Student Loan Debt And Homeownership: A Practical Guide

Table of Contents

Understanding the Impact of Student Loan Debt on Homeownership

Student loan debt significantly impacts your ability to buy a home. Understanding this impact is the first step towards successfully navigating both financial obligations. Two key areas are crucial: your credit score and your debt-to-income ratio.

Credit Score Implications

Student loan debt can significantly impact your credit score. Missed payments or a high debt-to-income ratio negatively affect your creditworthiness, making it harder to qualify for a mortgage with favorable terms. Lenders view a consistent history of on-time payments as a positive indicator of your financial responsibility.

- Regular on-time payments are crucial for maintaining a good credit score. Even small delays can have a lasting impact.

- Consider strategies to improve your credit score before applying for a mortgage. This might involve paying down other debts or addressing any errors on your credit report.

- Check your credit report regularly for errors. Errors can negatively impact your score, so regular checks are essential. You're entitled to a free credit report annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion).

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is the percentage of your gross monthly income that goes towards debt repayment. Lenders use your DTI to assess your ability to manage additional debt, like a mortgage. High student loan payments can significantly lower your DTI, making it harder to qualify for a mortgage or limiting the size of the loan you can obtain.

- Explore ways to reduce your DTI, such as budgeting and reducing other debts. A lower DTI improves your chances of mortgage approval.

- Consider a lower-priced home to improve your DTI. A smaller mortgage payment directly impacts your DTI.

- Consult a financial advisor to create a personalized debt management plan. A financial advisor can provide tailored strategies for improving your financial situation and reducing your DTI.

Strategies for Managing Student Loan Debt While Saving for a Down Payment

Balancing student loan payments with saving for a down payment requires careful financial planning and discipline. The key is to create a realistic budget and explore various avenues to boost your savings and manage your debt.

Budgeting and Financial Planning

Creating a detailed budget is paramount. Track your income and expenses meticulously to identify areas where you can cut back and redirect funds towards your down payment savings.

- Use budgeting apps or spreadsheets to monitor your finances effectively. Many free and paid apps can help you track your spending and create a budget.

- Prioritize saving a portion of your income for a down payment. Even small, consistent savings add up over time.

- Explore high-yield savings accounts or investment options. These can help your savings grow faster.

Income Optimization

Increasing your income can significantly accelerate your progress towards homeownership. Consider various avenues to supplement your income.

- Identify skills you can monetize. Freelance work, consulting, or a part-time job can provide extra income.

- Network to find new opportunities. Networking can lead to higher-paying jobs or freelance gigs.

- Consider professional development to improve your earning potential. Investing in your skills can lead to higher earning potential in the long run.

Student Loan Repayment Strategies

Explore different repayment plans offered by your loan servicer to manage your monthly payments effectively.

- Research federal student loan repayment programs. Programs like income-driven repayment (IDR) plans can lower your monthly payments based on your income.

- Contact your loan servicer to discuss repayment options. They can explain different plans and help you choose the best option for your situation.

- Consider refinancing your student loans if it lowers your interest rate. Refinancing can potentially reduce your monthly payments and save you money over the life of the loan.

Exploring Mortgage Options with Student Loan Debt

Even with student loan debt, various mortgage options can help you achieve homeownership. Understanding your options is crucial.

FHA Loans

Federal Housing Administration (FHA) loans require lower down payments than conventional mortgages, making them more accessible to those with student loan debt.

- Understand the requirements and eligibility criteria for FHA loans. These loans have specific requirements you need to meet.

- Compare interest rates and fees from different lenders. Shop around to find the best terms.

USDA Loans

United States Department of Agriculture (USDA) loans are available to borrowers in rural areas and may offer more favorable terms.

- Check your eligibility based on your location. These loans have specific geographic requirements.

- Research the specific requirements for USDA loans. Understanding these requirements is crucial for a successful application.

Working with a Mortgage Broker

A mortgage broker can help navigate the complexities of the mortgage process and find the best loan for your situation.

- Shop around and compare brokers before making a decision. Different brokers offer different services and fees.

- Understand the fees associated with using a mortgage broker. Be sure to factor these fees into your overall costs.

Conclusion

Successfully balancing student loan debt and homeownership requires careful planning, financial discipline, and a proactive approach. By understanding the impact of student loan debt on your credit score and DTI, creating a robust budget, exploring various repayment strategies, and researching different mortgage options, you can significantly increase your chances of achieving both goals. Don't let student loan debt derail your dreams of homeownership. Take control of your finances, develop a strategic plan, and begin your journey toward owning your own home. Remember to actively manage your student loan debt and homeownership journey, and seek professional financial advice when needed.

