Bank Of Canada's Rate Pause: Expert Analysis From FP Video

Table of Contents

Understanding the Bank of Canada's Decision to Pause

The Bank of Canada's decision to pause interest rate increases comes after a period of aggressive rate hikes aimed at curbing inflation. Several key economic factors contributed to this decision.

- Current inflation levels and the Bank of Canada's target: While inflation remains above the Bank of Canada's target of 2%, recent data suggests a slowing trend. This deceleration, although gradual, provided some breathing room for the central bank.

- Recent economic growth data and its implications: Economic growth has shown signs of softening, indicating a potential cooling of the economy. This reduced the urgency for further aggressive rate hikes.

- Potential risks and uncertainties affecting the Canadian economy: Global economic uncertainty, geopolitical tensions, and potential housing market vulnerabilities all played a role in the Bank's cautious approach.

The rationale behind the pause likely stems from a desire to assess the impact of previous rate hikes on the economy. The Bank aims to avoid overtightening monetary policy, which could trigger a recession. Their statements likely highlighted the need for a more data-driven approach, closely monitoring key economic indicators before making further decisions.

Expert Analysis from FP Video: Key Takeaways

The FP Video provides invaluable insights from leading economists and financial analysts who dissect the Bank of Canada's rate pause. Their expert opinions offer a crucial perspective on the current economic landscape and future projections.

- Experts' views on the current state of the Canadian economy: The consensus among experts seems to be that the Canadian economy is navigating a delicate balancing act between inflation control and economic growth.

- Predictions for future interest rate movements: The FP Video's experts offer varying predictions. Some anticipate further rate hikes if inflation proves sticky, while others suggest a prolonged pause or even potential rate cuts depending on economic data. The consensus leans toward a cautious and data-dependent approach by the Bank of Canada.

- Potential impacts of the rate pause on various sectors (housing, employment, etc.): The experts discuss the potential positive impacts on the housing market, with a pause potentially easing pressure on borrowers. However, they also highlight the need to monitor employment figures closely, as a prolonged pause could influence the labor market.

Impact of the Rate Pause on the Canadian Economy

The Bank of Canada's rate pause will have far-reaching implications across various sectors of the Canadian economy. Both short-term and long-term effects need to be carefully considered.

- Impact on consumer spending and borrowing: The pause could provide some relief to consumers burdened by high interest rates, potentially stimulating spending and borrowing.

- Effects on the housing market: A pause might stabilize or even slightly boost the housing market by reducing mortgage costs, although this depends on other market factors.

- Implications for businesses and investments: Businesses might see improved borrowing conditions, encouraging investments and expansion.

- Potential ripple effects on global markets: The Bank of Canada's decision could influence global market sentiment and potentially impact other central banks' monetary policy decisions.

Alternative Scenarios and Future Outlook

The future direction of interest rates remains uncertain. Several scenarios are possible, depending on evolving economic indicators.

- Scenario 1: Continued pause: The Bank of Canada might maintain the pause for an extended period, closely monitoring inflation and economic growth.

- Scenario 2: Further rate hikes: If inflation proves more persistent than anticipated, the Bank could resume rate hikes to bring inflation back to its target.

- Scenario 3: Potential rate cuts: If economic growth slows significantly, the Bank might consider rate cuts to stimulate the economy.

Numerous factors will influence the Bank of Canada's future decisions, including inflation data, employment numbers, global economic conditions, and housing market developments. The degree of uncertainty remains high.

