Stock Market Rally: Nasdaq, S&P 500 Gains On Tariff Hopes — Live Updates

Table of Contents

Nasdaq's Strong Performance

The technology-heavy Nasdaq Composite is leading the charge in today's stock market rally, demonstrating impressive gains. This surge is likely due to a combination of factors, including positive earnings reports from key tech companies and easing trade tensions between major global economies. The Nasdaq stock market is known for its sensitivity to global economic news, and today's positive sentiment is clearly reflected in its performance.

- Significant gains in major tech stocks: Apple, Microsoft, and Google are showing particularly strong growth, contributing significantly to the overall Nasdaq rally. This indicates a renewed confidence in the technology sector.

- Increased investor confidence: Positive earnings reports and the prospect of reduced trade barriers are bolstering investor confidence, leading to increased investment in Nasdaq-listed companies.

- Strong Nasdaq Index Performance: The Nasdaq index itself has seen a substantial percentage increase, marking a significant milestone for the tech-heavy market. This is a key indicator of the overall health of the tech sector.

- Potential for continued growth: Based on current market trends and the continued positive news flow, the potential for continued growth in the Nasdaq remains strong. However, market volatility should always be considered.

S&P 500's Positive Movement

The S&P 500, a broader market index representing 500 large-cap U.S. companies, is also experiencing considerable gains, reflecting a positive sentiment across various sectors. This widespread growth suggests that the positive market sentiment extends beyond the technology sector. The positive movement in the S&P 500 is a strong indicator of overall market health and investor confidence.

- Growth across multiple sectors: The rally is not confined to technology; gains are being observed across multiple sectors, including financials, consumer goods, and healthcare. This broad-based growth points to a robust economic outlook.

- Impact of positive economic data: Recent positive economic indicators, such as improved consumer confidence and strong employment numbers, are contributing to the positive market sentiment. These factors support the increased investor confidence.

- Key S&P 500 companies driving the rally: Several key S&P 500 companies are showing significant growth, further propelling the overall index upwards. Analyzing these companies provides a deeper understanding of the driving forces behind the rally.

- Positive implications for the economic outlook: The S&P 500's positive movement strongly suggests a positive outlook for the broader U.S. economy and global markets. This is a significant indicator for future economic forecasts.

The Role of Tariff Hopes

The primary catalyst behind today's stock market rally appears to be renewed hope for reduced trade tariffs, specifically between major global trading partners. Reports suggesting potential breakthroughs in trade negotiations have injected significant optimism into the market. This lessening of trade tensions is boosting investor confidence and encouraging investment.

- Specific tariff news driving optimism: [Insert specific details about recent tariff-related news, e.g., statements from government officials, reports on ongoing negotiations, or specific tariff reductions announced]. These developments are fueling the positive market reaction.

- Expert opinion on tariff reductions: [Quote or paraphrase opinions from financial experts on the likelihood of tariff reductions and their potential impact on the market]. This provides valuable context and analysis of the situation.

- Historical impact of tariffs on the stock market: A review of the historical impact of tariffs on market performance provides a valuable perspective on the current situation and potential future consequences. Understanding the past helps to predict the future.

- Potential long-term effects of reduced trade barriers: Reduced trade barriers have the potential to stimulate economic growth, increase global trade, and positively impact corporate earnings – all contributing to a more positive market outlook.

Live Market Updates and Analysis

This section will provide live updates on the key market indices, including real-time data on the Nasdaq and S&P 500, and ongoing analysis of market trends and volatility. We will track key indicators and offer insights into potential future market movements. This live feed ensures you are constantly informed of the latest market dynamics.

