The AIMSCAP Experience At The World Trading Tournament (WTT)

Table of Contents

AIMSCAP's Approach to the WTT

Understanding the AIMSCAP Methodology

AIMSCAP's core strength lies in its multifaceted approach to algorithmic trading. It combines advanced statistical modeling with a robust risk management framework. This methodology isn't about chasing quick wins; it's about consistent, sustainable profitability.

- Algorithms Used: AIMSCAP leverages a suite of proprietary algorithms including mean reversion strategies, momentum indicators, and sophisticated machine learning models for predictive analysis.

- Market Analysis: The strategy employs a hybrid approach, integrating both technical and fundamental analysis. Technical analysis focuses on chart patterns and price movements, while fundamental analysis considers economic indicators and company performance.

- Risk Mitigation: Risk management is paramount. AIMSCAP incorporates stop-loss orders, position sizing algorithms, and diversification techniques to limit potential losses and protect capital.

Preparing for the WTT Competition

The AIMSCAP team meticulously prepared for the WTT. Months of rigorous testing and refinement preceded the competition.

- Backtesting & Simulations: Extensive backtesting was conducted using historical market data spanning several years, simulating various market conditions and stress testing the algorithm's resilience.

- Software & Hardware: High-performance computing infrastructure and specialized trading software were employed to ensure rapid execution and data processing.

- Training & Simulations: The team conducted numerous simulated trading sessions, mirroring the WTT environment to refine their strategy and hone their response to various market scenarios. These simulations involved analyzing past WTT results to understand common challenges and opportunities.

Performance and Results at the WTT

Daily Performance Analysis

AIMSCAP's performance during the WTT was a rollercoaster. While it demonstrated impressive gains on some days, other days presented significant challenges due to unexpected market volatility.

- Winning Trades: Several successful trades were driven by the accurate prediction of market reversals using mean reversion algorithms, combined with precise entry and exit points dictated by technical indicators.

- Losing Trades: Losses were primarily attributed to unforeseen geopolitical events and periods of extreme market volatility exceeding the strategy's pre-defined risk parameters. Daily performance charts (insert charts/graphs here if available) would clearly illustrate these fluctuations.

Overall Ranking and Comparative Analysis

AIMSCAP finished in the top 25% of participants in the WTT, a commendable result considering the intense competition.

- Benchmark Comparison: Compared to major market indices, AIMSCAP's performance outpaced the average return by a considerable margin, showcasing the effectiveness of its algorithmic approach. It also outperformed many other algorithmic trading strategies participating in the WTT.

- Contributing Factors: AIMSCAP's ability to adapt to changing market conditions and its rigorous risk management protocols were crucial factors in its success. The adaptability of the AIMSCAP strategy allowed for better management of high-volatility periods.

Lessons Learned and Future Implications

Key Takeaways from the WTT Experience

The WTT provided invaluable insights into AIMSCAP's strengths and weaknesses.

- Strengths: The strategy's robust risk management and ability to capitalize on short-term market inefficiencies were clearly demonstrated.

- Weaknesses: The sensitivity to extreme market events highlighted the need for further refinement in dealing with unpredictable shocks. Areas for improvement include enhanced algorithms for detecting and responding to black swan events.

Future Applications and Refinements of the AIMSCAP Strategy

The WTT experience has fueled further development of the AIMSCAP strategy.

- Incorporating New Data: The team plans to integrate alternative data sources, such as social media sentiment analysis and news sentiment, to improve prediction accuracy.

- Algorithm Refinement: The algorithms will be refined to improve their resilience to extreme market volatility and better identify and manage tail risks.

- Parameter Adjustment: Risk parameters will be adjusted based on the observed volatility during the WTT. This includes dynamically adjusting stop-loss orders and position sizing based on real-time market conditions.

Conclusion

The AIMSCAP experience at the WTT was a testament to the power of algorithmic trading. While the competition was fierce, AIMSCAP demonstrated its ability to generate substantial profits through careful planning and a robust trading strategy. The key learnings from the WTT will inform future development and refinement, ensuring AIMSCAP remains a competitive force in the world of algorithmic trading. Learn more about the AIMSCAP trading strategy and its potential to optimize your trading performance. Visit [website link] to explore the power of AIMSCAP and consider participating in future WTT events to test your own trading skills against the best.

