Tesla's Reduced Q1 Profitability: Analysis Of Factors

Table of Contents

Price Wars and Reduced Margins

Tesla's aggressive price cuts, a key strategy to maintain market share amidst intensifying competition, significantly impacted its profit margins. This reflects a broader trend in the EV market.

Aggressive Pricing Strategies

Tesla's decision to slash prices across its model lineup was a bold move designed to boost sales volume and counter the growing competition from both established automakers and new EV startups.

- Significant price reductions across various Tesla models: These cuts, ranging from several thousand dollars to a higher percentage depending on the model and region, directly impacted the revenue per vehicle sold.

- Increased competition from established automakers and new EV startups: The EV market is becoming increasingly crowded, forcing Tesla to compete aggressively on price to maintain its market dominance. Legacy automakers are ramping up their EV production, and numerous startups are entering the market with innovative and competitive offerings.

- Impact of price cuts on revenue per vehicle: While increased sales volume might partially offset lower margins per unit, the impact on overall profitability is undeniable, and the long term effect of this strategy requires further evaluation.

Impact of Supply Chain Disruptions

Although supply chain issues have somewhat eased, lingering disruptions continue to affect Tesla's production costs and profitability. This is a factor that continues to impact the automotive industry as a whole.

- Analysis of the specific supply chain challenges faced: While specific details may not be publicly available, analysts point to potential bottlenecks in sourcing key components like semiconductors and battery materials as potential contributors.

- Comparison of Q1 2024 supply chain performance with previous quarters: A direct comparison with previous quarters reveals a persisting, although possibly lessening, impact on production efficiency and therefore profitability.

- Potential impact of geopolitical instability on supply chains: Global geopolitical uncertainties further complicate supply chains, adding another layer of unpredictability to production costs and timelines.

Increased Production Costs and Inflation

The rising costs of raw materials and broader inflationary pressures significantly impacted Tesla's profitability in Q1 2024. This represents a challenge facing many businesses.

Rising Raw Material Prices

The escalating cost of raw materials crucial for EV production, especially battery components like lithium and nickel, presents a major headwind. These price fluctuations directly impact Tesla's manufacturing expenses.

- Details on the price fluctuations of key raw materials: Tracking the prices of lithium, nickel, and cobalt reveals significant volatility, directly impacting the cost of battery production and ultimately the overall cost of a Tesla vehicle.

- Analysis of Tesla’s efforts to mitigate rising raw material costs (e.g., sourcing strategies, vertical integration): Tesla's efforts to secure its supply chain, including vertical integration and strategic partnerships, are crucial in mitigating these rising costs, but the effectiveness of these efforts remains a topic of ongoing discussion.

- Effect on overall manufacturing cost per vehicle: The combined impact of these raw material price increases significantly elevates the manufacturing cost per vehicle, squeezing profit margins.

Inflationary Pressures

General inflationary pressures, affecting labor costs, energy prices, and operational expenses, further contributed to the reduced profitability.

- Analysis of the impact of inflation on operational costs: Rising energy prices, higher wages, and increased transportation costs all contribute to higher operational expenses, reducing profitability.

- Comparison of inflationary pressures in Q1 2024 with previous periods: Comparing Q1 2024 inflation data with previous periods reveals the extent of the inflationary pressure on Tesla's operational costs.

- Strategies employed by Tesla to manage inflationary costs: Tesla is likely employing various strategies to mitigate these inflationary pressures, ranging from cost optimization and efficiency improvements to renegotiating contracts with suppliers.

Increased Investment in Research and Development (R&D) and Expansion

Tesla's substantial investment in R&D and global expansion, while crucial for long-term growth, significantly impacts short-term profitability. This is a classic trade-off between immediate returns and future potential.

Investments in New Technologies

Tesla's commitment to developing next-generation technologies, such as autonomous driving capabilities and advanced battery technology, requires substantial investment.

- Breakdown of R&D spending in Q1 2024: Analyzing Tesla's R&D spending in Q1 2024 provides insights into the magnitude of these investments.

