Tesla Q1 2024 Earnings: Net Income Down 71% Amidst Political Headwinds

Table of Contents

Significant Drop in Net Income: A Deep Dive into the Numbers

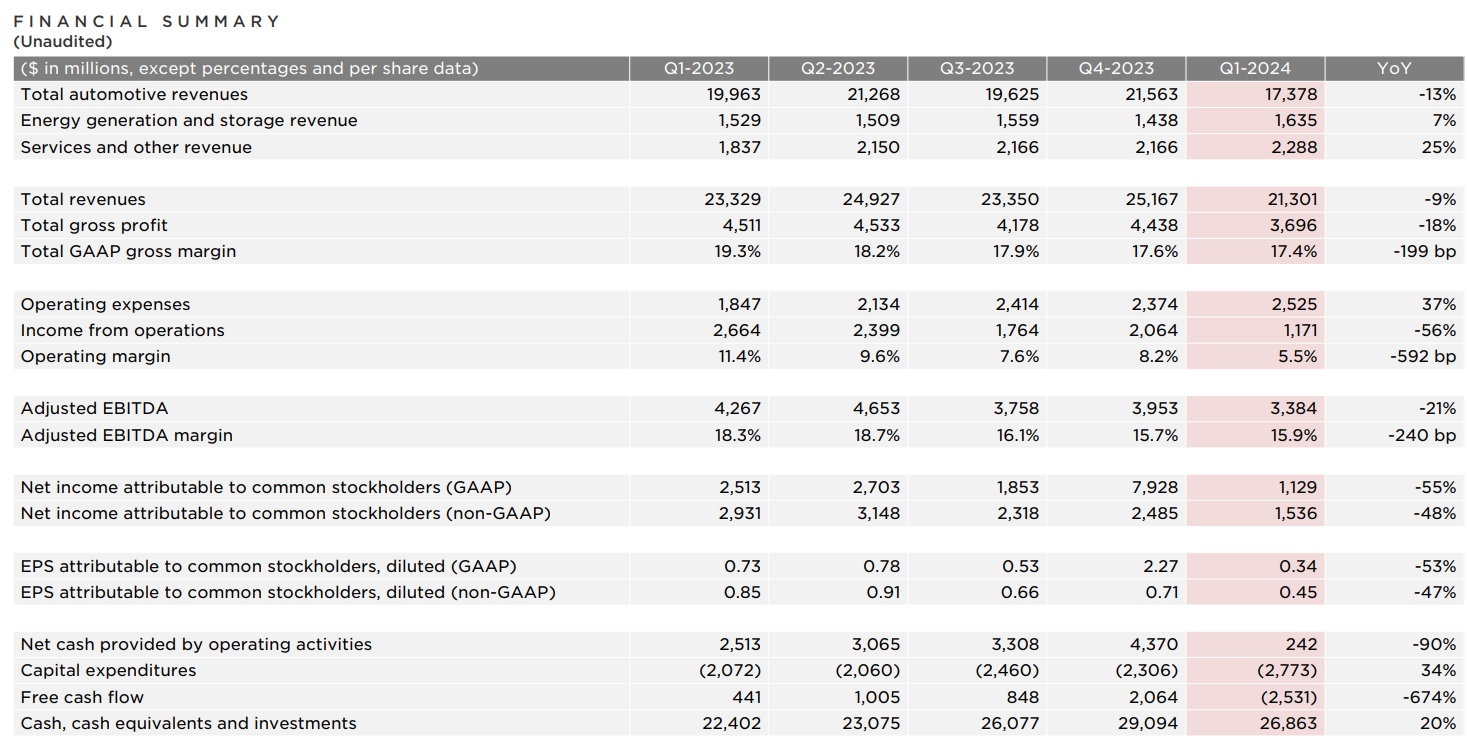

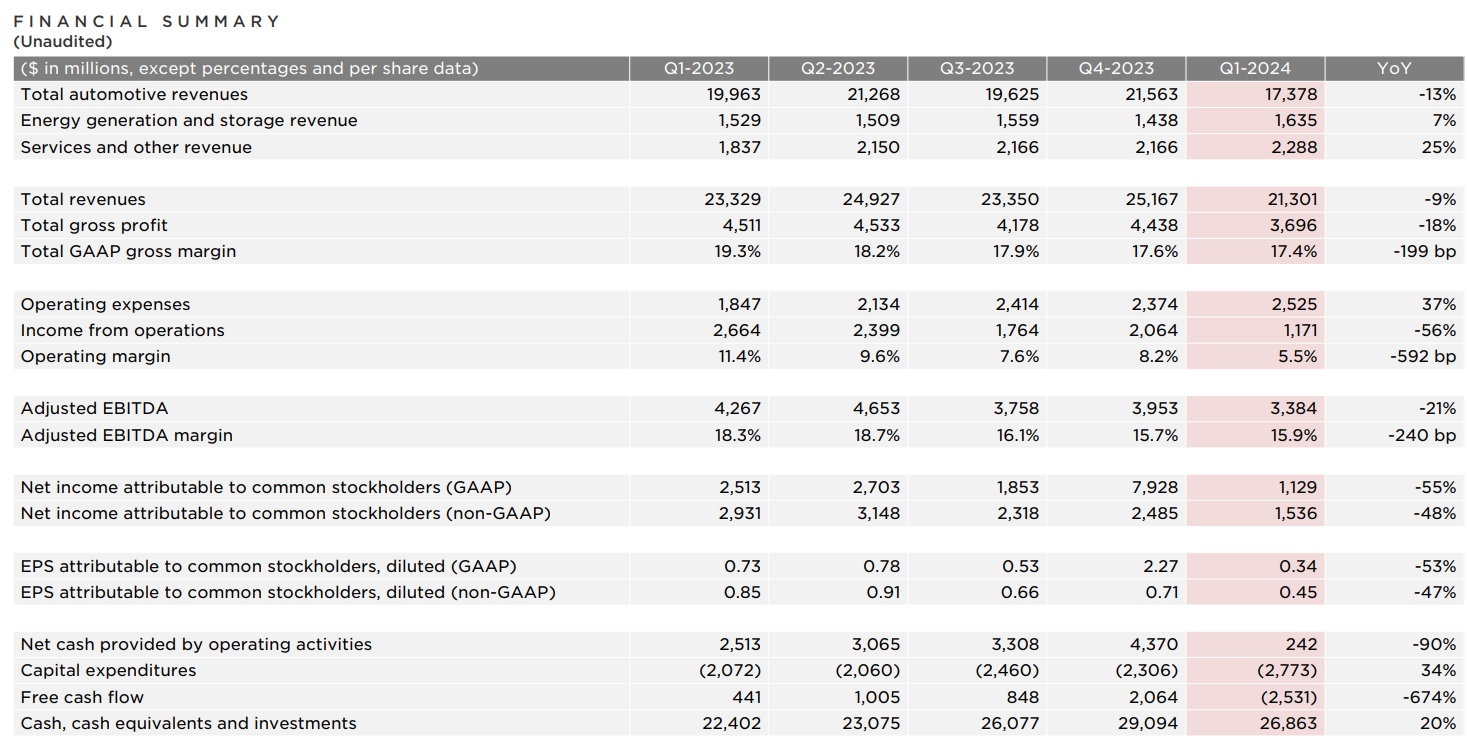

Tesla's Q1 2024 financial report revealed a stark reality: a 71% decrease in net income compared to the previous quarter. This dramatic fall demands a thorough examination of the underlying financial data. Comparing these Q1 results to previous quarters and industry benchmarks paints a clearer picture of the challenges faced by the company.

Key financial metrics paint a concerning picture:

- Revenue Figures: While revenue may have remained relatively stable or even slightly increased, the significant decrease in net income indicates a substantial widening of operational costs.

- Operating Margin: A sharp decline in operating margin suggests difficulties in controlling costs and maintaining profitability amidst increased pressure.

- Earnings Per Share (EPS): The EPS likely reflected the substantial reduction in net income, impacting investor confidence and the Tesla stock price.

Several factors contributed to this decline:

- Increased Competition: The burgeoning EV market is becoming increasingly competitive, with established automakers and new entrants vying for market share.

- Price Reductions: Tesla's strategic price reductions, implemented to boost sales volume, directly impacted profit margins.

