Stock Market Valuation Concerns: BofA's Response

Table of Contents

BofA's Stance on Current Stock Market Valuations

BofA's stance on current stock market valuations can be described as cautiously optimistic, leaning towards neutral. While acknowledging the elevated valuations in certain sectors, they haven't issued a blanket warning of an imminent market crash. Their concern stems primarily from stretched valuations in specific areas, not a systemic overvaluation across the entire market.

-

Key Arguments Regarding Current Valuation Metrics: BofA analysts utilize a variety of metrics, including Price-to-Earnings ratios (P/E), cyclically adjusted price-to-earnings ratios (CAPE or Shiller PE), and other fundamental analyses to assess valuation. They acknowledge that some indices and sectors exhibit higher P/E ratios than historical averages, indicating potentially higher risk. However, they also point to factors like low interest rates and strong corporate earnings growth as mitigating factors.

-

Specific Sectors Highlighted: BofA has highlighted the technology sector and certain growth stocks as potentially overvalued, citing high valuations relative to future earnings expectations. Conversely, they've suggested that some value sectors, like financials and energy, may be relatively undervalued, presenting potential opportunities for investors.

-

Price Targets and Predictions: BofA's specific price targets and predictions are usually found in their regularly published research reports and are subject to change. While they may offer forecasts, these should be considered as estimates and not guarantees. It's crucial to consult their latest publications for up-to-date information. (Note: Due to the dynamic nature of financial markets, specific price targets cannot be included here, Always refer to official BofA reports.)

-

Supporting Reports and Publications: BofA publishes extensive research on market valuations and investment strategies. For the most current data and analyses, visit their investor relations website and search for reports related to market outlooks and equity valuations.

Factors Contributing to Valuation Concerns

Several macroeconomic factors contribute to the current concerns surrounding stock market valuations. These interwoven elements create a complex environment that necessitates careful analysis and informed decision-making.

-

Inflation's Impact: Persistent inflation erodes corporate earnings and increases discount rates used in valuation models, thereby reducing the present value of future cash flows and potentially lowering valuations. High inflation also increases the likelihood of central bank intervention, potentially affecting market stability.

-

Interest Rate Hikes: Central banks' responses to inflation, such as raising interest rates, can negatively impact market sentiment and valuations. Higher interest rates make borrowing more expensive for businesses, reducing investment and potentially slowing economic growth. Furthermore, higher rates increase the attractiveness of bonds, potentially diverting investments away from equities.

