Tesla Earnings Plunge 71% In Q1: Analysis Of Political Factors And Financial Results

Table of Contents

Political Factors Impacting Tesla's Q1 Performance

Tesla's Q1 struggles weren't solely attributable to internal issues; significant political factors significantly impacted its performance. These external pressures created a perfect storm, hindering production, increasing costs, and negatively affecting consumer sentiment.

Geopolitical Instability and Supply Chain Disruptions

The ongoing war in Ukraine profoundly impacted Tesla's supply chain. The conflict disrupted the supply of crucial raw materials, particularly lithium and nickel, essential for EV battery production. Prices for these materials skyrocketed, significantly increasing Tesla's production costs.

- Increased lithium prices: A 40% increase in lithium carbonate prices directly translated into higher battery costs for Tesla.

- Nickel supply shortages: Disruptions to nickel mining and refining operations in Russia and other regions led to production delays.

- Logistical challenges: The war caused significant port congestion and transportation delays, further hindering the timely delivery of components.

Global trade tensions and sanctions also played a role. Increased tariffs and trade restrictions impacted the import and export of Tesla vehicles and components, leading to added costs and logistical complications.

Regulatory Hurdles and Policy Changes

Changes in government policies concerning EV subsidies and tax incentives significantly affected Tesla's profitability in various key markets.

- Reduced US tax credits: Changes to the US tax credit structure for EVs impacted consumer demand and Tesla's sales.

- Shifting European regulations: New emission standards and regulations in Europe increased compliance costs for Tesla.

- China's evolving EV landscape: The Chinese government's emphasis on domestic EV brands created increased competition for Tesla.

Furthermore, political controversies and negative press surrounding Tesla, particularly those involving CEO Elon Musk, impacted consumer sentiment and brand perception, potentially affecting sales.

China Market Challenges

Tesla's significant manufacturing presence in China faced headwinds due to several political and economic factors.

- COVID-19 lockdowns: Extended lockdowns in Shanghai and other regions severely disrupted Tesla's Gigafactory Shanghai production.

- Increased competition: The rapid growth of domestic Chinese EV manufacturers intensified the competitive pressure on Tesla's market share.

- Regulatory scrutiny: Increasing regulatory scrutiny in China concerning data security and other aspects added to the operational challenges faced by Tesla.

Analysis of Tesla's Q1 Financial Results

The political headwinds detailed above directly impacted Tesla's Q1 financial performance, resulting in a significant decline in revenue and profitability.

Revenue and Profitability

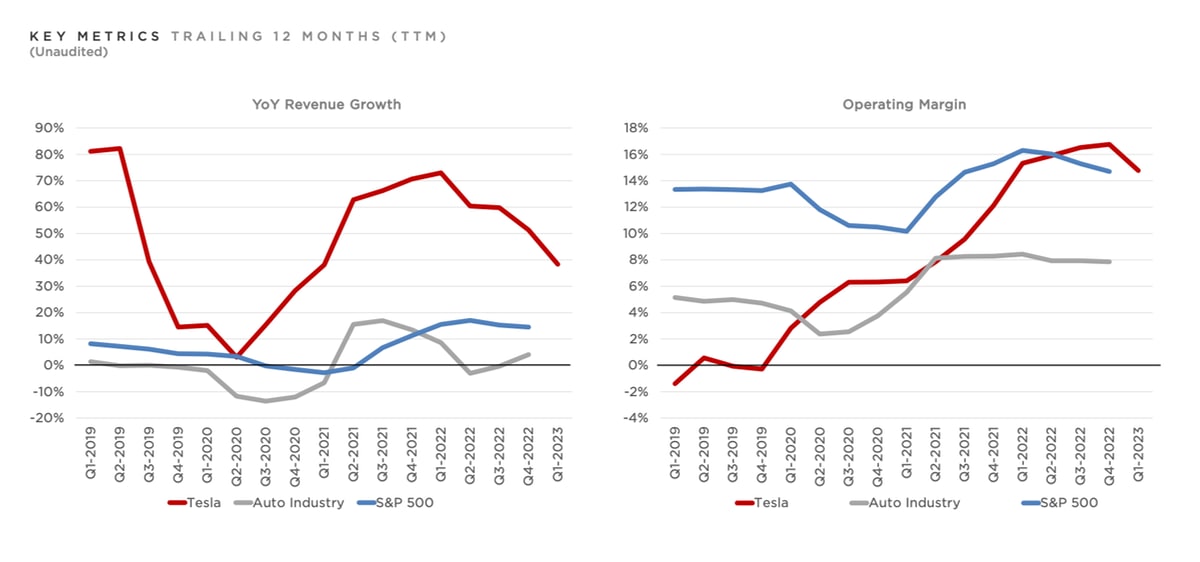

Tesla's Q1 revenue fell short of analyst expectations, a decline exacerbated by higher production costs and reduced sales. The 71% plunge in earnings represents a substantial setback for the company. (Insert chart/graph visually representing revenue and profit decline). The increased cost of raw materials, coupled with reduced sales, directly contributed to this significant drop in profitability.

