Tesla's Q1 2024 Financial Performance: A 71% Drop In Net Income Explained

Table of Contents

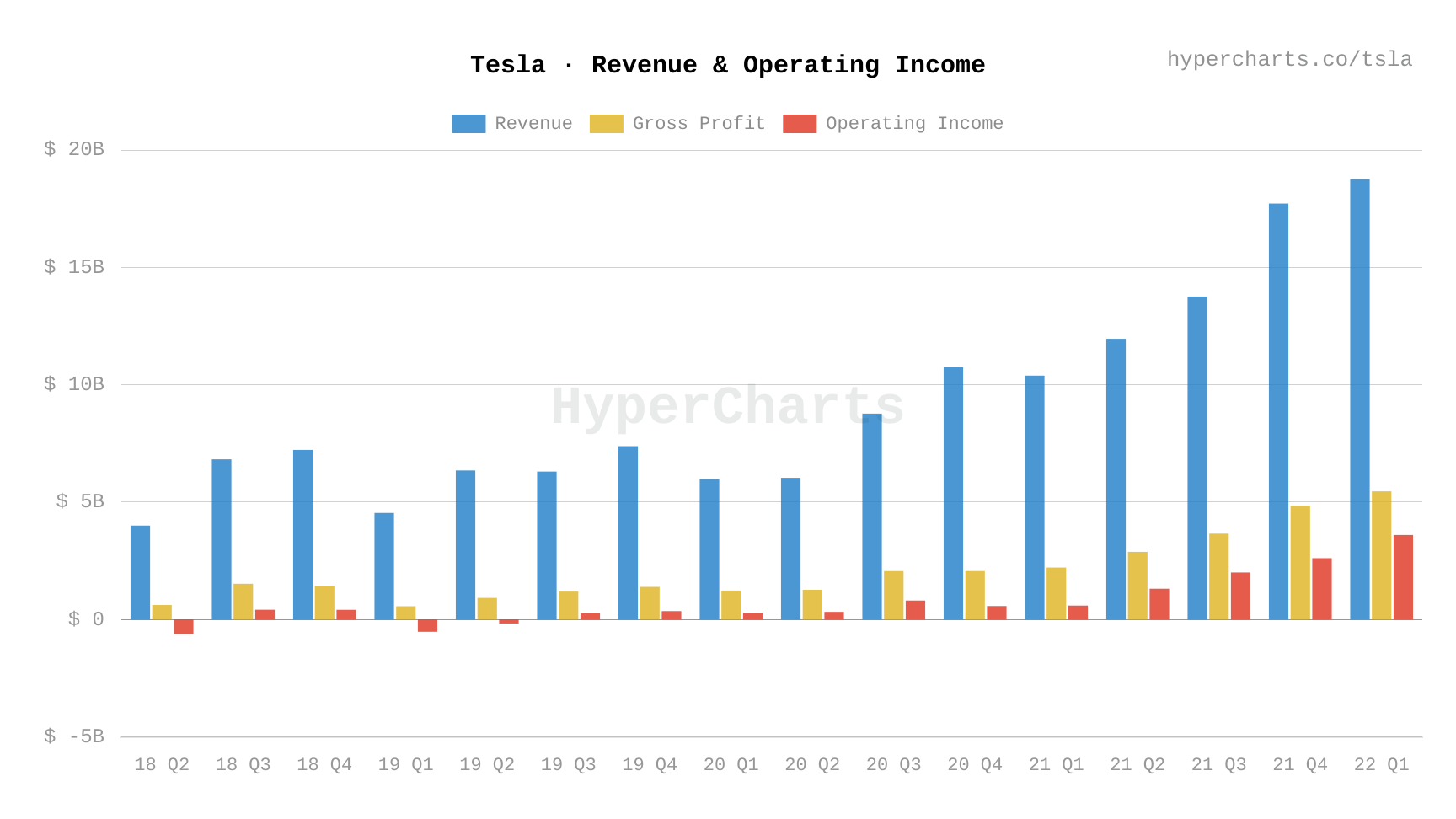

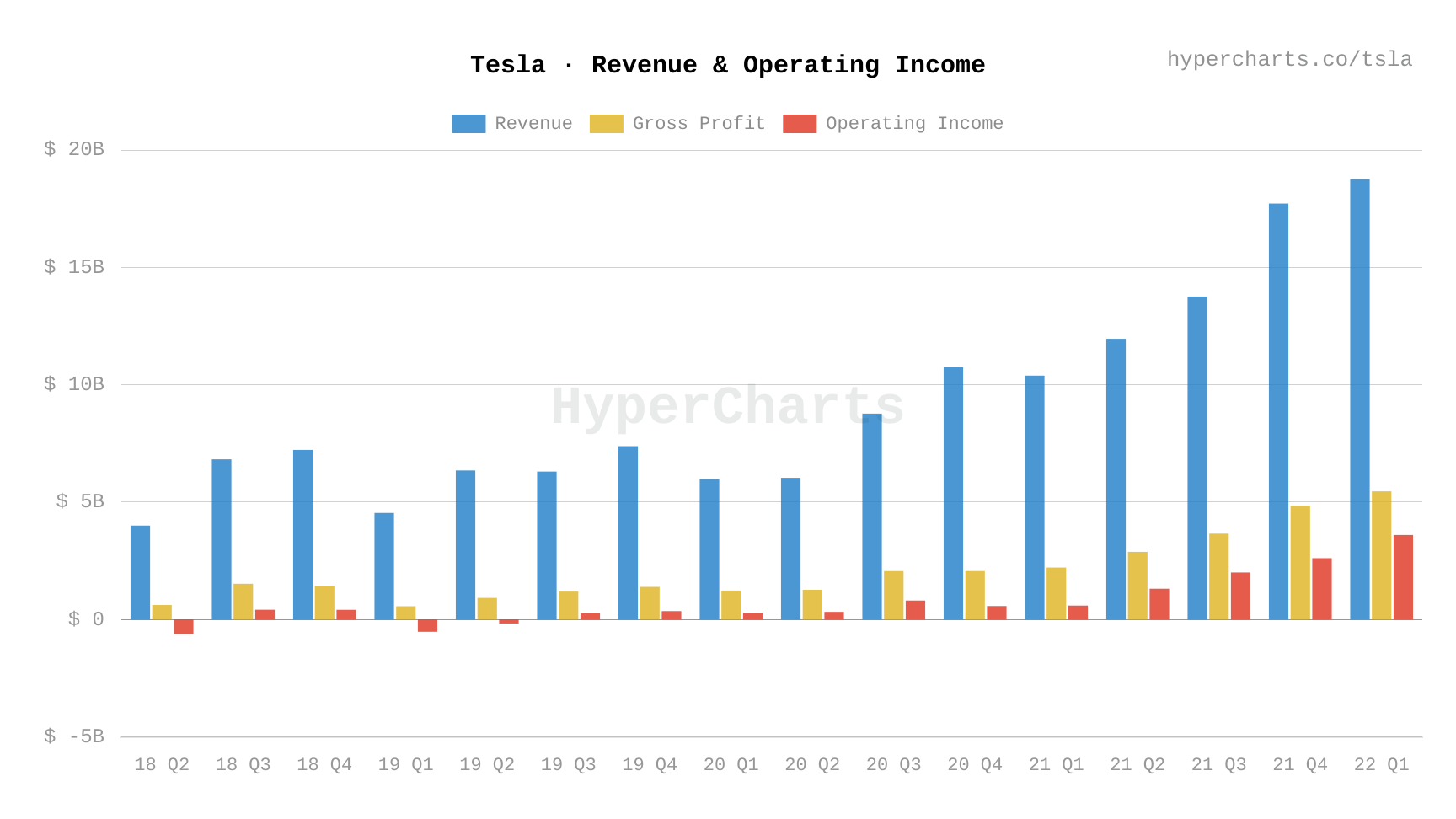

Price Wars and Margin Compression

Tesla's aggressive price cuts, implemented to boost sales volume and market share in an increasingly competitive EV landscape, significantly impacted profit margins. This strategic move, while aiming to increase market penetration, resulted in lower average selling prices (ASPs) and directly affected revenue.