- Discussion on the long-term benefits of these investments: These investments are crucial for maintaining Tesla's technological edge and driving future growth, even if they negatively affect short-term profitability.

- Comparison of R&D spending with competitors: Comparing Tesla's R&D spending with its main competitors highlights its commitment to innovation and future development.

Global Expansion and Infrastructure Costs

Expanding manufacturing facilities and charging infrastructure globally requires significant upfront capital investment.

- Overview of Tesla's expansion plans: Tesla's ambitious global expansion plans require substantial investment in new factories, charging stations, and related infrastructure.

- Analysis of the cost of expansion projects: The cost of these expansion projects, including land acquisition, construction, and equipment, is a significant factor impacting Tesla’s short-term profitability.

- Discussion of the long-term returns from these investments: While costly in the short term, these investments are crucial for long-term growth and market expansion, eventually leading to higher profitability.

Conclusion

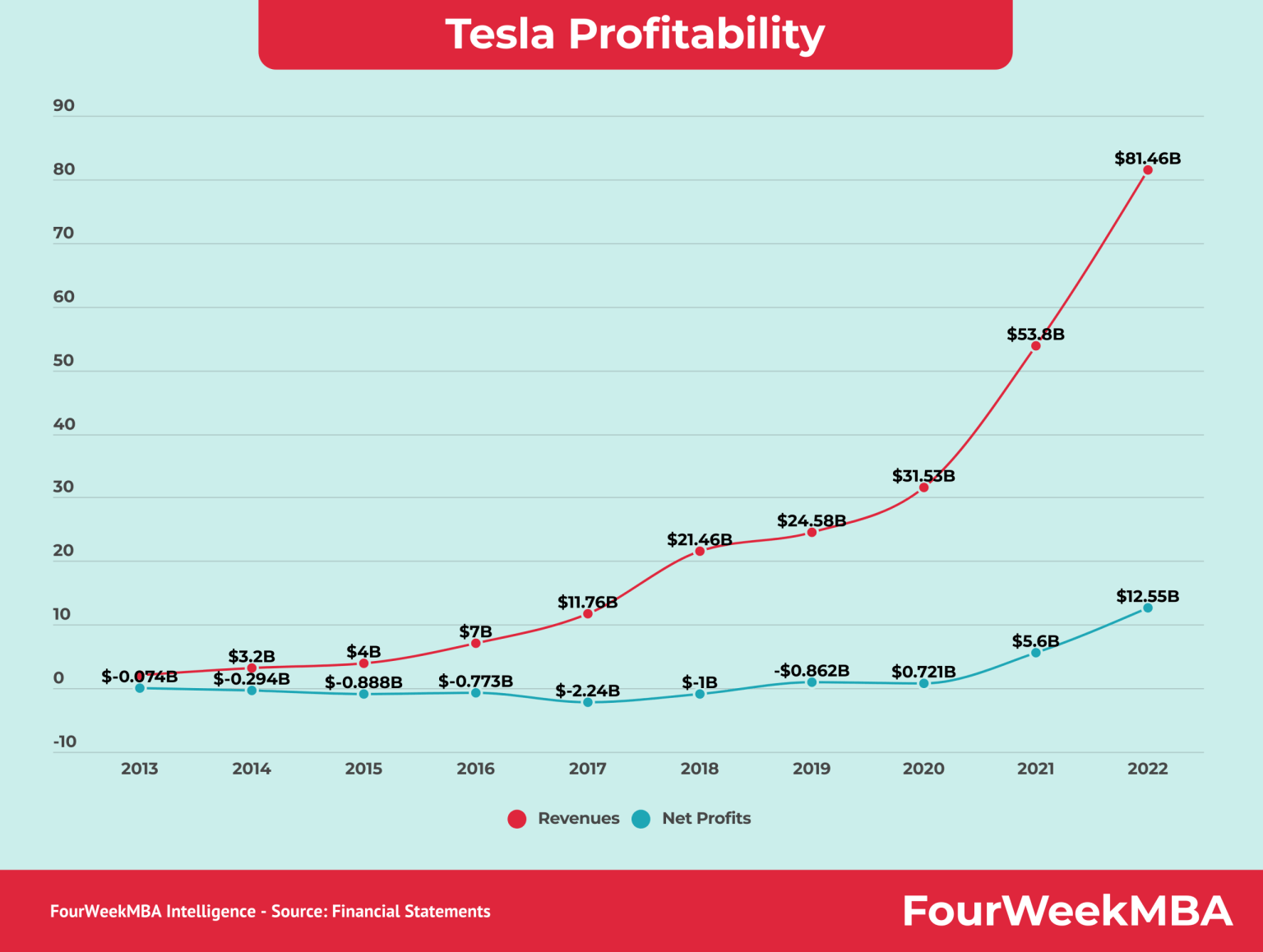

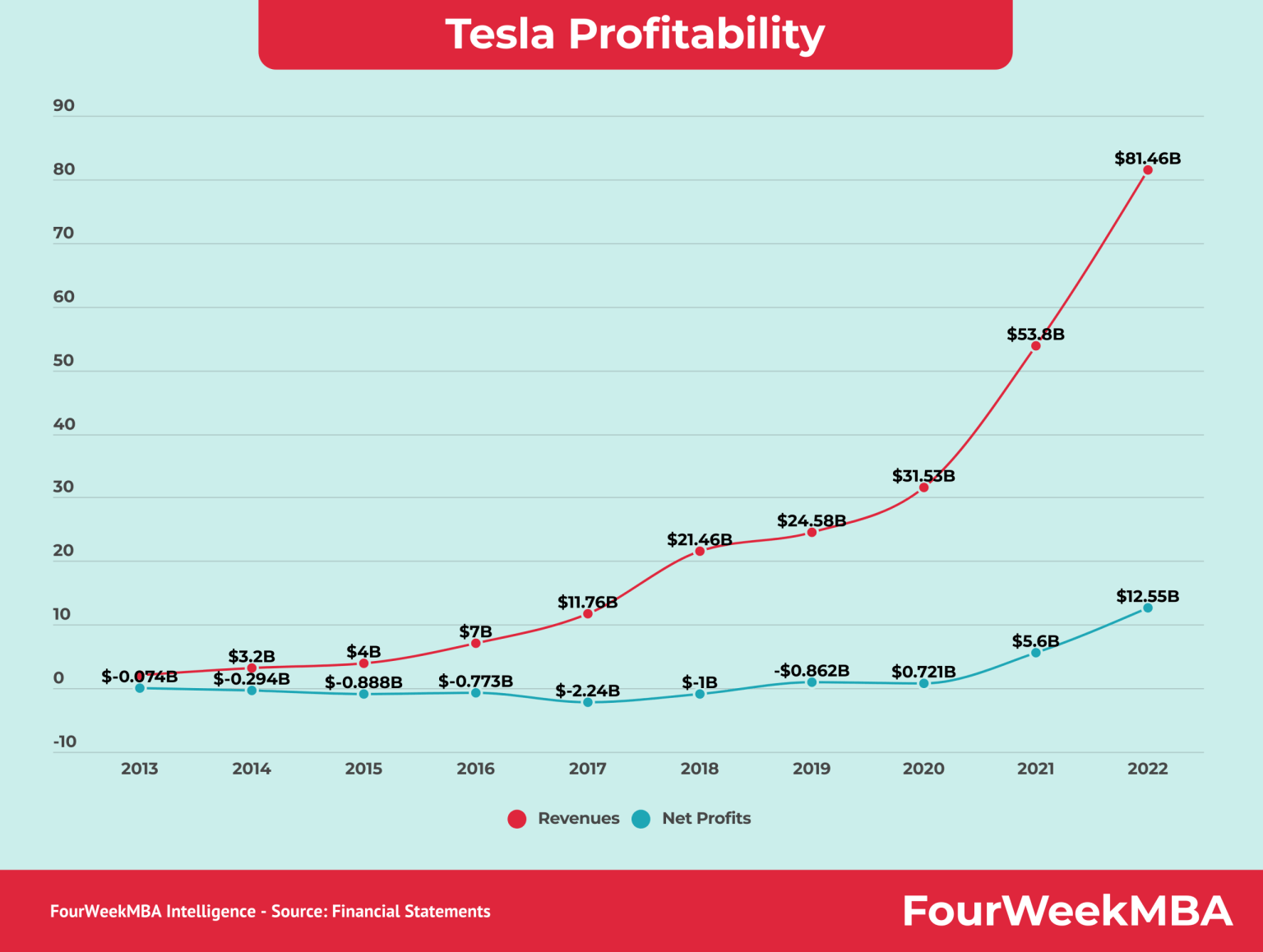

Tesla's reduced Q1 profitability results from a combination of factors. Aggressive pricing, rising production costs (due to inflation and raw material price increases), and substantial investments in R&D and global expansion all contribute to the lower-than-expected profit margins. While these investments are vital for Tesla's future, they create short-term financial pressure. To effectively assess Tesla's future performance, investors and analysts must carefully consider these interwoven factors. For continuous updates on Tesla Q1 Profitability and related market trends, continue to monitor dedicated financial news and analysis sources.

