Stock Market Update: Sensex Gains, Nifty Above 17,950

Table of Contents

Sensex's Impressive Surge

The Sensex experienced a remarkable [Insert Percentage Gain]% surge today, closing at [Insert Closing Value of Sensex]. This represents a substantial increase compared to yesterday's closing value of [Insert Yesterday's Closing Value] and the previous week's closing value of [Insert Previous Week's Closing Value]. Trading volume also showed a significant increase, indicating robust market activity. This impressive rise can be attributed to several key factors:

- Positive Global Cues: Positive economic data from major global markets, coupled with easing inflation concerns in several key economies, instilled confidence among investors.

- Strong Corporate Earnings: Several leading Indian companies announced strong quarterly earnings, boosting investor sentiment and driving up stock prices.

- Improved Investor Sentiment: Overall, a more positive outlook on the Indian economy and its growth potential contributed to the market’s upward trend.

Bullet Points:

- Positive global economic data, including [mention specific data points like US GDP growth, or Eurozone inflation figures].

- Strong corporate earnings reports from companies like [mention specific companies and sectors].

- Improved investor confidence driven by [mention specific policy changes or announcements].

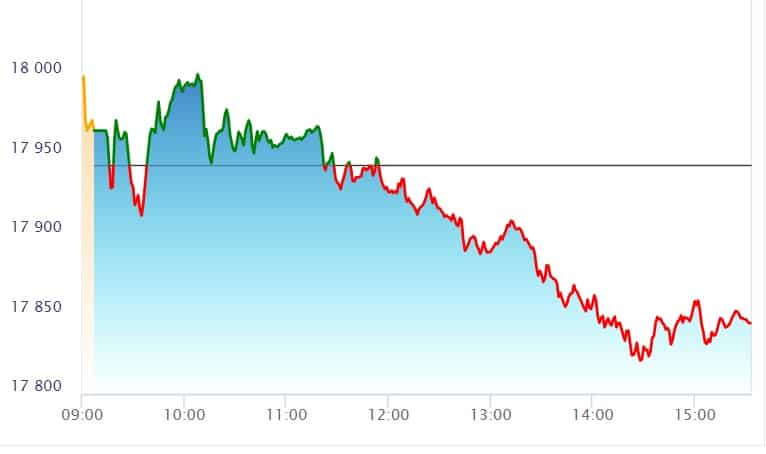

- Key sectors driving the Sensex gains include IT, Financials, and FMCG. [Include a chart visualizing Sensex performance over the last week or month].

Nifty50 Crossing 17,950: A Milestone Achieved

The Nifty50 index crossing the 17,950 mark is a significant milestone, signifying continued growth and investor confidence in the Indian stock market. This achievement holds immense implications for long-term investors, reinforcing the potential for substantial returns. The performance across different Nifty sectors contributed to this impressive feat.

Bullet Points:

- Key sectors contributing to Nifty50’s gains include Banking, Pharma, and Energy.

- FII (Foreign Institutional Investor) investment showed a [Increase/Decrease] of [Amount], while DII (Domestic Institutional Investor) investment saw a [Increase/Decrease] of [Amount]. This indicates [interpret the impact of FII and DII investment].

- Comparison with other major global indices: The Nifty50’s performance outpaced [mention specific indices like Dow Jones or Nasdaq] indicating relative strength in the Indian market. [Include a comparison chart of Nifty50 against other global indices].

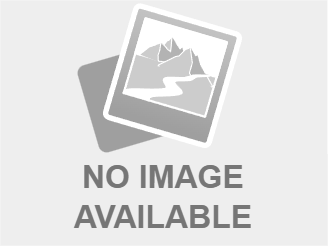

Sector-Wise Performance Analysis

Analyzing the Sectoral Performance reveals a mixed bag. While some sectors outperformed others, understanding these variations is crucial for informed Investment decisions.

| Sector | Performance (%) | Key Drivers |

|---|---|---|

| IT | [Insert %] | Strong export demand, positive global outlook |

| Banking | [Insert %] | Improved credit growth, positive economic outlook |

| FMCG | [Insert %] | Increased consumer spending, rural demand growth |

| Pharma | [Insert %] | Strong domestic and export markets |

| Energy | [Insert %] | Rising energy prices, increased demand |

| [Other Sectors] | [Insert %] | [Insert Reasons] |

[Insert a chart visualizing the data in the table]

Bullet Points:

- Top performing sectors and their key drivers (e.g., IT benefited from strong global demand).