-

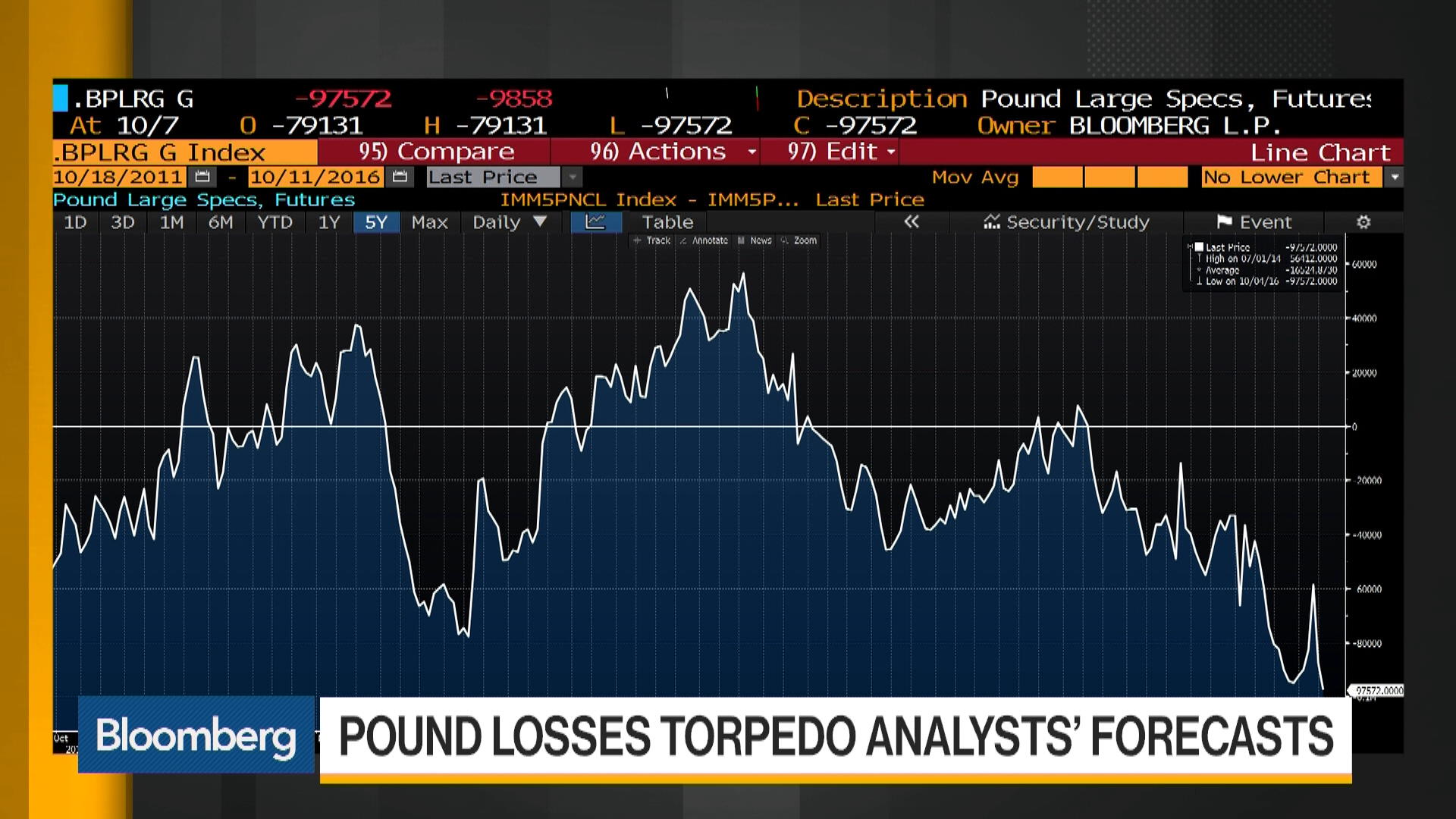

Geopolitical Risks and Uncertainties: Geopolitical events, such as wars, trade disputes, and political instability, can significantly influence investor confidence and market volatility. These uncertainties introduce risks that are difficult to quantify, making accurate valuation challenging.

-

Supply Chain Disruptions: Ongoing disruptions to global supply chains affect corporate profitability and contribute to uncertainty. These disruptions can lead to higher input costs, reduced output, and decreased earnings, thereby influencing market valuations.

BofA's Strategies for Navigating Valuation Concerns

BofA advises a cautious but proactive approach to navigating the current market environment. Their recommended strategies emphasize diversification, careful sector selection, and robust risk management.