Stock Price Performance and Investor Sentiment

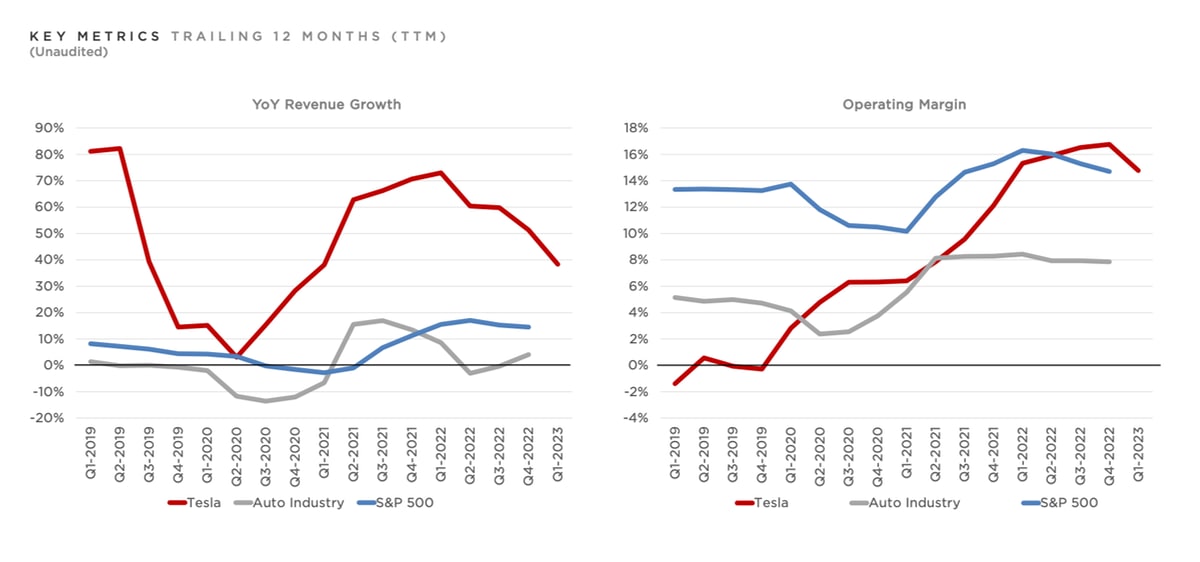

The Q1 earnings report triggered a negative reaction from investors, causing a significant drop in Tesla's stock price. This reflected decreased investor confidence in the company's short-term prospects. (Insert chart/graph visually representing stock price fluctuation). Analyst predictions for Tesla's stock price remain mixed, with some expressing concerns about sustained profitability.

Future Outlook and Strategic Adjustments

Tesla will need to implement several strategic adjustments to navigate these challenges and improve future performance.

- Supply chain diversification: Reducing reliance on specific regions and suppliers is crucial to mitigate future disruptions.

- Cost-cutting measures: Optimizing production processes and streamlining operations to reduce costs will be essential.

- Product diversification: Expanding its product line beyond its core offerings could help mitigate risks associated with specific market segments.

Tesla's long-term prospects remain positive, given the growing global demand for electric vehicles. However, successfully navigating the current political and economic headwinds will be critical for its future success.

Conclusion

Tesla's Q1 2024 earnings report revealed a stark reality: the 71% plunge in earnings reflects not only internal challenges but also the significant impact of external political factors. Geopolitical instability, regulatory hurdles, and challenges in the crucial Chinese market all contributed to this dramatic decline. Understanding these interconnected political and financial pressures is paramount for comprehending Tesla's current situation and anticipating its future trajectory within the ever-evolving EV landscape. Follow our analysis of Tesla's performance, stay tuned for updates on Tesla earnings, and understand the political factors affecting Tesla's future to stay informed about this critical industry player.

Featured Posts

-

Tyler Herros 3 Point Contest Triumph Defeating Buddy Hield

Apr 24, 2025

Tyler Herros 3 Point Contest Triumph Defeating Buddy Hield

Apr 24, 2025 -

Dow Jones Surges 1000 Points Stock Market Rally Explained

Apr 24, 2025

Dow Jones Surges 1000 Points Stock Market Rally Explained

Apr 24, 2025 -

Report Nba Opens Investigation Into Ja Morants Conduct

Apr 24, 2025

Report Nba Opens Investigation Into Ja Morants Conduct

Apr 24, 2025 -

Emerging Market Stocks Outperform Us In 2024 A Year Of Contrasts

Apr 24, 2025

Emerging Market Stocks Outperform Us In 2024 A Year Of Contrasts

Apr 24, 2025 -

Alterya Acquired By Chainalysis Boosting Blockchain Security And Analysis

Apr 24, 2025

Alterya Acquired By Chainalysis Boosting Blockchain Security And Analysis

Apr 24, 2025