Featured Posts

-

Week 26 Update 2024 25 High School Confidential

May 17, 2025

Week 26 Update 2024 25 High School Confidential

May 17, 2025 -

Real Time Network18 Media And Investments Share Price April 21 2025 Nse And Bse Data With Expert Opinions

May 17, 2025

Real Time Network18 Media And Investments Share Price April 21 2025 Nse And Bse Data With Expert Opinions

May 17, 2025 -

Mariners Giants Injury News Key Players Out April 4 6

May 17, 2025

Mariners Giants Injury News Key Players Out April 4 6

May 17, 2025 -

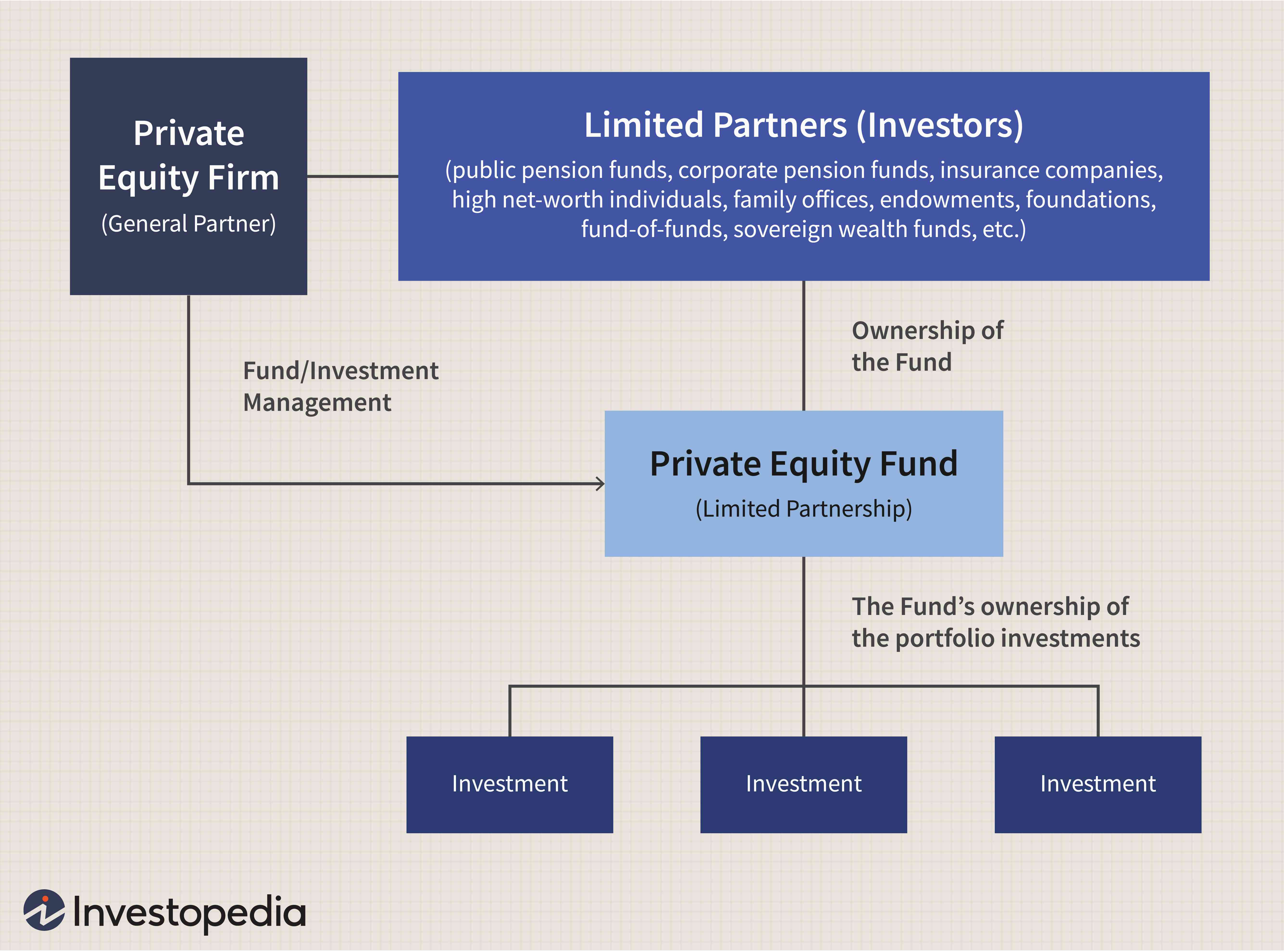

Celtics Sale To Private Equity A 6 1 Billion Deal And Fan Concerns

May 17, 2025

Celtics Sale To Private Equity A 6 1 Billion Deal And Fan Concerns

May 17, 2025 -

Prakticni Vodic Za Ujedinjene Arapske Emirate

May 17, 2025

Prakticni Vodic Za Ujedinjene Arapske Emirate

May 17, 2025