-

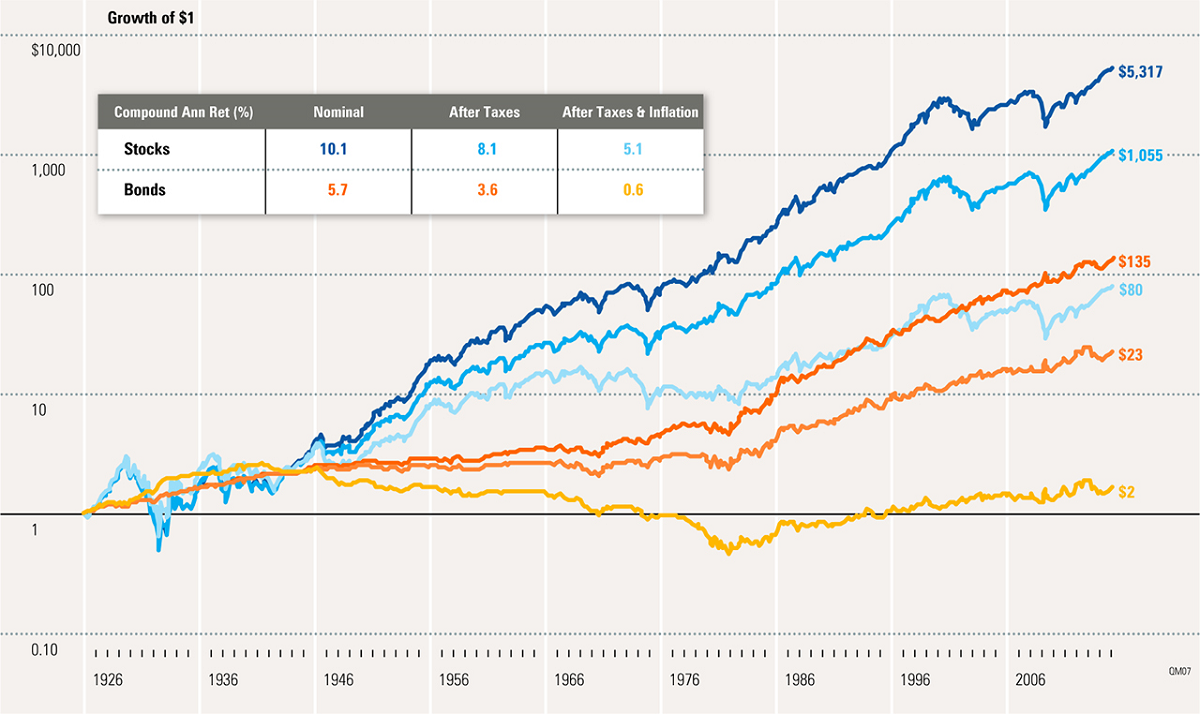

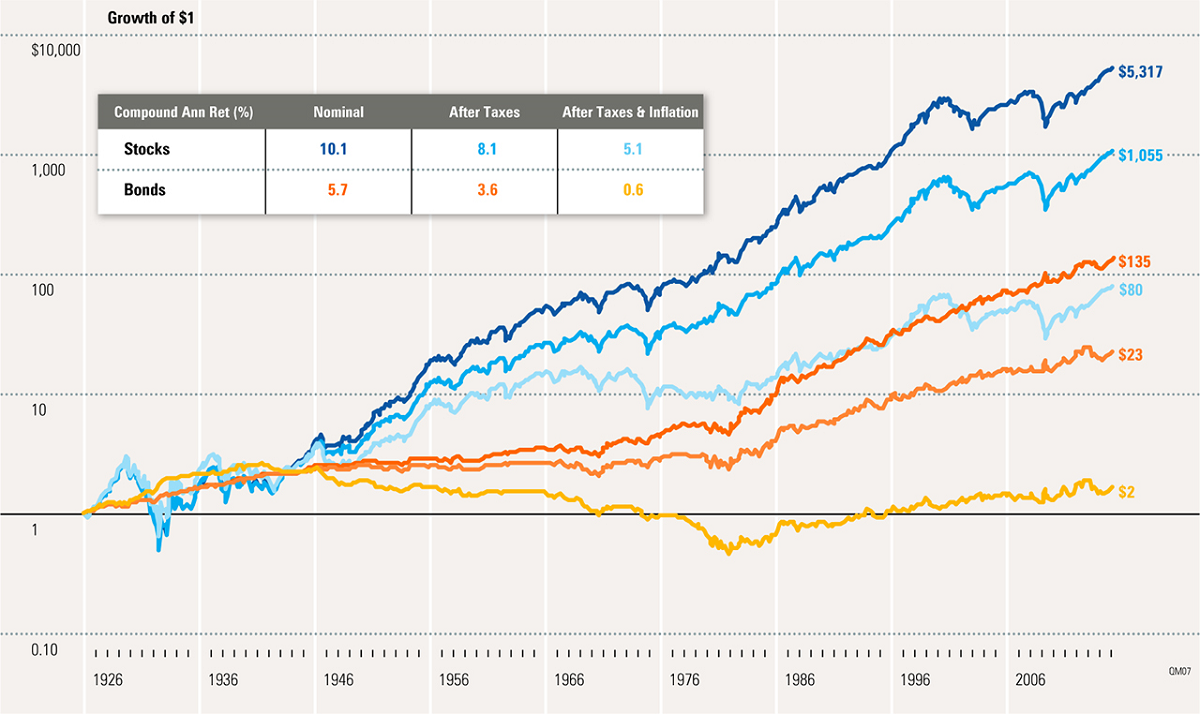

Portfolio Diversification: BofA recommends a well-diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk and limit exposure to any single area.

-

Sector Selection: Based on their valuation analysis, BofA suggests a selective approach to sector allocation. While acknowledging potential overvaluation in growth sectors, they identify opportunities in undervalued sectors exhibiting strong fundamentals.

-

Asset Allocation Strategies: Adjusting asset allocation in line with risk tolerance and market outlook is crucial. BofA may advise a more conservative allocation to equities during periods of high valuation concerns, potentially shifting more to fixed-income securities.

-

Risk Management Techniques: Employing sound risk management strategies, including setting stop-loss orders and regularly reviewing portfolio performance, is critical. This allows for timely adjustments to navigate market fluctuations and minimize potential losses.

-

Recommended Investment Products: While specific product recommendations are best obtained through direct consultation with BofA advisors, they may suggest strategies using index funds, ETFs, or actively managed funds depending on individual investor needs and goals.

Alternative Perspectives on Stock Market Valuation

Other financial institutions offer varying perspectives on stock market valuations. Some analysts might hold a more bearish outlook, emphasizing the risks associated with high valuations and predicting a market correction. Others may maintain a bullish stance, pointing to factors like strong corporate earnings or potential further stimulus measures as supporting higher prices. These differing viewpoints underscore the importance of conducting thorough research and understanding diverse perspectives before making investment decisions. Comparing these various market analyses and investment strategies is essential for a comprehensive understanding of current market conditions.

