Suncor Energy: Record Production, But Sales Volume Lags

Table of Contents

Suncor Energy recently announced record production levels, a significant achievement in the energy sector. This impressive feat, however, is counterbalanced by a concerning lag in sales volume. This discrepancy raises important questions about the company's operational efficiency and market positioning. This article will dissect the reasons behind this paradox, examining Suncor's upstream and downstream operations, analyzing key market factors, and exploring the implications for investors and the future of Suncor Energy's performance.

Record Upstream Production: A Closer Look

Increased Oil Sands Extraction:

Suncor's record-high oil production stems largely from its oil sands operations. Several factors contribute to this increase:

- Improved extraction techniques: Suncor has continuously invested in and implemented advanced extraction technologies, leading to higher efficiency and output from existing oil sands projects. These improvements include optimized steam-assisted gravity drainage (SAGD) processes and innovative well completion methods.

- Increased operational efficiency: Streamlined processes, enhanced maintenance programs, and a focus on reducing downtime have significantly boosted overall production capacity. This includes targeted investments in automation and data analytics to optimize operations.

- New project completions: The completion of new projects and expansions in existing oil sands facilities has added considerable capacity to Suncor's upstream operations. While specific project names might vary depending on the reporting period, the completion of such projects directly translates into increased oil production. The impact of these projects on overall production needs to be considered.

Technological advancements and significant infrastructure investments have been pivotal in driving this record-breaking production.

Upstream Challenges and Limitations:

Despite the impressive production figures, Suncor faces challenges that limit its ability to immediately translate increased production into higher sales volume:

- Pipeline capacity constraints: Limited pipeline capacity to transport the extracted oil to refineries and export terminals creates a bottleneck, restricting the flow of oil to market. This is a particularly critical aspect of Suncor’s operations given their focus on oil sands.

- Maintenance issues: Planned and unplanned maintenance on pipelines and other critical infrastructure can temporarily disrupt the flow of oil, impacting sales volume. These issues can be significant, especially in the context of aging infrastructure in some areas.

- Regulatory hurdles: Environmental regulations and permitting processes can sometimes delay or complicate the expansion of pipeline capacity or the development of new projects, indirectly affecting sales volume.

These bottlenecks significantly impact the transportation of extracted oil, highlighting the need for strategic investment in infrastructure and effective regulatory navigation.

Downstream Operations: The Sales Volume Bottleneck

Refinery Capacity and Utilization:

Suncor's downstream operations, particularly its refinery capacity and utilization rate, are key factors influencing sales volume.

- Refinery maintenance schedules: Planned refinery maintenance periods inevitably lead to temporary reductions in refining capacity and thus, in the volume of refined products available for sale. These shutdowns are necessary for safety and maintenance, but they do impact sales.

- Product demand fluctuations: Changes in consumer demand for different refined products (gasoline, diesel, etc.) influence refinery output and sales volume. Seasonal variations also play a role, with higher demand during peak driving seasons.

- Seasonal variations: The seasonal nature of demand for refined products necessitates careful planning and inventory management to optimize sales throughout the year.

Inefficiencies or underutilization of refining capabilities due to these factors can negatively affect the overall sales volume.

Marketing and Distribution Challenges:

Even with efficient refining, challenges exist in getting products to market:

- Competition in the market: Suncor faces stiff competition from other energy companies, impacting its market share and pricing power. This competitive landscape necessitates effective marketing and pricing strategies.

- Logistical challenges: Efficient and cost-effective distribution networks are crucial. Any disruption or inefficiency in these networks can significantly hamper sales volume.

- Pricing strategies: Suncor's pricing strategies must be carefully calibrated to remain competitive while maximizing profitability. Global market conditions significantly influence these strategies.

Market dynamics play a crucial role in determining Suncor's ability to effectively sell its refined products.

Market Factors Influencing Sales Volume

Global Oil Prices and Demand:

Global oil prices and overall demand are major external factors affecting Suncor's sales.

- Price volatility: Fluctuations in global oil prices directly impact Suncor's profitability and sales volume. Low prices can reduce demand and pressure sales.

- Changes in global energy consumption: Global trends in energy consumption, influenced by economic growth and environmental policies, significantly affect the demand for oil products.

- Impact of geopolitical events: Geopolitical instability and global events can create uncertainty in the oil market, impacting prices and demand, subsequently affecting Suncor's sales volume.

