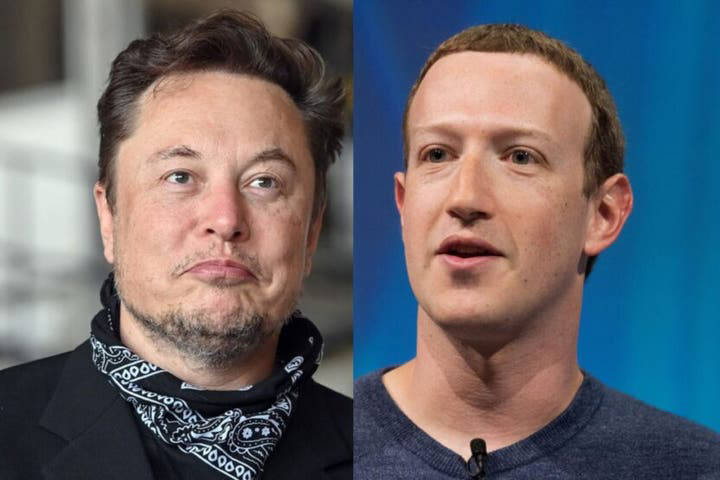

Tracking The Billions: Musk, Bezos, And Zuckerberg's Post-Trump Presidency Losses

Table of Contents

Elon Musk's Post-Trump Presidency Losses

Elon Musk, the CEO of Tesla and SpaceX, experienced significant fluctuations in his net worth following the Trump administration. While he benefited from certain policies during the Trump era, the post-Trump period presented unique challenges impacting his "Post-Trump Presidency Losses."

Tesla Stock Volatility

Tesla's stock price, a major component of Musk's wealth, experienced dramatic volatility post-Trump. This wasn't solely attributable to a single factor but rather a complex interplay of events.

- Tweets and Public Statements: Musk's often controversial tweets and public statements, sometimes impacting Tesla's stock directly, contributed significantly to the volatility. Examples include his pronouncements on cryptocurrency and his occasional impulsive announcements.

- Regulatory Scrutiny: Increased regulatory scrutiny in areas like autonomous driving technology and safety standards also affected investor confidence. This led to periods of uncertainty and subsequent stock price drops.

- Broader Market Trends: The overall market downturn in 2022, coupled with rising interest rates, further impacted Tesla's stock price, contributing significantly to Musk's overall "Post-Trump Presidency Losses."

Data analysis reveals a substantial percentage drop in Tesla's stock value compared to its peak during the Trump administration. This underscores the significant impact of post-Trump economic and political shifts on Tesla's valuation.

SpaceX Challenges

While SpaceX continued to secure contracts, the post-Trump era introduced new challenges.

- Changes in Government Space Exploration Policies: The Biden administration's shift in focus and priorities in space exploration, while not necessarily negative for SpaceX, introduced uncertainty regarding future contract awards.

- Increased Competition: The emergence of new competitors in the commercial space launch industry increased competition for contracts and potentially affected SpaceX's profitability, adding another dimension to Musk's post-Trump financial picture. While specific data on contract wins and losses is often confidential, industry analysts have noted increased competition in the sector.

- Financial Strain from Diversification: Musk’s significant investments in other ventures, such as Twitter, potentially diverted resources and attention away from SpaceX, potentially contributing to financial challenges.

Jeff Bezos's Post-Trump Presidency Losses

Jeff Bezos, founder of Amazon, also faced significant headwinds in the post-Trump era.

Amazon's Antitrust Scrutiny

The increased antitrust scrutiny faced by Amazon following the Trump administration created substantial legal and financial burdens.

- Antitrust Lawsuits and Investigations: Multiple lawsuits and investigations targeting Amazon's dominance in e-commerce, its treatment of third-party sellers, and its anti-competitive practices led to significant legal costs.

- Potential Fines and Settlements: The potential for substantial fines and settlements associated with these lawsuits further contributed to Amazon's financial strain, impacting Bezos's net worth and representing substantial "Post-Trump Presidency Losses."

- Reputational Damage: Negative publicity surrounding these lawsuits potentially affected consumer perception and brand loyalty, potentially impacting sales and market share.

Shifting Consumer Behavior

Changes in consumer behavior post-Trump, including fluctuations in online shopping habits and the rise of competitors, also influenced Amazon's profitability.

- E-commerce Trends: While e-commerce continued to grow, the rate of growth slowed in certain sectors, impacting Amazon’s overall sales.

- Increased Competition: The rise of other e-commerce giants and specialized online retailers intensified competition, squeezing Amazon's profit margins.

- Supply Chain Disruptions: Global supply chain disruptions further impacted Amazon's operations and profitability. These disruptions caused delays and increased costs, impacting bottom lines and adding to Bezos’s "Post-Trump Presidency Losses."

Mark Zuckerberg's Post-Trump Presidency Losses

Mark Zuckerberg, CEO of Meta (formerly Facebook), has faced significant challenges since the end of the Trump presidency.

Facebook's Regulatory Hurdles

Increased regulatory pressure on Facebook/Meta intensified, focusing on privacy concerns and antitrust issues.