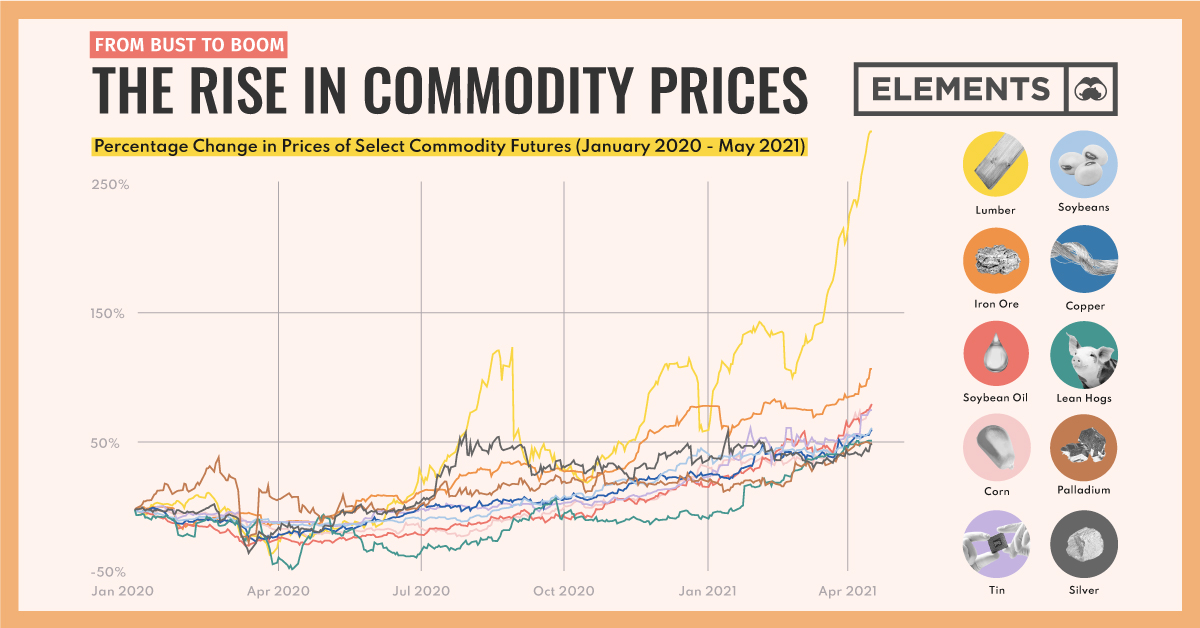

- Supply Chain Disruptions: Ongoing supply chain challenges might have further contributed to increased costs and reduced production.

Impact of Political Headwinds on Tesla's Performance

Geopolitical risks and shifting government policies significantly impacted Tesla's Q1 2024 performance. These political headwinds created significant challenges across various geographical markets.

Specific political events and regulations played a crucial role:

- Trade Wars: Escalating trade tensions disrupted supply chains and increased import costs.

- New Emission Standards: Stringent emission regulations in key markets increased compliance costs and potentially impacted sales.

- Government Subsidies: Changes in government subsidies for EVs in certain regions affected demand and profitability.

The impact varied geographically:

- China: Changes in government regulations and policies regarding EV subsidies and manufacturing had a direct impact on Tesla's Chinese operations.

- Europe: New emission standards and potential import tariffs presented significant hurdles for Tesla’s European sales.

- US: Political uncertainty surrounding future regulations and potential tax changes added to the overall market volatility.

Increased Competition and Market Saturation in the EV Sector

The electric vehicle (EV) market is experiencing rapid growth and increasing market saturation. This intensified competition significantly impacted Tesla's performance in Q1 2024. Key competitors are employing aggressive strategies to gain market share:

- Traditional Automakers: Established automakers are rapidly expanding their EV portfolios, posing a direct threat to Tesla's dominance.

- New EV Startups: Innovative startups are challenging Tesla with disruptive technologies and competitive pricing.

This increased competition forced Tesla to adapt its strategies:

- Pricing Strategies: Price reductions were implemented to maintain competitiveness, but this directly impacted profit margins.

- Sales Volume: While sales volume might have increased, the lower profit margins per vehicle offset the gains.

- Market Share: Tesla's market share may have experienced a slight decline due to increased competition.

Future Outlook and Investor Sentiment

Tesla's strategies to mitigate the negative impacts of the Q1 results include streamlining operations, improving cost efficiency, and focusing on innovation. However, investor sentiment remains cautious following the earnings report, reflected in fluctuations in the Tesla stock price.

The future outlook presents both challenges and opportunities:

- Tesla Growth: Long-term growth prospects remain positive, driven by the overall growth of the EV market.

- Challenges: Continued competition, geopolitical uncertainty, and supply chain disruptions remain significant challenges.

- Opportunities: Innovation in battery technology, autonomous driving, and expansion into new markets offer significant growth opportunities.

Conclusion

Tesla's Q1 2024 earnings report revealed a significant drop in net income, largely attributed to a combination of political headwinds, increased competition, and strategic price reductions. These factors impacted Tesla's financial performance and investor sentiment. While challenges remain, Tesla's long-term prospects in the expanding EV market remain positive. Stay informed about future Tesla Q[Number] earnings reports and the ongoing impact of political headwinds on the electric vehicle market. Subscribe to our newsletter for the latest updates!

Featured Posts

-

Utac Chip Tester Chinese Buyout Firm Explores Sale Options

Apr 24, 2025

Utac Chip Tester Chinese Buyout Firm Explores Sale Options

Apr 24, 2025 -

Dram Market Shift Sk Hynixs Ai Driven Rise To The Top

Apr 24, 2025

Dram Market Shift Sk Hynixs Ai Driven Rise To The Top

Apr 24, 2025 -

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025 -

Nbas Investigation Into Ja Morant Key Details And Updates

Apr 24, 2025

Nbas Investigation Into Ja Morant Key Details And Updates

Apr 24, 2025 -

Analysis Trumps Influence On Us Stock Futures Prices

Apr 24, 2025

Analysis Trumps Influence On Us Stock Futures Prices

Apr 24, 2025