standard deviation: Measuring the volatility of returns for each investment class helps assess the risk associated with each.

- Sharpe ratio: This risk-adjusted return metric helps determine which investment offers better risk-adjusted returns.

- Maximum drawdown: This indicates the maximum percentage decline from a peak to a trough for each investment type, highlighting the potential for losses. Using tables and graphs allows for a clear visual comparison.

Investment Strategy Implications

The performance comparison and risk profiles of SPACs and MicroStrategy have significant implications for investor strategy.

- Diversification benefits: Investors should carefully consider diversification. Holding both SPACs and Bitcoin (through MicroStrategy or direct investment) might offer diversification benefits. However, it is crucial to note that this strategy might still be highly volatile.

- Risk tolerance: The risk tolerance of investors should guide their investment decisions. SPACs and MicroStrategy's Bitcoin holdings both carry higher-than-average risk.

- Long-term vs. short-term investment horizons: The suitability of either investment depends on the investor's time horizon. Long-term investors might be better positioned to handle the volatility associated with both investment classes.

Conclusion

This analysis highlights that while SPACs may have shown periods of outperformance compared to MicroStrategy, this is not consistently the case. Both investment approaches involve substantial risk. SPAC success heavily depends on successful mergers and strong target company selection. MicroStrategy's performance is heavily tied to Bitcoin's price volatility. The inherent risks of significant losses and regulatory uncertainty cannot be ignored. Before investing in either SPACs or MicroStrategy, conduct thorough due diligence. Consider your risk tolerance and investment goals. Further research into individual SPACs and MicroStrategy's ongoing strategy is crucial for informed investment decisions. Conduct your own thorough research before making any investment decisions related to SPACs or MicroStrategy.

Featured Posts

-

Thailand Seeks New Bot Governor Amidst Rising Tariff Concerns

May 09, 2025

Thailand Seeks New Bot Governor Amidst Rising Tariff Concerns

May 09, 2025 -

Dogovor Mezhdu Frantsiey I Polshey Detali Soglasheniya Makrona I Tuska

May 09, 2025

Dogovor Mezhdu Frantsiey I Polshey Detali Soglasheniya Makrona I Tuska

May 09, 2025 -

Leon Draisaitl Injured Oilers Leading Goal Scorer Exits Game

May 09, 2025

Leon Draisaitl Injured Oilers Leading Goal Scorer Exits Game

May 09, 2025 -

Don De Cheveux A Dijon Pour La Bonne Cause

May 09, 2025

Don De Cheveux A Dijon Pour La Bonne Cause

May 09, 2025 -

Can Palantir Reach A Trillion Dollar Valuation By 2030

May 09, 2025

Can Palantir Reach A Trillion Dollar Valuation By 2030

May 09, 2025

Latest Posts

-

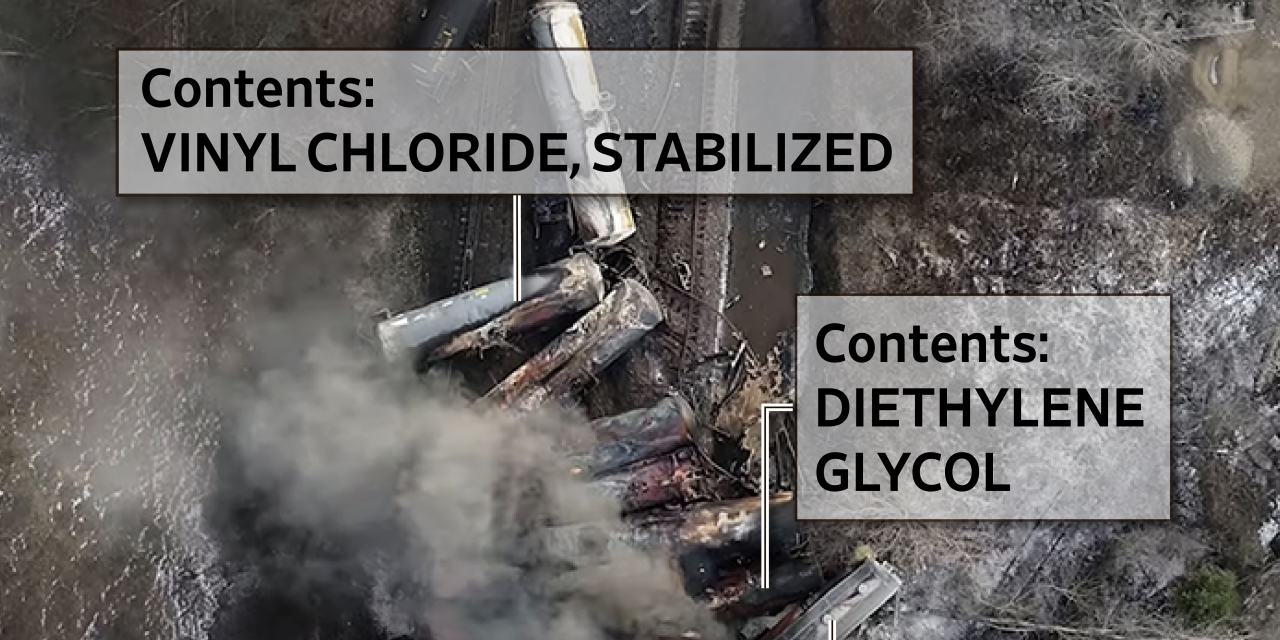

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025 -

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025 -

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025 -

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025