Stock Market Valuation Concerns? BofA Offers A Reassuring Perspective

Table of Contents

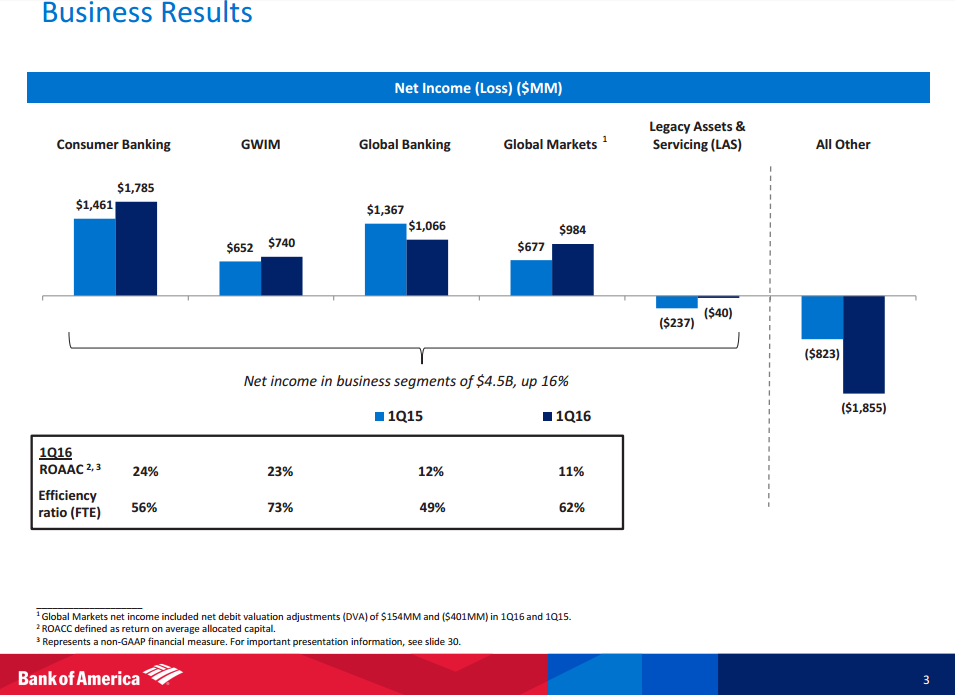

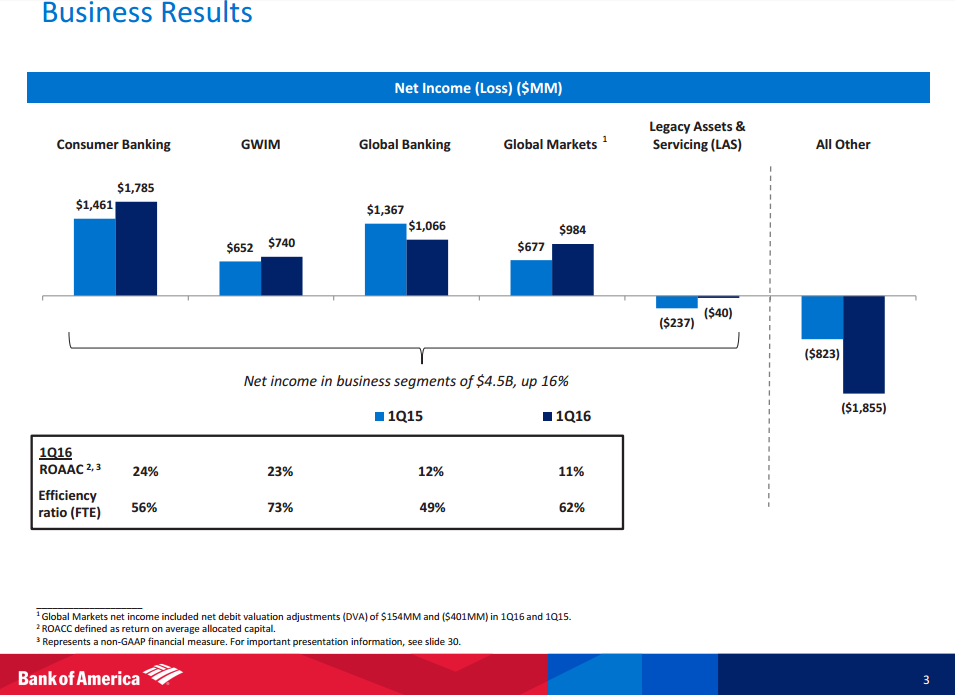

BofA's Key Arguments Against Overvaluation

BofA's analysis counters prevalent anxieties about overvalued stocks by focusing on several key factors. They argue that a balanced perspective requires considering earnings growth, interest rate impacts, and long-term growth potential.

Earnings Growth Projections

BofA's outlook on corporate earnings growth is a cornerstone of their reassuring perspective on stock market valuation. They project robust earnings growth across several key sectors, mitigating concerns about high Price-to-Earnings (P/E) ratios.

- Strong Growth Sectors: BofA anticipates significant earnings growth in technology, healthcare, and consumer discretionary sectors.

- Projected Growth Rates: While precise figures vary depending on the sector and specific companies, BofA projects average earnings growth in the mid-to-high single digits for the next few years. (Specific data citations would be included here referencing BofA research reports).

- P/E Ratio Justification: BofA argues that the current P/E ratios are justified given the expected robust earnings growth. Higher earnings naturally lead to a lower P/E ratio, all else equal.

Interest Rate Considerations

The impact of interest rate hikes on stock valuations is a significant concern for many investors. BofA acknowledges this but believes the effect will be more nuanced than some predict.