Conclusion

BofA's response to current stock market valuation concerns highlights a balanced approach. While acknowledging elevated valuations in specific sectors, they don't foresee an immediate collapse. Their strategies emphasize careful diversification, selective sector allocation, and robust risk management. However, it's crucial to remember that these are just insights; thorough individual research and professional financial advice are vital before making any investment choices. Understanding stock market valuation concerns is a vital step in responsible investing. Stay informed about evolving market dynamics and consult with a financial advisor to create a personalized investment strategy that aligns with your risk tolerance and financial goals.

Featured Posts

-

Brad Pitts F1 Film A Partnership With Apple Maps

May 26, 2025

Brad Pitts F1 Film A Partnership With Apple Maps

May 26, 2025 -

Inflation Report Impacts Boe Rate Cut Probabilities Boosting The Pound

May 26, 2025

Inflation Report Impacts Boe Rate Cut Probabilities Boosting The Pound

May 26, 2025 -

Epatazhnaya Naomi Kempbell Samye Smelye Obrazy V Novoy Fotosessii

May 26, 2025

Epatazhnaya Naomi Kempbell Samye Smelye Obrazy V Novoy Fotosessii

May 26, 2025 -

Espanyol Un Atletico Madrid E Takilmasi Hakem Hatasi Mi

May 26, 2025

Espanyol Un Atletico Madrid E Takilmasi Hakem Hatasi Mi

May 26, 2025 -

Zavidan Penzionerski Zivot Bogatstvo I Udobnost

May 26, 2025

Zavidan Penzionerski Zivot Bogatstvo I Udobnost

May 26, 2025