$3 Billion Crypto SPAC: Cantor, Tether, And SoftBank Explore Merger

Table of Contents

The Players Involved: A Closer Look at Cantor, Tether, and SoftBank

This potential $3 billion crypto SPAC merger involves three significant players, each bringing unique assets and challenges to the table.

Cantor Fitzgerald's Role

Cantor Fitzgerald, a well-established player in global financial markets, brings extensive experience in mergers and acquisitions (M&A) to the table. Their involvement suggests a move towards increased institutional legitimacy for cryptocurrency investments.

- Cantor's history in traditional finance: Cantor has a long and successful track record in traditional finance, giving them a deep understanding of regulatory landscapes and market dynamics.

- Expertise in mergers and acquisitions: Their expertise in structuring complex financial deals is crucial for navigating the intricacies of a crypto SPAC merger.

- Likely role in the SPAC structure: Cantor is likely to play a key role in structuring the SPAC, managing the process, and ensuring regulatory compliance.

- Potential benefits for Cantor: This move positions Cantor as a leader in the burgeoning crypto-finance sector, opening new avenues for growth and revenue.

Tether's Controversial Inclusion

Tether, a stablecoin pegged to the US dollar, is a controversial yet significant player in the cryptocurrency market. Its inclusion in this potential $3 billion crypto SPAC deal raises several questions.

- Tether's market capitalization: Tether's substantial market capitalization makes it a powerful force in the crypto world.

- Ongoing concerns regarding its reserves: Past controversies surrounding the transparency of Tether's reserves remain a significant concern for investors and regulators.

- Potential risks associated with its involvement: The ongoing scrutiny around Tether could create regulatory hurdles and impact investor confidence in the SPAC.

- How this could affect investor confidence: The inclusion of Tether could either attract or repel investors depending on their perspective on the stablecoin's stability and transparency.

SoftBank's Strategic Investment

SoftBank, known for its bold investments in technology companies, adds a layer of strategic depth to this potential $3 billion crypto SPAC. Their participation signals a potential shift in institutional attitudes toward cryptocurrencies.

- SoftBank's history of significant tech investments: SoftBank has a proven track record of identifying and investing in disruptive technologies.

- Potential long-term vision for the crypto space: Their investment suggests a belief in the long-term potential of the cryptocurrency market.

- Benefits of partnering with Cantor and Tether: The partnership brings together financial expertise, market presence, and potentially a large stablecoin base.

The Potential Implications of a $3 Billion Crypto SPAC Merger

A successful $3 billion crypto SPAC merger involving these players would have far-reaching implications for the cryptocurrency market.

Market Impact and Volatility

The merger could significantly impact cryptocurrency market volatility.

- Increased investor interest: The deal could attract substantial institutional investment, potentially driving up the price of cryptocurrencies.

- Potential price surges or crashes: The announcement and the subsequent integration could cause significant price fluctuations.

- Impact on other cryptocurrencies: The merger's success or failure could influence the performance of other cryptocurrencies.

- Influence on regulatory discussions: The deal could fuel further regulatory discussions surrounding cryptocurrencies and SPACs.

Reshaping the Crypto Landscape

This merger could redefine how cryptocurrency investments and acquisitions are conducted.

- Increased institutional investment: The deal could encourage more institutional investors to enter the crypto market.

- Potential for increased legitimacy: The involvement of established financial institutions could increase the overall legitimacy of the cryptocurrency sector.

- Influence on the development of new crypto projects: The combined resources could foster innovation and development in the crypto space.

- Impact on DeFi and other crypto sectors: The merger could have ripple effects on various sectors within the crypto ecosystem.

Regulatory Scrutiny and Potential Challenges

Navigating regulatory hurdles will be crucial for the success of this $3 billion crypto SPAC merger.

- SEC regulations on SPACs: The deal will need to comply with the stringent regulations governing SPACs in the US.

- Scrutiny from international regulatory bodies: International regulatory bodies will likely scrutinize the deal's implications.

- Potential legal challenges: Legal challenges from competitors or regulatory bodies are possible.

- The impact of Tether's controversial history on regulatory approval: Tether's past controversies could complicate the regulatory approval process.

Alternatives and Future Scenarios

While the $3 billion crypto SPAC merger is exciting, considering alternative scenarios is vital.

Potential Alternatives if the Merger Fails

If the deal falls through, several alternatives exist:

- Other potential partnerships for Tether: Tether could seek partnerships with other financial institutions.

- Alternative investment strategies for SoftBank: SoftBank could explore other investment opportunities in the crypto space.

- The implications for Cantor’s crypto investments: Cantor might pursue other crypto-related projects independently.