Conclusion

The Bank of Canada's rate pause marks a significant turning point in its monetary policy. The FP Video's expert analysis offers valuable insights into the complexities of this decision and its potential consequences. Understanding the rationale behind the pause, expert predictions, and potential future scenarios is crucial for navigating the evolving Canadian economic landscape. For a deeper dive into the Bank of Canada's interest rate pause analysis, and for expert commentary on Canada's interest rate decision, watch the insightful FP Video for a complete understanding of the Bank of Canada rate pause. [Link to FP Video]

Featured Posts

-

Who Will Bear The Cost Of Trumps Economic Policies

Apr 22, 2025

Who Will Bear The Cost Of Trumps Economic Policies

Apr 22, 2025 -

Cybercriminal Made Millions Targeting Executive Office365 Accounts

Apr 22, 2025

Cybercriminal Made Millions Targeting Executive Office365 Accounts

Apr 22, 2025 -

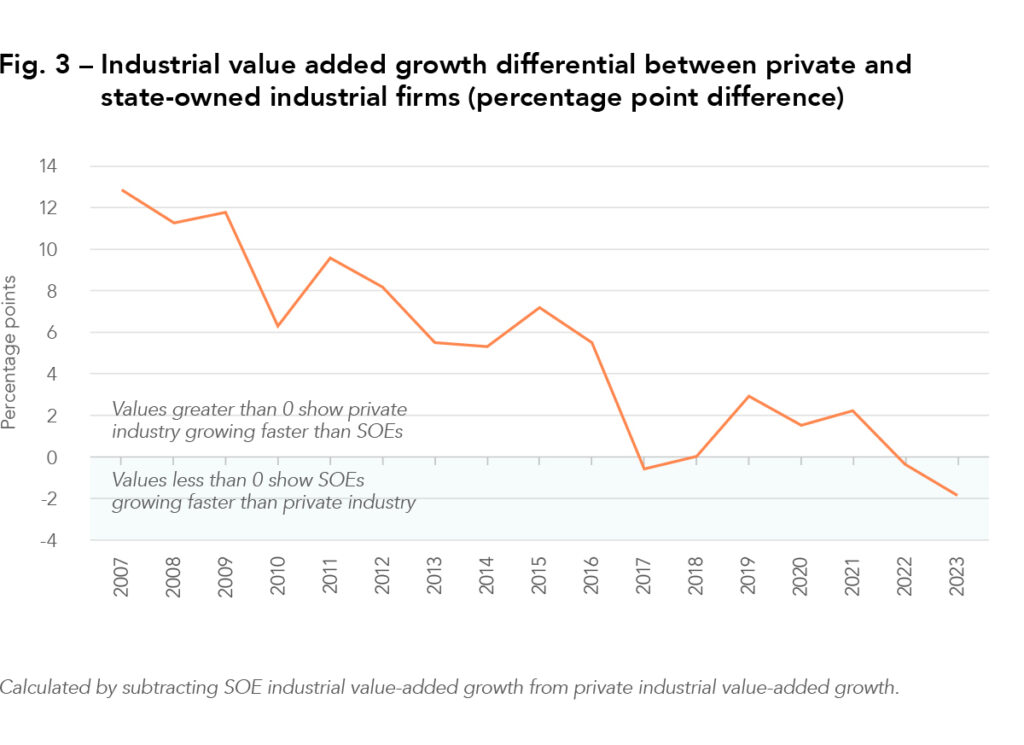

Bmw And Porsches China Challenges A Growing Trend

Apr 22, 2025

Bmw And Porsches China Challenges A Growing Trend

Apr 22, 2025 -

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 22, 2025

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 22, 2025 -

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 22, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 22, 2025

Latest Posts

-

Aoc Condemns Trump Loving Fox News Host

May 10, 2025

Aoc Condemns Trump Loving Fox News Host

May 10, 2025 -

Judge Jeanine Pirro An Intimate Conversation At Fox News Hq

May 10, 2025

Judge Jeanine Pirro An Intimate Conversation At Fox News Hq

May 10, 2025 -

Behind The Scenes With Judge Jeanine Pirro Fears Love And Fox News

May 10, 2025

Behind The Scenes With Judge Jeanine Pirro Fears Love And Fox News

May 10, 2025 -

Harry Styles Reaction To A Hilariously Bad Snl Impression

May 10, 2025

Harry Styles Reaction To A Hilariously Bad Snl Impression

May 10, 2025 -

Harry Styles On That Bad Snl Impression His Honest Response

May 10, 2025

Harry Styles On That Bad Snl Impression His Honest Response

May 10, 2025