Featured Posts

-

Understanding The Crucial Role Of Middle Management In Todays Workplace

Apr 24, 2025

Understanding The Crucial Role Of Middle Management In Todays Workplace

Apr 24, 2025 -

La Wildfires And The Gambling Industry A Troubling Connection

Apr 24, 2025

La Wildfires And The Gambling Industry A Troubling Connection

Apr 24, 2025 -

3 Billion Crypto Spac Cantor Tether And Soft Bank Explore Merger

Apr 24, 2025

3 Billion Crypto Spac Cantor Tether And Soft Bank Explore Merger

Apr 24, 2025 -

Hope And Liams Relationship Tested A Recap Of The Bold And The Beautiful Wednesday April 16

Apr 24, 2025

Hope And Liams Relationship Tested A Recap Of The Bold And The Beautiful Wednesday April 16

Apr 24, 2025 -

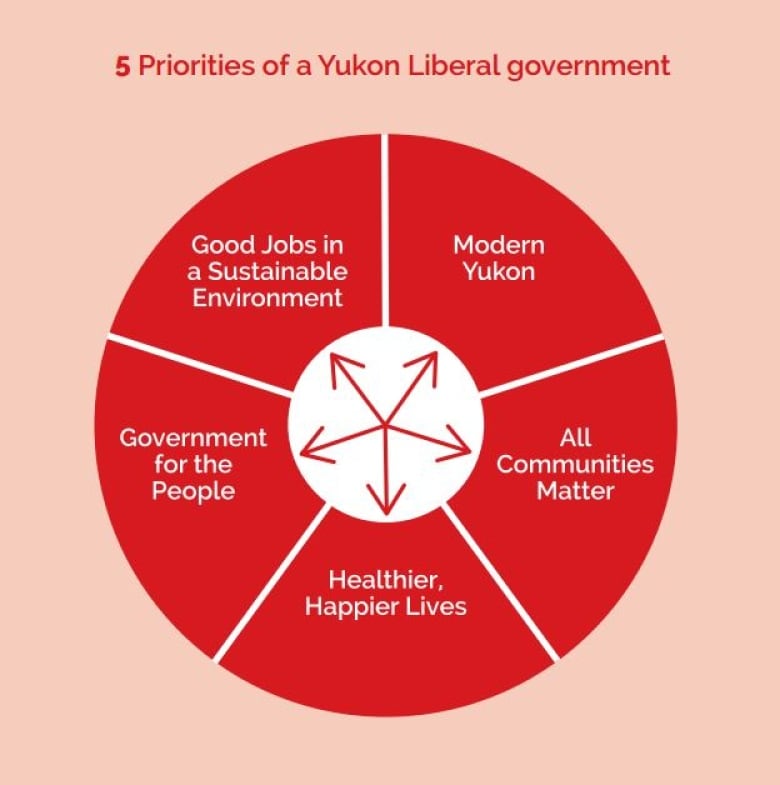

Is The Liberal Platform Right For You A Detailed Review

Apr 24, 2025

Is The Liberal Platform Right For You A Detailed Review

Apr 24, 2025