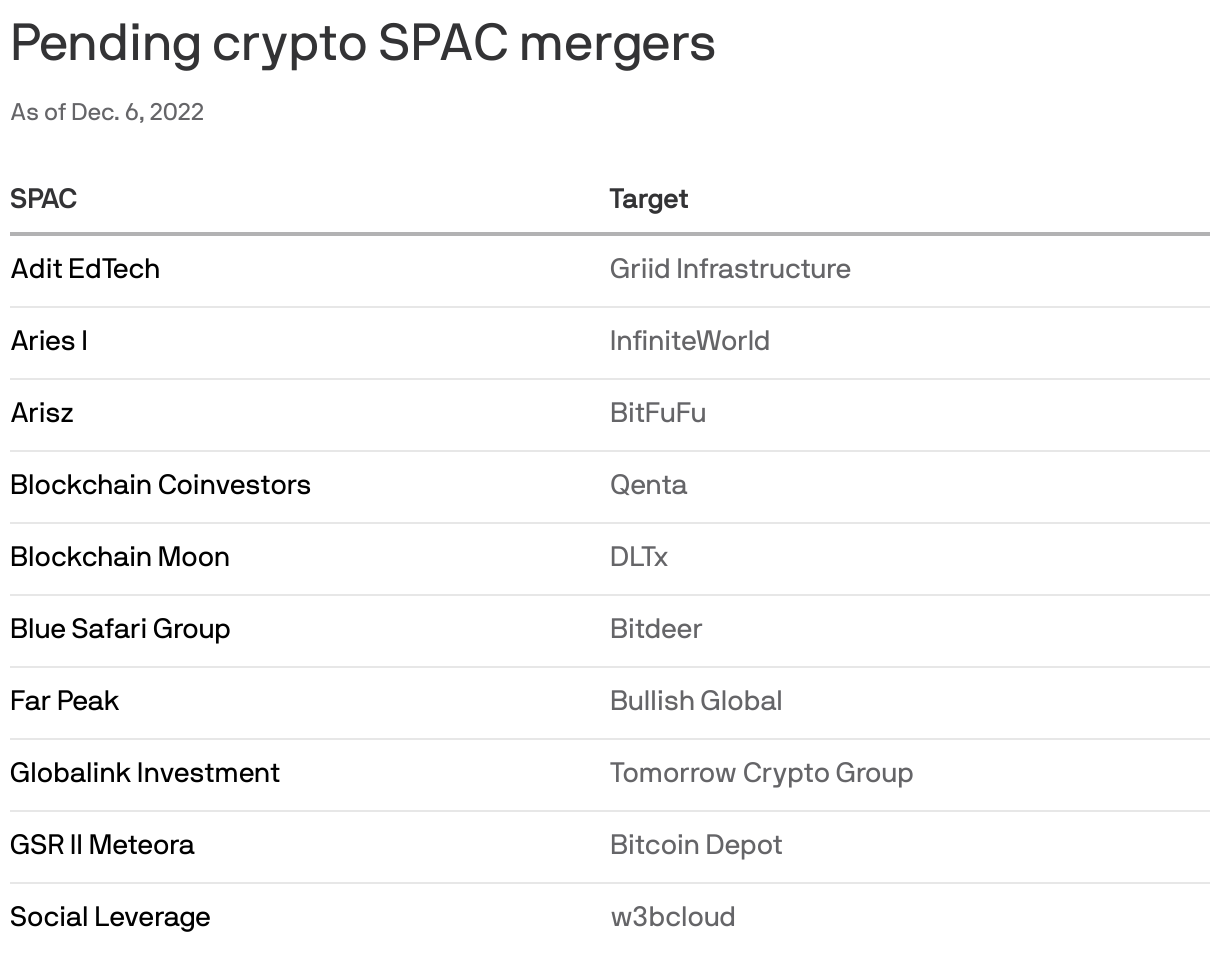

Future of Crypto SPACs

This deal could significantly impact the future of crypto SPACs.

- Increased use of SPACs for crypto acquisitions: The success of this merger could lead to more crypto companies utilizing SPACs for acquisitions and listings.

- Potential for similar large-scale mergers: The deal could pave the way for other large-scale mergers in the cryptocurrency industry.

- The evolving regulatory landscape surrounding crypto SPACs: The deal could influence the development of clearer regulatory frameworks for crypto SPACs.

Conclusion

The potential $3 billion crypto SPAC merger involving Cantor, Tether, and SoftBank presents a pivotal moment for the cryptocurrency industry. This union could significantly impact market volatility, reshape the crypto landscape, and accelerate the integration of cryptocurrencies into mainstream finance. However, regulatory hurdles and the controversies surrounding Tether present significant challenges. Staying informed about this unfolding story is crucial for anyone invested in or interested in the future of cryptocurrencies. Keep following the news for updates on this groundbreaking $3 billion crypto SPAC deal and its impact on the market. Learn more about the potential impacts of this massive crypto SPAC and its potential to revolutionize the industry.