- Limited Impact Hypothesis: BofA argues that while higher interest rates increase borrowing costs for companies, the impact on valuations might be limited if earnings growth remains strong. This is because higher interest rates also reflect a healthy economy.

- Inflationary Pressures: BofA incorporates the effects of inflation into its analysis. While inflation erodes purchasing power, it can also lead to increased corporate pricing power, potentially offsetting some of the negative effects of higher interest rates.

- Counterarguments and Responses: The analysis likely addresses counterarguments regarding potential for a recession triggered by interest rate increases, emphasizing their belief in the resilience of the underlying economy.

Long-Term Growth Potential

BofA's positive outlook extends beyond the short term. Their analysis highlights the potential for substantial long-term economic growth, further supporting their view on stock market valuations.

- Key Growth Drivers: BofA identifies technological innovation, global growth opportunities, and ongoing improvements in productivity as key drivers of long-term growth.

- Sector-Specific Optimism: The firm's optimism extends to specific sectors like renewable energy and advanced materials, viewing them as promising areas for future growth.

- Long-Term Forecasts: BofA likely provides long-term forecasts for GDP growth and corporate earnings, which would underpin their overall positive assessment of the market's long-term prospects.

Addressing Specific Investor Concerns

BofA's analysis proactively addresses several specific concerns often voiced by investors regarding stock market valuation.

High P/E Ratios

The seemingly high P/E ratios in certain sectors are a major concern. BofA offers explanations beyond simply dismissing them as excessive.

- Low Interest Rates (Historical Context): BofA acknowledges that historically low interest rates have contributed to higher valuations, but emphasizes the strong earnings growth as a counterbalance.

- Technological Innovation: Investment in innovative technologies often commands higher valuations due to the potential for exponential returns, a point considered by BofA.

- Strong Earnings Growth (Reiteration): The firm reiterates the projected strong earnings growth as a key justification for current P/E ratios.

Geopolitical Risks

Geopolitical factors, such as the war in Ukraine, supply chain disruptions, and persistent inflation, pose undeniable risks. BofA incorporates these into its assessment.

- Risk Mitigation Strategies: The analysis likely explores how companies are adapting to these challenges and mitigating potential negative impacts.

- Regional Diversification: BofA's assessment may highlight the diversification of investments across various regions to reduce the impact of localized geopolitical risks.

- Contingency Planning: The firm likely accounts for various geopolitical scenarios and their potential effect on valuations, presenting a range of possibilities rather than a single prediction.

Market Volatility

Current market volatility is a significant source of investor anxiety. BofA offers perspective on its likely trajectory.

- Causes of Volatility: The analysis probably pinpoints factors like interest rate uncertainty, inflation, and geopolitical events as key drivers of current market volatility.

- Future Volatility Prediction: BofA likely offers its perspective on the likelihood of continued or reduced volatility in the future.

- Advice for Long-Term Investors: The firm likely advises long-term investors to remain disciplined and avoid making rash decisions based on short-term market fluctuations.

Conclusion

BofA's analysis provides a counterpoint to widespread stock market valuation concerns. Their focus on robust earnings growth projections, considered impact of interest rate hikes, and the potential for long-term growth offers a reassuring perspective. By addressing concerns regarding high P/E ratios, geopolitical risks, and market volatility, BofA provides a more nuanced view of the current market landscape. While stock market valuation concerns remain valid, BofA's analysis offers a valuable counterpoint. Explore BofA's full research report to gain a more comprehensive understanding of the current market outlook and make informed decisions about your stock market investments. Understanding stock market valuation is crucial for navigating the complexities of the market.

Featured Posts

-

Bank Of Canadas Rate Pause Expert Analysis From Fp Video

Apr 22, 2025

Bank Of Canadas Rate Pause Expert Analysis From Fp Video

Apr 22, 2025 -

Obamacare Supreme Court Case Trumps Role And Rfk Jr S Potential Gain

Apr 22, 2025

Obamacare Supreme Court Case Trumps Role And Rfk Jr S Potential Gain

Apr 22, 2025 -

Kyivs Decision Point Evaluating Trumps Plan To End The Ukraine War

Apr 22, 2025

Kyivs Decision Point Evaluating Trumps Plan To End The Ukraine War

Apr 22, 2025 -

Hegseths Signal Chat And Pentagon Chaos A Deeper Look

Apr 22, 2025

Hegseths Signal Chat And Pentagon Chaos A Deeper Look

Apr 22, 2025 -

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025

Ai Transforms Repetitive Scatological Documents Into A Profound Poop Podcast

Apr 22, 2025

Latest Posts

-

Wynne And Joanna All At Sea A Review

May 10, 2025

Wynne And Joanna All At Sea A Review

May 10, 2025 -

Nottingham Hospital Data Breach Over 90 Nhs Staff Accessed Victim Records

May 10, 2025

Nottingham Hospital Data Breach Over 90 Nhs Staff Accessed Victim Records

May 10, 2025 -

Emmerdale Star Amy Walsh Defends Wynne Evans Amidst Strictly Scandal

May 10, 2025

Emmerdale Star Amy Walsh Defends Wynne Evans Amidst Strictly Scandal

May 10, 2025 -

Wynne Evans Faces Backlash Amy Walshs Response To Strictly Controversy

May 10, 2025

Wynne Evans Faces Backlash Amy Walshs Response To Strictly Controversy

May 10, 2025 -

Sex Slur Scandal Wynne Evans Removed From Go Compare Advertising Campaign

May 10, 2025

Sex Slur Scandal Wynne Evans Removed From Go Compare Advertising Campaign

May 10, 2025