- Underperforming sectors and reasons for underperformance (e.g., certain sectors might be impacted by regulatory changes).

- Potential future performance predictions based on current trends.

Expert Opinions and Market Outlook

Leading financial analysts offer mixed perspectives on the short-term and long-term Stock Market Outlook. While the current Market Gains are encouraging, several factors could influence future performance.

Bullet Points:

- Consensus view from leading analysts: [Summarize the majority view on future market trends – bullish, bearish, or neutral].

- Potential factors that could influence future market performance: [Mention factors like global economic uncertainties, interest rate hikes, geopolitical risks].

- Recommendations for investors: [Suggest strategies like holding, buying, or selling specific sectors based on expert analysis].

Conclusion: Navigating the Stock Market Update: Sensex Gains, Nifty Above 17,950

Today’s Stock Market Update reveals a positive trend, with significant Sensex gains and the Nifty surpassing the 17,950 mark. This upward movement is driven by a combination of global cues, strong corporate earnings, and improved investor sentiment. Sector-wise performance shows a varied picture, with some sectors outperforming others. While the outlook remains positive, it’s crucial to remain aware of potential risks and follow expert advice. To stay informed about future stock market updates and Sensex and Nifty performance, subscribe to our newsletter and consider consulting a financial advisor before making any Investment decisions. Remember to always conduct your own thorough research before making any investment choices.

