Strong Performance Of Emerging Markets: A Diversification Opportunity?

Table of Contents

The Allure of Emerging Market Growth

Emerging markets often exhibit significantly higher GDP growth rates compared to their developed counterparts, making them attractive for investors seeking substantial returns. This allure stems from several key factors.

High Growth Potential

- Examples of high-growth emerging markets: India, Vietnam, Indonesia, and the Philippines consistently rank among the fastest-growing economies globally. Their young and expanding populations fuel consumer demand and economic expansion.

- Factors driving growth: Several factors contribute to this impressive growth, including:

- Young and expanding populations: A large percentage of the population in many emerging markets is of working age, creating a significant labor pool and driving consumption.

- Technological advancements: Rapid technological adoption and innovation are transforming industries and boosting productivity.

- Urbanization: The ongoing migration from rural areas to cities creates new economic opportunities and infrastructure development.

- Statistical data supporting growth claims: Reports from the IMF and World Bank consistently project strong GDP growth rates for several emerging markets, outpacing those of developed nations. For example, India's GDP growth is consistently projected to be above 7% for several years.

Untapped Market Potential

Many emerging markets boast large, underserved populations representing considerable opportunities for businesses and investors. This translates into significant untapped market potential.

- Examples of sectors with high growth potential: The technology, infrastructure, and consumer goods sectors offer particularly promising investment avenues in many emerging markets. E-commerce, renewable energy, and healthcare are experiencing explosive growth.

- Increasing consumer spending and middle-class expansion: The burgeoning middle class in many emerging economies drives increased consumer spending, creating demand for a wide range of goods and services. This fuels growth across various sectors.

- Specific companies or industries benefiting from this growth: Several multinational corporations and local businesses are capitalizing on this growth, demonstrating the potential for significant returns on investment.

Navigating the Risks of Emerging Market Investment

While the growth potential of emerging markets is undeniable, it's crucial to acknowledge and manage the inherent risks involved.

Political and Economic Instability

Emerging markets can be susceptible to political and economic volatility, potentially impacting investment returns. Thorough due diligence and risk mitigation strategies are essential.

- Examples of political risks: Corruption, regime change, and social unrest can create uncertainty and negatively affect investment outcomes.

- Examples of economic risks: Currency fluctuations, inflation, and balance of payments issues can significantly impact investment performance.

- Risk mitigation strategies: Diversifying investments across multiple emerging markets, employing currency hedging strategies, and conducting thorough political and economic risk assessments are crucial for mitigating potential losses.

Regulatory and Infrastructure Challenges

Bureaucracy, lack of transparency, and inadequate infrastructure can pose challenges for investors in emerging markets.

- Examples of regulatory hurdles: Complex licensing procedures, inconsistent enforcement of regulations, and difficulties in navigating legal frameworks can create obstacles for businesses.

- Examples of infrastructural limitations: Inadequate transportation networks, unreliable power supply, and limited access to technology can hinder productivity and profitability.

- Importance of thorough research and due diligence: Before investing in emerging markets, investors should conduct thorough due diligence, including comprehensive market research and risk assessments. Seeking professional advice is highly recommended.

Emerging Markets as Part of a Diversified Portfolio

Integrating emerging markets into a well-diversified portfolio can enhance risk-adjusted returns and improve overall investment performance.

Reducing Portfolio Volatility

Emerging markets often exhibit low correlation with developed markets, meaning their performance may not always move in the same direction.

- Correlation between emerging and developed markets: The relatively low correlation reduces overall portfolio volatility, acting as a buffer against market downturns.

- How diversification reduces risk: By diversifying investments across different asset classes and geographies, including emerging markets, investors can reduce the impact of individual market fluctuations.

- Statistical data demonstrating the benefits of diversification: Numerous studies demonstrate that well-diversified portfolios, including emerging market exposure, tend to outperform less diversified portfolios over the long term.

Strategic Asset Allocation

Emerging markets should be a component of a broader asset allocation strategy, carefully considered within the context of an investor's risk tolerance and financial goals.

- Determining appropriate allocation to emerging markets: The optimal allocation will vary depending on individual circumstances, risk tolerance, and investment horizon.

- Importance of consulting a financial advisor: Seeking professional advice from a financial advisor is crucial to determine the appropriate allocation and investment strategy for emerging markets.

- Different investment vehicles for accessing emerging markets: Investors can access emerging markets through various investment vehicles, including exchange-traded funds (ETFs), mutual funds, and direct investments in individual companies.

Conclusion

The strong performance of emerging markets offers a compelling diversification opportunity for investors, but understanding and managing the associated risks is paramount. Careful consideration of political and economic factors, alongside strategic asset allocation tailored to individual risk tolerance and financial goals, is crucial for success. Don't miss the opportunity to benefit from the strong growth potential these dynamic markets offer. Explore the potential of emerging market investments and build a more resilient portfolio by conducting thorough research and, if necessary, seeking professional advice. Learn more about diversifying your portfolio with emerging market investments today!