External market forces exert considerable influence on Suncor's ability to sell its products profitably.

Competition within the Energy Sector:

The energy sector is highly competitive.

- Competitor activities: Actions by competitors, such as new capacity additions or aggressive pricing strategies, can impact Suncor's market share and sales volume.

- Market share analysis: A detailed analysis of Suncor's market share relative to its competitors is essential for understanding its competitive position.

- Strategic responses: Suncor needs to develop effective strategies to maintain and grow its market share in this highly competitive environment. These strategies could include innovative marketing, strategic partnerships or acquisitions.

Suncor's competitive position and its ability to implement effective strategies to enhance sales volume are paramount.

Conclusion:

Suncor Energy's record production in its upstream operations is a notable achievement, showcasing the company's capabilities in oil sands extraction. However, the significant lag in sales volume highlights the importance of addressing bottlenecks in downstream operations and navigating external market forces. Pipeline capacity constraints, refinery maintenance schedules, and competitive market dynamics all contribute to this discrepancy. Suncor needs to focus on enhancing its operational efficiency, optimizing its refining and distribution networks, and developing effective strategies to increase market share. Addressing these challenges is crucial for maximizing the value of its record production.

Stay tuned for updates on Suncor Energy's progress in bridging the gap between record production and sales volume. Learn more about Suncor Energy's strategic initiatives to boost sales volume and maximize its record oil production. Understanding the interplay between upstream production, downstream challenges, and market forces is key to comprehending the complete picture of Suncor Energy's performance.

Featured Posts

-

Melanie Griffith And Siblings Join Dakota Johnson At Materialist Event

May 09, 2025

Melanie Griffith And Siblings Join Dakota Johnson At Materialist Event

May 09, 2025 -

Thailands Central Bank Governor Search Navigating Tariff Challenges

May 09, 2025

Thailands Central Bank Governor Search Navigating Tariff Challenges

May 09, 2025 -

Katya Joness Exit From Strictly A Wynne Evans Betrayal

May 09, 2025

Katya Joness Exit From Strictly A Wynne Evans Betrayal

May 09, 2025 -

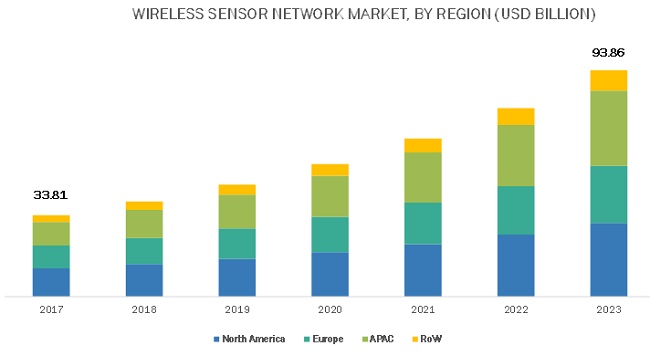

Growth Of The Wireless Mesh Networks Market A 9 8 Cagr Outlook

May 09, 2025

Growth Of The Wireless Mesh Networks Market A 9 8 Cagr Outlook

May 09, 2025 -

Wynne Evans Faces Backlash Amy Walsh Offers Support

May 09, 2025

Wynne Evans Faces Backlash Amy Walsh Offers Support

May 09, 2025

Latest Posts

-

Dangotes Influence On Nnpc Petrol Prices A Thisdaylive Analysis

May 09, 2025

Dangotes Influence On Nnpc Petrol Prices A Thisdaylive Analysis

May 09, 2025 -

Living Legends Of Aviation Awards Ceremony Recognizes Firefighters And Community Heroes

May 09, 2025

Living Legends Of Aviation Awards Ceremony Recognizes Firefighters And Community Heroes

May 09, 2025 -

Aviations Living Legends Celebrate Bravery Honoring Firefighters And Essential Workers

May 09, 2025

Aviations Living Legends Celebrate Bravery Honoring Firefighters And Essential Workers

May 09, 2025 -

Understanding The Candidates In Your Nl Federal Riding

May 09, 2025

Understanding The Candidates In Your Nl Federal Riding

May 09, 2025 -

Living Legends Of Aviation A Tribute To Firefighters And First Responders

May 09, 2025

Living Legends Of Aviation A Tribute To Firefighters And First Responders

May 09, 2025