Featured Posts

-

Your Guide To The Nl Federal Election Candidates

May 09, 2025

Your Guide To The Nl Federal Election Candidates

May 09, 2025 -

Wynne Evans Called Out By Joanna Page During Bbc Show Appearance

May 09, 2025

Wynne Evans Called Out By Joanna Page During Bbc Show Appearance

May 09, 2025 -

Tracking The Billions Musk Bezos And Zuckerbergs Post Trump Presidency Losses

May 09, 2025

Tracking The Billions Musk Bezos And Zuckerbergs Post Trump Presidency Losses

May 09, 2025 -

Nyt Strands Saturday Puzzle April 12 2025 Complete Guide

May 09, 2025

Nyt Strands Saturday Puzzle April 12 2025 Complete Guide

May 09, 2025 -

Draisaitls Lower Body Injury Oilers Playoff Hopes Hinge On His Return

May 09, 2025

Draisaitls Lower Body Injury Oilers Playoff Hopes Hinge On His Return

May 09, 2025

Latest Posts

-

2025 Presidential Politics A Case Study Of The Trump Administration Day 109

May 10, 2025

2025 Presidential Politics A Case Study Of The Trump Administration Day 109

May 10, 2025 -

The Impact Of High Potentials Season 1 Finale On Abc

May 10, 2025

The Impact Of High Potentials Season 1 Finale On Abc

May 10, 2025 -

Day 109 Retrospective On The Trump Administrations Actions On May 8th 2025

May 10, 2025

Day 109 Retrospective On The Trump Administrations Actions On May 8th 2025

May 10, 2025 -

Analyzing The Trump Presidency A Focus On Day 109 May 8th 2025

May 10, 2025

Analyzing The Trump Presidency A Focus On Day 109 May 8th 2025

May 10, 2025 -

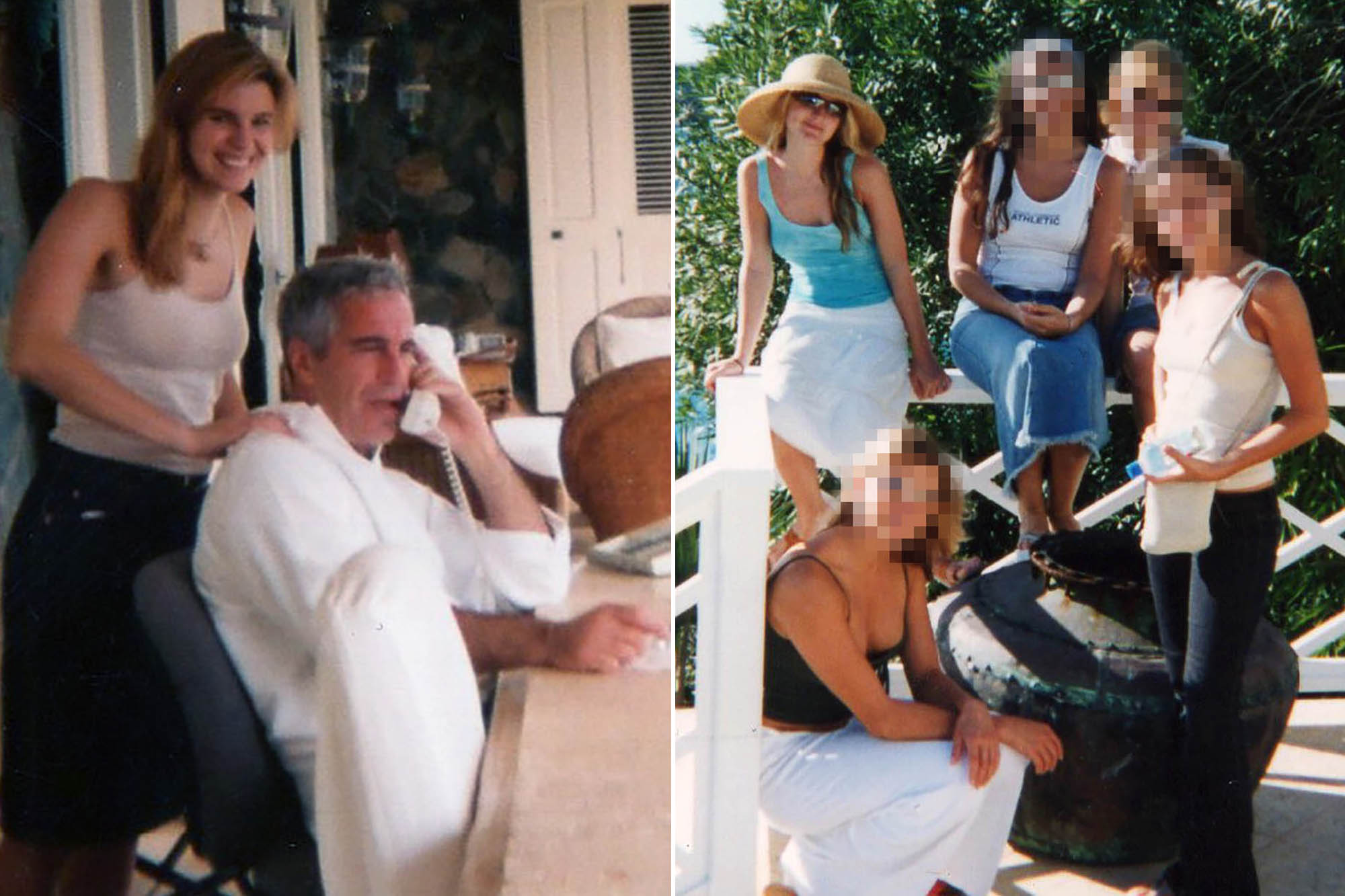

The Jeffrey Epstein Case Public Opinion On Ag Pam Bondis Decision To Release Files

May 10, 2025

The Jeffrey Epstein Case Public Opinion On Ag Pam Bondis Decision To Release Files

May 10, 2025