Featured Posts

-

Pete Hegseth Delivering Trumps Agenda Amidst Signal App Controversy

Apr 24, 2025

Pete Hegseth Delivering Trumps Agenda Amidst Signal App Controversy

Apr 24, 2025 -

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involved

Apr 24, 2025

Cantors 3 Billion Crypto Spac Deal Tether And Soft Bank Involved

Apr 24, 2025 -

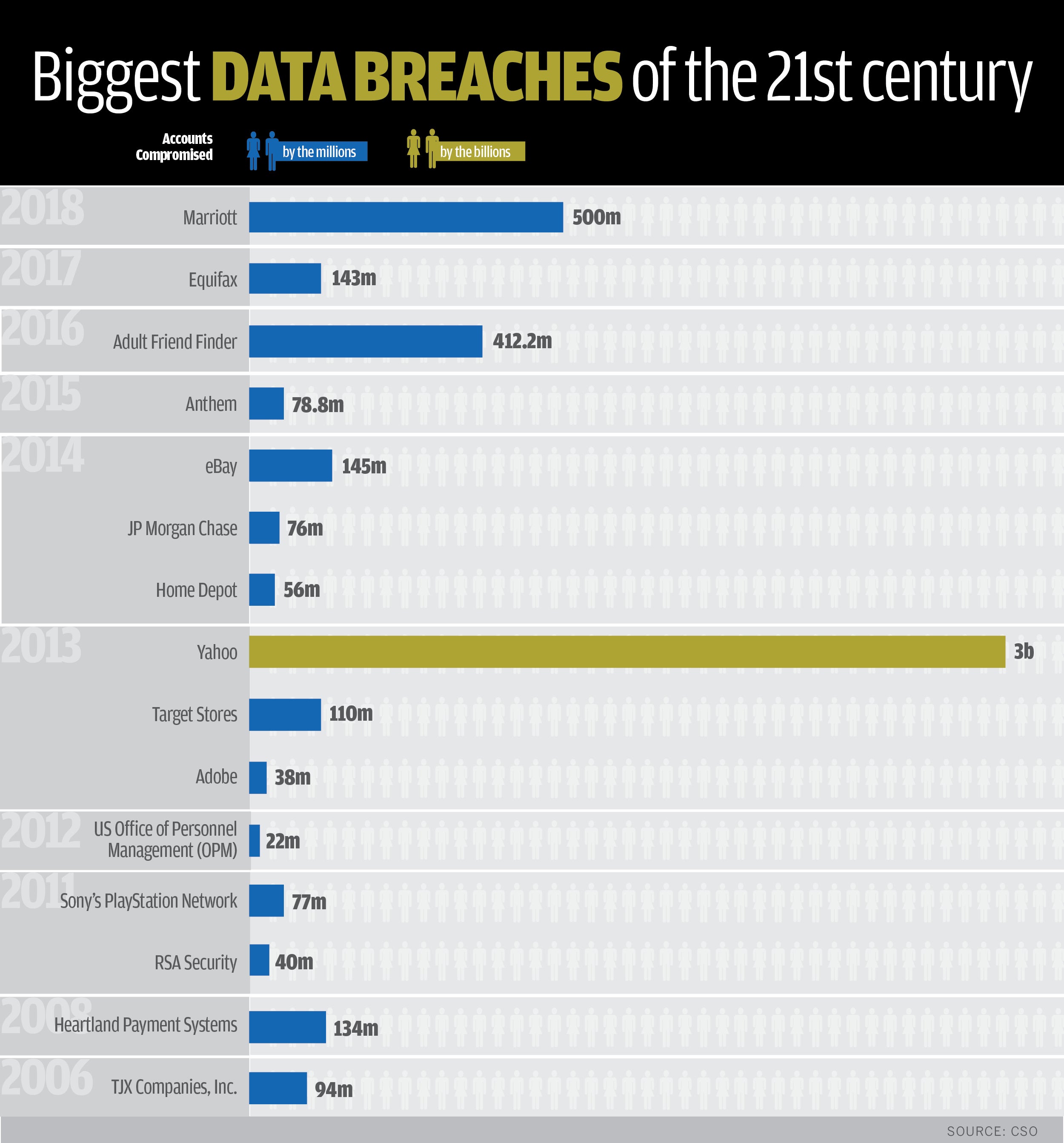

Millions Lost Executive Office365 Accounts Targeted In Major Data Breach

Apr 24, 2025

Millions Lost Executive Office365 Accounts Targeted In Major Data Breach

Apr 24, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 24, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 24, 2025 -

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025

Google Fis New 35 Unlimited Plan Everything You Need To Know

Apr 24, 2025