- Increased competition in the EV market: The EV sector is rapidly evolving, with established automakers and new entrants launching competitive models, forcing Tesla to adjust its pricing strategy.

- Lower average selling prices (ASPs) directly impacting revenue: The reduction in vehicle prices, while boosting sales numbers, considerably compressed profit margins. This trade-off between volume and profitability is a key factor in understanding Tesla's Q1 2024 performance.

- Analysis of the trade-off between sales volume and profitability: Tesla's decision highlights a crucial strategic dilemma: prioritizing market share through aggressive pricing versus maintaining higher profit margins with fewer sales. The Q1 results suggest a prioritization of market share, at least temporarily.

- Comparison to previous quarters' profit margins: A direct comparison of Q1 2024 profit margins to those of previous quarters reveals a substantial decrease, highlighting the severity of the margin compression caused by the price war. This data provides a clear picture of the impact of the price cuts on Tesla's bottom line.

Increased Production Costs and Supply Chain Issues

Rising raw material costs and persistent supply chain challenges added further pressure to Tesla's already strained profitability. The cost of goods sold (COGS) increased significantly, eating into the company's bottom line.

- Specific examples of rising raw material prices (e.g., lithium, nickel): The price volatility of key battery components like lithium and nickel directly impacts Tesla's production costs. Fluctuations in these markets have a significant cascading effect on the final vehicle price and profitability.

- Supply chain disruptions and their effects on production: Ongoing supply chain disruptions continue to pose challenges for Tesla, causing delays in production and increasing logistics costs. These disruptions highlight the vulnerability of global manufacturing to external factors.

- Increased transportation and logistics expenses: The rising cost of shipping raw materials and finished vehicles adds further pressure to Tesla's operating expenses, reducing overall profitability.

- Explain how these factors contribute to higher production costs per vehicle: The combined effect of rising raw material prices, supply chain disruptions, and increased logistics expenses resulted in a higher cost of production per vehicle, further eroding profit margins.

Increased Spending on Research & Development and Expansion

Tesla's substantial investments in research and development (R&D), new factory construction, and global expansion, while crucial for long-term growth, significantly impacted Q1 2024 profitability. This reflects a commitment to future innovation and market dominance but comes at a short-term cost.

- Breakdown of R&D spending in Q1 2024: A detailed analysis of Tesla's R&D expenditure in Q1 2024 reveals a considerable commitment to innovation, particularly in areas like autonomous driving technology and battery technology.

- Details on new factory construction and expansion projects: The ongoing expansion of Tesla's manufacturing capacity, including the construction of new Gigafactories, requires significant capital expenditure (CAPEX), which impacts short-term profitability.

- Discussion of investments in autonomous driving technology: Tesla's continued investment in autonomous driving technology represents a significant long-term bet on the future of the automotive industry, but these investments require substantial upfront costs.

- Long-term implications of these investments on profitability: While these investments may not yield immediate returns, they are crucial for Tesla's long-term competitiveness and future profitability.

Impact on Tesla Stock and Investor Sentiment

The Q1 2024 results triggered a significant market reaction, impacting Tesla's stock price and investor sentiment. The immediate response showcased the market's sensitivity to Tesla's financial performance.

- Stock price fluctuations following the earnings report: The announcement of the 71% drop in net income led to considerable volatility in Tesla's stock price.