- Privacy Regulations: New and stricter privacy regulations worldwide significantly impacted Facebook's data collection practices and advertising revenue model.

- Antitrust Actions: Similar to Amazon, Facebook faced increased antitrust scrutiny, leading to significant legal fees and potential fines.

- Content Moderation Challenges: The continuing debate surrounding content moderation policies and the spread of misinformation on Facebook created ongoing challenges and negative press, influencing investor sentiment and impacting Meta's valuation.

The Metaverse Gamble

Meta's massive investment in the metaverse, while ambitious, also represents a significant financial risk.

- Financial Commitment: The billions of dollars invested in metaverse development represent a considerable financial risk, especially with uncertain returns on investment.

- Market Uncertainty: The long-term success of the metaverse remains uncertain, and any failure of this massive investment could significantly impact Meta's financial health.

- Expert Opinions: While some experts are optimistic about the metaverse's potential, many remain skeptical about its short-to-medium-term viability, adding to the risk associated with Meta's investment.

Conclusion

This analysis of the "Post-Trump Presidency Losses" experienced by Musk, Bezos, and Zuckerberg reveals the multifaceted factors affecting even the most successful entrepreneurs. From market volatility and regulatory changes to shifts in consumer behavior and ambitious, yet risky, business ventures, the post-Trump era presented unique challenges. Understanding these factors is crucial for comprehending the complex dynamics of the global economy and the fortunes of its leading players. Further research into the long-term impact of these "Post-Trump Presidency Losses" is needed to fully grasp the lasting consequences. Continue to track these individuals' financial trajectories and the impact of ongoing political and economic changes by staying updated on relevant news and analysis concerning these prominent figures and their business ventures. Follow our site for more in-depth analyses of these "Post-Trump Presidency Losses" and their implications.

Featured Posts

-

Vatikanskaya Vstrecha Zelenskogo I Trampa Analiz Rezultatov Ot Makrona

May 09, 2025

Vatikanskaya Vstrecha Zelenskogo I Trampa Analiz Rezultatov Ot Makrona

May 09, 2025 -

Wynne Evans And Girlfriend Liz Enjoy Cosy Date Amidst Bbc Meeting Postponement

May 09, 2025

Wynne Evans And Girlfriend Liz Enjoy Cosy Date Amidst Bbc Meeting Postponement

May 09, 2025 -

Deutsche Bank Expands Into Defense Finance Sector With Dedicated Team

May 09, 2025

Deutsche Bank Expands Into Defense Finance Sector With Dedicated Team

May 09, 2025 -

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

May 09, 2025

Over The Counter Birth Control Implications For Reproductive Healthcare After Roe V Wade

May 09, 2025 -

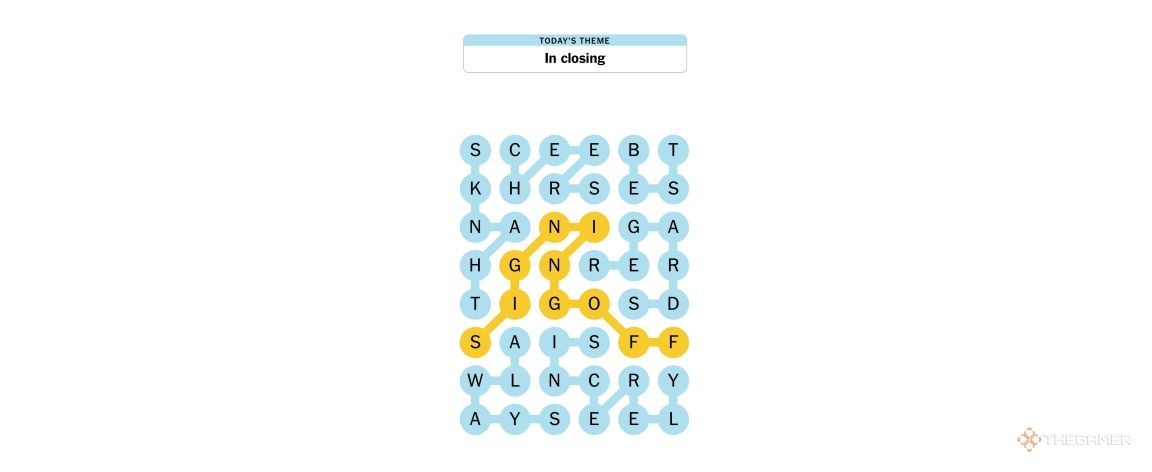

Nyt Strands Today April 1 2025 Clues And Solutions

May 09, 2025

Nyt Strands Today April 1 2025 Clues And Solutions

May 09, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance To Investors

May 10, 2025 -

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025

Relaxed Regulations Urged Indian Insurers And Bond Forward Contracts

May 10, 2025 -

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025

Understanding High Stock Market Valuations Bof As Viewpoint

May 10, 2025 -

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025

Bond Forward Market Indian Insurers Advocate For Simplified Rules

May 10, 2025 -

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025

Whats App Spyware Litigation Metas 168 Million Loss And The Path Forward

May 10, 2025