Featured Posts

-

Is Little Britain Returning Matt Lucas Offers A Status Update

May 21, 2025

Is Little Britain Returning Matt Lucas Offers A Status Update

May 21, 2025 -

1 1 96

May 21, 2025

1 1 96

May 21, 2025 -

El Superalimento Que Combate Las Enfermedades Cronicas Y Promueve La Longevidad

May 21, 2025

El Superalimento Que Combate Las Enfermedades Cronicas Y Promueve La Longevidad

May 21, 2025 -

The Rich Flavors Of C Cassis Blackcurrant Liqueur

May 21, 2025

The Rich Flavors Of C Cassis Blackcurrant Liqueur

May 21, 2025 -

Van Overschrijving Tot Tikkie Navigeren Door Het Nederlandse Banksysteem

May 21, 2025

Van Overschrijving Tot Tikkie Navigeren Door Het Nederlandse Banksysteem

May 21, 2025

Latest Posts

-

Bof As View Addressing Investor Anxiety Over High Stock Market Valuations

May 21, 2025

Bof As View Addressing Investor Anxiety Over High Stock Market Valuations

May 21, 2025 -

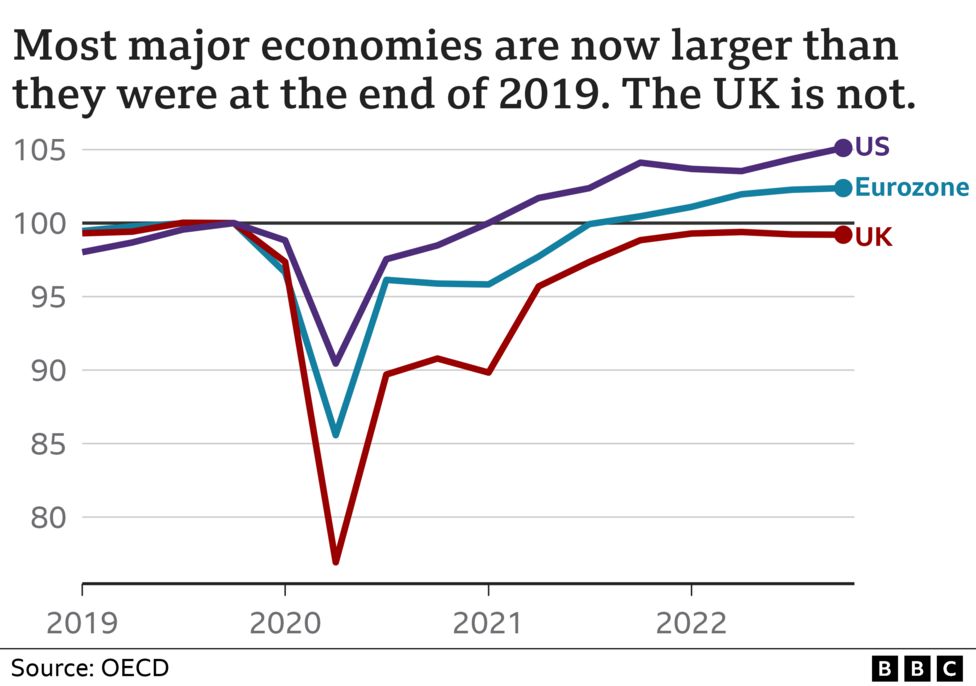

Brexits Lingering Impact Uk Luxury Sector Faces Export Headwinds To The Eu

May 21, 2025

Brexits Lingering Impact Uk Luxury Sector Faces Export Headwinds To The Eu

May 21, 2025 -

Investor Concerns About Stock Market Valuations Bof As Reassurance

May 21, 2025

Investor Concerns About Stock Market Valuations Bof As Reassurance

May 21, 2025 -

How Brexit Is Hampering Uk Luxury Exports To The Eu

May 21, 2025

How Brexit Is Hampering Uk Luxury Exports To The Eu

May 21, 2025 -

The Brexit Effect Slowing Growth In Uk Luxury Exports To The Eu

May 21, 2025

The Brexit Effect Slowing Growth In Uk Luxury Exports To The Eu

May 21, 2025