Tariff Wars Pose Significant Risk To Ryanair's Growth; Buyback To Offset Impact

Table of Contents

The Impact of Tariff Wars on Ryanair's Operations

The escalating Ryanair tariff wars have a multifaceted impact on the airline's operations, affecting its cost structure and potentially reducing demand.

Increased Costs of Aircraft Parts and Maintenance

Tariffs imposed on imported aircraft parts, including engines, avionics, and other crucial components, directly increase Ryanair's operational costs. These increased costs aren't simply absorbed; they ripple through the entire system. For instance, a 10% tariff on imported engine parts could translate to a significant increase in maintenance expenses, potentially impacting profit margins by several percentage points. This impact is magnified given Ryanair's business model which relies on efficient cost management and razor-thin margins.

- Higher maintenance bills: Increased costs for parts lead to significantly higher overall maintenance bills.

- Potential delays in repairs: Sourcing alternative parts or navigating complex tariff regulations can cause delays in repairs, leading to grounded aircraft and operational disruptions.

- Increased pressure on profit margins: The increased costs directly eat into Ryanair's already slim profit margins, putting pressure on its ability to offer competitive fares.

Fuel Price Volatility and Surcharges

The impact of Ryanair tariff wars extends beyond aircraft parts. Tariffs on imported goods can influence fuel prices, creating volatility and making it harder for Ryanair to effectively hedge against risk. Fluctuating fuel costs represent a major expense for any airline, and Ryanair, with its large fleet and high flight frequency, is particularly vulnerable. This instability could force Ryanair to increase fuel surcharges for passengers, potentially reducing its competitive edge against airlines less affected by these trade disputes.

- Increased fuel surcharges for passengers: To offset increased fuel costs, Ryanair may be forced to pass these costs onto consumers through higher ticket prices.

- Reduced competitiveness against non-impacted airlines: If competitors aren't facing the same fuel cost increases, Ryanair could lose market share due to less competitive pricing.

- Potential for reduced flight frequency or route cancellations: In extreme cases, high fuel costs could force Ryanair to reduce flight frequency on certain routes or even cancel less profitable routes altogether.

Potential Travel Restrictions and Reduced Demand

Beyond direct cost increases, Ryanair tariff wars can indirectly impact the airline through geopolitical instability and reduced travel demand. Escalating trade tensions can create uncertainty in the global economy, leading to decreased consumer confidence and potentially impacting travel plans. This reduced demand could translate to lower passenger numbers and lower load factors on Ryanair flights.

- Decreased passenger numbers: Economic uncertainty caused by tariff wars can lead to fewer people booking flights.

- Lower load factors on flights: Empty seats translate to lower revenue generation per flight.

- Impact on revenue generation: The combined effect of reduced passenger numbers and lower load factors directly impacts Ryanair's overall revenue.

Ryanair's Share Buyback Program: A Strategic Response

In the face of the challenges posed by Ryanair tariff wars, Ryanair's share buyback program serves as a strategic response aimed at mitigating risks and bolstering investor confidence.

Buybacks as a Means of Offsetting Losses

Share buybacks are a common corporate strategy used to return value to shareholders, particularly during periods of economic uncertainty. By repurchasing its own shares, Ryanair reduces the number of outstanding shares, thus increasing the earnings per share (EPS). This can help offset any negative impacts on earnings caused by increased operational costs or reduced demand. The buyback also signals confidence in the company's long-term prospects to the market.

- Artificial boost to share price: Buybacks can artificially increase the demand for the stock, potentially boosting its price.

- Improved investor sentiment: Demonstrating confidence through buybacks can help maintain positive investor sentiment.

- Offsetting negative impacts on earnings: Increased EPS can help mask the negative impact of increased costs and reduced demand on reported earnings.

Analyzing the Effectiveness of Ryanair's Strategy

The effectiveness of Ryanair's share buyback program in countering the effects of the Ryanair tariff wars will depend on several factors. The size and timing of the buyback in relation to the escalation of trade tensions are crucial. A larger buyback during a period of significant tariff increases might be more effective than a smaller buyback during a calmer period. Analyzing the long-term effects will require monitoring shareholder returns, comparing Ryanair's performance to industry peers, and assessing its overall financial health.

- Evaluation of shareholder return: Did the buyback program result in a significant increase in shareholder value?

- Comparison to industry practices: How did Ryanair's response compare to other airlines facing similar challenges?

- Assessment of overall financial health: Did the buyback program improve Ryanair's long-term financial stability?

Conclusion

The escalating Ryanair tariff wars pose a substantial threat to Ryanair's growth trajectory, increasing operational costs and potentially dampening demand. While the airline faces considerable challenges, its strategic share buyback program represents a proactive attempt to mitigate risks and reassure investors. The effectiveness of this strategy will depend on the duration and intensity of the trade tensions and the broader economic climate. Understanding the interplay between these global economic factors and Ryanair’s business model is crucial for investors and stakeholders alike. To stay informed on how Ryanair tariff wars and related trade disputes impact the airline's future, continue to follow industry news and analysis.