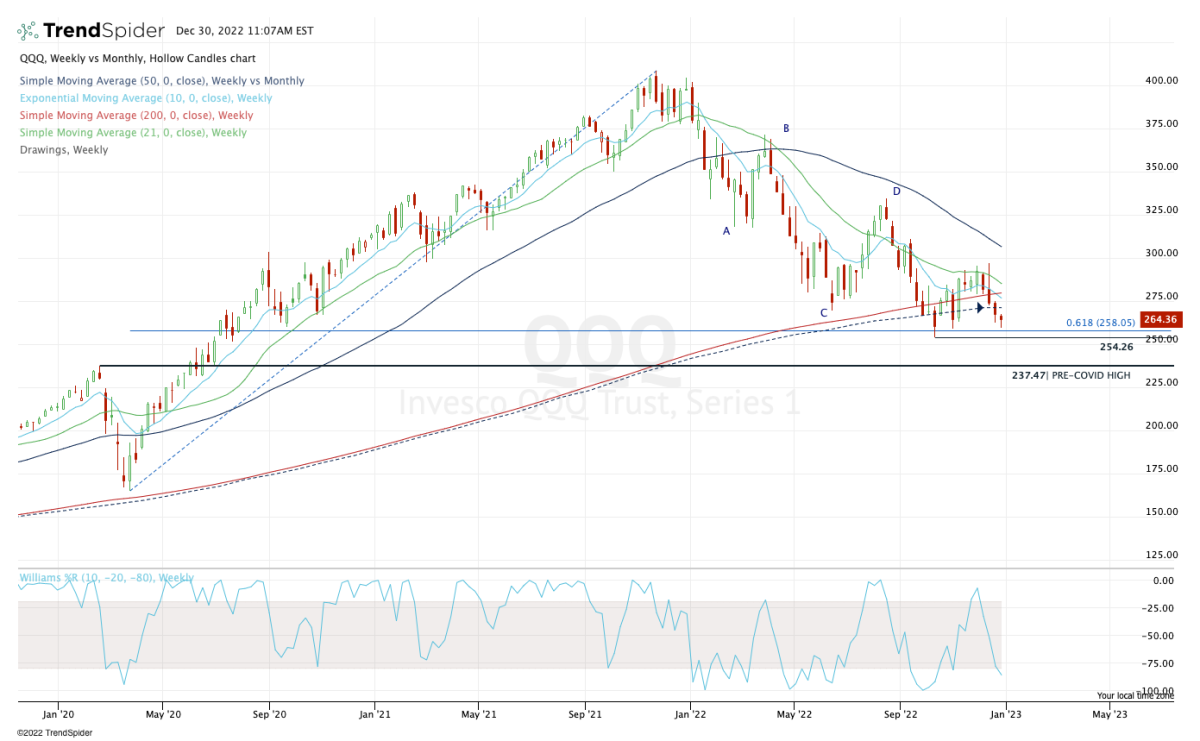

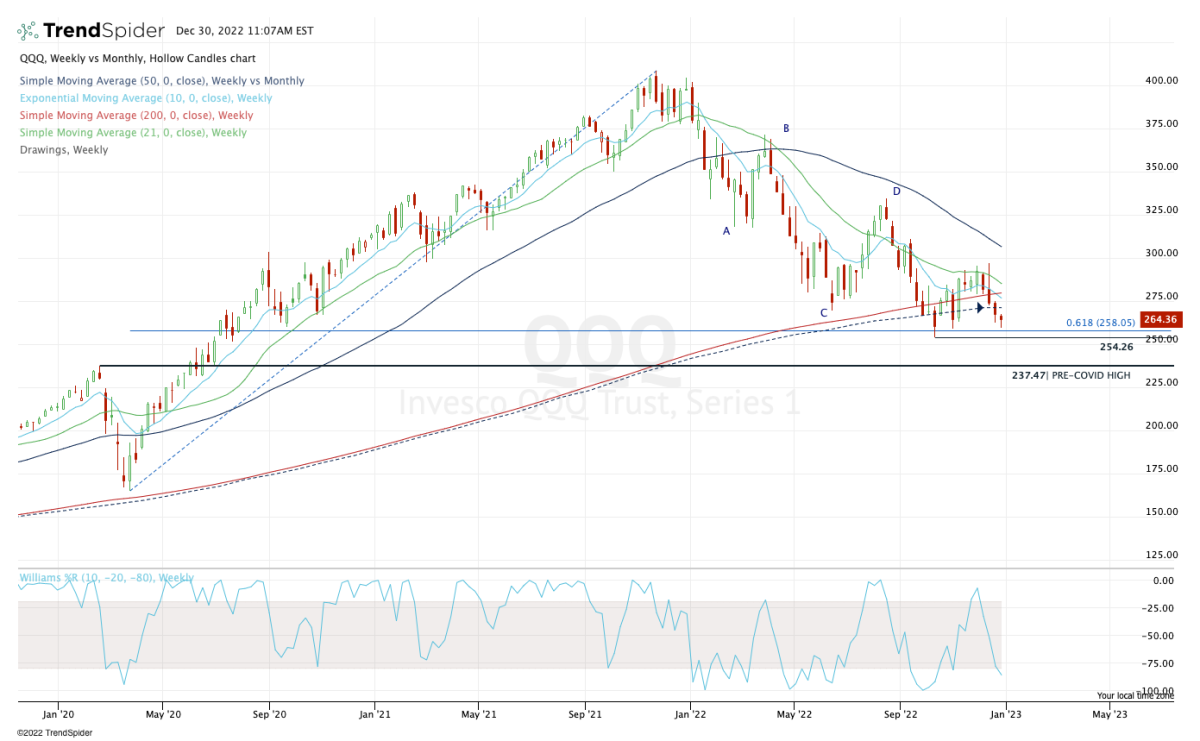

- Real-time charts and graphs: [Insert space for real-time charts and graphs visualizing the performance of the Nasdaq and S&P 500]. This visual representation helps in understanding market dynamics quickly.

- Commentary on significant market shifts: We will provide ongoing commentary on any significant shifts in market trends and volatility. Understanding these fluctuations is crucial for informed investment decisions.

- Analysis of market volume and trading activity: Analysis of market volume and trading activity provides insights into the strength and sustainability of the current rally. This data helps determine the underlying sentiment.

- Predictions and outlook based on current trends: Based on current trends and data analysis, we will offer predictions and an outlook on potential future market movements. However, remember that market prediction is inherently uncertain.

Conclusion

Today's stock market rally, with significant gains in the Nasdaq and S&P 500, is largely attributed to renewed optimism surrounding tariff reductions. The easing of trade tensions has boosted investor confidence, leading to increased investment and positive market movements. The sustained impact of this rally will depend on further developments concerning trade negotiations and other economic factors. This stock market rally underscores the importance of monitoring global economic events.

Call to Action: Stay informed about the latest developments in this exciting stock market rally! Keep checking back for live updates and analysis on the Nasdaq, S&P 500, and the impact of tariff hopes on market performance. Monitor our site for continuous coverage of the stock market rally and its implications for your investment strategy.

Featured Posts

-

The Fishermans Ring Its Symbolic Destruction Following A Popes Death

Apr 24, 2025

The Fishermans Ring Its Symbolic Destruction Following A Popes Death

Apr 24, 2025 -

Nba

Apr 24, 2025

Nba

Apr 24, 2025 -

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 24, 2025

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 24, 2025 -

Cantor Tether And Soft Bank A 3 Billion Crypto Spac On The Horizon

Apr 24, 2025

Cantor Tether And Soft Bank A 3 Billion Crypto Spac On The Horizon

Apr 24, 2025 -

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025