- Analyst reactions and predictions for future quarters: Financial analysts offered varied interpretations of the results, with some expressing concerns about the sustainability of the current strategy while others maintained a positive long-term outlook.

- Impact on investor confidence and future investments: The Q1 results undoubtedly impacted investor confidence, potentially affecting future investment in the company.

- Comparison to other EV manufacturers' stock performance: A comparison of Tesla's stock performance with that of other major EV manufacturers provides context and insights into the market's overall reaction to the Q1 results.

Conclusion

Tesla's Q1 2024 financial performance reflects a complex interplay of aggressive price wars leading to margin compression, increased production costs driven by supply chain issues and rising raw material prices, and significant investments in R&D and expansion. While the 71% drop in net income is concerning, Tesla's long-term growth potential and innovative capabilities remain significant. The company’s commitment to future technologies suggests a strategic focus on long-term market dominance. What are your thoughts on Tesla's Q1 2024 financial performance? Stay updated on future Tesla financial reports and learn more about Tesla's Q1 2024 performance through further analysis and commentary.

Featured Posts

-

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Feast

Apr 24, 2025

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Feast

Apr 24, 2025 -

Zagonetka Tarantina Razotkrivanje Filma S Travoltom Kojeg Izbjegava

Apr 24, 2025

Zagonetka Tarantina Razotkrivanje Filma S Travoltom Kojeg Izbjegava

Apr 24, 2025 -

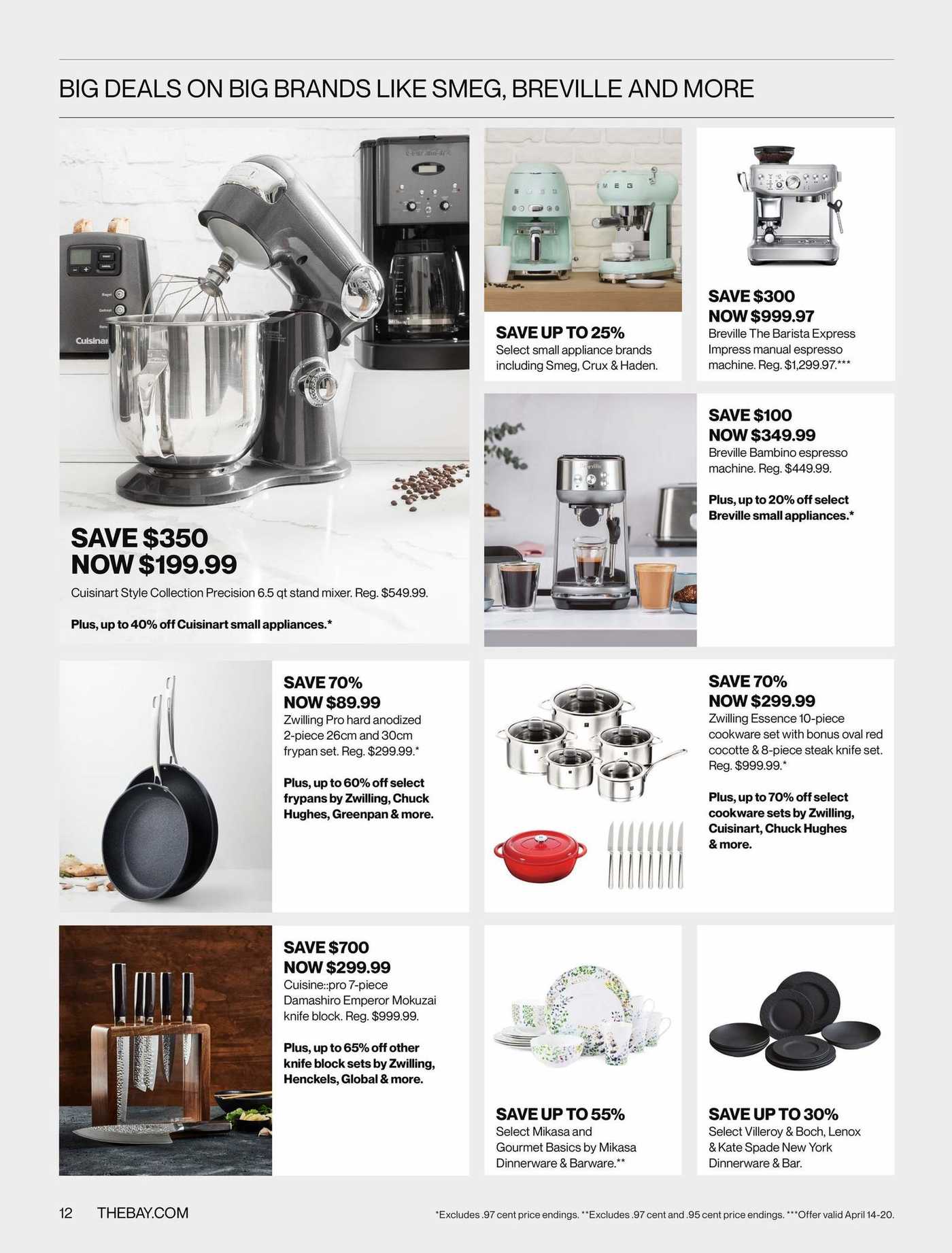

Hudsons Bay 65 Leases Attract Significant Interest

Apr 24, 2025

Hudsons Bay 65 Leases Attract Significant Interest

Apr 24, 2025 -

Trumps Budget Cuts A Threat Multiplier During Tornado Season

Apr 24, 2025

Trumps Budget Cuts A Threat Multiplier During Tornado Season

Apr 24, 2025 -

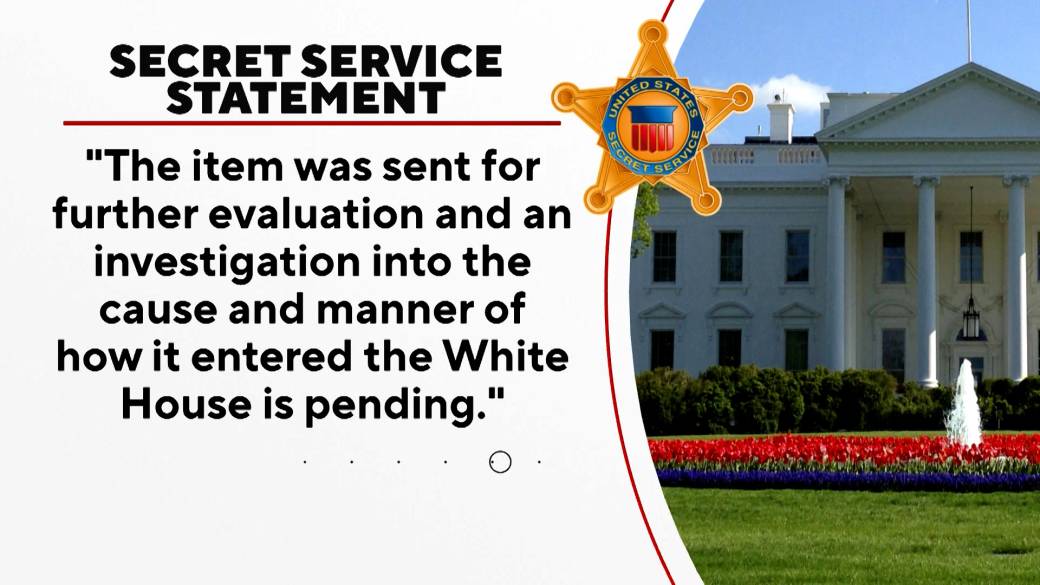

Cocaine Found At White House Secret Service Investigation Complete

Apr 24, 2025

Cocaine Found At White House Secret Service Investigation Complete

Apr 24, 2025