Featured Posts

-

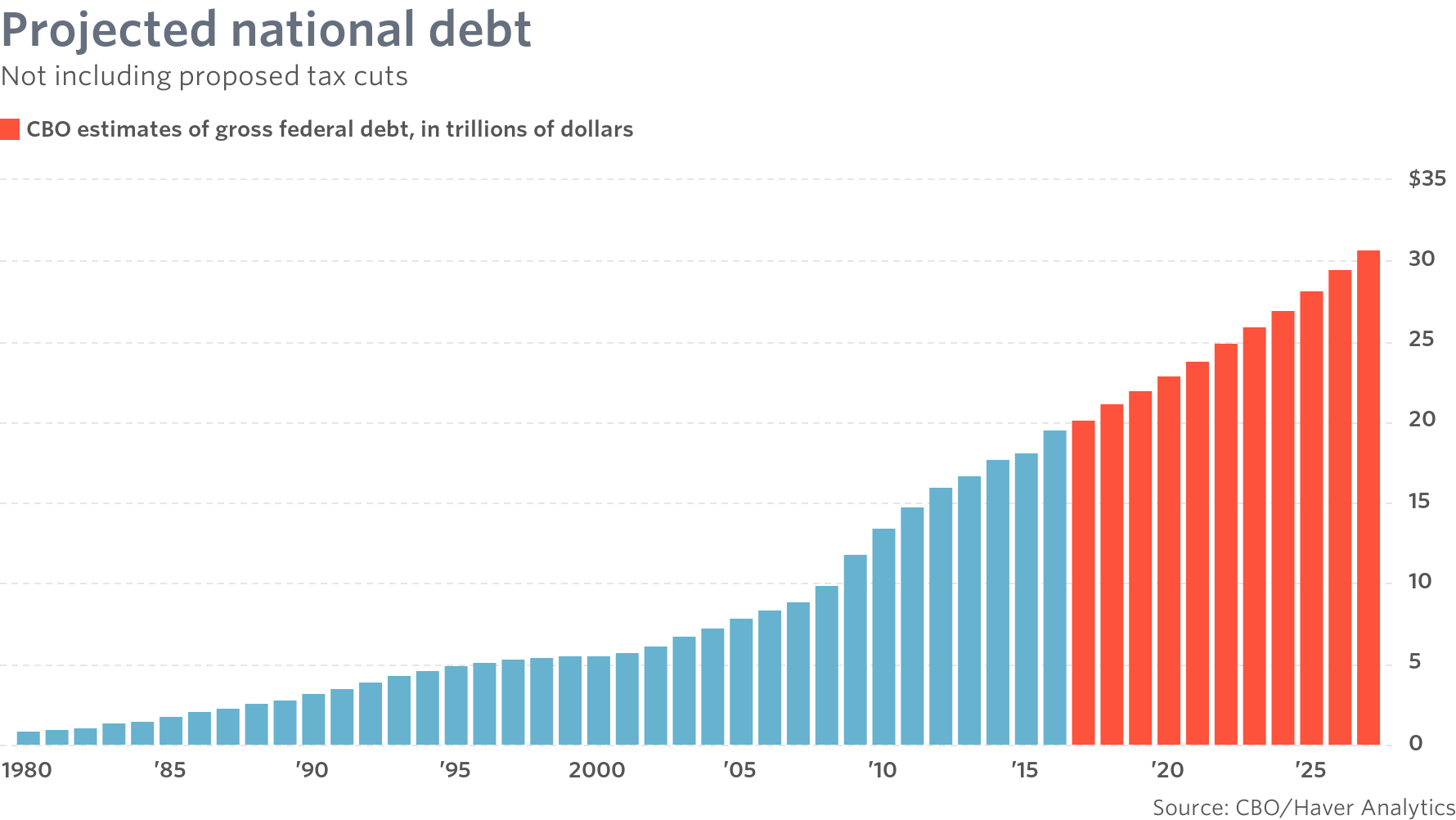

Analyzing The Gop Tax Plan The Reality Of Deficit Reduction

May 20, 2025

Analyzing The Gop Tax Plan The Reality Of Deficit Reduction

May 20, 2025 -

Philippines China Tensions Rise Over Typhon Missile Deployment

May 20, 2025

Philippines China Tensions Rise Over Typhon Missile Deployment

May 20, 2025 -

Sofrep News Israel Yemen Missile Conflict And Russias Action Against Amnesty International

May 20, 2025

Sofrep News Israel Yemen Missile Conflict And Russias Action Against Amnesty International

May 20, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Details A 1 050 Cost Surge

May 20, 2025

Broadcoms Proposed V Mware Price Hike At And T Details A 1 050 Cost Surge

May 20, 2025 -

Nyt Mini Crossword Clues And Answers March 13 2025

May 20, 2025

Nyt Mini Crossword Clues And Answers March 13 2025

May 20, 2025