Featured Posts

-

Exclusive Report World Economic Forum Faces Scrutiny Over Klaus Schwabs Role

Apr 24, 2025

Exclusive Report World Economic Forum Faces Scrutiny Over Klaus Schwabs Role

Apr 24, 2025 -

Covid 19 Test Fraud Lab Owner Pleads Guilty

Apr 24, 2025

Covid 19 Test Fraud Lab Owner Pleads Guilty

Apr 24, 2025 -

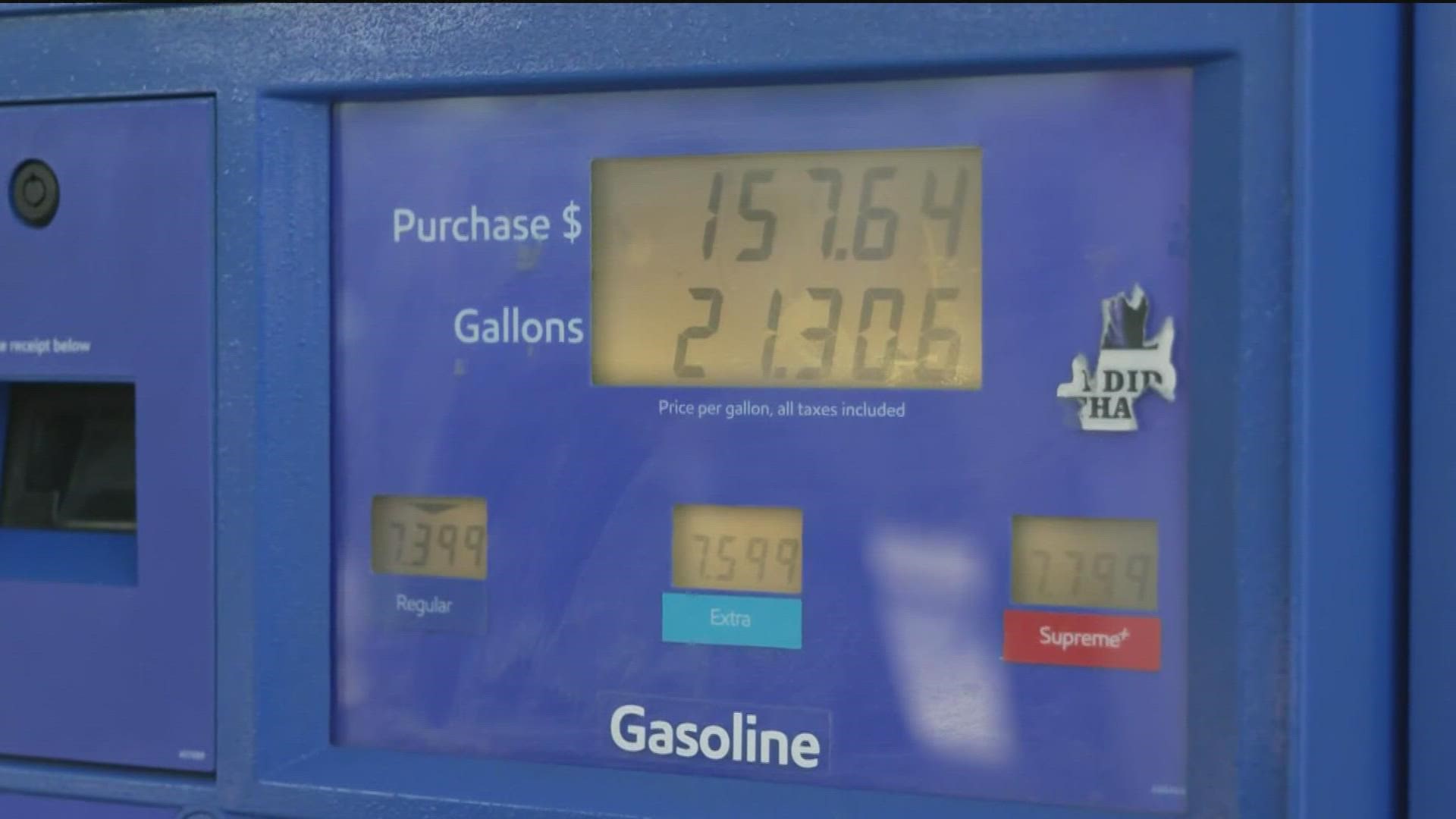

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025

California Gas Prices Soar Newsoms Plea For Oil Industry Cooperation

Apr 24, 2025 -

Trump Administrations Response To Harvard Lawsuit Open To Negotiation

Apr 24, 2025

Trump Administrations Response To Harvard Lawsuit Open To Negotiation

Apr 24, 2025 -

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025